Key Insights

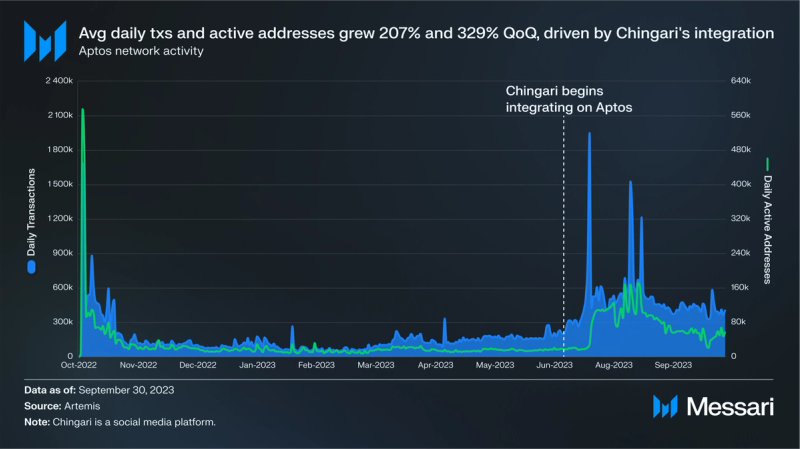

- Average daily transactions, active addresses, and new addresses grew 207%, 329%, and 410% QoQ, respectively. The increase in network usage was driven by the integration of social media platform Chingari in early July and sustained DeFi growth.

- Aptos Labs formed a partnership with Microsoft in early August. The partnership will bring Microsoft Azure AI features to Aptos, beginning with Aptos Assistant, a chatbot aimed at helping users and developers onboard to Aptos.

- Aptos upgraded to V1.5 in early July and then V1.6 at the end of August. The upgrades brought Quorum Store and a Fungible Assets standard. They also enabled applications to subsidize gas from end users and delegators to participate in onchain governance.

- DeFi protocol Thala announced Thala Foundry, a DeFi incubator in partnership with the Aptos Foundation. The Foundry has $1 million in initial funding, which it will distribute to Aptos DeFi projects.

- The Aptos Foundation announced partnerships with several large conglomerates and gaming companies, including NEOWIZ, MARBLEX, NBCUniversal, and the Lotte Group.

Primer on Aptos

Aptos (APT) is a Layer-1 blockchain designed around the core tenets of scalability, safety, reliability, and upgradeability. Aptos was born out of Meta’s Diem and Novi projects, eventually launching in October 2022. Core developer Aptos Labs raised about $400 million in two 2022 private investor rounds.

Aptos’ technological stack features many novel aspects, including the AptosBFTv4 consensus mechanism, the Quorum Store mempool protocol, the Block-STM parallel execution engine, and the programming language Aptos Move. Aptos Move, which builds on the original Move language created by the Diem and Novi teams, offers enhanced flexibility and safety compared to other Web3 programming languages. Aptos Move is being co-developed by multiple protocols.

Other key features aim to improve user experience and safeguards, including accounts where private keys are decoupled from public keys, transaction pre-execution to explain the outcome of a transaction before a user signs it, and transaction expiration time and sequence numbers. Development of the Aptos network and growth of the Aptos ecosystem is primarily led by Aptos Labs and the Aptos Foundation.

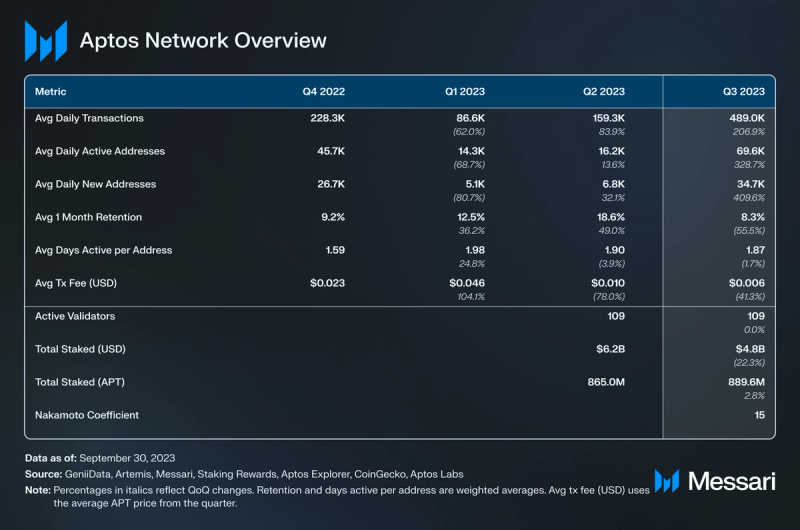

Key Metrics

Financial Analysis

Q3’23 featured a largely quiet crypto market that mostly traded sideways. The one major exception was a large selloff in mid-August. From August 15-18, APT’s market cap fell 19.5%. The drop was less severe QoQ, decreasing 14% to $1.28 billion. APT’s market cap rank dropped one spot from 34 to 35 QoQ. APT’s price dropped 24.5%, as token unlocks continued in Q3, detailed further below.

Aptos revenue, i.e., all fees collected by the protocol, rebounded in Q3 after reaching quarterly lows in Q2. Denominated in USD, revenue grew 82% to $268,000. The growth was even greater denominated in APT, up 162% QoQ to 42,000. Currently, Aptos burns all revenue generated. At the moment, these burned tokens have not significantly reduced inflation.

APT inflation began at a 7% annualized rate and will decrease by 1.5% each year until it reaches a 3.5% inflation rate. This yearly change is set to occur in mid-October. Note that this rate is based on the initial total supply of 1 billion APT. Other inflationary pressure comes from genesis supply unlocks. The genesis supply accounts for the 1 billion APT initially allocated and does not include staking rewards. By the end of Q3, 18% of the genesis supply was distributed.

Another 5.4% is set to unlock in Q4, including the first unlocks for the team and private investor allocations. Based on APT’s price at the end of Q3, $219 million will unlock toward those two categories, representing 92% of the end of Q3 circulating supply. Notably, FTX Ventures participated in Aptos Labs’ first fundraising round and co-led its second.

There will also be $52 million unlocking toward the Ecosystem category, although these tokens will not necessarily immediately distributed upon becoming liquid. Note that before distribution, 80% of these tokens are held by the Foundation and 20% by Aptos Labs. These tokens are used for grants, incentives, and other initiatives. So far, just over 20 million APT from this allocation has been airdropped.

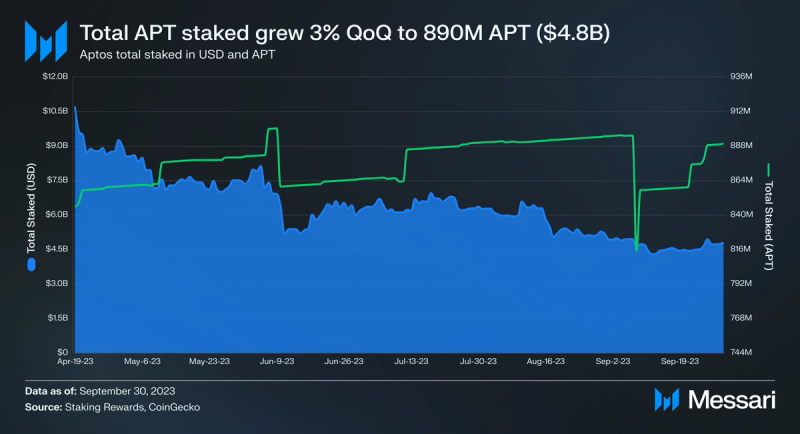

At the end of Q3, 84% of supply eligible to be staked was staked. Note that locked tokens can still be staked and earn liquid staking rewards. Thus, in this case, the supply eligible to be staked is APT’s total supply.

Network Analysis

Usage

After a dropoff in activity following mainnet launch in October 2022, Aptos network usage picked up in Q3’23. Average daily transactions and average daily active addresses increased 207% QoQ to 489,000 and 329% QoQ to 69,600, respectively. Growth was largely driven by social media platform Chingari, which began integrating on Aptos in early July (more details in the Ecosystem Section). Despite increased activity, the average transaction fee decreased 41% QoQ to $0.006.

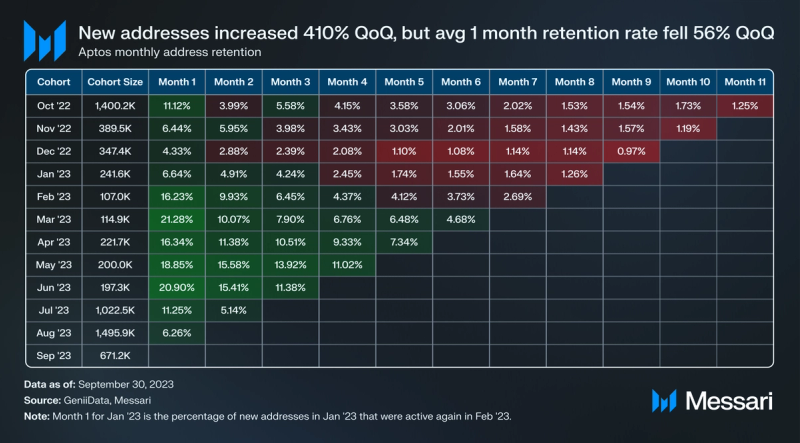

Average daily new addresses also grew considerably, up 410% QoQ to 34,700. However, these new addresses have not been retained at the same rate as previous months. Q3’s weighted average 1-month retention rate was 8.3%, down 56% QoQ.

Security and Decentralization

As noted above, locked tokens can be staked and earn liquid rewards. Along with Aptos not having a slashing mechanism in place, this makes staking for the ~82% of APT’s illiquid genesis supply a very attractive option. As a result, Aptos is a top network by staked market cap, ending Q3 at $4.8 billion. The amount of APT staked increased slightly QoQ, up 3% to 889.6 million. As tokens unlock, the majority will likely remain staked, as tokenholders will likely choose to opt out of dilution from the ~7% inflation rate.

Since launch, there have been around 100-110 validators. Around 15% of the validators accept in-protocol delegated stake, which launched near the end of April 2023. The majority of stake for the other validators comes from out-of-protocol delegation from the Aptos Foundation and private investors’ locked tokens. With the Aptos Foundation holding a majority of the total supply between its own allocation and the tokens on behalf of the Ecosystem allocation, it can help distribute stake rather equally among validators. As a result, Aptos has a Nakamoto coefficient of 15, which is above the median of other networks.

Upgrades and Roadmap

Aptos is designed to support frequent protocol upgrades. It has this ability due to validator management occurring onchain, allowing validators to easily sync to a new upgrade. Parts of Aptos itself are also written in Move, which can improve the time-to-market for developers.

In mid-July, Aptos completed its upgrade to V1.5, which executed several Aptos Improvement Proposals (AIPs) including:

- AIP-26: This proposal brought Quorum Store, an implementation of the Narwhal mempool protocol, to Aptos mainnet. Quorum Store improves consensus efficiency by separating data dissemination from consensus.

- AIP-21: This proposal introduced a Fungible Assets (FA) standard using Move Objects, allowing any onchain asset to be represented as an object to be expressed as a fungible asset.

- AIP-20: This proposal added support for generic cryptography algebra operations in the Aptos standard library.

- AIP-35: Transactions that trigger invariant violation errors are now charged gas fees rather than discarded, which mitigates a potential DDoS vector for the network.

- AIP-29: This proposal added a peer monitoring service, aiming to improve node performance, operational quality, peer discovery, and network observability.

- AIP-37: Duplicate transactions within a block are now filtered out before execution, improving the performance of parallel transaction execution.

Near the end of August, Aptos completed its upgrade to V1.6, which executed several AIPs including:

- AIP-39: Gas payers are now decoupled from the transaction sender, allowing applications to subsidize gas on behalf of the end user.

- AIP-28: Previously, users could delegate APT, but the delegation pool owner would vote on behalf of the entire pool. Now, delegators can participate in onchain governance with their delegated tokens.

- AIP-36: The proposal added the ability to generate unique identifiers or addresses, making transaction parallelization more efficient.

- AIP-34: Full nodes can now provide an API for clients to quickly estimate the unit gas price they need to execute a transaction.

After quarter end, governance approved an upgrade to V1.7, introducing several improvements including an upgraded Rust toolchain, a new module-level event framework, storage deletion refunds, enhanced state syncing, and new modules for cryptographic operations like ElGamal encryption and Bulletproof range proof verification.

Ecosystem Overview

DeFi

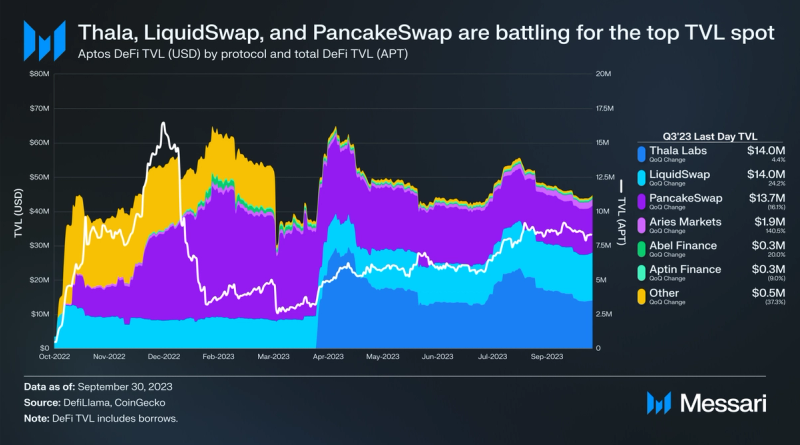

Thala Labs barely edged out Liquidswap as Aptos’ top DeFi protocol by TVL at the end of the quarter, with both around $14 million.

Thala features a suite of DeFi products, including a CDP, an AMM, and a token launchpad. It raised $6 million in a seed round in Q4’22, launched its governance token THL at the end of March, and shortly after launched on mainnet. Its CDP mints Move Dollar (MOD), which had around 4.8 million tokens in circulation at the end of the quarter. Both MOD and THL are omnichain fungible tokens (OFTs). OFT is a multichain token standard created by LayerZero Labs that is interoperable with fungible token standards across chains. The majority of MOD’s overcollateralized backing is based in LayerZero and Wormhole-based USDC.

Right at the end of the quarter, Thala announced Thala Foundry, a DeFi incubator in partnership with the Aptos Foundation. The Foundry has $1 million in initial funding and will distribute $50,000-$250,000 in funding to Aptos DeFi projects, along with other developer and business development support.

LiquidSwap was one of the first AMMs live on Aptos. It was developed by Pontem Network, who also built the Pontem Wallet for Aptos. LiquidSwap averaged $411,000 daily trading volume, just behind Thala at $422,000.

PancakeSwap, BNB Chain’s top DeFi protocol, launched its AMM on Aptos and is not far behind Thala and LiquidSwap in TVL, ending the quarter at $13.7 million.

In mid-September, SushiSwap announced its plans to deploy its V2 AMM on Aptos. Aptos will become the first non-EVM that SushiSwap launches on.

Consumer

NFTs

Since launch, there’s been around $17 million in NFT trading volume. Over 78% of that volume has occurred through marketplace Topaz. Volume was high following the Aptos mainnet launch, but it has since cooled off. Total trading volume in Q3 was $425,600. Topaz had a 67.9% market share, with Wapal in second at 14.9%. Wapal is an NFT marketplace for “pro traders”, similar to Blur and Tensor. It launched on August 1, 2023 and had a 20% market share of volume from launch to quarter end. Like Blur and Tensor, Wapal has a points system to incentivize activity, which will be used for an airdrop.

Other NFT developments from Q3 include:

- Aptos Digital Asset Standard: Aptos Labs introduced the Aptos Digital Asset Standard (DA) near the end of August. The DA focuses specifically on NFTs, with features including dynamic NFTs, soul-bound tokens, reduced gas costs, the ability for NFTs to own other NFTs, simplified airdrop support, and more.

- KYD Labs: KYD Labs is a Web3 ticketing company. In Q3, they powered ticketing for several live events, including music festival WonderBus and Korea Blockchain Week closing event SEOULBOUND.

- NBCUniversal Partnership: In Q3, Aptos Labs furthered its partnership with NBCUniversal by launching a digital fan experience for viewers of The Exorcist: Believer. Viewers who buy tickets through Fandango can collect digital artwork, behind-the-scenes footage, and more.

- Aptos Foundation grants to the following projects: Aptos Art Museum, Aptos Monkeys, and Attarius Network.

Gaming

Aptos Labs and Foundation have partnered with several large gaming companies, including:

- NPIXEL: NPIXEL is a South Korean Triple-A gaming studio. It partnered with Aptos Labs in Q4’22 to bring its METAPIXEL gaming universe to the network. In Q3’23, it concluded its second playtest for upcoming game Gran Saga Unlimited.

- NEOWIZ: NEOWIZ is a South Korean game developer and publisher. The Aptos Foundation partnered with NEOWIZ and its Web3 subsidiary Intella X in mid-August.

- MARBLEX: MARBLEX is the Web3 subsidiary of Netmarble, South Korea’s largest mobile gaming company. It partnered with the Aptos Foundation near the end of August to develop the MARBLEX WARP Bridge and integrate its multichain gaming universe with Aptos. The Bridge will connect Aptos to MARBLEX’s existing ecosystem, including its MBX token and in-game NFTs.

- Lotte Group: Lotte Group is one of South Korea’s largest retail conglomerates. It partnered with the Aptos Foundation at the end of August to bring subsidiary Daehong Communication’s BellyLand universe to Aptos.

Other Q3 developments include:

- Onchain Randomness API: AIP-41 proposes creating a new Move module which will enable developers to easily add onchain randomness into their smart contracts. The AIP was created at the end of Q2 and updated at the end of July.

- Aptos Foundation grants to upcoming games Mirror Realms and XenoShot.

After quarter end, arcade style shooter Aptos Arena launched with over $10,000 in prizes for the first week.

Social

One of the biggest Q3 developments in the Aptos ecosystem was the integration of Chingari, which initially launched in 2018 as a Web2 social media platform. Chingari is a video-sharing mobile app, similar to TikTok, with over 100 million downloads on the Google Play store. At the end of August, Chingari was the third highest-grossing mobile social app on the Google Play store. As noted above, Chingari’s onchain features, such as virtual gifts, drove the Q3 uptick in Aptos network usage.

Other Q3 developments include:

- In early August, Web3 social network TowneSquare opened its waitlist, which received over 38,000 signups.

- An Aptos Foundation grant to decentralized content creation protocol Atem Network.

Development and Growth

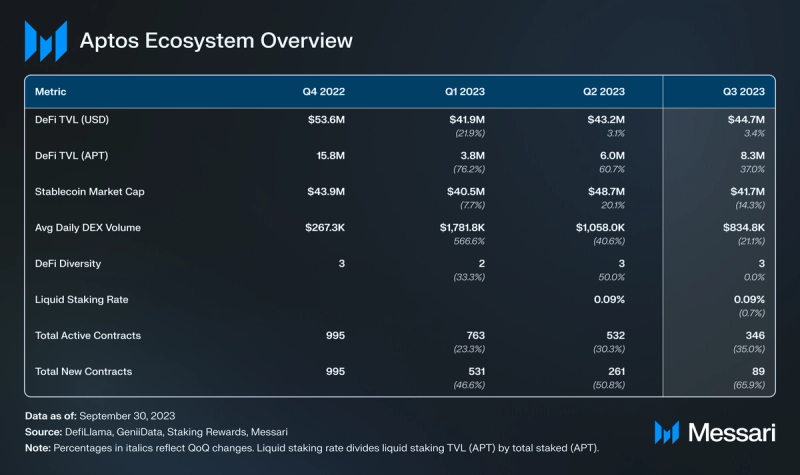

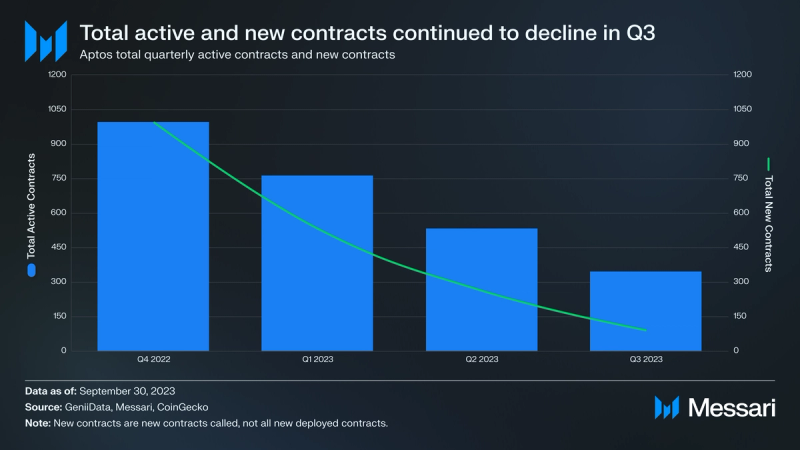

Total active and new contracts continued their decline since launch. Total active contracts were down 35% QoQ to 346, with total new contracts called decreasing 66% QoQ to 89.

Aptos Labs, the Aptos Foundation, and other organizations will look to reverse this trend through developer resources and infrastructure as well as grants, hackathons, accelerators, and other initiatives.

Notable developer-related releases in Q3 include:

- Aptos Move on VSCode: In mid-September, Aptos Labs released the Aptos Move Analyzer plugin for VSCode, allowing developers to write in Aptos Move and use helper features like identifier support, “Go to Type Definition”, and more from within VSCode.

- Create-apt-dapp: Aptos Labs released Dapp development starter kit create-apt-dapp in mid-September. The kit includes common script examples, project dependency tools, and more.

- Magic integration: In mid-September, wallet-as-a-service Magic added support for Aptos, allowing developers to use its easy login, token management, and other tools in their apps.

- Luniverse partnership: In early September, Web3 development platform Luniverse announced plans to support Aptos, which will be its first non-EVM supported.

Beyond the grants and partnerships mentioned throughout the Ecosystem section, Q3 events include:

- Microsoft Partnership: In early August, Aptos Labs announced a partnership with Microsoft. The partnership will bring Microsoft Azure AI features to Aptos, beginning with Aptos Assistant, a chatbot aimed at helping users and developers onboard to Aptos. Aptos Move will also be supported within GitHub’s Copilot feature.

- Hack Singapore: Hack Singapore was Aptos Foundation’s third hackathon of the year, following Hack Holland in June and Seoul Hack in February. With sponsorship from Jump Crypto, GSR, Alibaba Cloud, and Google Cloud, the hackathon offered over $200,000 in prizes. Prize winners are set to be announced shortly.

- Move Accelerator: In early August, Outlier Ventures announced its Move Accelerator in partnership with the Aptos Foundation. The 12-week program features eight teams across a wide span of sectors. Outlier Ventures recently shared an update on each project’s progress.

- Flowcarbon Partnership: In mid-September, the Aptos Foundation partnered with Flowcarbon to make Aptos a carbon-negative blockchain. The Aptos Foundation will purchase and retire carbon credits tokenized by Flowcarbon.

- The Registry: In mid-July, the Aptos Foundation released The Registry grant program. The Registry features a list of project ideas curated by the Foundation that they consider vital to the growth of the Aptos network and ecosystem. The list initially includes seven projects, mostly related to gaming and Move infrastructure. Applications are closed for all seven, with the projects already in development. The Foundation plans on adding new projects periodically.

- Indore Blockchain Days: Indian-based developer community Move Developers DAO (MDD) hosted Indore Blockchain Days, bringing workshops, networking, fireside chats, and more to four colleges. The event attracted over 600 student attendants.

- Learn to Earn Fellowship: Near the end of the quarter, MDD also opened the waitlist for its upcoming learn-to-earn fellowship.

Closing Summary

In Q3, the Aptos network experienced a notable increase in usage. Driven by the integration of social media platform Chingari and sustained DeFi growth, average daily transactions, active addresses, and new addresses grew 207%, 329%, and 410% QoQ. The network also continued its pattern of frequent upgrades. The V1.5 and V1.6 upgrades brought Quorum Store, a Fungible Assets standard, and more. On the ecosystem front, new projects and partnerships spurred growth. Notably, Aptos Labs formed a partnership with Microsoft to bring Microsoft Azure AI features to Aptos beginning with an onboarding chatbot. Other partnerships were formed or furthered with NEOWIZ, MARBLEX, NBCUniversal, and the Lotte Group. Lastly, Thala Foundry, a DeFi incubator by leading protocol Thala in partnership with the Aptos Foundation will incentivize DeFi development with $1 million in initial funding.