Key Insights

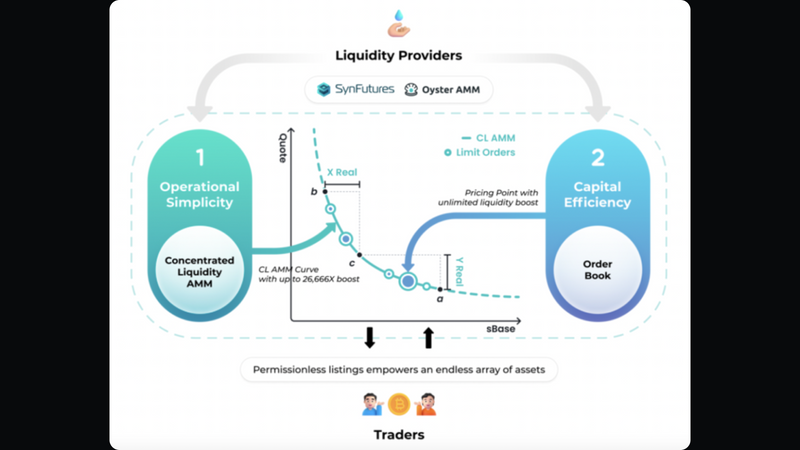

- The recently released SynFutures V3 whitepaper unveiled the Oyster Automated Market Maker. It maximizes capital efficiency by merging the benefits of concentrated liquidity and a traditional order book under one unique model.

- The Oyster AMM enables users to trade with up to 100x leverage while protecting LPs and limit order makers through a dynamic penalty fee framework.

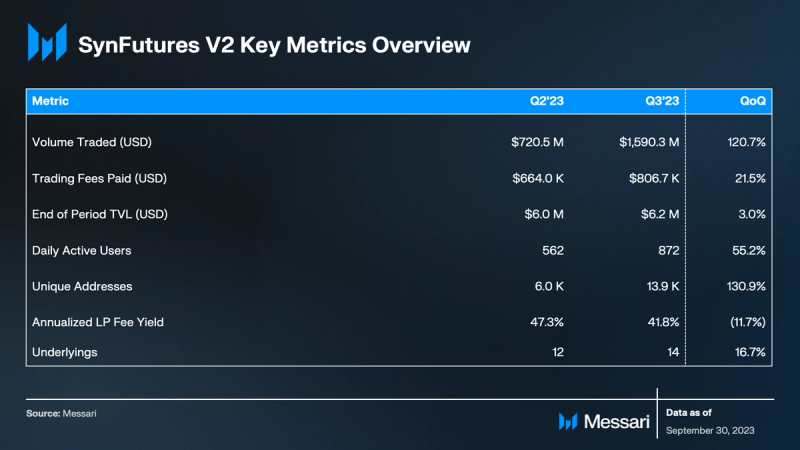

- SynFutures V2 surpassed $2.3 billion in total volume traded and facilitated trades for more than 24,000 unique wallet addresses.

- Liquidity Providers achieved an annualized return of 42% from trading fees in Q3.

Primer on SynFutures V2

SynFutures is a decentralized derivatives exchange deployed on Polygon Mainnet and zkSync. While the platform has yet to launch a native token, the SynFutures team is open to the idea and recently secured $22 million in a Series B funding round spearheaded by Pantera Capital. Through a single-token liquidity model, SynFutures enables users to freely list and trade any asset in seconds, without centralized intervention or DAO proposals. The spot price for each underlying derives from oracles such as Chainlink or spot DEX markets and uses an exponential moving average to smooth volatility. The synthetic automated market maker (sAMM) model of SynFutures V1 facilitated over $18 billion in trading volume, serving more than 50,000 traders across 257 underlyings.

To enhance the trading experience, V2 was publicly released in May 2023, focusing on perpetual futures. This move enabled SynFutures to offer a better UX experience by eliminating the need for users to roll over positions and juggle separate margins. Additionally, V2 introduced unique mechanics to guarantee the futures price convergence to spot price. Unlike other perpetual futures contracts that have traders pay the funding rate out of their margin account on a fixed schedule, the funding rate on SynFutures is reflected in a trader’s PnL and is determined by the price discrepancy between the spot price and perpetual futures contract price every day at 8 a.m. UTC.

V2 Key Metrics

Introducing SynFutures V3

Just six months after the public release of V2, the team unveiled SynFutures V3: The Oyster AMM Model for Next-Gen DeFi Derivatives. This evolution of the protocol’s AMM aims to rival centralized alternatives in capital efficiency without sacrificing transparency. The AMM’s unique design houses range-bound liquidity with the additional functionality of a traditional order book. To enable native limit orders like those in central limited order book systems, it ditches the first-in/first-out approach for a matching process better suited for AMMs.

Source: SynFutures

Each liquidity provision within the Oyster AMM is treated as a self-contained AMM, concentrated around the prevailing price of the underlying. Liquidity providers (LPs) only need to specify the width of their desired range. Native limit orders are defined at single price points and irreversible once filled. This design allows for atomic transactions and provides makers with certainty of the status of their limit orders.

The AMM uses a smart contract struct termed “Pearl” to encapsulate the collection of concentrated liquidity positions at a specific price point, as well as all open limit orders at that price. The Oyster AMM resembles a pearl necklace, with each Pearl representing a point along the AMM price curve. At any given price point with existing limit orders, limit orders are prioritized and filled before tapping into any concentrated liquidity. Thus, if a taker’s trade size stays within the existing limit orders at a specific price, it can avoid slippage, allowing the Oyster AMM to compete with the efficiency of centralized exchanges.

Compared to V2, the Oyster AMM has lower margin requirements, allowing users to trade with up to 100x leverage. To protect LPs and makers, the lower margin requirement is balanced by a dynamic penalty fee framework. It works by increasing the fees paid to liquidity providers if a trade results in significant deviations between the fair price and mark price.

For more on SynFutures V3, please see the Qualitative Discussion.

Performance Analysis

Since the beta release in Q2, SynFutures V2 has recorded over $2.3 billion in total trading volume and attracted over 24,000 distinct wallet addresses. By July, the distribution of volume from top traders stabilized, with the top 5, 10, and 50 traders accounting for 16%, 22%, and 54% of the daily volume in Q3, respectively. Notably, an average of 871 daily active wallets were recorded, with 137 of them interacting with the product for the very first time on any given day.

Accounting for both the V2 and the now-discontinued V1 product, the SynFutures platform has facilitated more than $21 billion in total trading volume for over 100,000 traders.

SynFutures’ sAMM determines trading fees based on each trade’s market impact. When initiating a trade, a 0.3% fee is applied if the subsequent fair price change is up to 10%. However, for changes exceeding 10%, the fee rises to 1.2%. Liquidity providers receive 83% of this fee because they serve as counterparties to traders. The remaining 17% of the fee is directed to market-specific insurance funds, which are used to fund account deficits when traders aren’t promptly liquidated. Throughout Q3, SynFutures implemented a promotional period that discounted the total fee paid by 80%. Despite this, trading fees totaled $806,000, and annualizing the fees paid on the TVL showed liquidity providers earning 42% APY.

Qualitative Analysis

Since early 2021, the SynFutures platform has been breaking new ground in democratizing the decentralized derivatives market. The foundational sAMM (synthetic Automated Market Maker) model introduced in SynFutures V1 pioneered a path for SynFutures to become the first onchain derivatives platform to offer permissionless listing and trading of any cryptoasset. The sAMM mechanics achieved this by providing synthetic liquidity for Dated Futures contracts using a Constant Product Market Maker (CPMM) model. SynFutures quickly gained traction with V1 as users of various communities could permissionlessly list assets of new projects and start going long or short on them for the first time. Before deprecation in February 2023, V1 facilitated more than $18 billion of trading volume for more than 50,000 traders and scaled to 257 underlyings.

While V1 showcased the potential of a permissionless derivatives market, it was evident that enhancements were needed. Traders grappled with challenges such as fragmented liquidity, managing various contract expiries, juggling separate margins, and the intricacies of rolling over positions upon contract expiration.

To address these concerns, V2 was developed with an emphasis on refining the UX of the trading experience. After a successful closed Alpha Launch, the V2 beta made its debut in May 2023 on the Polygon Mainnet, ushering in the era of Perpetual Futures for its traders. Unlike the dated futures of V1, these contracts do not expire, offering a continuous trading experience. The funding mechanism for SynFutures’ Perpetual Futures differentiated it from other perpetual contracts in the market. This legacy of V1 continues to ensure that the futures price remains in harmony with the underlying spot price. Funding rates on other perpetual offerings instead rely on soft pegging mechanisms, which can be manipulated, especially in low-liquidity environments. The SynFutures design not only guarantees price convergence to the spot index but also streamlines the mechanism. Rather than extracting the funding rate from traders’ margin accounts at fixed intervals, SynFutures embeds this rate into a trader’s PnL.

SynFutures V3 Deep Dive

Solving Capital Efficiency with Single Token Liquidity

The sAMM revolutionized onchain derivatives by making it possible for anyone to launch a new market for any asset using just a single token. Yet, DEXs like SynFutures require volume to be a viable place for market makers to provide liquidity and fulfill the flywheel of better prices. While immense innovation has taken place over the last couple of years, the DEX landscape is still in its formative stages and has yet to offer competitive solutions for deploying robust LP strategies. This gap has led major market makers to prefer provisioning liquidity on established centralized platforms over venturing into newer decentralized alternatives. The Oyster AMM is designed to address this chicken-and-egg dilemma.

Building on the sAMM’s single-token design, the Oyster AMM introduces range-bound liquidity. Each liquidity provision is treated as a unique, self-contained AMM, concentrating liquidity around the prevailing price along a constant product price curve. This approach alleviates each liquidity provision from supporting a full range, significantly boosting capital efficiency. It achieves this by allowing LPs to offer deeper liquidity with the same value of assets, facilitating higher yields for liquidity providers.

Unlike other concentrated liquidity mechanisms, LPs only need to define the width of their desired range, characterized by the parameter , instead of manually setting their preferred price boundaries. The Oyster AMM then automatically sets the lower and upper price boundaries. For instance, when an LP wishes to add liquidity to an ETH-USDC pool, they choose a 5% range with the underlying token at $1,000. In other words, they would be LPing between $952.38 (1,000/1.05) and $1,050 (1,000*1.05). The AMM defines the effective price range for that liquidity, dictating the creation of the corresponding ETH-USDC long and short positions. This process effectively enables single-token liquidity provision.

Providing liquidity in both the sAMM and Oyster AMM is a multifaceted process, with many complexities abstracted for the LP’s convenience. Effectively, LPs take a long and short position to give them net zero exposure to the underlier, with leverage determined by how much they deposited and the range they specified. By having positions on both sides of the market, they act as market makers willing to take the other side of user trades.

The primary goal for LPs is to earn enough trading fees to compensate for the risk of having a directional position, which occurs if the pair trades outside the range. In the Oyster AMM, LPs can withdraw their concentrated liquidity at any time. The liquidity is then transformed into a trading position, factoring in the implied net position, remaining margin, and any accrued fees.

LPs stand to profit when trading fees surpass volatility. However, if the Oyster AMM price exceeds the concentrated liquidity’s price range in either direction, any party can initiate the removal of that liquidity. Doing so would convert it into a trading position credited to the account of the original liquidity provider. If the price continues to move further out of the range, the converted trading position can be liquidated if there is not sufficient margin. Thus, while the trading fees earned from perpetual futures trading can offer outsized returns compared to spot markets, LPs are effectively short volatility and should be mindful of the underlying pair’s daily volatility.

Here’s where the Oyster AMM stands out. It has a built-in safeguard to ensure that every concentrated position is always in line with its margin requirement. To be precise, Oyster AMM mandates that the liquidity maintains sufficient margin to meet the initial margin requirement for the implied net position at both price range boundaries. Yet, because the net position value and margin requirement are lower at the lefthand side, liquidation risks from price movements to this side are reduced because of sufficient margin.

Order Book

Constant product AMMs have played a pivotal role in democratizing market access by providing automated “market maker” functionality for even the most niche assets. While innovations like concentrated liquidity have emerged, AMM models still grapple with the challenge of decreased capital efficiency. They require significant liquidity to achieve a price impact comparable to the central limit order book (CLOB) systems of centralized trading platforms. Even then, a constant product AMM model can never achieve infinite efficiency, as any infinitesimal trade would still result in non-zero slippage. The downfall of FTX, however, sparked a surge in demand from traders seeking non-custodial, decentralized alternatives for trading derivatives.

To address this need, the Oyster AMM introduces an onchain order book that enables the capital efficiency of centralized exchanges. This is accomplished by merging concentrated liquidity with irreversible limit orders under one unique model. Here, all concentrated liquidity positions at a specific price point, along with all open limit orders at that price, are encapsulated in a smart contract struct termed Pearl. The Oyster AMM can be visualized as a compilation of Pearls along the AMM price curve.

Source: SynFutures V3

Instead of adhering to the first-in/first-out approach typical of central limit order books, the Oyster AMM introduces a matching process tailored for AMMs. It can be summarized as follows:

- At any given price point with existing limit orders, these orders are prioritized and filled before tapping into concentrated liquidity.

- Trading volume is proportionally distributed across multiple limit orders at the same price.

This cohesive approach reduces overall slippage and ensures traders can enjoy atomic transactions with predictability. Further, if a taker’s trade size remains within the bounds of existing limit orders at a specific price, its efficiency can achieve that of centralized exchanges, further bridging the gap between onchain and centralized systems.

Market Stabilization and Dynamic Penalty Fees

In a well-functioning derivatives market, it’s common for the fair price to differ from the spot price. Similar to the sAMM, the spot price, derived from oracles such as Chainlink or spot DEX markets, uses an exponential moving average to smooth volatility. The Oyster AMM’s fair price combines all concentrated liquidity and limit orders, similar to the mid-price in a central limit order book (CLOB) system. This price is essential for liquidity calculations. It helps determine if concentrated liquidity is outside its price range and is also used when converting it into a trading position. In contrast, the mark price determines unrealized profits or losses and the initial margin required to initiate a position, making it the primary reference for managing position risks. By distinctly separating trading and marking responsibilities, the Oyster AMM’s pricing mechanism shields the system against potential threats, including flash loan exploits and attempts at price manipulation.

Additionally, the Oyster AMM introduces dynamic penalty fees to ensure market stability and fairness, safeguarding LPs and limit order makers without impacting normal trading behavior. These fees penalize trades that cause significant price deviations between the fair and mark prices. If a trade increases the deviation between these prices, a stability penalty is added to the standard trading fees. Specifically, trades that cause a deviation greater than 0.5x the initial margin ratio face an escalating stability penalty, which can be up to 4x times the regular trading fee ratio.

The contract specifies four Initial Margin Ratio parameters (1%, 3%, 5%, and 10%) permitting users to trade with a leverage of up to 100x, given there is sufficient liquidity. Significantly, this marks a tenfold increase in the leverage offered by SynFutures V2. While harnessing the enhanced leverage can be a powerful trading tool, it’s crucial to recognize both the inherent risks of leverage trading and the influence of the Oyster AMM’s dynamic penalty fee system on it. To better educate its users about these risks, SynFutures Academy dives into the mechanics of leverage trading.

Key Events

- June 8, 2023: SynFutures takes a step forward in its cross-chain strategy by successfully deploying the V2 protocol to zkSync Era in mainnet trial phase.

- June 14, 2023: SynFutures integrates with Push Protocol to send announcements and updates to the expanding community. This collaboration will soon offer onchain notifications for events like liquidations, price shifts, and liquidity alerts to further enrich the user experience on the platform.

- June 20, 2023: SynFutures partners with Rhino Finance to enable users to effortlessly bridge assets across chains Era for instant trading.

- July 27, 2023: SynFutures launches NFTures mainnet trial phase on Polygon zkEVM. The new product leverages fractionalized NFT prices combined with the SynFutures LWAP oracle to enable traders to long and short popular NFT collections with up to 3x leverage.

Closing Summary

While SynFutures V2 was initially envisioned to be a more extended phase, it evolved into a bridge to bigger aspirations. After releasing V2 to the public in Q2, the team quickly transitioned to developing a perp dex that could rival centralized alternatives. Recently completed, SynFutures V3 introduces the Oyster AMM, bringing about another evolution in decentralized derivative markets. By merging single-token concentrated liquidity with an onchain order book under one model, it maximizes capital efficiency to fulfill the flywheel of better prices, offering a win-win solution for both traders and liquidity providers. In tandem with this development, SynFutures announced a $22 million funding round led by Pantera Capital, set to further accelerate product development and multichain expansion. What stands out in SynFutures’ journey so far is its consistent innovation and commitment to democratizing access to derivative markets using fully transparent, permissionless systems.