BlackRock has reportedly bought a staggering 11,500 Bitcoin from the available supply during the latest dip since the launch of its spot Bitcoin ETF.

This amount is significant, considering that only 900 BTC are issued daily. The purchase by BlackRock effectively represents about 13 days’ worth of Bitcoin production being absorbed by a single player.

The asset manager’s CEO, Larry Fink, recently said his views on Bitcoin have evolved significantly over the years, and he now sees it as a “viable asset class.”

Supply crunch

Based on data, the iShares Bitcoin Trust (IBIT) Spot ETF managed only around 25% of the trading volume over the same two-day period. From this, one could infer that approximately 46,000 BTC were removed from the system over the past two days, with influences from other players like Grayscale Bitcoin Trust (GBTC).

If this trend continues, the Bitcoin market could face a severe supply crunch. With an estimated 46,000 BTC being absorbed in two days, which equates to 23,000 BTC per day, this rate is about 25.5x the daily production of Bitcoin.

The substantial uptake by U.S. ETFs, not to mention the additional demand from retail investors and other global ETFs, suggests a tightening of available Bitcoin supply.

Despite the fluctuations in Bitcoin’s price, the underlying asset remains resilient. Despite the high fees associated with GBTC, the successful launch of the Bitcoin ETF is a strong indication of growing institutional interest. It could herald a new era of scarcity in the Bitcoin market.

ETF inflows hit $819M

The first two trading sessions following the approval of new Bitcoin exchange-traded funds (ETFs) experienced substantial inflows totaling $1.4 billion. After accounting for outflows from GBTC, the net total inflows across all Bitcoin-related products amounted to $819 million.

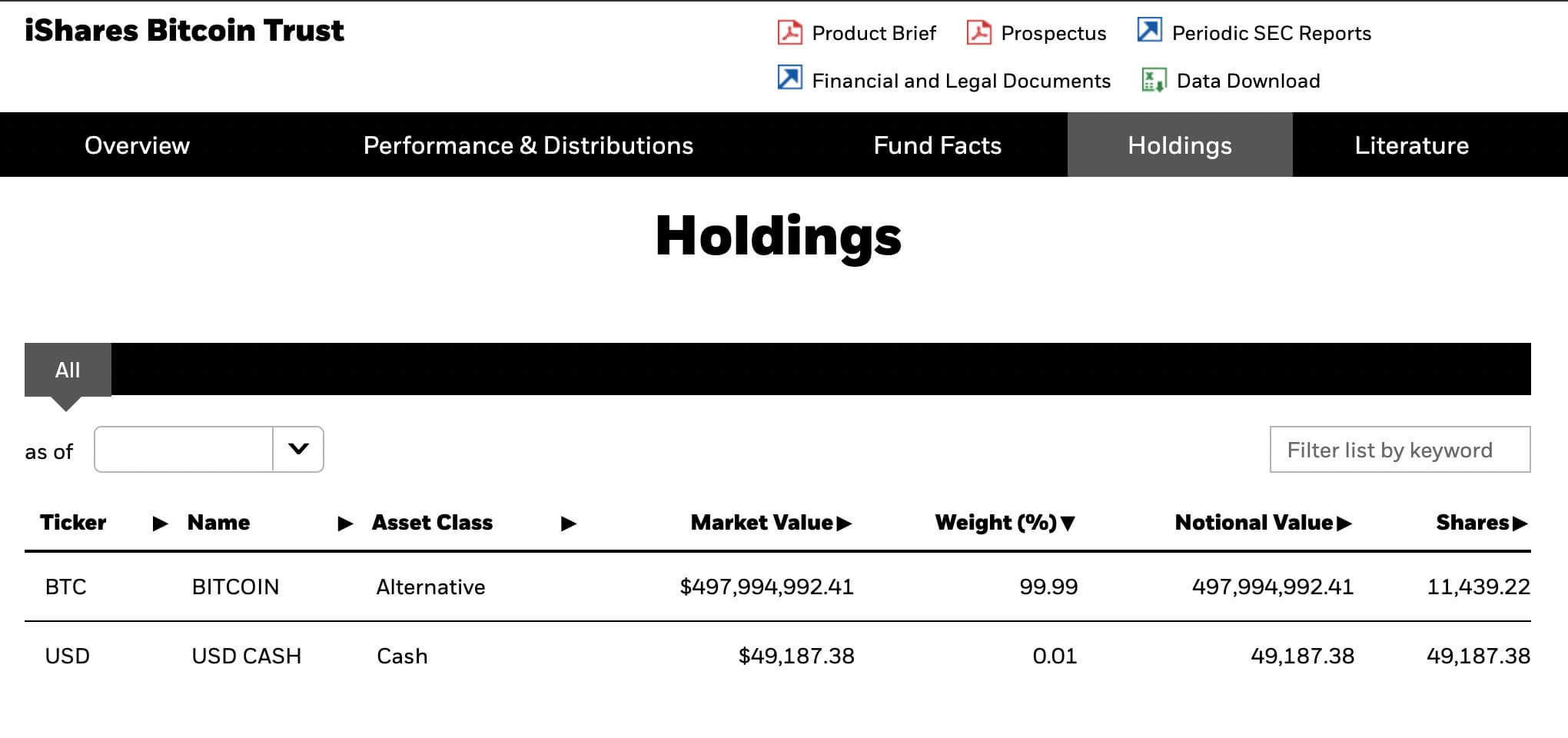

A breakdown of this activity shows a remarkable volume of 500,000 individual trades, contributing to a total trading volume of $3.6 billion. BlackRock’s iShares Bitcoin Trust (IBIT) led the pack in this initial surge, which garnered $497.7 million in total flows.

The Fidelity Advantage Bitcoin ETF (FBTC) was close behind, amassing $422.3 million. Bitwise (BITB) also significantly impacted, attracting $237.90 million in investments.

In contrast, the Grayscale Bitcoin Trust (GBTC), a pre-existing product, saw an outflow of $579 million during the same period. This shift is partly attributed to investors opting for the new Bitcoin ETFs offering lower fees.

This trend aligns with earlier forecasts by ETF analysts, who anticipated that Bitcoin ETFs could attract around $10 billion in their first year of operation. It’s worth noting that GBTC is one of the largest holders of Bitcoin, managing over $27 billion.

The post BlackRock scoops up 11,500 BTC during dip as ETF leads the pack appeared first on CryptoSlate.