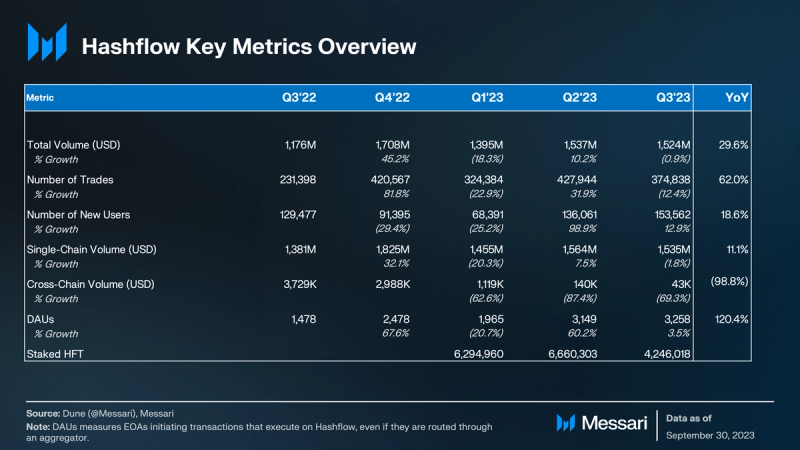

Key Insights

- While prices and DEX volumes fell, Hashflow increased market share as volumes remained steady at $1.5 billion in Q3.

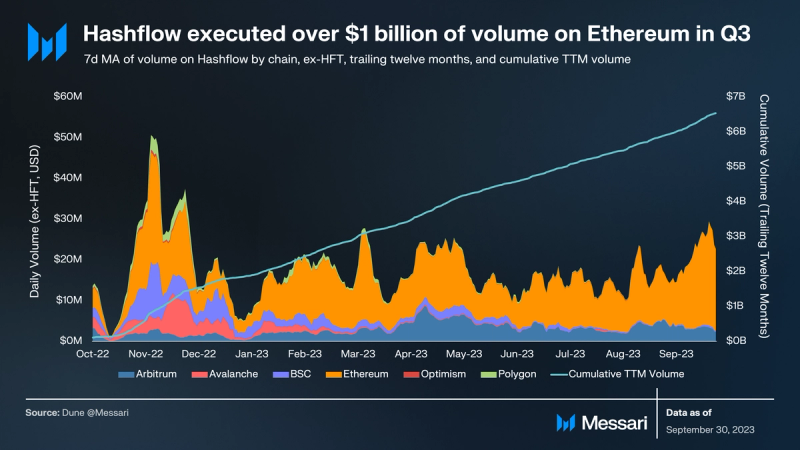

- Hashflow is deployed on seven chains. Its Ethereum instance was the fastest-growing instance by number of daily average users in Q3, capturing 77% of total Hashflow volume.

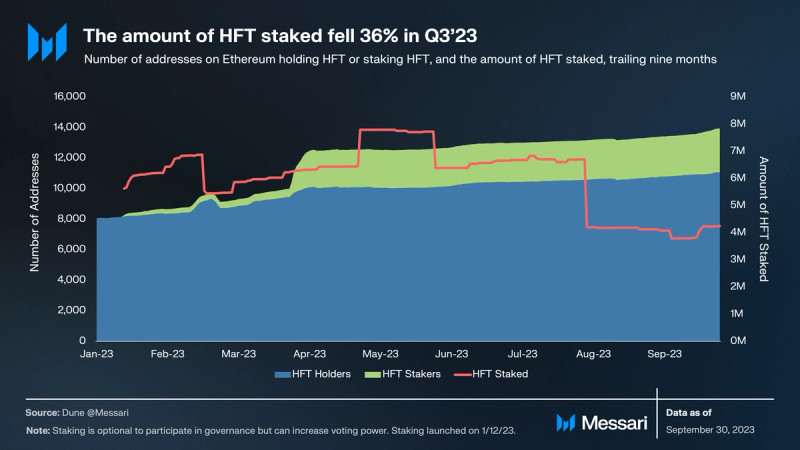

- The number of HFT stakers increased, but the amount of staked HFT fell over 30% in the quarter as a single large lockup ended.

- September 20 marked the launch of the Hashverse, a gamified trading competition for Hashflow users. The game saw an early uptake with over 5,000 NFT mints in the first three weeks and a 170% increase in direct DAUs in its first ten days.

Primer on Hashflow

Hashflow is a decentralized exchange (DEX) that uses a request-for-quote model with pricing provided by professional market makers. Hashflow’s signature-based pricing offers traders guaranteed execution price, MEV-resistance, and no slippage. Hashflow was founded in 2020 by Varun Kumar, Victor Ionescu, and Vinod Raghavan. After launching in Private Alpha in April 2021, Hashflow fully launched in August 2021. Since initially launching on Ethereum, it has expanded to Arbitrum, Avalanche, BNB, Polygon, and Optimism.

Hashflow also offers cross-chain trading, allowing traders to exchange assets on different chains without escrowing or bridging assets between chains. HFT is the governance token for the Hashflow protocol. In early 2023, the Hashflow Foundation announced the Hashverse, a gamified experience to onboard new users, diversify HFT ownership, and promote usage.

Key Metrics

Performance Analysis

Product Usage

Hashflow celebrated a milestone in August this quarter by surpassing $15 billion in volume traded in its lifetime. In a quarter where trading volumes generally fell, Hashflow’s volume proved resilient and was largely unchanged from the previous quarter. On the Ethereum network specifically, where DEX volumes were down 24%, Hashflow took market share and grew volume by 22% to over $1.18 billion. Optimism was the only other chain where volume executed on Hashflow grew, and it is much smaller at only $7 million in volume.

Hashflow deployments on Polygon, BSC, and Avalanche continue to see depressed activity. The volume from the three deployments combined fell to under $50 million in Q3’23 compared to over $600 million in last year’s same quarter (Q3’22). Arbitrum, the second largest Hashflow instance by volume, fell 31% in Q3 to $295 million in volume. Over the last four quarters, Arbitrum has executed over $1 billion in volume, accounting for 16.5% of Hashflow volume.

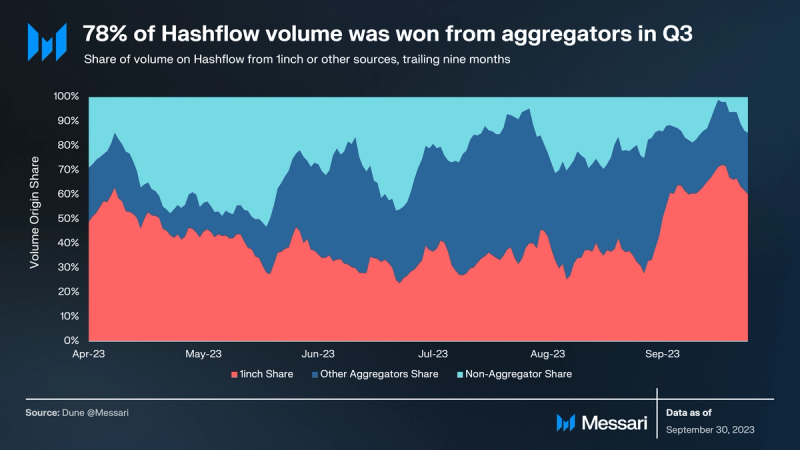

Hashflow derives a majority of its volume from integrations with DEX aggregators. In the third quarter, the share of Hashflow volume from aggregators increased from 70% in Q2 to 78%. This is likely a testament to the RFQ model and its ability to offer better prices than competitors. If Hashflow can scale this model, it can become a critical infrastructure for enabling market makers while providing better execution for traders. Importantly, Hashflow appears to have won a larger share of 1inch volume in Q3 versus Q2, again showing the strength of its pricing. Volume from other, non-1inch aggregators rose 64% in the quarter to over $500 million.

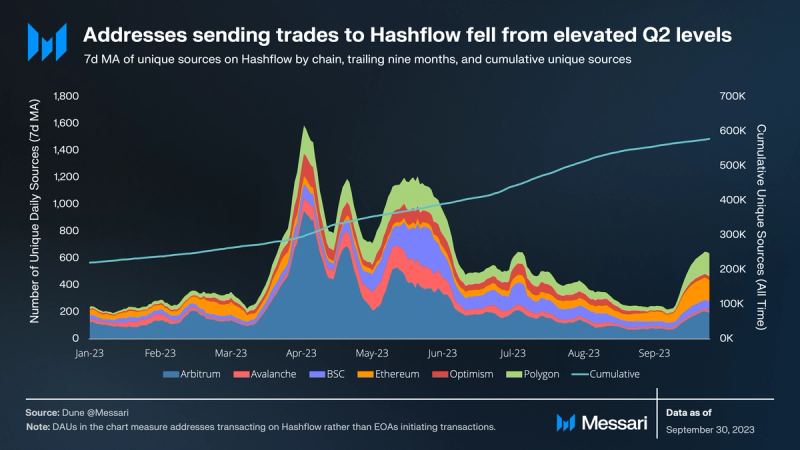

The number of daily active users (DAUs) measures how many externally owned accounts (EOAs) are initiating transactions that get routed to Hashflow or use Hashflow directly. However, here, we measure the number of direct interactions with Hashflow. “Sources” counts native users and aggregation routers that use Hashflow, thus excluding EOAs that interact with an aggregator directly instead of Hashflow. After a very active Q2 that captured spillover from the USDC depeg, protocol usage normalized in Q3.

Hashflow’s Ethereum deployment is its largest by volume with a 77% share. Its number of daily sources increased, while the remaining six Hashflow deployments saw a drop in daily average addresses routing volume to Hashflow. Trade sources on Ethereum increased 67% in Q3 to average 67 per day. In the last 10 days of the quarter, Ethereum usage did enjoy a boost from the launch of the Hashverse, when 157 daily average users executed transactions through Hashflow. For the quarter, the total average was 402 sources per day, down 58% from the 952 in Q2 but up 29% from the 311 in Q1.

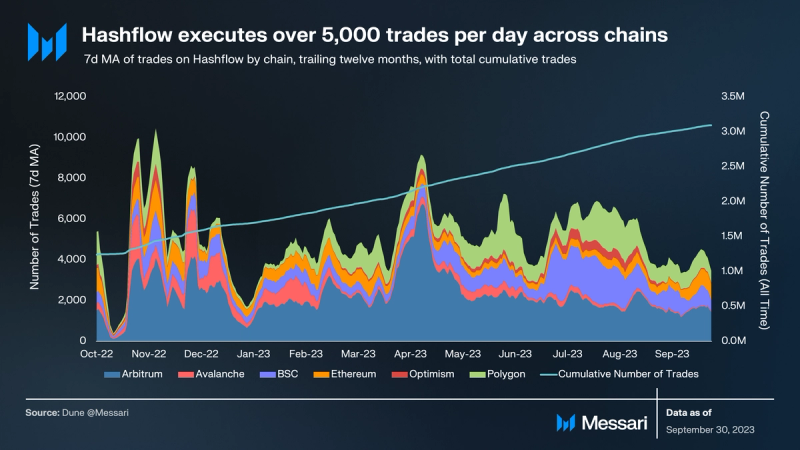

The average number of trades per day on Hashflow fell to 5,300 in Q3, largely due to the drop in activity on Arbitrum. After making up 53% of Hashflow transactions in Q2, transactions on Hashflow’s Arbitrum instance fell to less than 1,800 per day in Q3, making up 34%. Daily transactions increased on BSC, Ethereum, Optimism and Polygon QoQ.

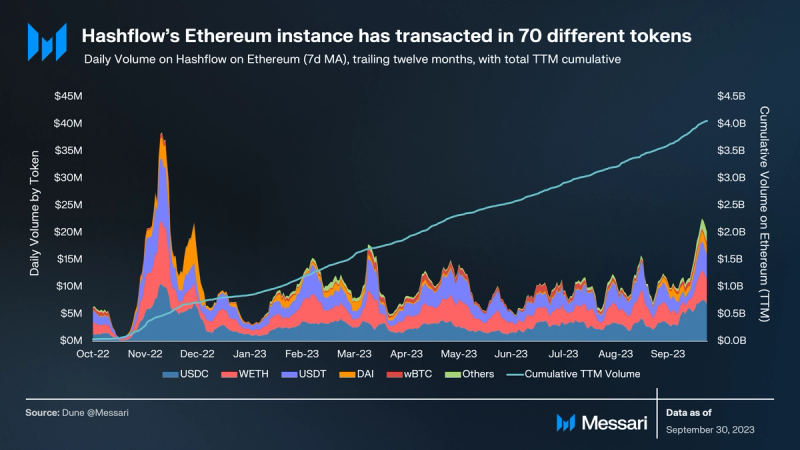

Trading volume on Hashflow’s Ethereum deployment was up 22% in the third quarter, surpassing $1 billion. The increase was largely driven by stablecoins, as the combined volumes for USDC, USDT, and DAI increased 25% to $675 million. The three stablecoins accounted for 57% of volume in the quarter, a four percentage point increase for Q2. wETH volume was also up, increasing 9% QoQ to over $400 million, second only to USDC volumes. On July 20, Hashflow added stETH as a tradable underlier and transacted over $20 million in the liquid staking token.

Volumes certainly experienced a boost from the launch of the Hashverse on September 20. From July 1 to September 19, volumes averaged $11.6 million daily, and after the launch through the end of the quarter, they nearly doubled to $21.9 million per day. The Hashverse is intended to bring users and activity to the native DEX, and early signs show it doing just that.

HFT Distribution and Staking

In the previous quarterly report, we highlighted that roughly half of the staked HFT was set to be unlocked. At the unlock date, a large 2.5 million stake was unstaked and did not restake. In terms of breadth, the number of HFT holders and stakers increased in Q3 by 7% and 14%, respectively. The launch of the Hashverse also drove over 400,000 HFT to be staked by over 200 new stakers in the last 10 days of the quarter. Staking HFT gives power in the Hashverse and earns HFT rewards.

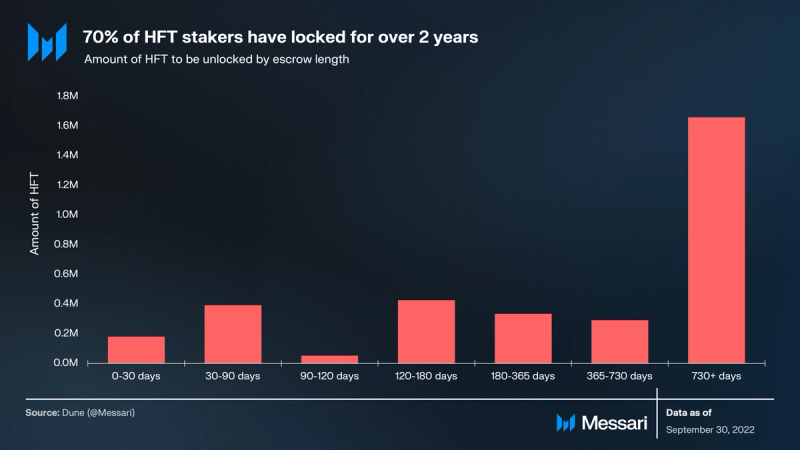

Contrary to the previous quarter, there is a small share of the existing locked HFT coming unlocked in the next 90 days. Furthermore, stakers have largely maximized their HFT power by locking for over two years, likely due to participation in the Hashverse. The total amount staked at quarter-end was 4.25 million HFT, with 26% of HFT holders participating as stakers.

Qualitative Analysis

The Launch of the Hashverse

User acquisition strategies have become an area of rapid innovation and development with the advent and adoption of crypto. The most common is token farming, with rollup incentives certainly rising the ranks in 2023. While the Hashflow team has been working on the core hybrid DEX product, they also teamed with Hollywood agency SuperConductor to build a gamified trading competition and DeFi education platform called the Hashverse.

Hashverse is a novel execution on a trading competition, introducing teams and stories for users to build on. The game uses NFTs for roles and powers and encourages users to compete, take on quests, and earn real rewards. Hashflow requires volume to be a viable place for market makers to provide liquidity and fulfill the flywheel of better prices for users. The Hashverse is a key part of the user acquisition strategy to drive those volumes in the near and long-term.

Launched on September 20, the Hashverse attracted over 3,000 users in its first 10 days, according to the Hashflow Foundation. Although a small sample size, average daily direct users (not going through aggregators) and the number of trades increased 171% and 108%, respectively, post-launch. The last 10 days of the quarter also doubled the average daily trading volume on Hashflow’s Ethereum instance compared to the rest of the quarter.

Q4 will test the stickiness of the game and gauge how much the experience can increase the DEX’s usage. The Hashverse was launched in a much quieter market than other gamified experiences, but its early learnings can offer an opportunity to improve the game and incentives while driving usage of the core product.

Closing Summary

Hashflow’s core product continues to win share in the DEX market. Volumes were steady at $1.5 billion, despite DEX volumes falling in the quarter. Hashflow accounted for a higher share of 1inch volume, while also growing its share from other aggregators faster. Doing so demonstrated the ability of their model to offer better execution prices for traders. Daily activity/usage on Hashflow’s Ethereum deployment, its largest by volume, continued to grow along with Optimism activity, while Arbitrum, BSC, Polygon, and Avalanche usage shrunk. A large HFT staker withdrew a position that unlocked, but staking increased since the launch of the Hashverse in the last 10 days of the quarter. Looking forward, Hashflow should enjoy the benefits from the release of its gamified trading competition, which has already caused an uptick in activity.