Ethereum’s (ETH) price jumped yesterday and today after asset management giant BlackRock revealed plans to launch an ETF that holds the cryptocurrency. The news, which broke on Thursday, propelled ETH to its highest levels since April, exceeding $2,100 and rising about 3% from pre-announcement levels.

The filing, submitted by BlackRock to Nasdaq where it hopes to list the ETF, signals a deepening commitment to cryptocurrencies by the world’s largest asset manager. While the product still requires regulatory approval, the move was hailed by Ethereum supporters as validation of the blockchain network’s growing mainstream acceptance.

“A few thoughts on $ETH here: It didn’t come this high to not take out the yearly highs at the very least. Might let some shorts build up first in that area tho to build liquidity,” commented crypto analyst Pentoshi, who boasts over 711k followers on Twitter.

“If $BTC etf is approved, good chance ETH rallies harder seeing as it’s next.”

Ethereum Price Breaks Out Above $2,000

Momentum has been building behind a potential Bitcoin ETF approval by the SEC, so BlackRock diving into Ethereum reflects rising institutional appetite across crypto assets.

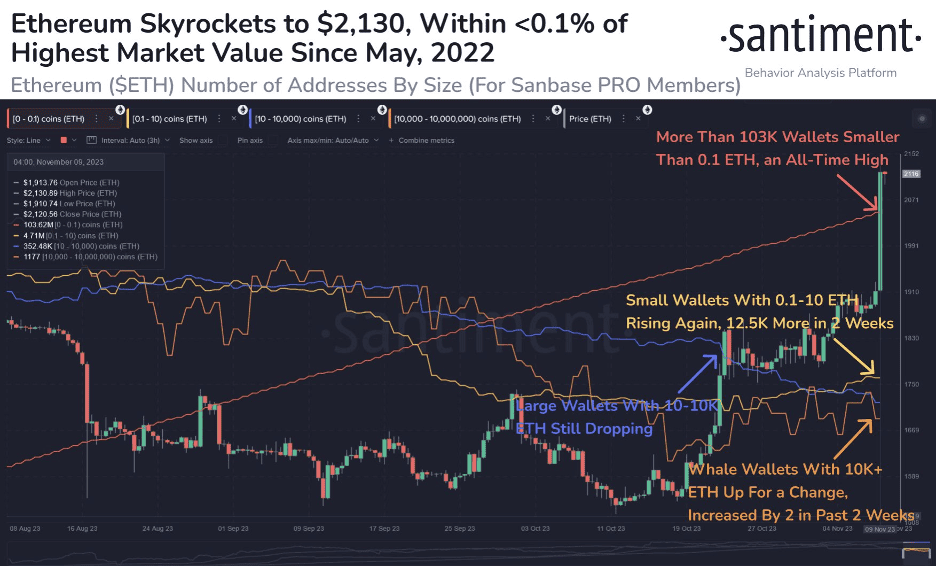

As noted by analytics firm Santiment in a Thursday tweet, Ethereum’s market value has surged 38% over the past four weeks thanks to expanding network usage. The number of addresses holding small amounts of ETH (less than 0.1) exceeded 100,000 for the first time, while larger holders are also accumulating.

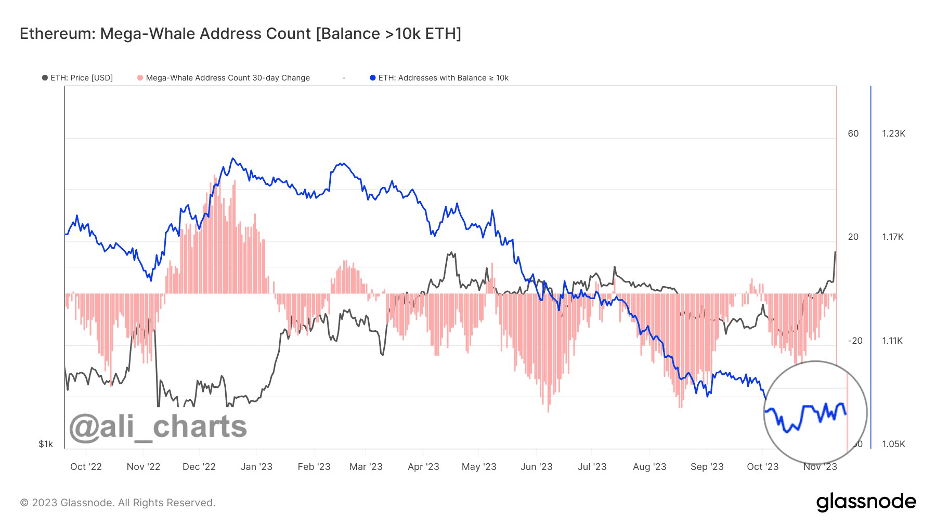

Overall, Ethereum appears poised for additional upside as whales begin buying, according to prominent analyst Ali.

“Ethereum has reclaimed the $2,000 threshold, and intriguingly, this is all happening before whales have even started buying $ETH!” he wrote today. Currently, ETH is trading close to the $2,100 level.

However, investors should pay close attention in the coming days, as traders who got long around $1,900 may look to scalp profits if ETH pushes much past $2,100. Even though major whales have yet to accumulate, profit-taking by shorter-term holders could put some pressure on the price in the very near-term.

While the overall sentiment remains bullish, traders anticipating new highs may look to sell into any parabolic strength to book quick gains. Scalping activity could introduce volatility and intermittent pullbacks as ETH contends with overhead supply on its way to “fight” with the next major resistance level at $3,000.

New Crypto ICO Front-Running the Spot Bitcoin ETF Narrative

As institutional gatekeepers like BlackRock warm to crypto, retail interest is poised to surge as well – especially if the SEC approves spot Bitcoin ETFs in the coming months.

Anticipating this outcome, new crypto ICO Bitcoin ETF Token (BTCETF) was launched this week, offering retail investors early exposure before ETF-driven mania takes hold.

Some buy BTCETF for just $0.005 using ETH or stablecoins like USDT, while others purchase with cards. With a target of $420,000 in stage one, BTCETF breached its first $200,000 milestone amid booming presale demand.

Currently $250,000 has already been raised, and the price will increase in hours as the project moves to stage 2 of its ICO – so early participation is advised.

BTCETF powers the ecosystem, front-running the spot BTC ETF narrative referenced by analysts like Bloomberg’s James Seyffart. With Bitcoin above $37,000 and Ethereum at $2,100, the timing is ideal to join the BTCETF movement before approvals stoke a frenzy.

BTCETF’s design aligns with key ETF approval milestones. As each one passes, like an approval date announcement or first ETF trading launch, a portion of the total supply is burned. 25% will be burned overall, reducing the circulation from 2.1 billion to 1.57 billion BTCETF.

This deflationary mechanism boosts scarcity and incentivizes long-term holding. Staking rewards also promote network stability, with 25% of the supply allocated to participants. The current APY exceeds 1,000%, but will decrease as more tokens are staked.

The ICO offers early backers discounted access before ETF launches heighten demand. 40% of the total supply is available, 840 million tokens at $0.005 each. The tier-based structure rewards the earliest supporters most, via 10 stages that each raise the price per token.

By capitalizing on the imminent ETF approvals through presale entry, BTCETF has positioned itself perfectly to capture gains as Bitcoin expands through SEC endorsements.

The project’s deflationary setup and staking rewards give holders multiple avenues to benefit from the coming spot ETF launch frenzy. As BlackRock validates institutional appetite, the door also opens for retail prosperity with BTCETF.

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

The project in the above article is not related to Bitcoin or to a Bitcoin ETF. It’s a completely different token.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post BlackRock Bets on Ethereum With Potential ETF Filing, Accelerating This New Crypto ICO – Here’s Why appeared first on CryptoPotato.