Analyzing the performance of Bitcoin against various fiat currencies on the Binance platform offers pivotal insights into the interplay between digital assets and traditional financial systems. CryptoSlate examined the performance data of Bitcoin trading pairs with several key fiat currencies over varying periods – 6 months, 3 months, 1 month, and 5 days- to uncover the underlying economic and market factors at play.

CryptoSlate used data from Binance, as its stature as the largest and most liquid exchange of the market provides a comprehensive and reliable dataset, making the performance of each fiat trading pair more indicative of the overall state of the respective fiat currency.

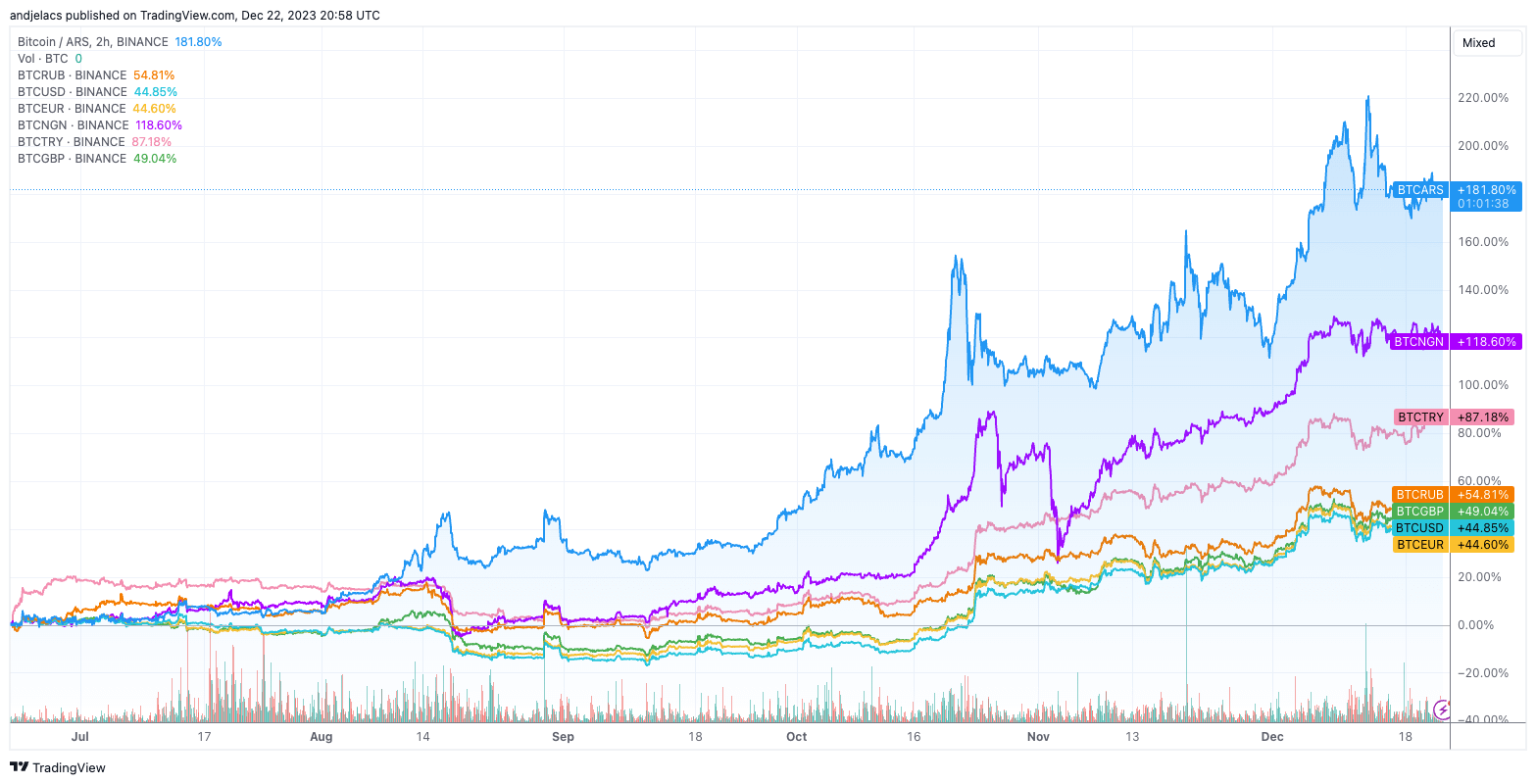

Over six months, the Bitcoin to Argentine Peso (BTC/ARS) trading pair exhibited a striking increase of 181.41%. This significant surge indicates Argentina’s economic challenges and political changes, marked by rampant inflation and currency instability, propelling Bitcoin as a refuge and a stable store of value. Similarly, the Bitcoin to Nigerian Naira (BTC/NGN) pair recorded a substantial growth of 118.6%, reflecting Nigeria’s increasing inflation and a growing young, technology-oriented demographic that sees digital currencies as viable investment and remittance avenues.

The Turkish Lira, facing its own set of economic hurdles, saw the BTC/TRY pair grow by 87.08% in the same six-month span. This trend is a testament to the economic difficulties in Turkey, including significant currency devaluation and inflation, driving the populace towards Bitcoin. In more stable economies such as the United States, the United Kingdom, and the Eurozone, the increases were more moderate, with BTC/GBP growing by 48.94%, BTC/USD by 44.71%, and BTC/EUR by 44.43%, highlighting a more mature and stable market environment for cryptocurrencies.

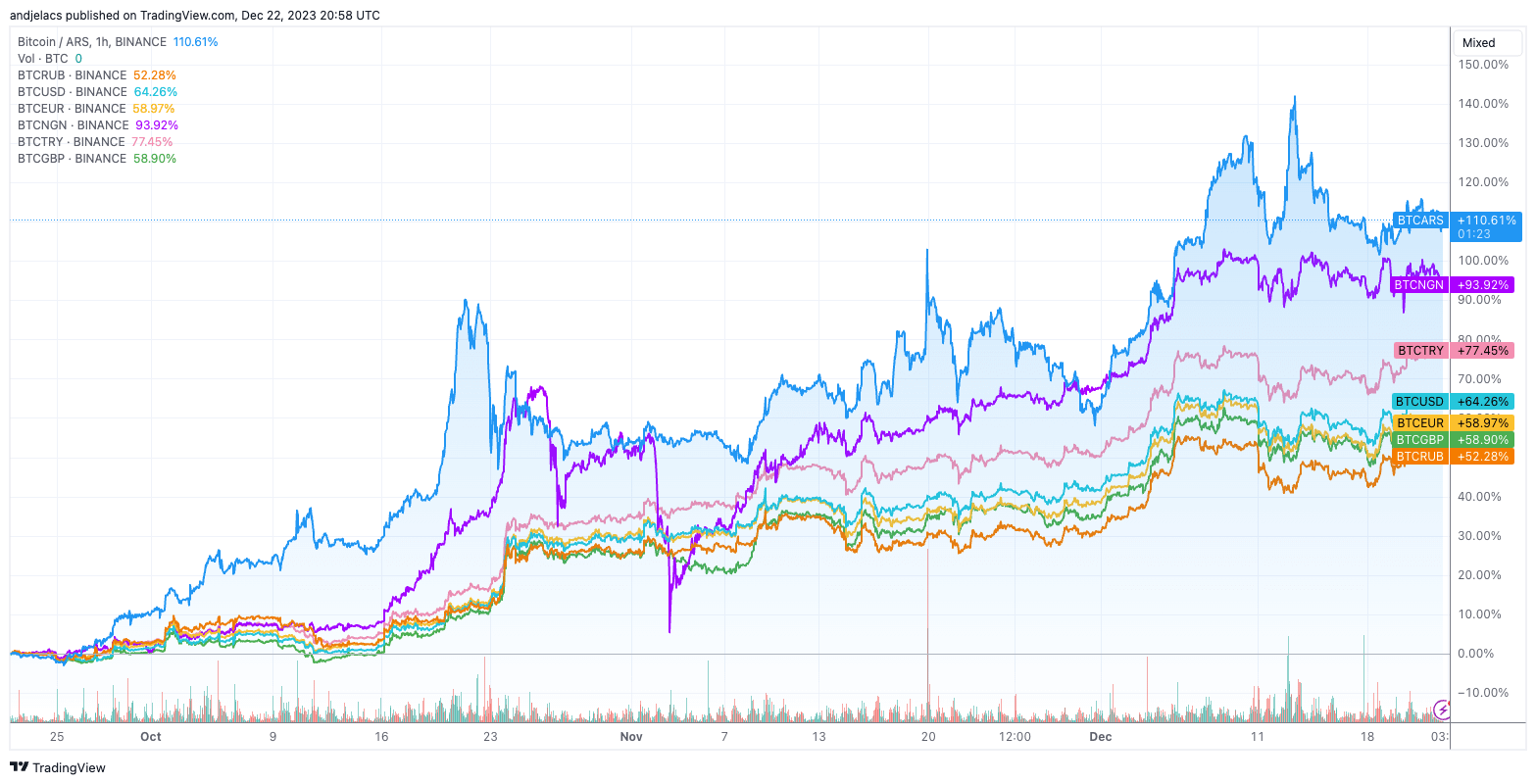

Observing the 3-month performance of these Bitcoin pairs, the emerging market currencies outperformed their developed counterparts. The BTC/TRY pair increased 77.45%, while BTC/USD and BTC/GBP grew by 64.26% and 58.90%, respectively.

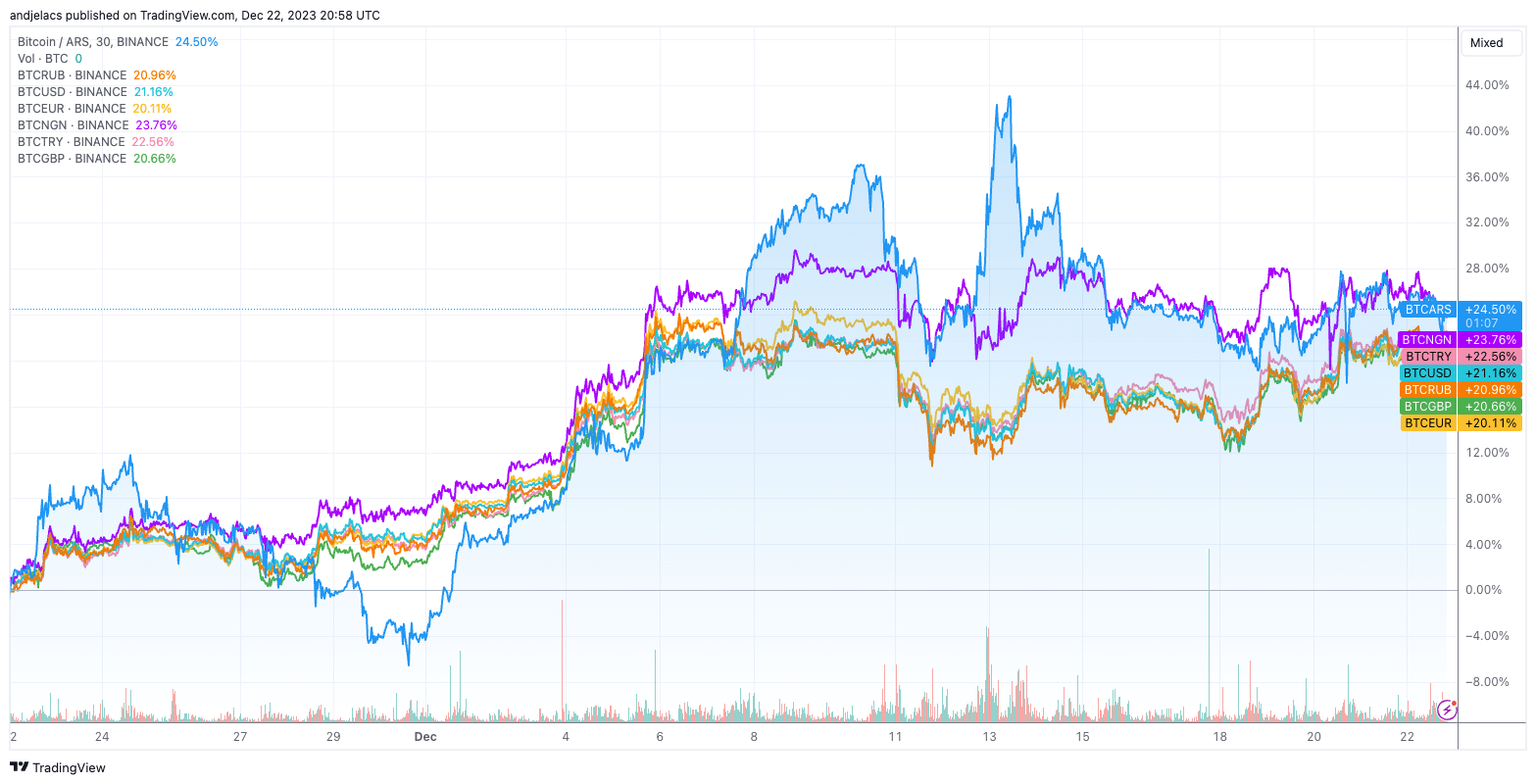

This pattern persisted in shorter timeframes, with the 1-month data showing BTC/ARS and BTC/NGN leading at a 24.50% and 23.76% increase, followed closely by BTC/TRY at 22.56%.

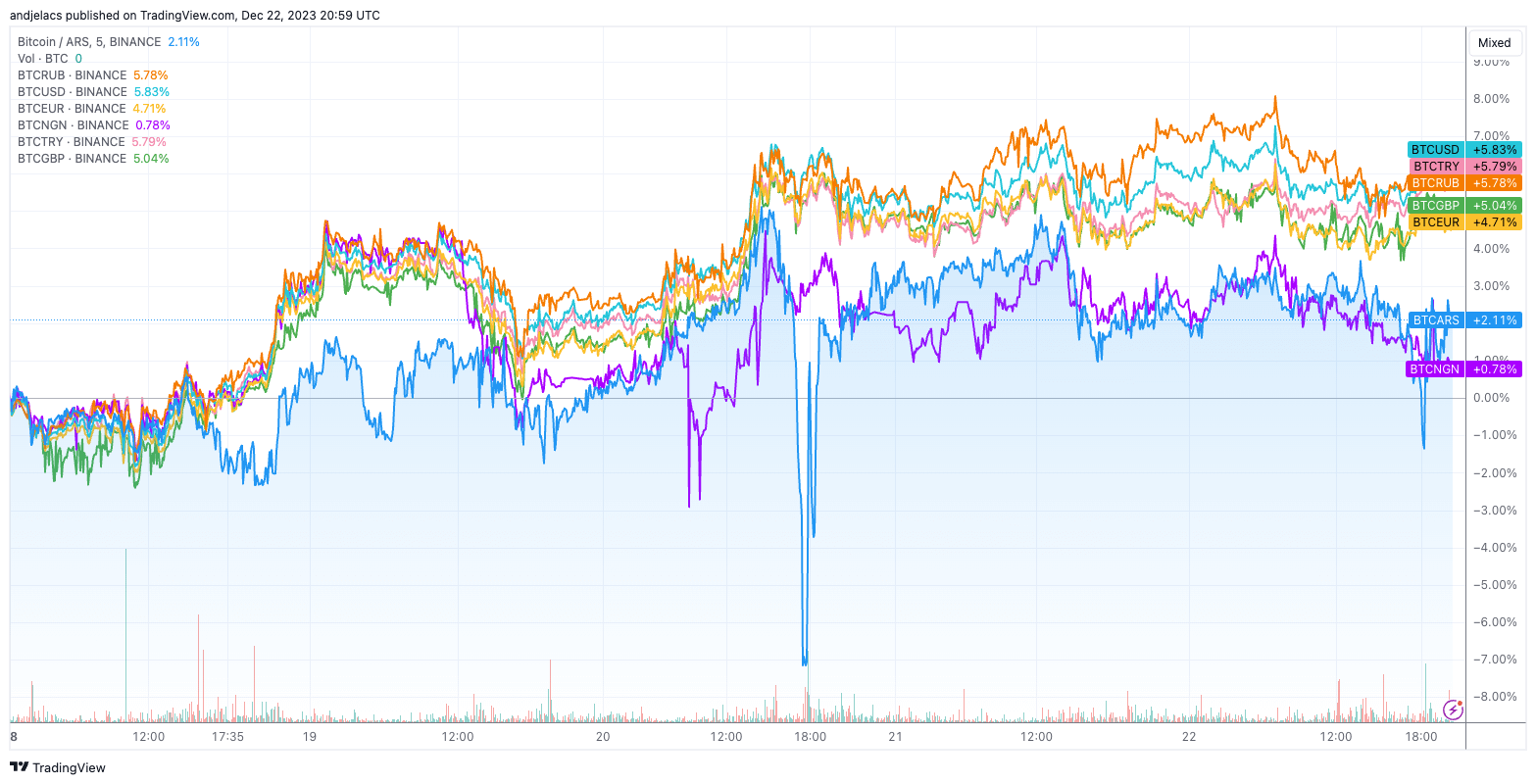

The 5-day snapshot further substantiates this trend, with BTC/USD at a 5.83% increase, BTC/TRY at 5.79%, and BTC/RUB at 5.78%.

The reasons behind these discrepancies are multifaceted. Economies grappling with inflation and devaluation often see their populations turn to Bitcoin as a financial safe haven. The regulatory landscape in these countries also significantly influences trading volumes as it alters the perceived risks and legal standing of cryptocurrency trading.

Additionally, liquidity levels for certain trading pairs can play a crucial role. A lack of liquidity can lead to higher volatility and larger price swings, which might attract more speculative trading, thus driving the performance of these pairs. Furthermore, geopolitical circumstances like sanctions or domestic unrest can accelerate the adoption of decentralized financial assets like Bitcoin.

The diverse performance of Bitcoin against various fiat currencies is a reflection of the economic conditions, market maturity, and geopolitical climate of the respective countries.

The post Troubled economies turn to Bitcoin, sparking rally in local trading pairs appeared first on CryptoSlate.