Key Insights

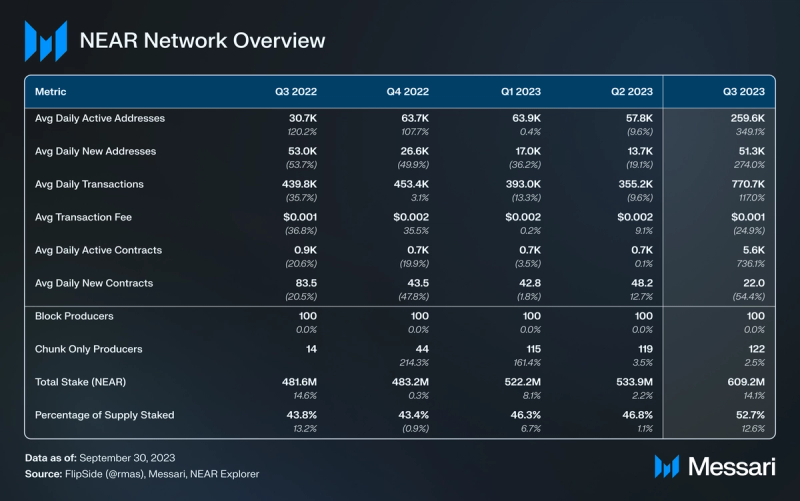

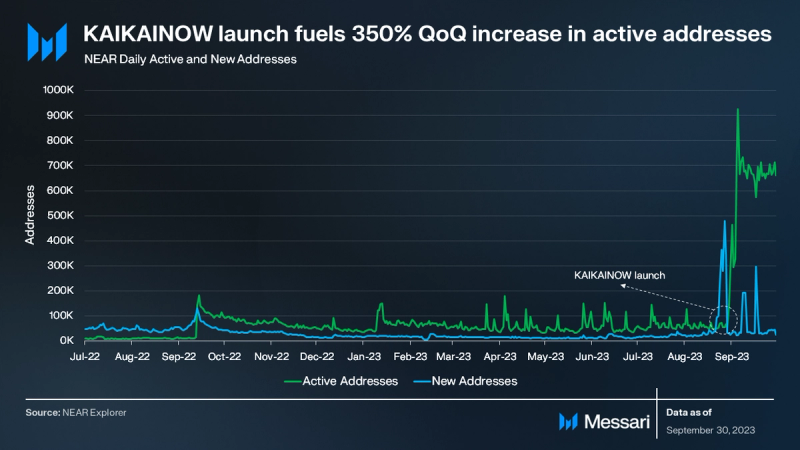

- Daily active addresses increased by 350% QoQ from 60,000 to 260,000. The growth was largely due to the launch of KAIKAINOW.

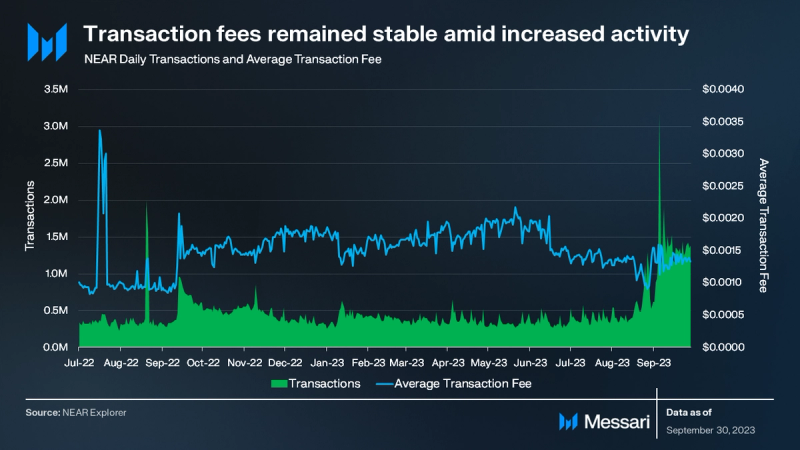

- Daily transactions reached an all-time high of 770,000 in Q3 ’23. Even with heightened activity, the average transaction fee declined by 25% QoQ to $0.001.

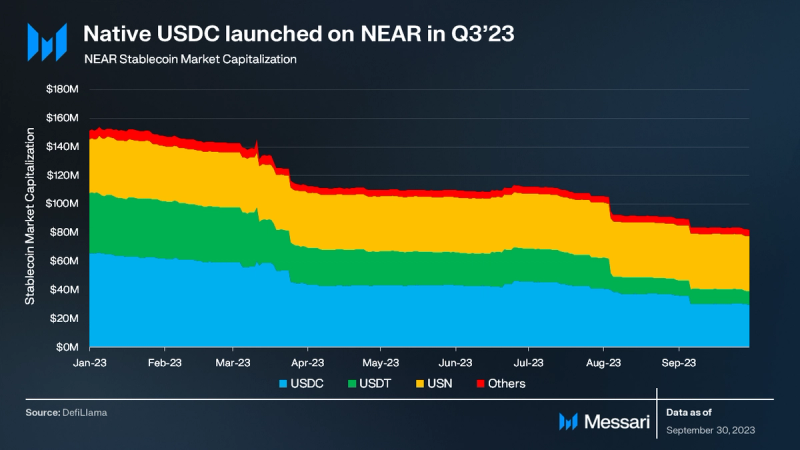

- Native USDC went live native on NEAR. By the close of Q3 ’23, NEAR stablecoin market capitalization stood at $82 million.

- Octopus 2.0 will introduce NEAR restaking. Stakers will have the ability to secure Octopus app chains with their staked NEAR.

Primer on NEAR

NEAR is the Blockchain Operating System (BOS), a fully crypto-native stack that unifies the Web3 space into a single interface and a common layer for building, browsing, and discovering experiences on any blockchain. It provides users the opportunity to connect with various communities and applications while maintaining their data’s privacy, all without the requirement of owning crypto. The BOS provides a cohesive platform addressing Web3 complexities and Web2 centralization limitations.

NEAR Protocol is a smart contract platform that utilizes a Thresholded Proof of Stake (PoS) consensus algorithm to execute transactions. NEAR incorporates a Nightshade Sharding mechanism, which facilitates increased transaction throughput and scalability, takes a novel approach to basic network functionality, and supports EVM and Substrate via Aurora and Octopus Network.

Key Metrics

Financial Overview

Market Capitalization

In Q3 2023, despite favorable court rulings for XRP and Grayscale, the overall crypto market experienced a moderate downturn. The total crypto market capitalization decreased by 5.8%, while BTC and ETH fell by 7.5% and 10.0%, respectively. NEAR’s circulating market capitalization reduced by 14% QoQ to $1.08 billion, while its fully diluted market capitalization decreased by 17% QoQ to $1.12 billion. By the end of the quarter, NEAR ranked as the 40th largest crypto protocol by market capitalization.

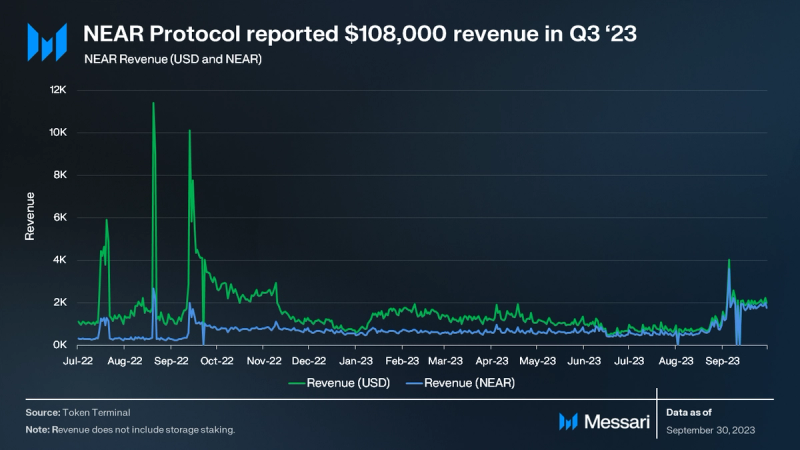

Revenue

In Q3 ‘23, NEAR’s revenue, derived from network transaction fees and excluding storage staking, rose 9% QoQ from $98,000 to $108,000. This growth was primarily attributed to an uptick in transactions after KAIKAINOW’s launch (further detailed in the Network Overview section). Despite the increased transaction volume, the average transaction fee stood at $0.001. Of note, NEAR uses a fee-burning mechanism for transaction fees, where 70% of all fees are burned, and the remaining 30% is directed to the contract from which the transaction originated.

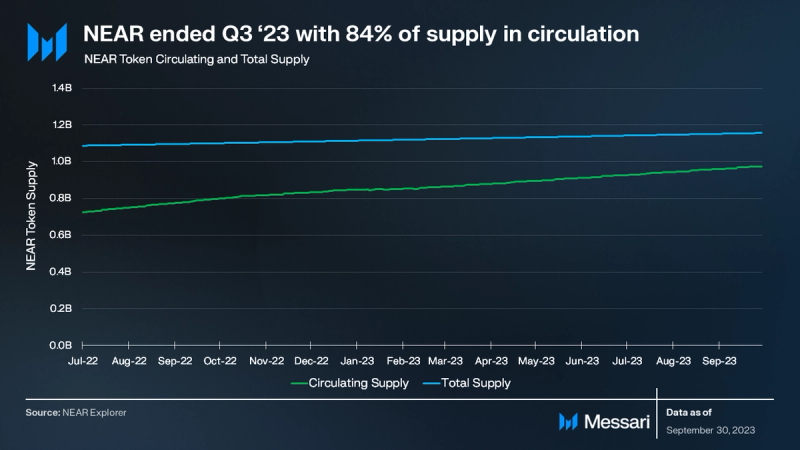

Supply

NEAR’s native token (NEAR) is used for staking, transaction fees, and storage fees. NEAR employs a combination of inflationary and deflationary measures, with no fixed supply of NEAR tokens. The network follows a fixed annual inflation rate of 5%, with 90% of the inflationary rewards directed towards validators and the remaining 10% allocated to the protocol treasury. As of Q3, approximately 84% of the total NEAR supply is currently in circulation. NEAR tokens are gradually unlocked at a rate of 4.3 million NEAR per month into the treasury, with full unlocking expected by October 2025. However, these tokens will only enter the market when distributed from the treasury.

Network Overview

Usage

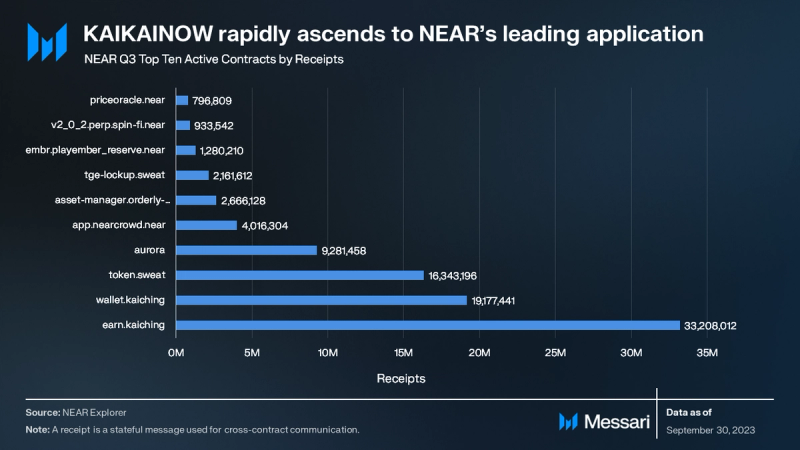

On the NEAR Protocol, contract activity is measured by receipts — stateful messages facilitating cross-contract communication. For the last year, Sweat Economy led in receipt volume on NEAR but was overtaken in Q3 ‘23, despite a 14% QoQ increase in receipts.

In September 2023, Cosmose AI introduced KAIKAINOW. This technology aims to redefine the smartphone lock screen experience by leveraging blockchains and AI to push curated content, from news to games, onto users’ home screens. To incentivize engagement, the system awards users KAI-CHING tokens via the NEAR blockchain, redeemable for both online and offline purchases. KAIKAI was NEAR’s most active contract in Q3, and ranks as the most used protocol in crypto according to Dapp Radar.

Following KAIKAINOW and Sweat Economy, Aurora and NEAR Crowd secured the fourth and fifth positions in contract activity for the quarter. Aurora serves as the Ethereum Virtual Machine (EVM) within the NEAR protocol and saw a 126% QoQ increase in receipts. NEAR Crowd is a task-oriented platform, rewarding users in NEAR tokens for completing tasks, and saw a 26% QoQ decrease in receipts. Other notable contracts in the top ten for the quarter included Orderly Network, Play Ember, and Spin.

In Q3 ‘23, NEAR recorded substantial growth in addresses. Active addresses increased 350% QoQ, reaching 260,000 daily active addresses. Simultaneously, new addresses saw a 274% QoQ increase, totaling 51,000 daily new addresses. This growth can be primarily attributed to the launch of KAIKAINOW. Moreover, contributions from Sweat Economy and Aurora further supported this uptrend.

In Q3 ’23, NEAR’s transaction activity mirrored its account metrics, registering a QoQ surge. Average daily transactions increased by 117% QoQ, climbing from 355,000 to 771,000. Despite this spike in transactions, the average transaction fee remained stable at around $0.001. This stability can be attributed to NEAR’s unique transaction fee mechanism. Unlike Ethereum’s auction-style system, NEAR adjusts fees based on the network’s compute and bandwidth utilization.

Development

NEAR places a strong emphasis on supporting developers. From the total transaction fees accrued, 70% are burned, while the remaining 30% are distributed to the creators of the smart contract called by the transaction. In addition to this fee structure, NEAR offers an extensive suite of tools tailored for developers working within its ecosystem. This suite encompasses SDKs dedicated to popular coding languages, sandbox environments, a NEAR CLI, and NEAR Developer Governance.

- Several notable developer-centric events occurred in the third quarter:

- The debut of the NEAR APAC conference in Vietnam.

- The release of the NEAR BigQuery Public Dataset, designed for querying data from the NEAR blockchain.

- The Encode x NEAR Horizon Hackathon took place spanning four weeks along with other DevHub-sponsored hackathons.

- The announcement of NEARCON 2023, scheduled from November 7-10 in Lisbon.

NEAR has established the NEAR Dev Hub as part of its decentralization efforts. The Dev Hub serves as a resource repository for developers, facilitating collaboration and innovation within the NEAR ecosystem. Early successes include sponsored hackathons, the formation of community groups, and collaboration on NEAR Enhancement Proposals. The implementation of Dev Hub and the BOS, which are designed to support developers, is expected to catalyze development activity.

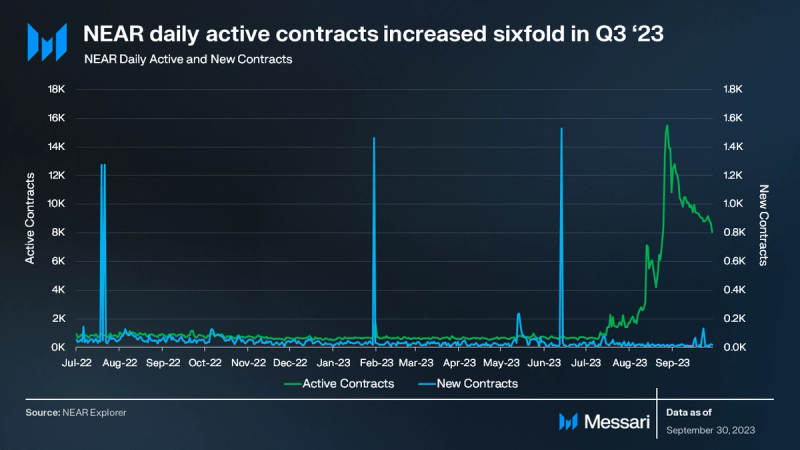

Overall, daily active contracts increased 736% QoQ, while daily new contracts fell 54% QoQ.

Decentralization and Security

NEAR employs a Thresholded Proof of Stake (TPoS) consensus mechanism, consisting of three distinct validator roles:

- Block Producers are responsible for validating transactions across all shards

- Chunk-Only Producers Focus on individual shards and have reduced requirements

- Hidden Validators act as independent third-party monitors.

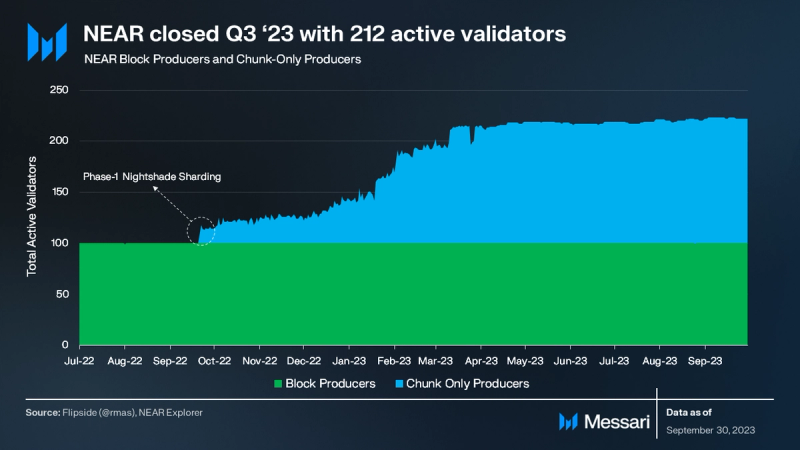

In September 2022, the introduction of Phase-1 of Nightshade sharding enhanced the network’s capacity, enabling support for Chunk-Only Producers. Since this implementation, the amount of Chunk-Only Producers on the network has been on a consistent upward trend. By the conclusion of Q3 ‘23, NEAR recorded a total of 122 Chunk-Only Producers. Conversely, the quantity of Block Producers has been steady at 100.

According to the Pagoda roadmap, Nightshade sharding’s Phase-2 started in Q3 ‘23 and is set to extend until mid-2024. Phase-3 is slated to kick off in mid-2024 and proceed through the remainder of the year into 2025. In Phase-2, the network will expand to 100 shards, with no validators overseeing all shards. Conversely, Phase-3 plans to introduce a mechanism to dynamically modify the shard count based on demand.

NEAR Protocol enables staking through running a validator node or delegation, rewarding participants with inflationary NEAR tokens and storage staking benefits. NEAR has a set annual inflation of about 5% of the total supply. Of this, 90% goes to staking rewards, and 10% to the protocol’s treasury. Notably, 30% of transaction fees are directed to smart contract developers.

In Q3, NEAR introduced a Validator Delegation Proposal based on community feedback and announced restaking will launch with Octopus 2.0. By quarter’s end, 609 million NEAR (53% of total supply) was staked.

Governance

In early January, the NEAR Foundation announced that it is actively working towards a more decentralized model of capital allocation by handing over decision-making to community DAOs. The first community DAOs have already been created, each with a specific focus and mandate:

- Marketing DAO: Created to unify and improve the allocation of funds for marketing-focused projects. It is actively reviewing proposals related to amplification and marketing, with a core focus on content and social media.

- Dev Hub: Created to help decentralize the NEAR developer ecosystem and encourage broad innovation from the developer community. It is currently ramping up and reviewing proposals supporting technical ecosystem projects.

- Creatives DAO: Created for all creative contributors in the NEAR ecosystem, with the goal of empowering artists and creators by providing them with a platform for collaboration, as well as the tools and resources they need to monetize their work and connect with their audience. It is currently accepting proposals for funding.

- NEAR Digital Collective (NDC): A new governance body being developed to help govern the NEAR ecosystem. The NDC aims to allow any member of the network to have a say in how NEAR is run. In Q3 ‘23 the NDC conducted its first elections.

In addition to the NEAR Foundation’s treasury, the NEAR ecosystem has a community treasury. In the third quarter, the NEAR Foundation launched a Grassroots Support Initiative to support projects. The initiative allocated 15 million NEAR to the NDC Community Treasury, with subsequent allocation of up to 100M NEAR contingent on reaching specific milestones.

Additionally, the CEO of the NEAR Foundation Marieke Flament has transitioned to a council-only position in the NEAR Foundation, with former General Counsel Chris Donovan stepping up as CEO to continue working on the Foundation’s broader vision.

Network Overview (BOS)

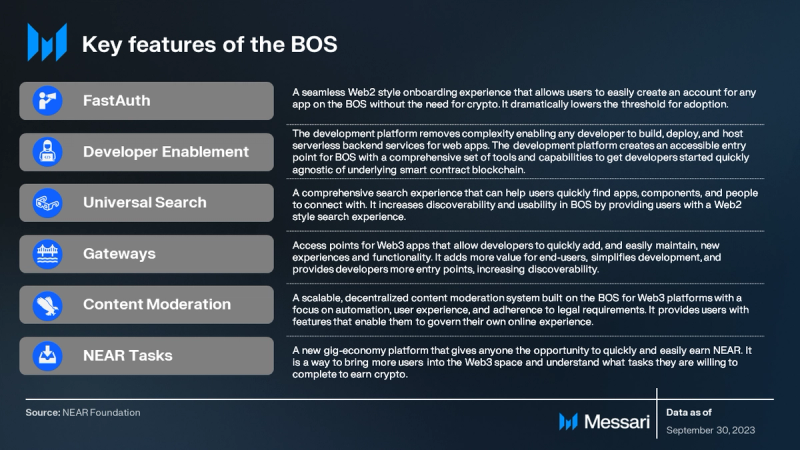

In March, NEAR launched the Blockchain Operating System (BOS), an open-source platform enabling developers to develop on any blockchain using popular languages and community-developed components. It provides users the opportunity to connect with various communities and applications while maintaining their data’s privacy, all without the requirement of owning crypto. The BOS provides a cohesive platform addressing Web3 complexities and Web2 centralization limitations. The BOS is powered by and settles on the NEAR Layer-1 blockchain. As such, it inherits all of the benefits from the NEAR chain.

Key BOS releases include:

- FastAuth SDK Beta: Streamlining user onboarding by enabling email sign-ups without seed phrases or passwords. It uses “Passkeys” linked to biometric data for account security, and account recovery is facilitated via the “MPC recovery” service using emails.

- Web Push Notifications: Enhances real-time user engagement by sending direct push notifications to devices, moving beyond the limitations of in-app notifications on near.org.

- NEAR Query API (Beta): A serverless solution offering NEAR blockchain indexers, storage, and GraphQL endpoints, streamlining blockchain data interaction, and optimizing BOS application development.

Additional BOS features include Developer Enablement, Universal Search, Gateways, Trust and Safety Content Moderation, and NEAR tasks. For an in-depth review of the BOS, check out this Messari report.

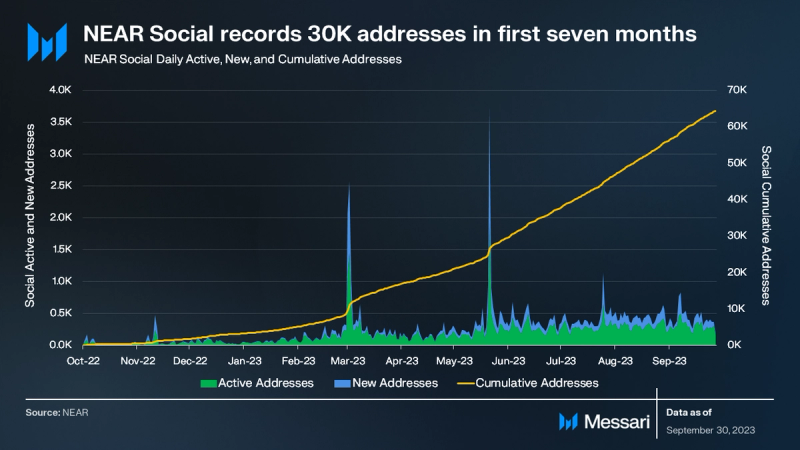

NEAR Social serves as the social layer of the BOS. It offers a peer-to-peer network for social interactions, content creation, and distribution. Users own their data, developers can access public data to create apps, and customizable widgets foster innovation. Today, NEAR Social is the central hub of activity on the BOS.

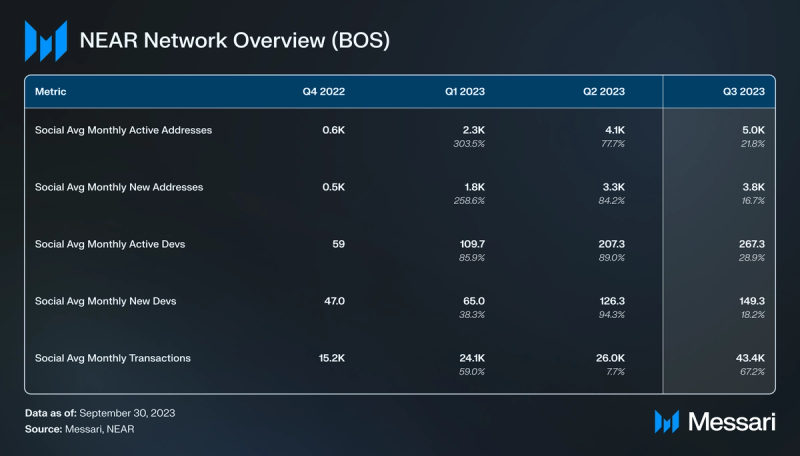

Since its inception, NEAR Social has demonstrated consistent growth in active and new addresses. In Q3 ’23, the platform recorded an average of 5,000 monthly active addresses, marking a 22% increase QoQ. Concurrently, the number of new monthly addresses reached an average of 4,000, a 17% rise QoQ. Cumulatively, NEAR Social has registered close to 30,000 addresses in its first seven months.

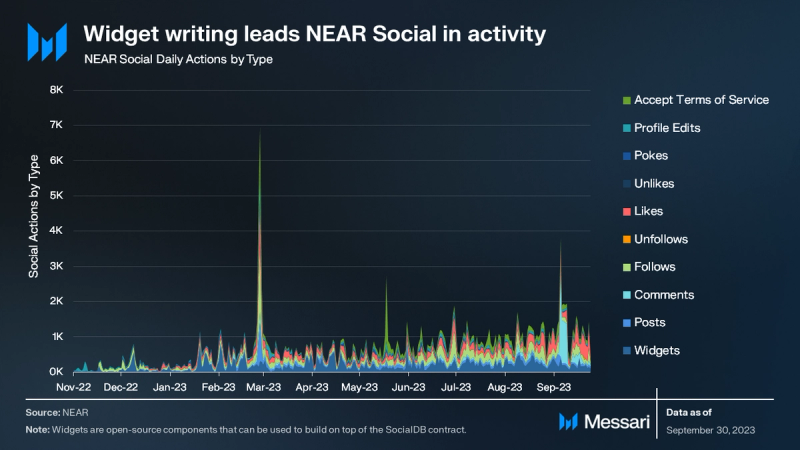

Widget writing has emerged as the primary action on NEAR Social. Widgets serve as versatile, open-source components for developing atop the SocialDB contract. They range from simple buttons to complex application structures. Following widget creation, the most frequent user actions are “follows” and “likes”. Overall, NEAR Social experienced a 67% QoQ increase in average monthly transactions.

The BOS was designed to cater to developers, and Q3 saw a series of launches and activities in this regard:

- NEAR core team members participated in the We Are Developers World Congress 2023 in Berlin, highlighting BOS’s capabilities.

- A partnership was forged with Vistara for multi-chain rollup deployment on the BOS, accompanied by a rollup deployment framework.

- The BOS introduced an ecosystem gateway for the Polygon zkEVM and Mantle.

- Tokenproof, a startup focusing on token-based brand-audience interactions, announced it will integrate with the BOS.

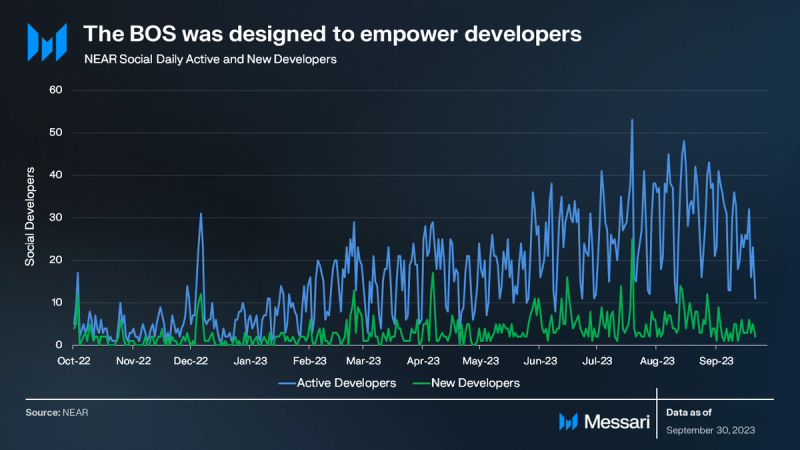

Monthly active developers and new developer figures for Q3 grew by 18% and 67% QoQ, respectively.

Ecosystem Overview

DeFi

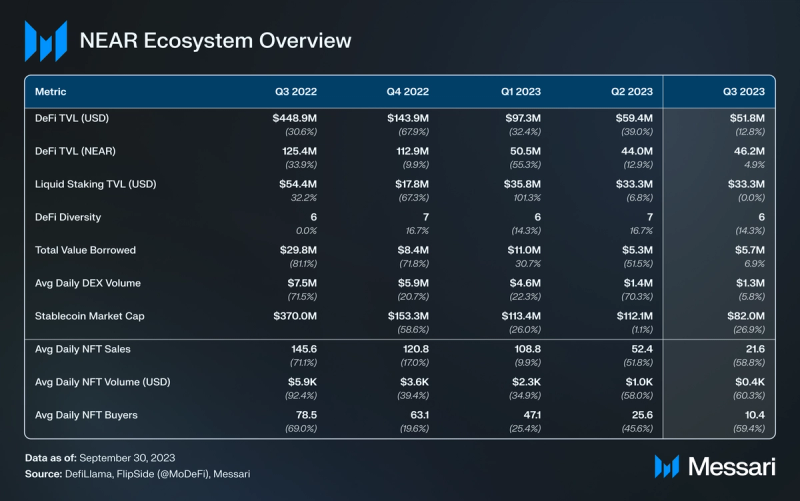

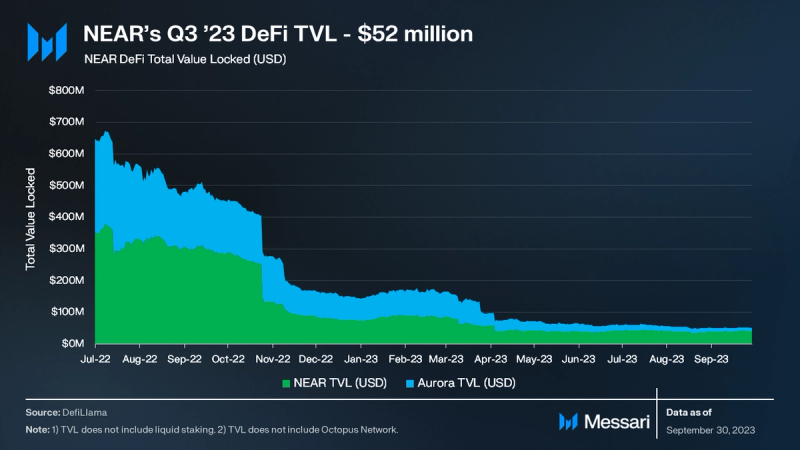

NEAR’s Total Value Locked (TVL) experienced a 13% QoQ decrease, ending the quarter at $52 million. By the close of Q3, NEAR was ranked approximately 35th among blockchains in terms of TVL. Within the NEAR Network’s TVL, NEAR’s contribution was $41 million (80%), and Aurora’s contribution amounted to $11 million (20%).

During Q3 ’23, Burrow maintained its position as the leading protocol on NEAR in terms of TVL, registering an 18% QoQ increase and ending with a TVL of $20 million, which is equivalent to 39% of NEAR’s total TVL. Among the leading DeFi protocols, only Burrow witnessed a QoQ TVL increase. Conversely, the subsequent six major DeFi protocols averaged a 31% QoQ decrease in their TVL.

DeFi Diversity denotes the number of protocols comprising the top 90% of DeFi TVL. A wider spread of TVL across protocols can mitigate potential systemic risks from negative events. NEAR concluded Q3 with a DeFi Diversity score of 6.

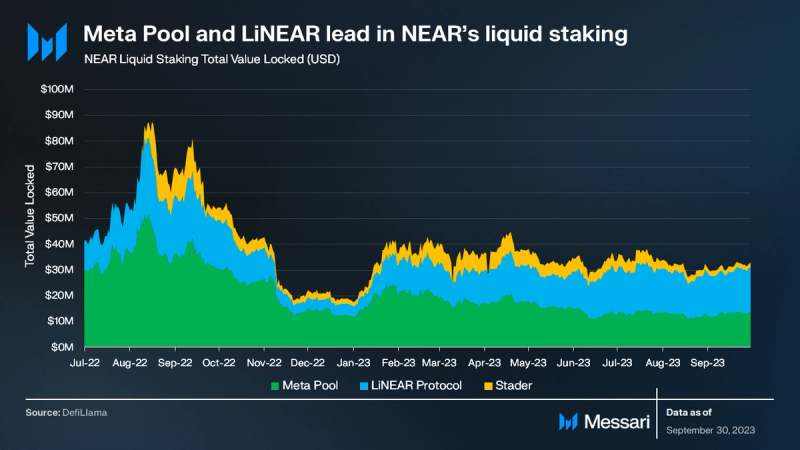

While liquid staking is excluded from the TVL figures, it remains an increasingly important metric in crypto. At Q3’s conclusion, NEAR’s liquid staking TVL was $33 million, unchanged QoQ, and equivalent to 64% of the total network TVL.

The predominant liquid staking protocols on NEAR are Meta Pool and LiNEAR, having TVLs of $14 million and $17 million, respectively. Last quarter, LiNEAR unveiled the Automatic Validator Selection Optimization. This feature is designed to autonomously distribute users’ NEAR among validators to simultaneously maximize yield and bolster network security. During the same period, Meta Pool expanded its offerings to include Aurora. Additionally, in Q3 ’23, Meta Pool’s ETH liquid staking became operational on the BOS, and the protocol disclosed its intention to transition protocol governance to the BOS.

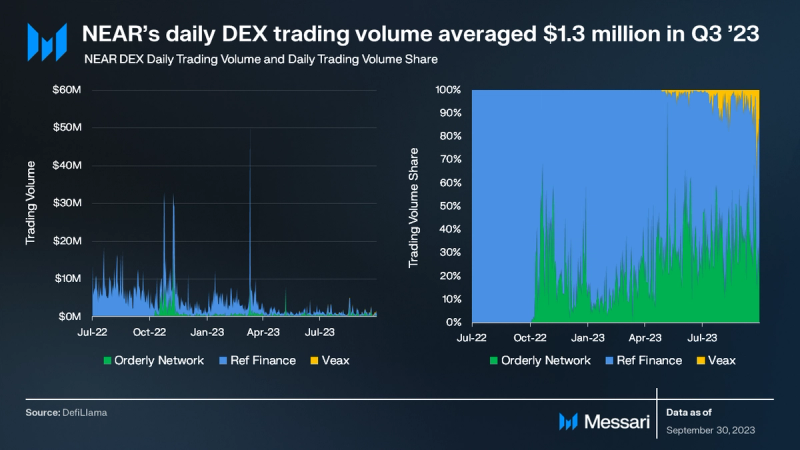

For Q3 ’23, NEAR reported an average daily DEX trading volume of $1.3 million, flat QoQ. Over the past year, there has been a consistent decrease in NEAR’s DEX trading volume, a pattern that aligns with the broader crypto DEX market trend. By the quarter’s end, NEAR held approximately the 30th position in DEX trading volumes.

On NEAR, Orderly Network and Ref Finance registered QoQ declines of 4% and 14% in trading volume, respectively. In contrast, Veax, which launched on mainnet in April, witnessed a QoQ jump of 300% in its average daily trading volume. However, it’s worth noting that Veax represented just 5% of NEAR’s total DEX trading volume.

Spin, NEAR’s inaugural perpetual futures protocol, experienced a reduction in trading momentum during Q3 ’23, logging a total trading volume of $2 million. In addition, Spin made an announcement regarding the postponement of the SPIN token’s launch.

NEAR’s stablecoin market capitalization experienced a 27% QoQ decline, moving from $112 million to $82 million. This downturn was primarily driven by USDC, which saw a reduction from $46 million to $30 million (-35%), and USDT which went from $23 million to $10 million (-59%). Amidst this backdrop, native USDC went live on NEAR. Conversely, USN, the winding-down stablecoin from Decentral Bank, remained unchanged in its market capitalization over the quarter.

The contraction in NEAR’s stablecoin market capitalization mirrors the broader crypto market trend, which started its decline following its peak in mid-2022. By the end of Q3, NEAR secured the eighteenth position for stablecoin market capitalization among blockchain networks.

NFTs and Gaming

Q3 ’23 saw a continued decline in NEAR’s NFT activity. Paras Marketplace led the sector, with Few and Far, TradePort, and Mintbase trailing. Mintbase collaborated with the NEAR Foundation to mark the Indian festival, Raksha Bandhan.

Additionally, the NEAR Foundation announced a number of partnerships and developments:

- The NEAR Foundation partnered with Hibiki Run to revolutionize music discovery and digital collectibles through the introduction of a ‘Digital Gachapon’ economy.

- The NEAR Foundation partnered with Shred Spots, a social platform for street sports enthusiasts. Shred Spots integrates NFTs, empowering skaters within the action sports metaverse.

- TheFunPass, a Web3 rewards app by The Littles, debuted at the Richmond Night Market. This app, built on the NEAR blockchain, transforms event engagement by providing a blend of digital and physical missions in carnival games.

- SailGP launched “The Dock,” a mobile app for fan engagement by combining sports and blockchains. The Dock uses NEAR blockchain to offer personalized accounts, exclusive content, and rewards for fan interaction.

- NEAR Foundation partnered with Blumer, Colombia’s first Web3 social network. Blumer rewards active users by distributing 18% of its advertising revenue back to the community.

- GLASS, the world’s first compliant Web3 community and loyalty platform for the alcohol industry, is deploying on the NEAR blockchain to engage social drinkers.

- NEAR Foundation announced a new partnership between Los Angeles Football Club (LAFC) and Dropt — a fan engagement platform built on the NEAR Protocol — supporting the club’s vision to rewrite the playbook on the fan experience.

- The NEAR Foundation joined forces with IT company SK Inc. C&C to help Web3 businesses expand in South Korea.

- The International Cricket Council (ICC) and the NEAR Foundation entered into a new partnership that will utilize Web3 tools built on the NEAR Blockchain to deepen engagement in the sport.

Closing Summary

In Q3 ’23, NEAR showcased significant growth despite a turbulent crypto environment. The quarter saw an upsurge in network activity, with a 350% QoQ increase in active addresses and a 117% QoQ increase in transactions. The increases can largely be attributed to the introduction of KAIKAINOW, an innovative technology that harnesses blockchain and AI to revolutionize smartphone lock screen experiences by delivering tailored content.

KAIKAINOW was not only the most engaged contract on NEAR but also clinched the top spot as the most used protocol in crypto in September. Notably, despite the increase in network activity, transaction fees saw a 25% QoQ reduction, averaging $0.001.

Simultaneously, the Blockchain Operating System (BOS) underwent significant advancements and experienced increased adoption. Noteworthy Q3 BOS deployments include the FastAuth SDK Beta, Web Push Notifications, and the NEAR Query API (Beta). NEAR Social exhibited encouraging metrics with 5,000 monthly active addresses (+22% QoQ), 43,000 monthly transactions (+67% QoQ), and 267 monthly active developers (+30% QoQ).

Looking ahead, NEAR’s core developers remain firmly focused on the BOS. The vision is clear: solidify NEAR’s distinct footprint in the industry, centered around the BOS and synergies with AI.