Key Insights

- ApeCoin DAO voted to fund $20.3 million in grants during Q3, up 974% QoQ.

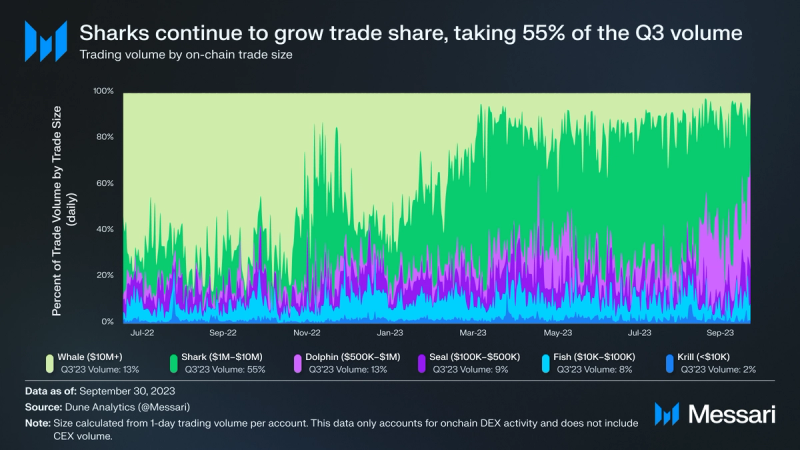

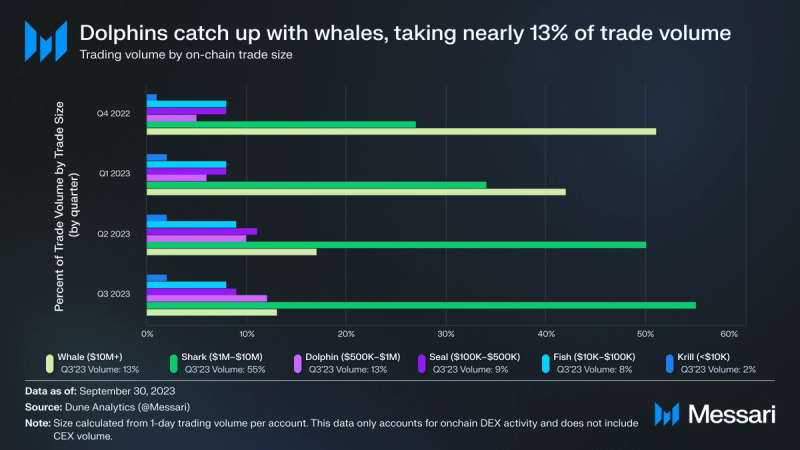

- Sharks ($1 million – $10 million in daily trading) grew their share of APE DEX trade volume to 55%, further lessening the influence of whales (over $10 million in daily trading) in DEX trading of the APE token.

- During Q3, roughly 49.8 million APE was unlocked to non-DAO entities, and 17.7 million APE was claimed by Yuga ecosystem asset and APE holders. Simultaneously, the price of APE fell by 51% QoQ.

- ApeCoin transfer volume fell 49.6% QoQ, but it didn’t outpace the 51% fall in APE price. Hence, the amount of APE transferred actually increased by 3%, though total transfers still fell by 12%.

- ApeCoin DAO approved roughly $18.2 million to fund an NFT collection vault that will consist of at least 70% Yuga assets and will exhibit and donate said content to art institutions.

Primer on ApeCoin

ApeCoin (APE) is an ERC-20 token used for governance of the ApeCoin DAO. Holding any amount of APE qualifies the holder as an ApeCoin DAO member. Members create and vote on ApeCoin Improvement Proposals (AIPs) that encompass Ecosystem Fund distribution, governance rules, partnerships, and more. Third-party developers can incorporate APE into their respective projects.

APE is the adopted token of the APE Foundation, a legal entity that administers the decisions of the ApeCoin DAO. The APE Foundation also has a Special Council, called the DAO’s Board, to perform certain functions within the governance process. The operations of the APE Foundation are run by transient administrative entities elected by members of the ApeCoin DAO.

The ApeCoin DAO and the APE Foundation are separate entities from Yuga Labs, the creator of the Bored Ape Yacht Club (BAYC) and associated NFTs. Below is a breakdown of the relevant entities associated with the APE token.

- ApeCoin DAO — A decentralized autonomous organization (DAO) made up of APE holders that create and vote on AIPs.

- APE Foundation — A legal entity incorporated in the Cayman Islands that administers the decisions of the ApeCoin DAO. Consists of the Special Council and a third-party project management team also called an administrator.

- Special Council (the DAO’s Board) — Five individuals that oversee the APE Foundation’s administrators, can approve grants outside of the AIP process, and perform certain functions within the ApeCoin DAO governance process. The current Special Council members are Bored Ape G, Gerry, Vera Li, Waabam, and CaptainTrippy.

- WebSlinger — Current administrator of the APE Foundation; started its 12-month renewing agreement on March 1, 2023. Based in the Cayman Islands.

- Cartan Group — The first and former administrator of the APE Foundation. Registered in the Cayman Islands.

- Yuga Labs — A Web3 company responsible for creating the Bored Ape Yacht Club (BAYC). Yuga Labs is a contributor to ApeCoin and plans to use APE as the primary token in future projects like Otherside, an NFT-based game incorporating APE and Yuga Labs IP co-developed by Yuga Labs and Improbable.

The APE Foundation, the DAO’s Board, and WebSlinger are the primary entities that ensure the implementation of relevant passed ApeCoin DAO proposals (AIPs). Yuga Labs is largely an associated third-party developer facilitating the adoption of the APE token by incorporating it into its future projects.

Key Metrics

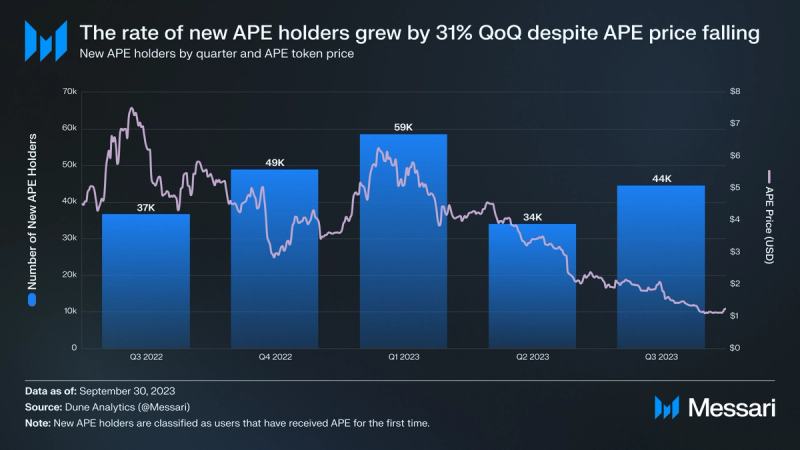

Despite all of ApeCoin’s financial metrics experiencing the roughest QoQ performance in a year, the Q3’23 declines in APE token usage metrics were less severe than in the previous quarter. In fact, the inflow of new APE holders increased by 31% QoQ. The lowest performing metric in Q3 was the APE price, falling by 51%. By comparison, the total crypto market declined roughly 9% over the same period. Regardless, ApeCoin DAO activity remained strong, with APE holders voting on 49 proposals in Q3, up 44% compared to Q2 (34).

Performance Analysis

FDV

Changes in fully diluted valuation (FDV) reflect an asset’s price. Tracking FDV complements price volatility with a sense of scale for the asset’s significance.

APE’s fully diluted valuation (FDV) hit its lowest mark in history during Q3, dropping to $1.1 billion in mid-September. This contributed to the 51% QoQ fall of the average daily FDV. For context, related Yuga NFT floor prices have plunged between 15–35% QoQ.

APE Liquid Supply

Liquid supply curves help determine when an increase in sell pressure may occur for certain assets (or when tokens may get dumped onto unsuspecting buyers). Specifically, they show when tokens unlock and to whom.

A total of 71.8 million APE (13% of the circulating supply) was unlocked in Q3’23, of which 49.8 million APE (9% of the circulating supply) was unlocked to non-DAO entities, including Yuga Labs, Yuga Labs Founders, three groups of Launch Contributors (unnamed entities that helped initially build ApeCoin DAO), and the Jane Goodall Legacy Foundation. A total of 53% more APE was unlocked in Q3 than in the previous quarter. This was a result of 25 million extra APE being unlocked from the Launch Contributor 1 allocation in September — the final unlock for this particular allocation.

The unlock to non-DAO entities represents 9% of the circulating supply. The Launch Contributor 1 allocation added sell pressure to the APE token in September, the same month APE hit its lowest price ($1.10). This extra sell pressure may have contributed to the steeper QoQ decline in the APE price and FDV.

Claimed Staking Rewards

ApeCoin DAO started to issue staking rewards in Q4’22 after passing AIP-21 and AIP-22. APE holders and Yuga Labs’ ecosystem projects like Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and Bored Ape Kennel Club (BAKC) received staking allocations.

Staking was implemented in early December 2022 and will last for three years. It will ultimately distribute 175 million APE (17.5% of the max supply) to Yuga ecosystem asset and APE holders. Since staking launched, the amount of APE claimed has decreased every quarter. In Q3, only 17.7 million APE was claimed, 31% less than the previous quarter. However, APE is still being claimed, which compounds on the sell pressure from unlocks to non-DAO entities. This effect is particularly pertinent in a bear market when confidence is low and may influence the sales of newly liquid APE.

Volume by Trade Size

Volume by trade size shows the percentage of the trading volume corresponding to various trade sizes. For example, if the total volume were $200 million and two wallets traded $50 million each (a total of $100 million), then the two wallets with a volume of $50 million each (a combined $100 million) would account for 50% of the trading volume.

For the past year, the volume by trade size has been getting more equitable. In part, this change is a function of declining prices (in both APE and any non-stablecoins that APE is traded against). As the APE price decreases, sales of the same amount of APE from a previous time period also decrease in USD-value if traded today. Conversely, sales in USD can also decrease when APE is bought with a speculative asset like ETH, whose price has similarly declined the past two quarters. For example, the trade volume of whales (accounts with 1-day trading volumes of greater than $10 million) has continued to fall QoQ since the end of 2022. Considering the changes in sales in USD, this decrease may be more indicative of price changes as opposed to a cohort of new, smaller traders overtaking absolute volume.

Regardless of the reasons, volume by trade size is changing. Sharks (between $1 million and $10 million) overtook whales in Q2 and continued gaining momentum, accounting for 55% of the Q3 trade volume. Dolphins (between $500,000 and $1 million) nearly caught up to whales in Q3, taking just shy of 13% of the volume, while whales took slightly over 13%.

The above data only includes onchain activity, meaning CEX trades are excluded. Higher volume traders may be more inclined to use CEX platforms because they usually offer assurances, protections, and incentives. For example, institutional traders often have access to advanced tools and technical support on CEXs. Additionally, CEXs are not subject to sophisticated MEV strategies like sandwich trading, which is prevalent on DEXs. These dynamics, coupled with the tight money attitudes typically associated with bear markets, may have led more higher-volume traders to CEX platforms.

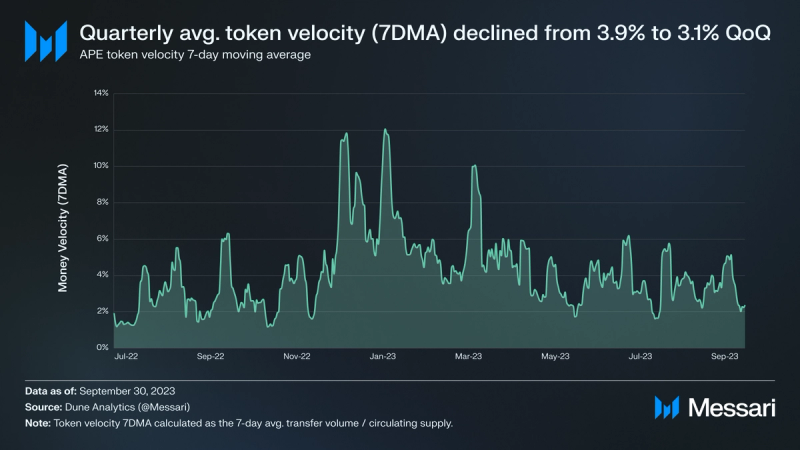

Token Velocity

Token velocity shows the frequency through which an asset changes hands (or wallets). A change in token velocity can show a few things depending on the asset. If the asset can be used beyond trading, such as a token used within a game, an increase in token velocity may imply that the game encourages the adoption/use of the asset. If the asset is more speculative, then a decrease may imply that users are more interested in holding the asset or that it has low demand. In the chart below, token velocity is calculated by dividing the circulating supply by the seven-day moving average (7DMA) of transfer volume.

Token velocity continued its Q2 trend of becoming more stable: the average quarterly token velocity declined from 3.9% to 3.1% QoQ. During Q3, the use cases for APE remained unchanged — it is largely used for governance. Given that velocity measures how frequently a token changes hands, the decline in velocity indicates that users are trading and transferring the asset less frequently than in Q2.

As Yuga Labs plans to launch the Otherside game, which will use APE as an in-game currency, the token velocity of APE may increase. If successful, the game could generate excitement for APE. In turn, its velocity would increase because APE will need to change hands while conducting economic activity in Otherside.

On the other hand, the increased excitement may also lead to a decrease in token velocity. More holders could become interested in managing the DAO, leading users to hold the asset to participate in governance.

New APE Holders

New APE holders are addresses receiving APE for the first time. This metric does not include any new holders using centralized exchanges to custody their assets. Despite most metrics falling QoQ, the inflow of new APE holders increased by 31%. The increase came in spite of the transfer volume falling by 49.6% and the APE price falling by 51%.

The increase in new holders may be a result of the developments coming from ApeCoin DAO’s improvement proposals. AIP-304 will create an NFT collection (of at least 70% Yuga assets) to donate and exhibit at art institutions. And, AIP-297 will create a sister DAO that will maintain a vault to similarly collect NFT assets, except it will also allow APE holders to apply for grants to lease vault-held NFT IP rights.

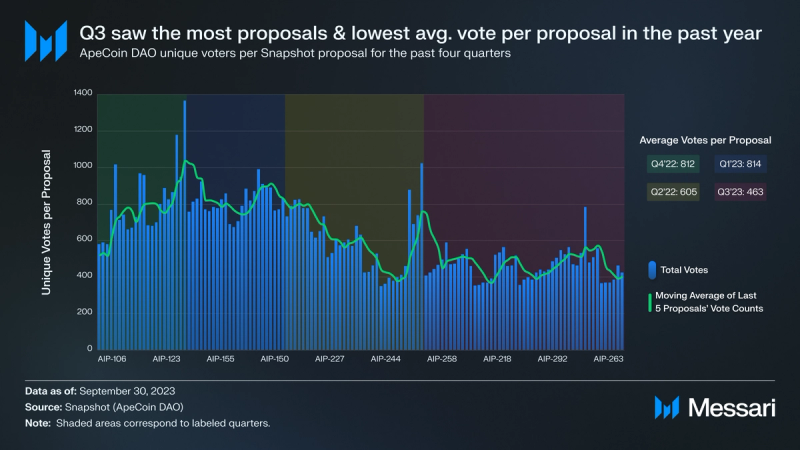

Unique Votes per Proposal

Unique votes per proposal measure how many individuals are participating in governance. If new voters only hold small amounts of an asset, then the impact of their unique votes would be marginal on proposal outcomes in token-weighted governance systems like ApeCoin DAO. However, counting unique votes can show the interest within a DAO, diversity of the active holder base, and decentralization of the active holder base.

During Q3, ApeCoin DAO voted on 49 proposals, the largest amount within the past year. Despite activity in the form of proposals, the average unique voters per proposal dropped to 463, a 23% fall QoQ. This was the first quarter in a year where the largest vote (781) contained less than 800 unique voters. While most top proposals tend to focus on elections or operational budgets, this AIP proposed the creation of an NFT collection with a fund of roughly $18.2 million — and it passed.

In the future, ApeCoin DAO plans to move more of the voting process onchain. Doing so would remove central points of failure (like the reliance on Snapshot) and would add to the governance structure’s decentralization. However, implementing onchain voting would require gas fees for participation. In this scenario, the resulting gas fees could dissuade users from participating in governance.

Governance Analysis

Throughout Q3’23, ApeCoin DAO voted on 49 proposals: 25 passed, 23 failed, and 1 was multiple choice. The failed AIPs proposed costs for implementation totaling $2.5 million. The total value of passed proposals was $20.3 million. The DAO tends to pay these costs monthly or upon project completion. No election proposals were voted on during Q3.

The ApeCoin DAO Q2 2023 Transparency Report was published in September. The report shows that at the start of Q3, ApeCoin DAO held 381 million APE in its treasury ($630 million at the Q3 average APE price of $1.65), owes 784,357 APE in accounts payable ($1.3 million at the Q3 average APE price of $1.65), and has 102 million APE reserved for grants($169 million at the Q3 average APE price of $1.65). By the time all grants are funded for Q3, ApeCoin DAO should have 89.7 million APE left reserved for grants ($148 million at the Q3 average APE price of $1.65).

Listed below are five proposal highlights from the quarter in order from newest to oldest. For a full overview of ApeCoin governance, including preliminary discussions, see the Messari Governor page on ApeCoin.

AIP-317: ApeCoin DAO Governance and Operations Budget

Sept. 27, 2023

AIP-317 outlines a plan that focuses on how the Governance Working Group (GWG) manages the AIP process and executes typical governance operations. Working groups are community-elected parties responsible for implementing the DAO’s initiatives. It plans for the GWG to establish a non-profit DAO LLC structure that provides services and is capable of receiving grants, further separating the GWG from the APE Foundation. This AIP will also fund third-party sustainability and compliance studies of the ApeCoin DAO. Additionally, ApeCoin plans to add a governance analytics dashboard to its website. The GWG consists of seven team members: Amplify, ALL CITY, Tiger, Lost, 12GAUGE, CryptoLogically, and Vulkan. ApeCoin DAO approved $488,000 to fund these governance and operational needs for six months.

AIP-304: Create the Digital Art Movement Collection to acquire Yuga Assets

Sept. 20, 2023

In the most expensive proposal of Q3, ApeCoin DAO approved 11 million APE ($18.2 million at the Q3 average APE price of $1.65) to build an NFT collection called “Create the Digital Art Movement Collection.” Authored by controversial figure Machi Big Brother, AIP-304 proposes that this collection will acquire Yuga Labs assets and other notable NFTs for exhibition and donation to art institutions. The collection will consist of at least 70% Yuga assets and an optional 30% of other notable NFTs. All funds and assets will be deposited into a publicly known multisig that Machi Big Brother will not control any keys to. In addition to being the most costly proposal of Q3, AIP-304 also garnered the most unique voters (781), 33% more than the next most-voted on proposal (588).

AIP-297: An NFT Community Vault Operating as an ApeCoin Sister DAO

Sept. 20, 2023

Authored by two Animoca Brands executives, Tyler Durden and Yat Siu (also former ApeCoin DAO Special Council Member), AIP-297 aims to establish the ApeCoin Sister DAO that will build and operate an NFT vault. Sister DAO plans to be governed by APE holders (holding at least 1 APE). It will build functionality that enables DAO members to utilize the IP rights of NFTs held in the vault by applying for grants. ApeCoin DAO approved 750,000 APE ($1.2 million at the Q3 average APE price of $1.65) for this proposal.

AIP-303: Bored Ape Yacht Club Documentary

Sept. 13, 2023

Since May 2021, three filmmakers have been producing a feature-length documentary called BORED AS F*CK that tells a comprehensive story of the Bored Ape Yacht Club and the evolution of Web3. A stated goal of the film is for it to be accessible to a broad audience and increase the awareness of the ApeCoin ecosystem. ApeCoin DAO approved $400,000 for AIP-303 to support the documentary in its final production stages.

AIP-252: Funding Grant Proposals using Delegated Domain Allocation

Aug. 30, 2023

ApeCoin DAO made a near-unanimous (99.5%) decision to reject AIP-252, which sought $1 million to fund a grant program using the Delegated Domain Capital Allocation Model via Questbook. Had ApeCoin DAO approved this proposal, it would have allocated the requested $1 million to a third party to then decide how to deploy that funding.

Closing Summary

ApeCoin DAO remains active despite a 51% decline in the price of APE and the number of unique voters dropping 23% QoQ. In Q3, ApeCoin DAO voted on 49 proposals (the most in the past year), approved 25 (more than doubling the 11 approved in Q2), and funded $20.3 million in grants, 974% more than the previous quarter.

Complementing the DAO, the future use case of APE being used in the Otherside game is highly dependent on Yuga Labs executing that vision. Without it, APE will continue to be strictly a DAO token. Regardless, ApeCoin has shown progress in executing or developing a plan to execute most of its visions for the future, like creating community-led groups to take on administrative tasks and electing new members of the DAO’s board. However, it has yet to develop a plan to build an onchain voting mechanism. As in Q3, ApeCoin DAO will continue deploying capital via a decentralized voting process led by the community.

——