- Solana was down by more than 9% in the last week as market sentiment turned bearish.

- Most indicators supported the sellers, but derivatives metrics hinted at a trend reversal.

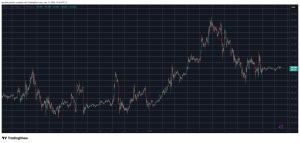

Solana [SOL] displayed a tremendous performance in the last month, which allowed it to increase its market capitalization. Alongside this, a bullish pattern had formed on SOL’s price chart, which hinted at a further uptrend.

However, not everything was working in the token’s favor.

Solana to start another rally?

Over the last month, SOL’s price rallied in the double digits. According to CoinMarketCap, SOL was up by more than 44% in the past 30 days.

Not only did the token’s price surge, but development around it also increased.

AMBCrypto had earlier reported that Solana’s monthly active developer count consistently ranged between 2500 and 3000 throughout 2023, which was an optimistic sign.

Moreover, on the 9th of January, crypto analyst Ali reported that Solana’s hourly chart was showing signs of forming a bull flag. A strong closing over the $110 resistance level may serve as the impetus for a large upward advance.

On the hourly chart, #Solana is showing signs of forming a bull flag. A decisive close above the $110 resistance level could be the catalyst for a significant upward move!

If this pattern holds, we might see $SOL heading toward an ambitious target of $163. pic.twitter.com/dHNDnb9uNK

— Ali (@ali_charts) January 9, 2024

Though the bullish pattern looked promising, things on the ground were complicated, as the token’s price action turned bearish. As per CoinMarketCap, SOL was down by more than 9% in the last seven days.

At the time of writing, SOL was trading at $98.84 with a market capitalization of over $42 billion, making it the fifth-largest crypto.

Looking forward

The effect of the recent price drop was clearly visible on SOL’s social metrics. AMBCrypto’s look at Santiment’s data revealed that SOL’s Social Volume had dropped slightly in the recent past.

Bearish sentiment around the token also increased, which was evident from the dip in its Weighted Sentiment.

Will SOL reach $110?

Therefore, to check the possibility of SOL touching $110 anytime soon, AMBCrypto took a look at its daily chart. We found that Solana’s Relative Strength Index (RSI) took a sideways path near the neutral zone.

Its Chaikin Money Flow (CMF) also registered a sharp downtick, meaning that the chances of a continued downtrend were high. Also, as per the Bollinger Bands, SOL’s price was entering a less volatile zone at press time.

The token’s Binance Funding Rate also dropped in the last week, meaning that derivatives investors were not actively buying Solana despite its lower price at the time of writing.

Nonetheless, the Money Flow Index (MFI) registered an uptick, showing positive signs. Things on the derivatives side also looked optimistic, as SOL’s Open Interest dropped alongside its price — a sign of a trend reversal.

Is your portfolio green? Check out the SOL Profit Calculator

If SOL manages to go above $110, the token might initiate a fresh bull rally. At first glance, the possibility of that happening looks slim, but things can actually work out in Solana’s favor.

As SOL is currently in the midst of a bullish flag pattern, it may see some short-term price declines. However, if things stay in favor of its MFI and derivatives, then SOL can touch $110 quite soon.

The post Why Solana’s $110 price prediction is viable despite 9% weekly drop appeared first on AMBCrypto.