Key Insights

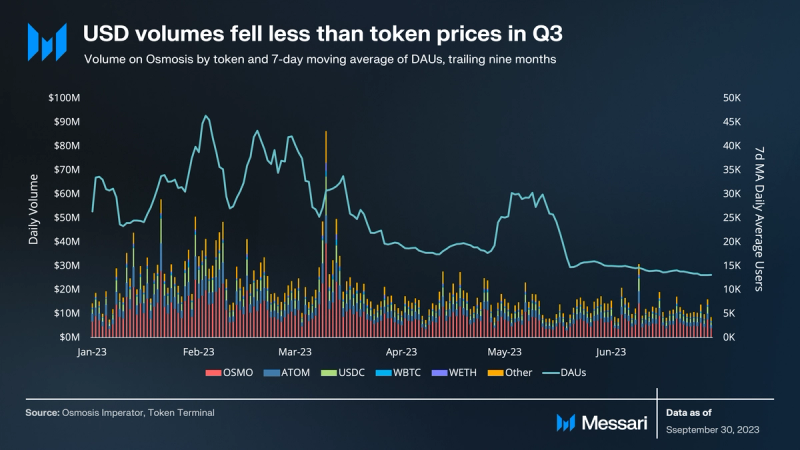

- Activity on Osmosis fell less than the USD values would imply, as OSMO price fell more than volume and fees paid.

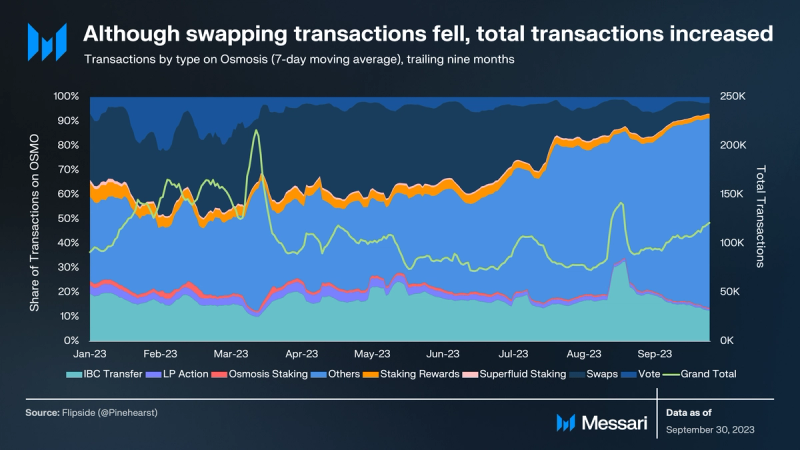

- The number of swaps and LP transactions on Osmosis both fell by nearly 60% in the third quarter.

- OSMO tokenomics and inflation updates have brought the annualized inflation rate close to single digits, with circulating supply increasing only 2.8% in the third quarter.

- Osmosis is preparing to integrate with Celestia, a data availability layer, that could expand the liquidity available to Osmosis users to rollups beyond the IBC.

Primer on Osmosis

Osmosis is a sovereign decentralized exchange (DEX)-focused app-chain in the Cosmos ecosystem. In other words, Osmosis simultaneously serves as a blockchain and an application. The application operates similarly to other automated market making (AMM) functioning DEXs – liquidity providers (LPs), which are responsible for supplying liquidity to asset pools where traders can make trades from. It’s the same model for Uniswap or Balancer, though more similar to the latter as Osmosis places a high priority on offering asset pool customization. Several parameters within the DEX are adjustable, including market-maker functions, swap costs, token weighting, and more. As an appchain, a number of complimentary apps can also be built on top of Osmosis. Additionally, Osmosis has introduced new features such as superfluid staking, which allows users who provided liquidity in certain pools to also stake to help secure the network, as well as MEV capture, concentrated liquidity, and more.

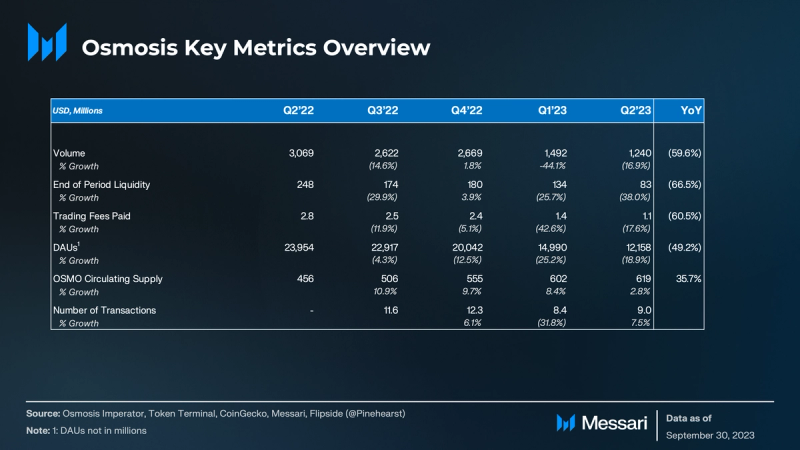

Key Metrics

Performance Analysis

Trading volume on Osmosis fell in the third quarter by 17%, when measured in USD terms. wBTC and wETH fell the most of the big five, down 27% and 34%, respectively, to roughly $22 million. OSMO trading volume only fell 20%, which is a positive sign, considering that the token price was down 34% in the quarter. ATOM fell the least, down 9% from the previous quarter to $176 million in volume traded.

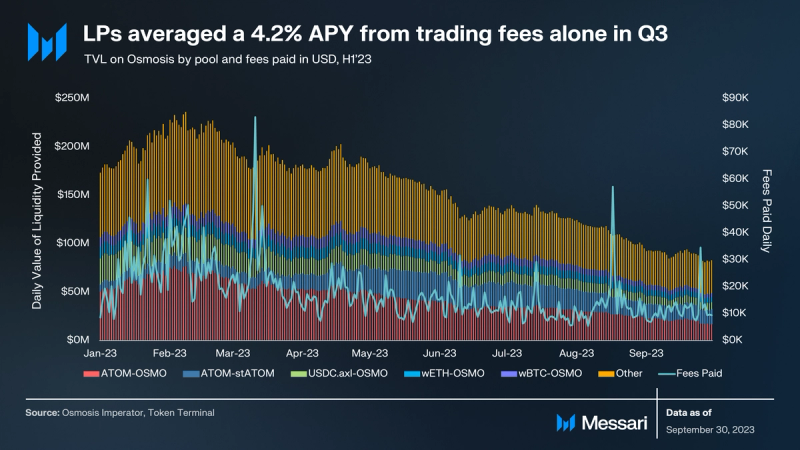

In Q3, TVL and fees paid fell again on Osmosis with TVL falling below $100 million. Trading fees paid in the quarter still totaled more than $1 million. After annualizing the daily trading fees paid on the TVL, liquidity providers earned over 4% APY from trading fees alone.

The ATOM-OSMO pair, the largest on Osmosis by TVL, fell 50% over the quarter, ending with $17 million in TVL. On the plus side, it reduced its share of TVL on Osmosis to 21%. The share for Others increased by 5% over the quarter to make up 41% of TVL on Osmosis. The ATOM-stATOM pool also grew its share this year, sitting at 18% at quarter-end with $15 million in TVL. In October, the DAO voted to add an additional 20 million OSMO to the OSMO-stOSMO pair to deepen liquidity.

Swapping transactions on Osmosis were down 59% in the third quarter to just over 1.1 million swaps. LP actions and Osmosis staking (not including superfluid staking) were also laggards, with transactions down 58% and 46%, respectively. There was a 5% increase in IBC transfers, with nearly 1.6 million executed in the third quarter. The fastest growing category was Others, which made up 62% of the transactions in Q3, nearly doubling its share of 36% in Q2.

Qualitative Analysis

Bringing Liquidity to Celestia

Osmosis is embarking on a significant expansion beyond the Cosmos ecosystem by integrating with Celestia’s data availability (DA) layer. As a prominent decentralized exchange (DEX) within Cosmos, Osmosis has functioned as a key liquidity hub for interconnected chains through the Inter-Blockchain Communication (IBC) protocol. This upcoming integration aims to bridge liquidity between rollups on Celestia and existing IBC-connected chains. Osmosis also plans to abstract DA layer fees for rollups participating in this bridging system, enabling them to pay fees in any token available on the DEX. This trust-minimized bridging system, in collaboration with Hyperlane, aims to eliminate reliance on trusted third parties and chain operators during cross-rollup transactions. Doing so would enhance security through state transition verification and by way of a fraud-proof mechanism.

Furthermore, Osmosis intends to deploy a fraud-proof system to monitor and respond to activities across mesh-secured chains — a concept it champions within the Cosmos ecosystem. This initiative allows Cosmos chain delegators to restake their tokens with validators on other Cosmos chains. Compared to, the traditional Cosmos Interchain Security model, this approach is a unique way for delegators to contribute to enhanced security. With the Celestia bridging announcement, Osmosis has signaled its intention to expand its DEX liquidity beyond the Cosmos ecosystem, venturing into the interconnected rollup ecosystem. This transformative step positions Osmosis as both a DEX and a cross-rollup communication protocol, addressing the challenge of seamlessly connecting rollups in the modular blockchain landscape. The achievement of trust-minimized bridging in the Celestia rollup ecosystem would mark a pioneering milestone and would represent a significant technical endeavor for Osmosis and Hyperlane.

Other Key Events

- July 7, 2023: Osmosis Proposal 549 signals support for the future distribution of fees collected in OSMO to OSMO stakers on a pro-rata basis.

- July 8, 2023: Osmosis seeks to restore the maximum emission of OSMO to 1 billion by burning the excess 548,000 OSMO produced during a delay to the Thirdening event on June 20, 2023. The proposal recommends utilizing the null address as the burn address from which the excess OSMO will be sent. Like the burn mechanism on other systems, this method would require all supply queries to exclude this null address.

- August 14, 2023: Front-end update, joining forces with Frontier.

- August 28, 2023: SkipProtocol becomes a core contributor to Osmosis Labs and Osmosis Zone. Funded by the Osmosis Grant Program, Skip introduced ProtoRev in March, an in-protocol arbitrage system that returned around $200,000 to the Osmosis community. Skip’s ambitious plans for the next two years include designing, building, and launching the MEV Lane in the Block SDK, developing an in-protocol Oracle solution called “Slinky,” and introducing an EIP-1559 fee market. There are also two undisclosed projects currently in development.

- September 5, 2023: The Osmosis V19 upgrade is scheduled to activate at block 11,317,300. This upgrade includes taker fee logic to the pool manager, aiming to improve fee handling and income distribution. It also fixes a bug in the Superfluid protocol, restoring voting power to validators provided to validators using Superfluid Staking.

- September 10, 2023: This proposal was titled “Create Supercharged Pools: Community Requests (Proposal 614).” It aims to create 19 new Supercharged Liquidity pools, all of which have been requested by the community. They are also upcoming listings, initialized on Streamswap, or have had insufficient liquidity compared to trading demand without incentives.

- September 18, 2023: Polychain-backed Quasar introduces concentrated liquidity vaults on Osmosis. Quasar Finance, a Cosmos-based DeFi protocol, launches these vaults, which use an automated mechanism to optimize yields for liquidity providers.

- September 25, 2023: Osmosis passed the permissioning of Membrane contracts, enabling the launch of a new, decentralized stablecoin on Osmosis. Membrane was founded to create a robust, user-first debt token, reducing central control and decentralizing the protocol.

Closing Summary

In line with a softer quarter for crypto activity, trading activity on Osmosis fell in the third quarter. In USD terms, volume and fees paid both fell, albeit at a slower pace than the token prices of the most active tokens on Osmosis. The dynamic indicates that the changes were likely due to price changes. Total transactions on Osmosis rose in the quarter, but the important usage metrics of the number of swaps and LP actions both fell. The DAO’s actions in 2023 to reduce inflation have been successful, bringing annual inflation down to single digits and increasing OSMO in circulation to a more sustainable 2.8% in the quarter.