Key Insights

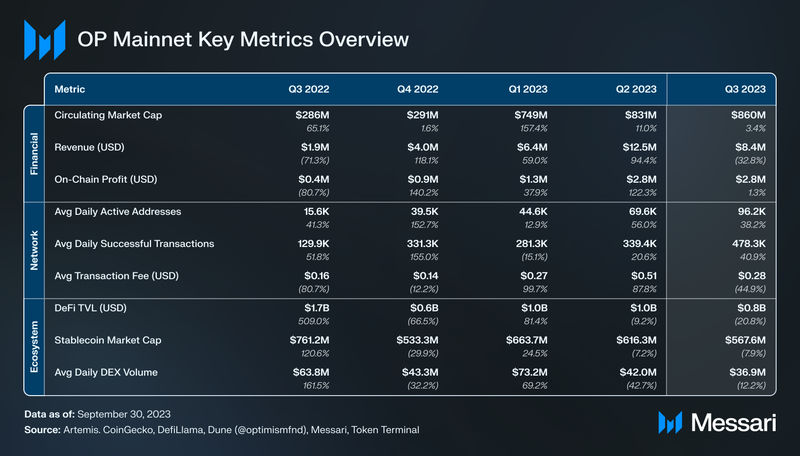

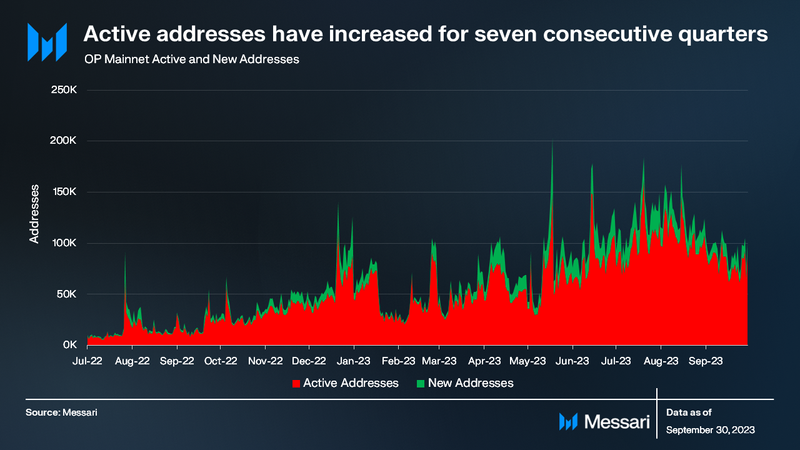

- Daily active addresses reached an all-time high of 96,000 in Q3 ’23. This marks the seventh consecutive quarterly increase, with the DeFi sector leading the activity.

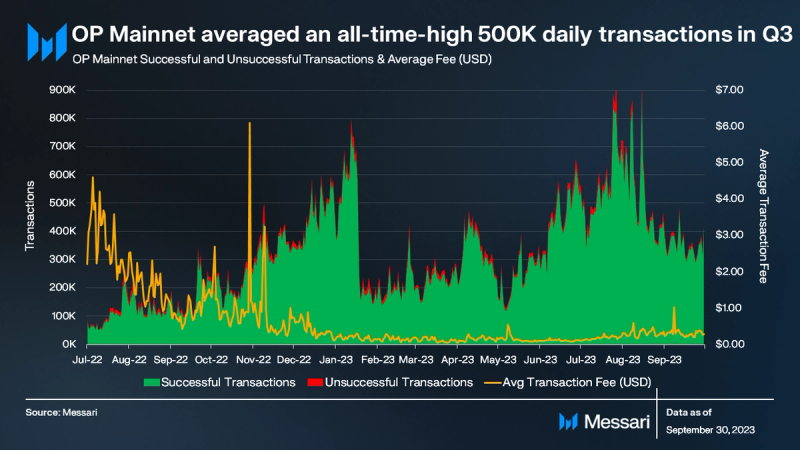

- Daily transactions reached an all-time high of 500,000 in Q3 ’23. The Bedrock Upgrade contributed to a 45% QoQ decrease in the average transaction fee, which fell to $0.28.

- Q3 2023 onchain profit totaled $2.8 Million. OP Mainnet’s cumulative onchain profit now stands at $15 million or 8,600 ETH.

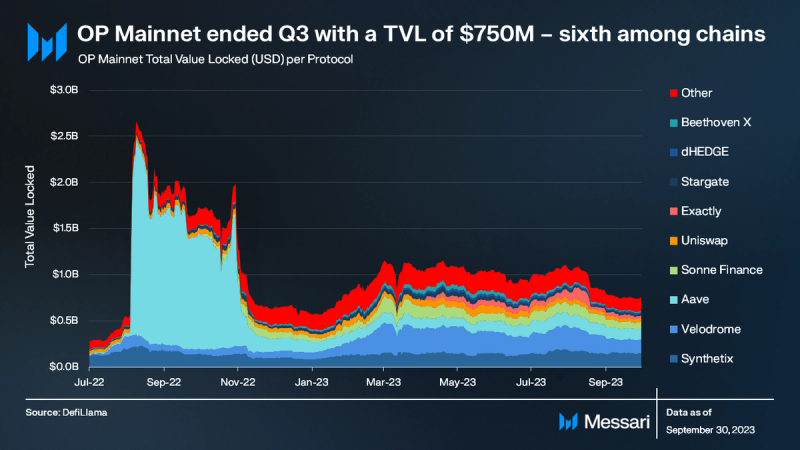

- OP Mainnet ended Q3 ‘23 with a TVL of $750 million, ranking sixth among all networks.

Primer on Optimism

Optimism is a Layer-2 Ethereum scaling protocol. It aims to increase Ethereum’s transaction throughput while decreasing transaction costs via Optimistic Rollups.

When Optimism users sign a transaction and pay a gas fee in ETH, the pending transaction is stored in a private mempool before being executed by the sequencer. Blocks of executed transactions on OP Mainnet are created every two seconds and periodically batch-submitted as transaction call data to Ethereum by the sequencer.

The Optimism Foundation controls the lone sequencer. Since its mainnet inception, the Optimism Foundation has allocated all sequencer revenues, denominated in ETH, to support Retroactive Public Goods Funding. Plans are underway for sequencer decentralization, with new sequencers expected to receive a portion of the network’s sequencer transaction fees.

Optimism’s long-term strategy stems from its vision for a Superchain. The Optimism Superchain is envisioned as a unified network of chains built using the OP Stack. The ultimate goal of the Superchain is to bring seamless interoperability between OP Chains that share security, bridging, governance, upgrades, and a communication layer. Notable protocols that have created or are creating chains using the OP Stack include Base, opBNB, Public Goods Network, and Zora.

Key Metrics

Financial Analysis

Market Capitalization

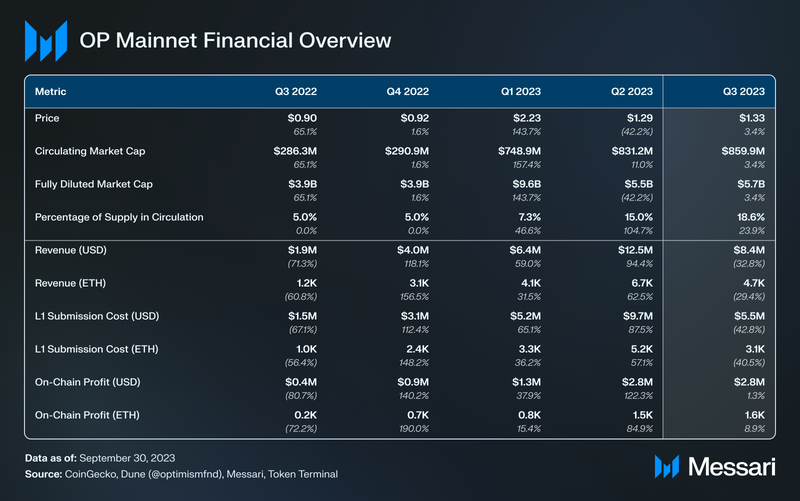

In Q3 2023, despite favorable court rulings for XRP and Grayscale, the overall crypto market experienced a moderate downturn. The total crypto market capitalization decreased by 5.8%, while BTC and ETH fell by 7.5% and 10.0%, respectively.

In contrast, Optimism’s native token, OP, exhibited growth during the quarter. The circulating market capitalization of OP grew by 3.4% QoQ, concluding the quarter at $860 million. Additionally, OP’s fully diluted market capitalization increased by 3.4%, settling at $5.7 billion by the end of the quarter. By the close of Q3 2023, Optimism stood as the 40th largest crypto protocol by market capitalization.

OnChain Financials

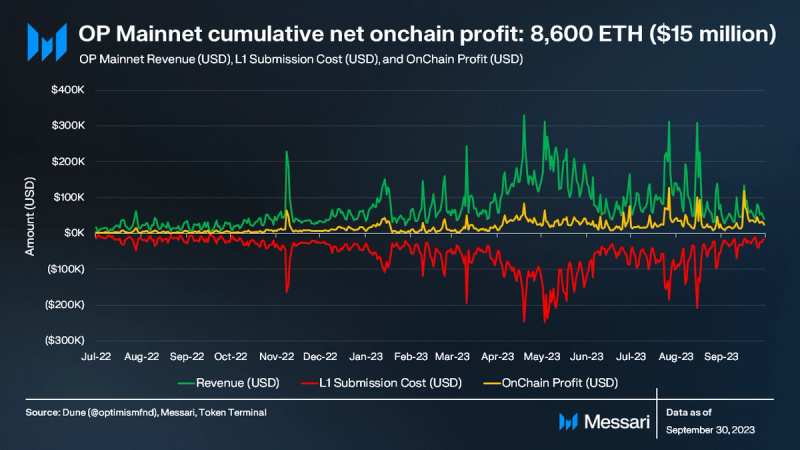

In Q3 2023, OP Mainnet’s revenue (USD), derived from network transaction fees, fell by 33% QoQ from $12.5 million to $8.4 million. The primary factor behind the revenue drop was a 45% QoQ decline in the average transaction fee, going from $0.51 to $0.28. This reduction in the average transaction fee was attributed to the Optimism Bedrock Upgrade incorporating various batch compression techniques and L2 support for EIP-1559.

As an Ethereum Layer-2, blocks of executed transactions on OP Mainent are created every two seconds and periodically batch-submitted as transaction call data to Ethereum by the sequencer. The submissions represent a cost to OP Mainnet. In the third quarter, due to the Bedrock Upgrade, these Layer-1 submission expenses saw a 43% QoQ reduction, going from $9.7 million to $5.5 million.

Calculating onchain profitability involves subtracting these submission costs from the network’s revenue. In Q3, this resulted in an onchain profit for OP Mainnet of $2.8 million. In total, OP Mainnet’s aggregate onchain profit stands at $15 million, equivalent to 8,600 ETH.

Supply

OP is the native token of the Optimism network. It serves multiple functions including governing, securing, and fostering the growth of the Optimism ecosystem. The OP token allocations are as follows:

- Core Contributors (19%) – Allocated to individuals instrumental in developing the Optimism Collective.

- Investors (17%) – Reserved for investors.

- User Airdrops (19%) – Distributed to members of the Optimism and Ethereum communities to incentivize participation and growth.

- Ecosystem Fund (25%) – Geared towards stimulating development within the Collective ecosystem, subdivided into a Governance Fund (5.4%), Partner Fund (5.4%), Seed Fund (5.4%), and Reserves (8.8%).

- Retroactive Public Goods Funding (20%) – Ensures adequate rewards for impactful contributions to the Collective.

By the close of Q3 ‘23, 800 million OP tokens, or 18.6% of the initial supply, were in circulation. The total supply stands at 4,294,967,296 OP. On Sep. 18, 2023, the Optimism team announced their third airdrop distributing 19.4 million OP tokens to more than 31,000 eligible addresses. On September 20th, Optimism shared that they entered into a private token sale of approximately 116 million OP tokens, split among seven purchasers, for treasury management purposes.

Network Analysis

Usage

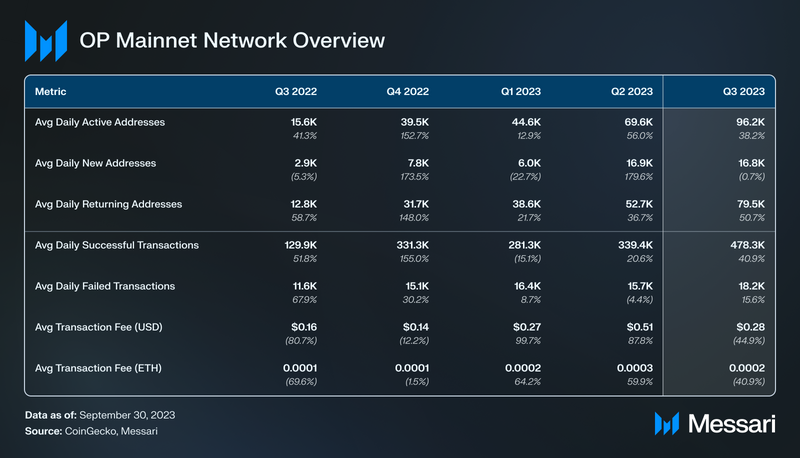

In Q3 2023, OP Mainnet’s daily active addresses reached a record 96,000, marking a 38% QoQ increase and the seventh consecutive quarterly rise. The DeFi sector accounted for most of these addresses, as detailed in the report’s Ecosystem Overview section. Concurrently, daily new addresses remained steady at 17,000, totaling 1.5 million new addresses for the quarter.

Transactions on OP Mainnet increased in six out of the last seven quarters. Q3 ’23 saw an average of 500,000 daily transactions, the highest ever for the network. Despite a 40% QoQ surge in transactions, the average transaction fee dropped 45% QoQ to $0.28. Factors contributing to OP Mainnet’s rising activity include developments around the OP Stack, the Bedrock Upgrade, and the third airdrop.

Ecosystem Analysis

Sector Comparison

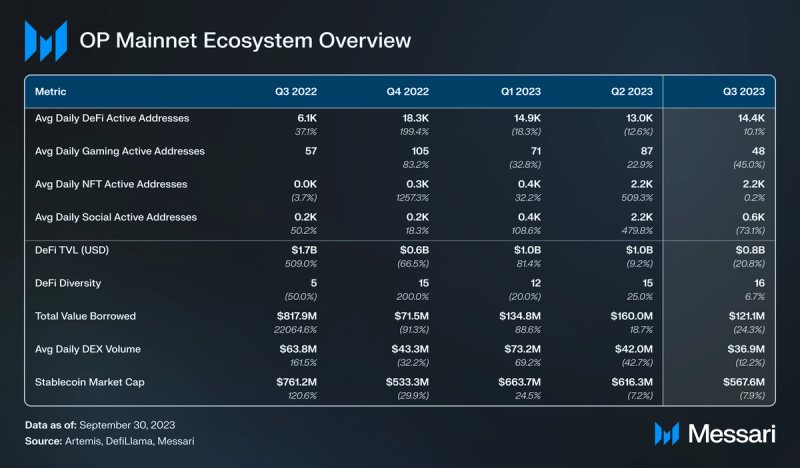

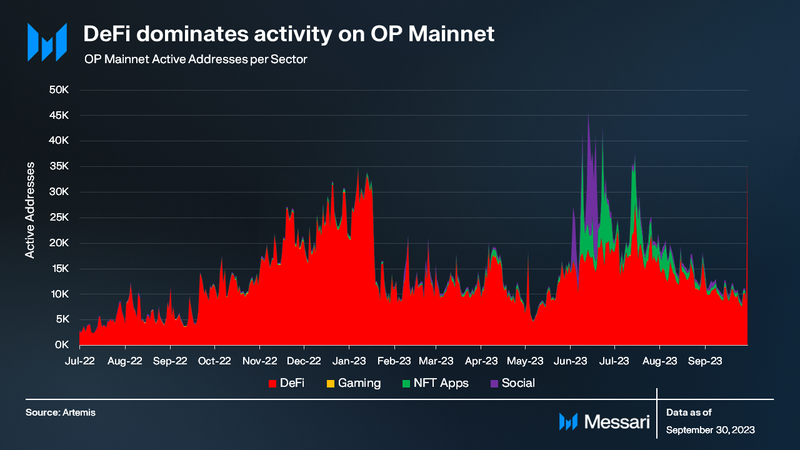

On the OP Mainnet network, within the four primary consumer-focused sectors, which include DeFi, Gaming, NFTs, and Social, DeFi dominates by accounting for 83% of the active addresses in Q3 ’23. NFTs follow with 12%, while the Gaming and Social sectors register minimal activity in comparison. Non-DeFi sectors remain an area for potential growth on the network.

DeFi

OP Mainnet’s Total Value Locked (TVL) decreased by 20% QoQ, concluding the quarter at $750 million. At the end of Q3, OP Mainnet ranked sixth among networks based on TVL. OP Mainnet’s reduction in TVL is consistent with the broader market trend that started its decline after peaking in mid-2022.

Synthetix was the leading protocol by TVL on OP Mainnet with $150 million TVL, which constituted 19.9% of the aggregate TVL. Velodrome followed closely with a TVL of $147 million, representing 19.5% of the aggregate value. Aave finished third with $120 million TVL, or 15.8%. Aave has seen a massive YoY decline of 90% going from $1.3 billion to $120 million. The “Other” category, which aggregates protocols outside of the top ten by TVL, held a TVL of $143.22 million, or 19.0% of the total value, but experienced a QoQ drop of 28.6%.

DeFi Diversity denotes the number of protocols comprising the top 90% of DeFi TVL. A wider spread of TVL across protocols can mitigate potential systemic risks from negative events. OP Mainnet concluded Q3 with a DeFi Diversity score of 16.

OP Mainnet recorded an average daily DEX trading volume of $37 million for Q3, a 12% decline QoQ. This trend mirrors the wider DEX market trajectory that began declining after its March peak due to the USDC depeg event. OP Mainnet secured the sixth position in DEX trading volumes among networks.

Within the OP Mainnet ecosystem, Uniswap was responsible for 55% of the total DEX trading volume. Velodrome followed with 16%, and Curve and KyberSwap each with 5%. The combined volume of other DEX platforms on OP Mainnet constituted the remaining 16%.

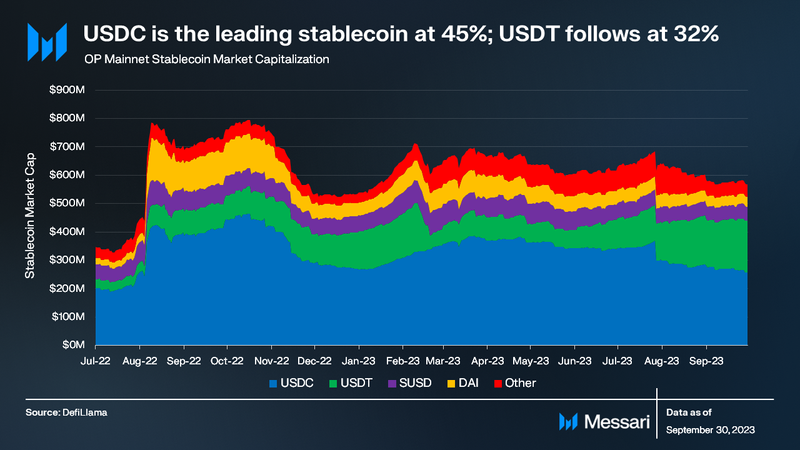

By the close of Q3, OP Mainnet’s stablecoin market capitalization stood at $568 million, placing it eighth among networks. USDC’s market capitalization was $258 million, or 45% of the total on OP Mainnet. Meanwhile, USDT’s market capitalization reached $182 million, making up 32% of OP Mainnet’s stablecoin market cap. Notably, USDT’s market cap on OP Mainnet grew 77% QoQ.

Closing Summary

In Q3 2023, OP Mainnet demonstrated resilience amidst a volatile crypto landscape. The quarter witnessed a surge in network usage; both active addresses and transaction volumes recorded all-time highs. In contrast, transaction fees dipped by 45% QoQ, reaching an average of $0.28. This decline in fees is attributed to the Bedrock upgrade, which brought in advanced batch compression techniques and L2 support for EIP-1559.

DeFi stands as the predominant sector on OP Mainnet, accounting for more than 80% of the consumer-facing activities. However, sectors such as Gaming, NFTs, and Social remain potential growth avenues. The quarter culminated with OP Mainnet securing a TVL of $750 million, ranking it sixth among networks.

As the quarter concluded, OP Mainent stood out as one of the networks that achieved growth during the bear market. However, the road ahead is not without challenges. Competing networks and emerging protocols with analogous growth strategies are growing, and their moves will inevitably influence Optimism’s position and strategy in subsequent quarters.