As the year winds down, Bitcoin’s leap over the $43,000 mark fuels talks of an upcoming bitcoin ETF by 2024. Ethereum’s not just riding Bitcoin’s coattails – it’s charted a 45% jump on its own, hinting that the whole market’s catching a lift. Parallel to these developments, traditional equity markets, including the S&P 500 and Nasdaq Composite, are also gearing up to end the year on a high note – this bullish sentiment is widespread across various financial sectors.

In the realm of altcoins, names like Solana (SOL), Uniswap (UNI), Polkadot (DOT), Polygon (MATIC), Aptos (APT) and ScapesMania are emerging as particularly promising investment opportunities. Buoyed by this positive market climate, these altcoins are poised for potentially significant growth in the upcoming bull run.

Ride The Wave Of Innovation With ScapesMania

While some are facing an uncertain future, the trajectory of a presale project is far easier to predict. ScapesMania (MANIA) is a well-balanced, meticulously designed project that acts as a gaming ecosystem. Through DAO governance, backers will be able to influence and benefit from a multi-billion-dollar industry. A wide range of features paired with the best technology, a professional team, and a long-term, highly ambitious vision can make ScapesMania the next big thing in crypto. Presale discounts and stage bonuses only add to the project’s appeal.

Presale is Live Now – Join Now for a Chance to Benefit with MANIA

Backed by an award-winning developer crew, ScapesMania stands for transparency: every member’s social media profile is public. The project can achieve this not just by bringing big innovation to the game, but by putting its community front and center. Driving customer engagement and making sure that everyone benefits through great tokenomics and generous rewards is what makes ScapesMania the project with a bright future ahead.

Presale is Live, Learn More About Major Benefits

Solana (SOL): Potential Growth Versus Regulatory Headwinds

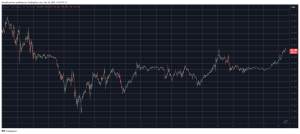

Since early June, Solana (SOL) has witnessed a remarkable uptrend, soaring by 550%. The market’s reaction to Solana (SOL) has been exceptionally positive – if Bitcoin maintains support above $44,200, there’s a growing anticipation that altcoin’s value might increase by an additional 20%, potentially reaching the significant $100 mark by the end of 2023.

Presently, Solana’s (SOL) price fluctuates between $84.79 and $99.2. Its 10-day Moving Average is currently at $98.06, suggesting a short-term bullish trend, while the 100-day Moving Average at $90.35 indicates a strong medium-term performance. The key support levels for Solana (SOL) are established at $61.32 and $75.73, with critical resistance points at $104.56 and $118.97.

Looking forward, if market conditions remain favorable, Solana (SOL) could extend its growth trajectory, targeting and even surpassing the $104.56 resistance level. However, one should remain cautious as market dynamics can change. And if they do, Solana (SOL) could face a decline, potentially falling to its support level at $61.32.

Uniswap (UNI): Capitalizing on Market Turbulence

Uniswap (UNI), a decentralized cryptocurrency exchange renowned for its automated market maker (AMM) model, has recently experienced a significant surge in trading volume – following the collapse of Silicon Valley Bank, it soared to $11.84 billion, nearly doubling its previous record, primarily due to an uptick in USDC trades. Uniswap’s (UNI) ability to keep the crypto waters calm and ensure a steady flow of trades, even when things get rough, really shows its clout in the market.

Currently, Uniswap’s (UNI) trading range is between $4.45 and $7.03. The 10-day Moving Average stands at $6.1, while the 100-day Moving Average is at $5. Key support levels for Uniswap (UNI) are identified at $0.36 and $2.94, whereas resistance levels are found at $8.1 and $10.69.

Uniswap’s (UNI) horizon looks bright, with its robust trading volumes and the fresh launch of a non-custodial mobile wallet adding to its momentum. However, the token faces significant resistance at the $8.1 and $10.69 levels. If Uniswap (UNI) manages to break past these hurdles, it could be looking at some serious growth ahead. Conversely, failure to surpass these thresholds might lead to a reevaluation of lower support levels.

Polkadot (DOT): Decentralization at the Forefront

Polkadot (DOT) has been consistently prominent in the market, especially in terms of its decentralization metrics. However, altcoin hasn’t been immune to the market volatility and has recently faced a dip in value. Despite this, Polkadot’s decentralization, measured by its Nakamoto Coefficient, achieved an impressive score of 92, signaling a strong and secure network.

Currently, Polkadot’s (DOT) trading range is between $7.41 and $8.92. Its 10-day Moving Average stands at $8.15, with the 100-day Moving Average slightly lower at $7.88. Alctoin has set support levels at $4.89 and $6.4 and faces resistance at $9.43 and $10.94.

As Polkadot navigates the future, it’s eyeing a horizon filled with as many opportunities for growth as potential stumbling blocks. With Polkadot (DOT) ramping up its decentralization and tightening security, it’s poised to catch the eye of keen investors and could spark a rise in its market price. However, it has to navigate through the headwinds of recent price corrections and the broader bearish market trends. Should the market conditions improve, Polkadot (DOT) could aim to surpass its recent high of $8.92.

Polygon (MATIC): Whale Movements and Market Reactions

Recently, Polygon (MATIC) experienced significant whale activity, highlighted by a substantial transfer of 26 million MATIC tokens to Coinbase. This has stirred the market, triggering a reassessment of support levels, but nevertheless, Polygon’s (MATIC) layer-2 network continues to expand, nearing a total value locked (TVL) of $8 billion.

Currently, Polygon (MATIC) is trading within a range between $0.592 and $0.957. The 10-day Moving Average stands at $0.825, while the 100-day Moving Average is at $0.683. Key support levels are observed at $0.057 and $0.422, with resistance levels noted at $1.151 and $1.516.

The future trajectory of Polygon (MATIC) seems to be shaped by a combination of market trends and influential whale activities – the notable transfer to Coinbase and the market’s response to it indicate a potentially volatile short-term future. Although the network’s growth and its rising TVL signal strength, the overbought status on the hourly charts and a decrease in significant chain transactions point to possible upcoming challenges.

Aptos (APT): Token Unlock and Its Market Implications

Aptos (APT) is at a pivotal point due to the imminent release of 24.84 million APT tokens, worth approximately $193.25 million – this upcoming event has sparked concerns about the possibility of increased selling pressure, which may adversely affect the token’s price. Despite showing bullish tendencies earlier by breaking out from an inverse head-and-shoulders pattern, Aptos (APT) has seen its potential growth limited by low trading volume and prevailing bearish market conditions.

Currently, Aptos (APT) is swinging in a range between $7.21 and $9.03. Its 10-day Moving Average stands at $8.36, while the 100-day Moving Average is slightly lower at $8.15. Altcoin has support levels at $4.57 and $6.39 and faces resistance at $10.03 and $11.84.

The future trajectory of Aptos (APT) hinges significantly on how the market reacts to the token unlock – a sell-off by holders could push the price down, potentially testing the lower support levels around $6 and $5. On the other hand, if the market manages to absorb the influx of tokens without substantial selling, Aptos (APT) might regain its bullish trend.

Conclusion

In the run-up of 2024, the crypto market is showing promising signs of a resurgence, making it an opportune time for long-term investments – leading the rally is Bitcoin whose strong performance is fostering a bullish sentiment across the broader market. This positive atmosphere is particularly beneficial for altcoins such as Solana (SOL), Uniswap (UNI), Polkadot (DOT), Polygon (MATIC), Aptos (APT) and ScapesMania – each offering unique innovations and holding distinct positions in the market, which collectively suggest their potential to be frontrunners in the upcoming bull run.

ScapesMania, with its innovative approach, is creating a unique space for itself in the market; at the same time, Solana (SOL) and Uniswap (UNI) are effectively leveraging market trends and technological advancements to enhance their positions; Polkadot (DOT) is continuously working to strengthen its network’s decentralization, a key aspect of its strategy; Polygon (MATIC) is adeptly managing the challenges of whale-induced volatility, thanks to its burgeoning layer-2 network; even though Aptos (APT) faces challenges related to token unlocks, it remains determined to maintain its bullish momentum.

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.