Quick Take

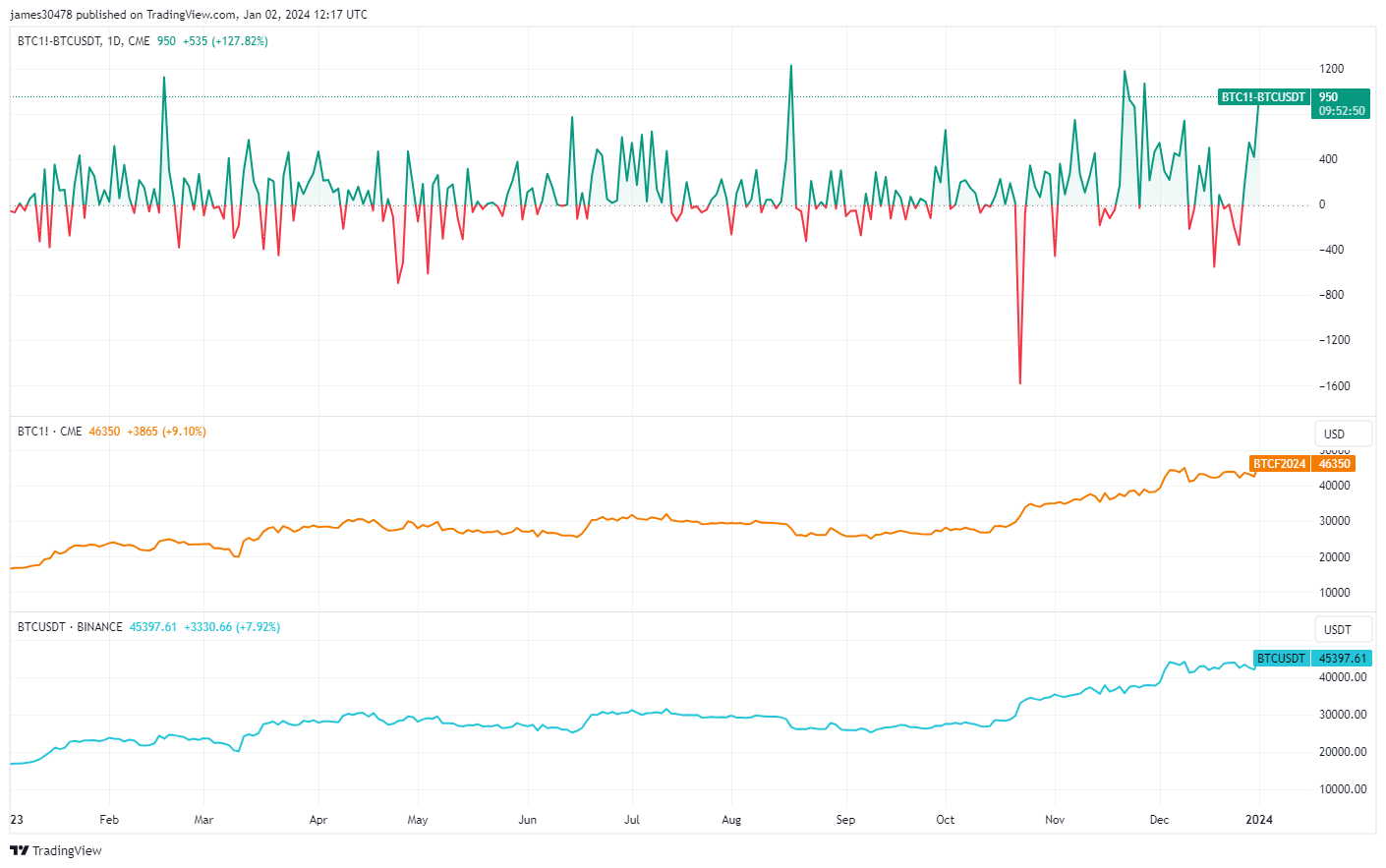

A notable development ensues as Bitcoin enters 2024 with the reappearance of premiums on both Chicago Mercantile Exchange (CME) futures and Coinbase. Data analysis reveals a discernible price discrepancy between CME’s Bitcoin futures, trading approximately at $46,400, and Binance’s BTCUSDT pair, exchanging hands at about $45,300. This almost $1,000 variance emerges as the fifth-largest differential observed in the past year.

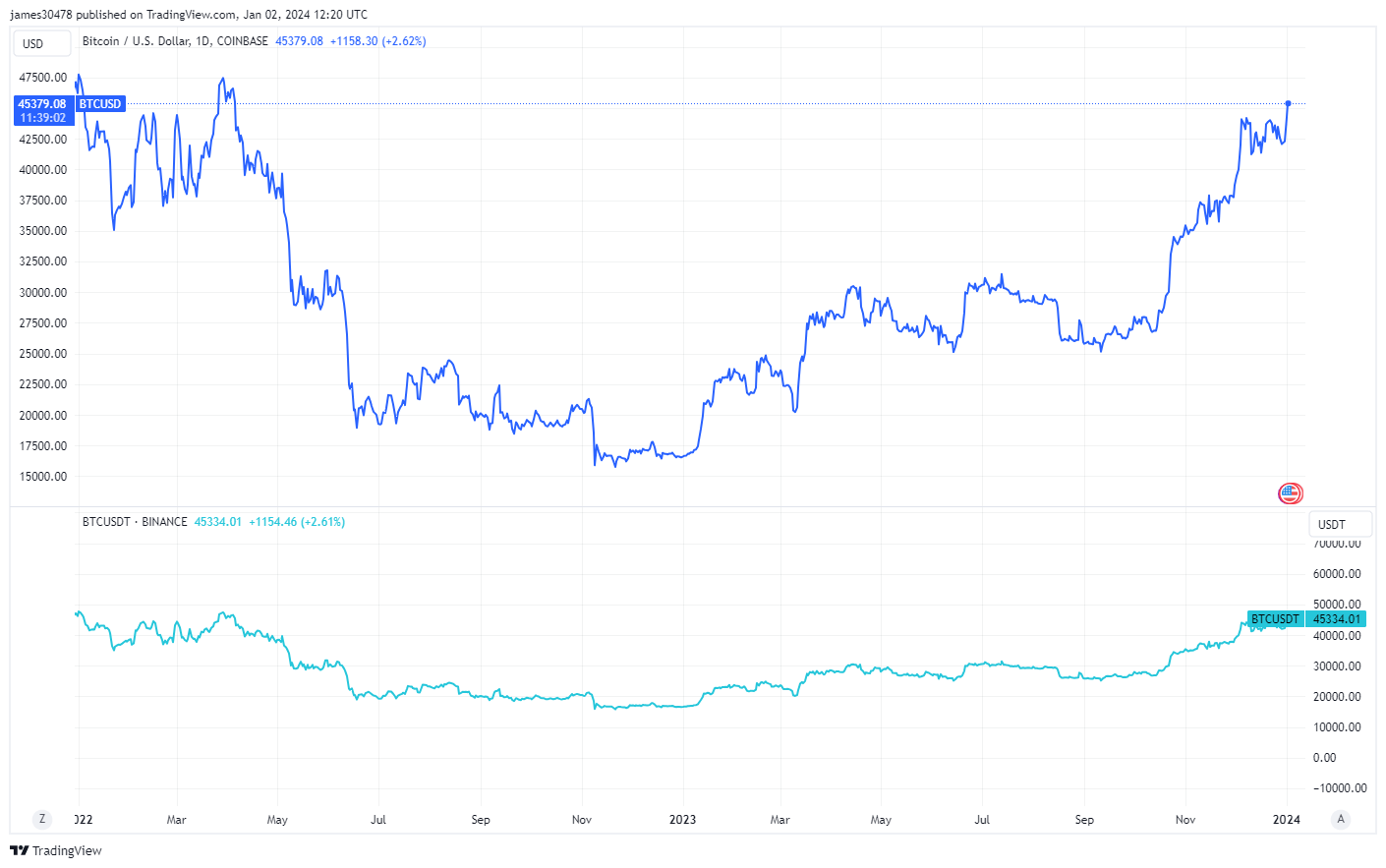

Further, the Coinbase premium, too, has made a comeback. The BTCUSD pair on Coinbase is seen trading for $45,400, in contrast to the BTCUSDT pair, set at $45,300. This evolving landscape indicates a resurgence in institutional interest, primarily from the United States, coinciding with the potential approval of a Bitcoin spot Exchange-Traded Fund (ETF).

While the dynamics of this resurgence are multifaceted, it is clear that the potential approval of the spot ETF may have a major role in this shift.

The post Bitcoin CME futures and Coinbase show renewed premiums as institutional interest spikes appeared first on CryptoSlate.