Crypto market sentiment has turned “neutral” for the first time since October 2023. According to the ‘Crypto Fear and Greed Index,” sentiments turned “neutral” following almost three months in the “greed” phase.

The Crypto Fear and Greed Index, an indicator of crypto market sentiment, has entered the “neutral” phase after spending three months in “greed.” The recorded change in market sentiment comes just days after the SEC greenlit 11 spot bitcoin exchange-traded funds in the US.

Investors are Feeling Neutral After Months of Greed

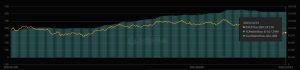

The Crypto Fear and Greed Index, an indicator of crypto market sentiment, entered the “neutral” phase on Monday after being in “greed” since mid-October 2023. The index, aimed at managing emotional behaviour in the crypto market, is a handy tool to gauge investor sentiment. At the time of reporting, the Index measured 52.

On the one end of the index is “extreme fear”, which indicates investors are worried about the market and signals a good buying opportunity. It logically follows that when investors feel greedy, the market is due for a correction. The index shows market sentiment on a meter from 0 to 100. Zero indicated “extreme fear”, while 100 indicates “extreme greed.”

The index calculates market sentiment by gathering data from various sources, including volatility (25%), market momentum or volume (25%), social media (15%), dominance (10%), and trends (10%). The index also includes surveys as a data source but has suspended this data source for the time being.

Investors have been greedy over the past three months in anticipation of regulatory shifts and the long-awaited spot BTC ETF approval. According to the index’s historical values, the index indicated a 67 – a rather greedy score. Approaching the deadline for the SEC’s approval of the first spot BTC ETF in the US, investors turned even more greedy last week, with the index recording 71.

Opinion: Market Due for a Correction?

After recording a rather greedy 71 last week, the sentiment has swayed to a neutral 52 as of Monday, January 15, 2024. While prices surged immediately after the SEC’s approval, the market appeared to stabilize. Curiously, Bitcoin remained largely unchanged following the decision while Ethereum and other altcoins skyrocketed.

Vanguard’s decision not to support spot BTC ETFs may also have factored into investor sentiment, and Senator Elizabeth Warren’s unsurprising criticism of the SEC’s decision may well influence sentiment. Sen. Warren said the SEC’s decision to approve the spot ETFs was “wrong on the law” and called for immediate and stringent AML rules in response to the decision.

According to data from CoinMarketCap, $BTC was trading at $42,718 at the time of writing and $ETH at $2,527.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.