The futures contracts of Bitcoin on Binance currently show a contango state, with premiums exceeding $2,000.

According to an analyst, this phenomenon is interpreted as a positive signal for the price of Bitcoin during the first quarter of 2024. Let’s see all the details below.

Binance: Bitcoin futures signal a premium of over $2,000 for March 2024

As anticipated, there is a significant premium of over $2,000 on Bitcoin futures contracts on Binance, which will expire at the end of March.

According to an analyst, these conditions suggest that the market anticipates a price appreciation of Bitcoin during the spring season.

We remind you that when futures contracts are traded at a value higher than the current price of the asset, this is referred to as “contango”.

This situation reflects the market’s expectation of an increase in the price of the asset before the expiration of the futures contracts, set in this case on March 29th.

The head of YouHodler’s markets, Ruslan Lienkha, interpreted the current contango state as a “clear bullish signal” for Bitcoin.

He also emphasized that institutional investors are using futures to hedge the price of Bitcoin, showing confidence in a growth perspective.

Lienkha has finally indicated that these investors are willing to pay an additional premium to fix the current price in anticipation of future asset acquisitions, especially in view of a possible approval of additional spot ETFs on Bitcoin.

Market anticipations: a remarkable crescendo by March

As already anticipated, the data from The Block highlight a significant increase in the premium on Bitcoin futures contracts, indicating an anticipation of a price increase by the end of March.

In addition, the difference between the spot price and the future price of Bitcoin has reached its historical peak, as revealed by The Block’s Data Dashboard.

According to data on Binance’s quarterly futures contracts expiring in March, Bitcoin’s annualized daily basis has exceeded 20%.

Luuk Strijers, Chief Commercial Officer of Deribit, explained that an increase in the base suggests the market’s expectation of a spot price increase.

In the last 24 hours, Bitcoin briefly reached a yearly high of over $45,800, fueled by growing speculation on the regulatory approval of US spot Bitcoin ETFs.

However, the main digital asset has experienced a slight retracement, stabilizing at around $45,284, according to the latest price data.

In the same way, important altcoins like Solana and Ether have recorded daily gains of 4% and 2%, respectively.

Bitcoin on the rise in 2024: growing anticipation for ETFs and company moves

Bitcoin has started 2024 with a remarkable surge, reaching $45,000 and sparking debates throughout the financial community.

Analysts, economists, and Bitcoin holders all converge on analyzing the key factors that have catalyzed the recent growth of the cryptocurrency.

The main driving factor behind the increase in value of Bitcoin is the growing expectation for the approval of Spot Bitcoin ETFs in the United States.

In this regard, Coinbase has stated that it has carefully prepared its system to handle an increase in volume, greater liquidity, and a growing demand resulting from the approval of ETFs.

Even MicroStrategy, renowned for its significant holdings of Bitcoin, has experienced a remarkable increase in the value of its shares.

With the addition of another 14,620 Bitcoin to its already substantial portfolio, the company has consolidated its position in the cryptocurrency sector.

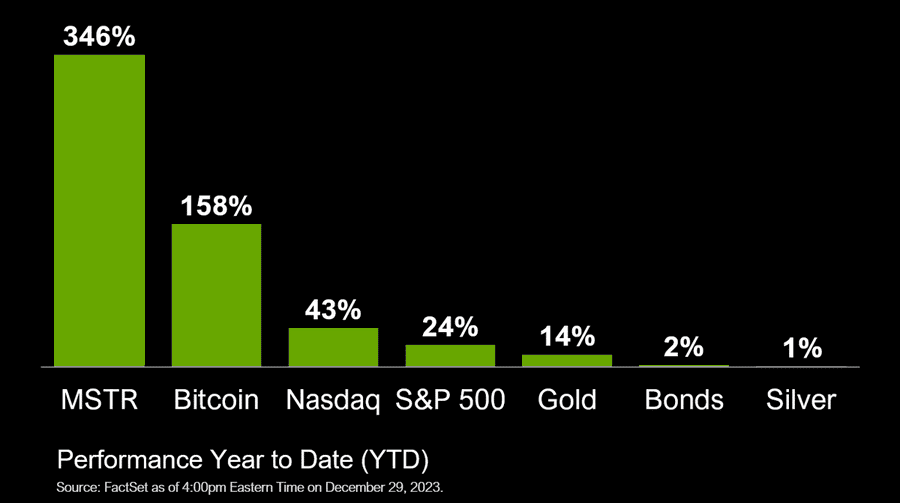

The CEO of MicroStrategy, Michael Sylor, has shared a chart highlighting Bitcoin’s outperformance compared to the S&P 500 and Nasdaq, further strengthening the cryptocurrency’s position in the financial landscape.