Nasdaq-listed business intelligence firm MicroStrategy has seen the value of its significant Bitcoin ($BTC) holdings increase to the point that the firm is now sitting on over $500 million of unrealized gains on the cryptocurrency in its treasury just this year.

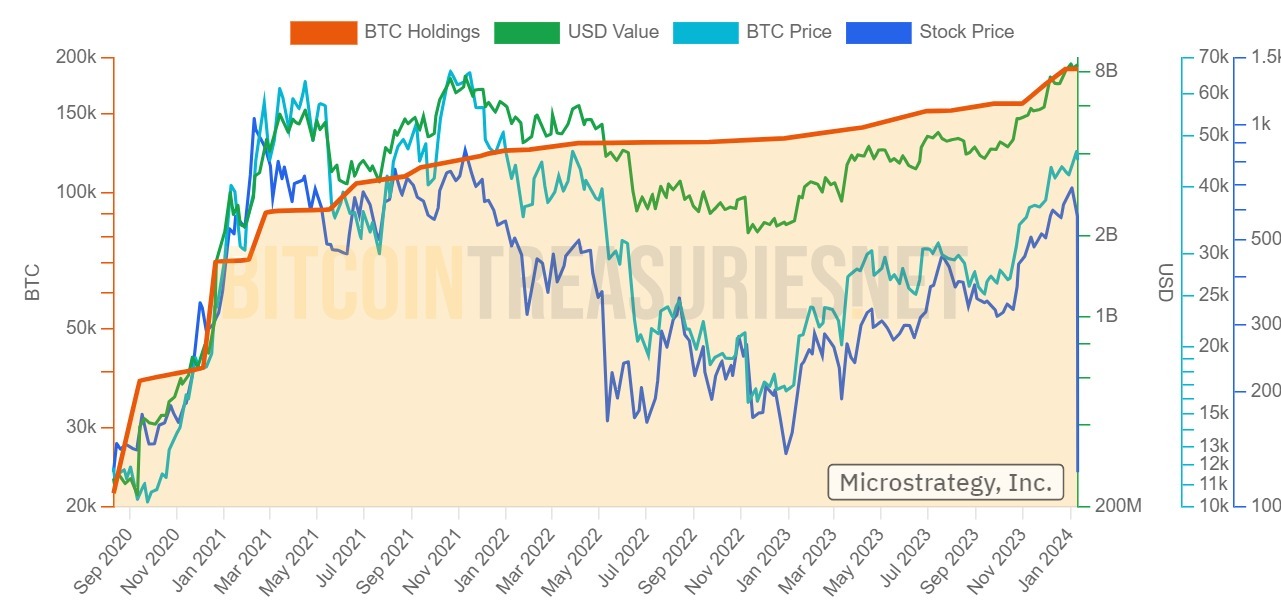

According to data from BitcoinTreasuries the company, which is the world’s largest corporate Bitcoin holder, has benefitted form Bitcoin’s recent significant price rise ,as it currently holds 189,150 BTC valued at around $8.55 billion.

Per the same source, MicroStrategy’s Bitcoin strategy has been paying off handsomely, as the total cost basis for the BTC it holds on its balance sheet is reported at $5.89 billion after the company first started accumulating the cryptocurrency back in August 2020.

When the Nasdaq-listed business intelligence firm first started accumulating Bitcoin, the cryptocurrency was trading just above the $10,000 mark. MicroStrategy then bought 21,454 BTC as it entered the space, and has been investing in Bitcoin since to now have an average investment cost per BTC of around $31,165.

As CryptoGlobe reported, the firm recently added an additional 14,620 BTC to its stash for around $615.7 million, at an average price of $42,110 per coin to hold around 0.9% of the flagship cryptocurrency’s total supply.

MicroStrategy’s CEO, Michael Saylor, has also benefited from his Bitcoin investments, owning more than 17,000 BTC. Following a recent sale of his company options for $216 million, Saylor plans to increase his Bitcoin holdings, indicating his confidence in the cryptocurrency’s future.

Saylor has notably recently broken down Bitcoin’s recently rally in an interview on CNBC’s “Closing Bell: Overtime,” where he attributed the recent rally to the digital transformation of capital.

Blockstream founder and CEO Adam Back noted on the microblogging platform that MicroStrategy has been financing the firm’s BTC purchases by selling new shares on the market and diluting existing shareholders, and using the proceeds to buy BTC.

Per Back, the ratio of BTC per share has increase, which means the “net effect is about 1.4% anti-dilutive in bitcoin/share.”

Back added that the firm previously bought 174,530 BTC on 15.64 million shares, and sold 1.077 million new shares for $610 million to add $617 million worth of BTC to its position, meaning that its BTC/share rose from 0.011159 BTC to 0.011313 BTC/share.

Featured image via Unsplash.