Key Insights

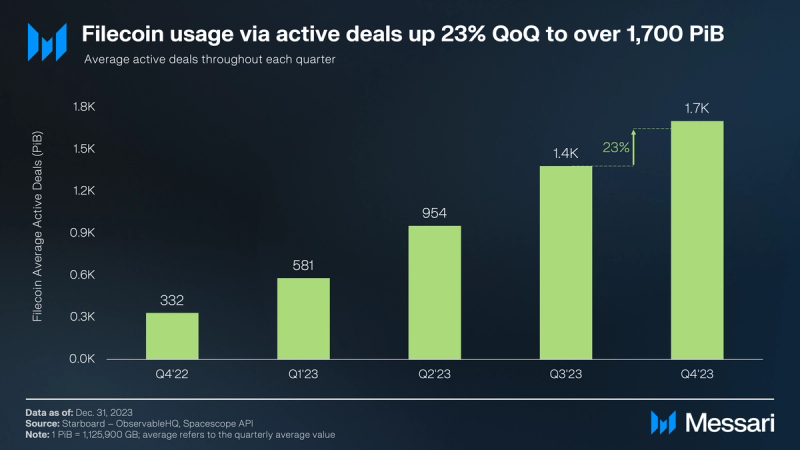

- Filecoin’s storage market continued to grow in Q4’23, as active deals were up 23% QoQ and 414% YoY. Simultaneously, storage utilization grew from 13% in Q3’23 to 18% in Q4’23, as Filecoin’s storage capacity continued to decrease 15% QoQ.

- As of the end of 2023, over 1,800 clients have onboarded datasets on Filecoin, of which 465 were over 1,000 TiB in size, up 10% QoQ and 196% YoY.

- The Filecoin Virtual Machine (FVM) brought Ethereum-style smart contracts to enable new use cases. Since the FVM launch of FVM in March 2023, the TVL reached over $230 million by the end of 2023.

- The proposal to deploy Uniswap V3 on FVM was successfully executed and will likely usher in a new phase of DeFi applications built on the Filecoin network.

- The FIP0001v2 community initiative was launched to improve and scale the Filecoin Improvement Process (FIPs) and governance process.

Primer

Relying on centralized data storage has a major shortcoming: it’s hard to systematically verify the integrity of the stored data. The Filecoin storage network is a peer-to-peer version of Amazon S3. It’s built on top of the InterPlanetary File System (IPFS), which serves as the Filecoin network’s distributed data storage and sharing layer. Filecoin regularly verifies the storage of data and uses deals that price the storage based on supply and demand dynamics, instead of a fixed pricing structure.

A storage deal is like a contract with a service level agreement (SLA) — users pay fees to storage providers to store data for a specified duration. To keep data safe, Filecoin uses a cryptoeconomic incentive model that regularly verifies the storage with zero-knowledge proofs. To incentivize storage providers to participate in deals, Filecoin rewards them with FIL, the network’s native token. Storage providers are also slashed in the event they either fail to provide reliable uptime or act maliciously against the network.

To retrieve data, Filecoin users pay a retrieval provider to fetch the data. Unlike storage deals, which involve transactions onchain, retrieval deals use payment channels to settle payments offchain, resulting in faster retrieval. Besides storage and retrieval, Filecoin aims to offer an open market where compute power can be contracted to run over data, providing more efficient alternatives to traditional centralized systems.

Key protocol upgrades to enable compute-over-data services include Smart Contracts (the Filecoin Virtual Machine – FVM) and Scaling (Interplanetary Consensus). The launch of the FVM in March 2023 brought Ethereum-style smart contracts to enable new use cases on Filecoin, including liquid staking, perpetual storage, and data-intensive compute.

Key Metrics

Performance Analysis

The Filecoin blockchain is used to store data decentrally by two parties:

- The demand side, i.e., storage users in need of data storage

- The supply side, i.e., storage providers with excess capacity of the network.

Usage

The amount of data stored in active deals between storage users and storage providers gauges the demand for Filecoin storage from both Web2 and Web3 clients.

Deals

In Q4’23, Filecoin continued its adoption of decentralized storage by means of active deal growth. Nearly 1,700 PiB was stored on the Filecoin network through active deals in Q4’23, up 23% QoQ from 1,400 PiB in Q3’23 and up more than 4x YoY from 332 PiB in Q4’22.

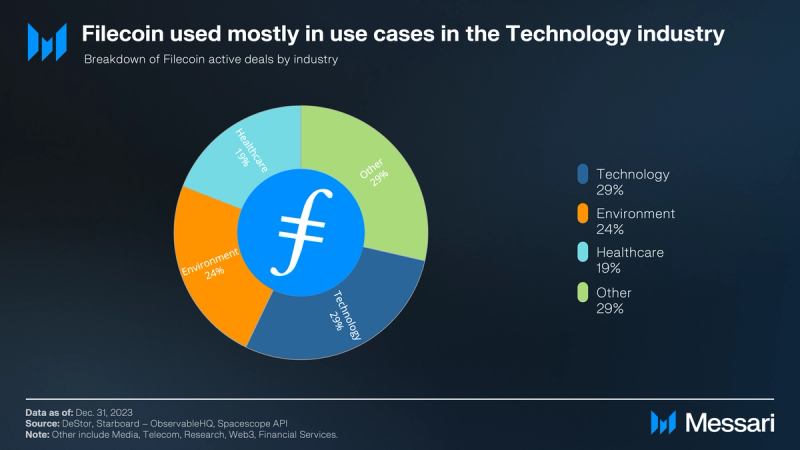

A breakdown of the active storage deals by their industry use cases reveals the industries that leverage Filecoin most are Technology (35%) and Natural Resources (31%). To encourage usage via active deals, several storage services are being offered, including: NFT.Storage, Web3.Storage, Seal, Banyan, and Steeldome.

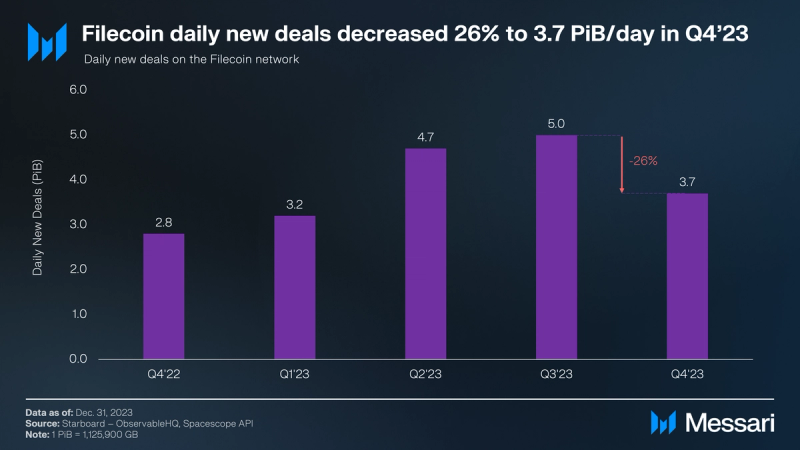

Simultaneously, daily new deals decreased 26% QoQ, after a sustained growth over the past four consecutive quarters. While still positive, this slowdown in new deal growth corresponds to an overall reduction in rewards to storage providers (as discussed later in the Supply-Side Revenue section). Moreover, new deals being added corresponded to an increase in the utilization of the Filecoin network.

Utilization vs. Capacity

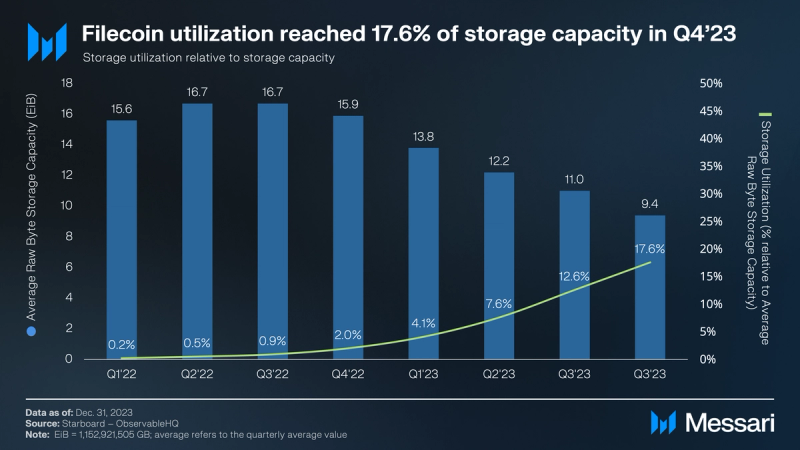

Filecoin’s storage utilization relative to the total available storage capacity increased to 17.6% in Q4’23, up from 12.6% in Q3’23. While this increase is a positive sign in terms of Filecoin’s adoption through active storage deals, it requires the context of the network’s capacity.

In Q4’23, Filecoin experienced a 15% QoQ decline in average raw byte storage capacity to 9.4 EiB. This gradual decline started approximately one year ago, after average raw byte storage capacity reached its all-time high at nearly 17 EiB in Q3’22.

The decreasing average raw byte storage capacity was further reflected by the drop in the total number of storage providers reaching continuously declining to 3,390 by the end of Q4’23, after reaching an all-time high of over 4,100 in Q3’22.

Clients

As per Messari’sguide on decentralized storage networks, Filecoin is geared toward providing cold storage solutions (e.g., archival and recovery) for enterprises and developers. Its competitive pricing and ease of access help attract Web2 clients seeking cost-effective alternatives for storing large amounts of archival data. Active efforts beyond cold storage are driven by: Banyan, Lighthouse, RIBS, Retriev, Seal, and Flamenco.

As of the end of Q4’23, a total of 1,808 clients have onboarded datasets on Filecoin. Of those clients, 465 onboarded large datasets (e.g., datasets that exceed 1,000 TiB in storage size), up 10% from 421 in Q3’23.

According to Filecoin’s client explorer, its major clients range from the City of New York and the USC Shoah Foundation to the Web3 platform OpenSea and the Layer-1 network Solana. Further notable efforts that leverage the Filecoin network include:

- The Victor Chang Cardiac Research Institute safeguarding and sharing research data.

- Democracy’s Library storing datasets collected by the Internet Archive at the end of administration.

- SETI Institute using Filecoin to store astronomical research data.

- UC Berkeley collaborating with Seal Storage for storing physics research.

- GenRAIT leveragingEstuary to store critical genomics data on Filecoin.

- The research center Starling Lab storing sensitive digital records of human history.

- Ewesion (China’s fastest growing host of graphic files) using Filecoin for data preservation.

DeSci Labs using decentralized data storage on Filecoin to enable research to be reproduced and independently verified by other researchers.

An overview of featured clients leveraging the Filecoin network can be accessed here.

Retrievals

To serve storage retrieval needs, a content delivery network (CDN) for Filecoin and IPFS – called Project Saturn – is currently being developed. Saturn aims to serve Filecoin’s retrieval market through fast and low-cost content delivery. Its node operators are incentivized to fulfill retrieval requests by earning FIL from a monthly pool of approximately 30,000 FIL. Simultaneously, the FILStation app is bringing decentralized retrievals to desktops, and the SPARK module allowing retrieval checks on the network is now available on FILStation.

In terms of retrieval performance, the goal of Saturn is to provide reliable content retrieval for both Web2 and Web3 use cases. It’s focused on improving the speed and performance of retrievals, with the majority of data being mirrored from IPFS. A deep dive into Saturn’s decentralized CDN, its traction to date, and its roadmap is available here. An overview of Saturn’s node performance is available in the Saturn dashboard.

FVM Usage

The Filecoin Virtual Machine (FVM) brought Ethereum-style smart contracts to Filecoin. Since its launch in March 2023, the TVL reached over $230 million by the end of 2023. DeFi apps give storage providers greater access to FIL, potentially making data onboarding more efficient. As of December 31, 2023, more than 2,700 unique contracts were deployed on FVM and used by over 22,000 monthly active users. These users collectively generated over 1.8 million transactions.

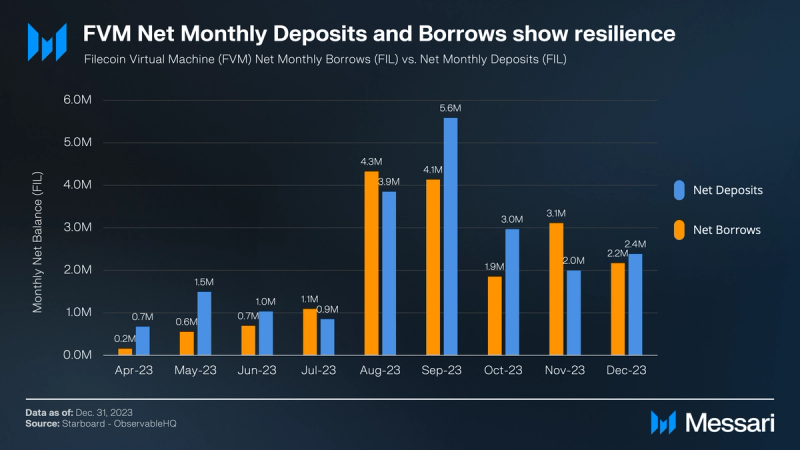

According to the FVM Explorer, total DeFi net deposits accounted for 14.2 million FIL (approx. $85.2 million), distributed as follows: 9.1 million FIL in GLIF, 3.8 million FIL in stFIL, 2.8 million FIL in SFT Protocol, and over 1.9 million FIL in HashKing. Simultaneously, total DeFi net borrows accounted for 12.3 million FIL (approx. $73.8 million) as of December 31, 2023, according to the FVM DeFi leaderboard. Both monthly net deposits and borrows showed resilience throughout Q4’23.

The proposal to deploy Uniswap V3 on FVM was passed and successfully executed in October. The deployment of Uniswap contracts on the FVM will likely usher in a new phase of DeFi applications built on the Filecoin network. As Filecoin continues to acquire new users and onboard valuable datasets, it may serve as a base for developing monetizable FVM-enabled use cases around data.

Revenue

Filecoin’s revenue framework is similar to Ethereum’s because its gas system is based on EIP-1559. This gas system consists of network fees that are burned to compensate for the resources used. Both storage users and storage providers generate revenue.

Protocol Revenue

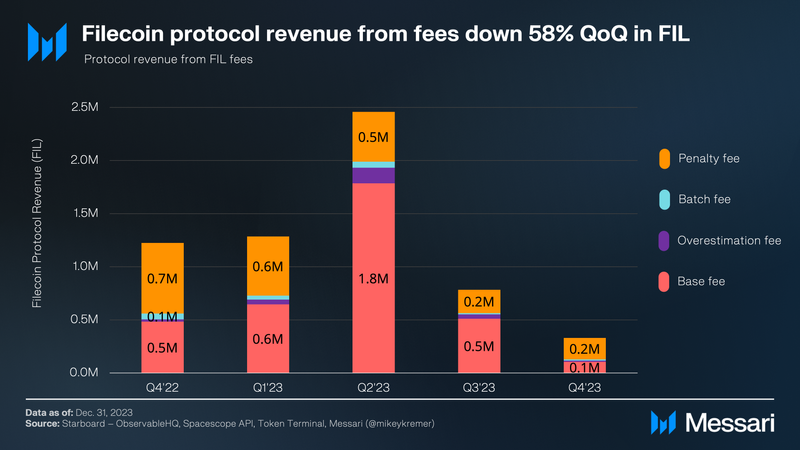

As per Messari’s revenue analysis, Filecoin’s protocol revenue represents the sum of:

- Base fees – Determined by blockspace congestion and required by any storage proof.

- Batch fees – Used for bundling storage proofs.

- Overestimation fees – Required to optimize gas usage.

- Penalty fees – Collected for storage provider failures.

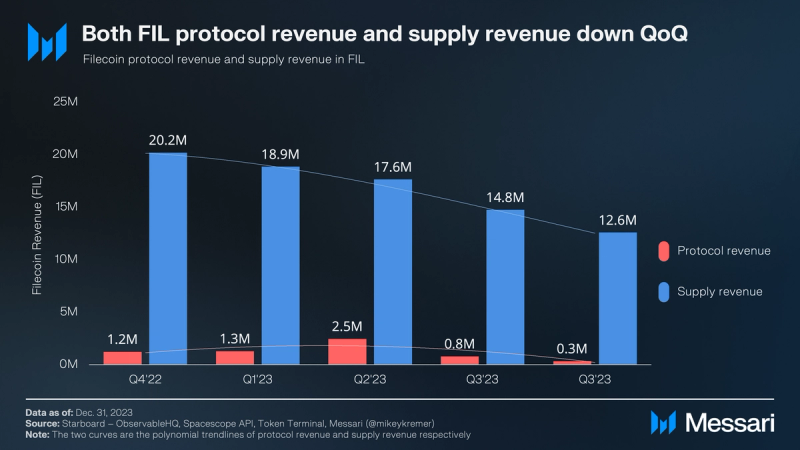

While demand for Filecoin storage grew, protocol revenue from FIL fees decreased 58% in Q4’23 to 0.3 million FIL (down 58% in USD terms to $1.3 million). This decline in protocol revenue is in line with the overall decline in demand-side revenue across the decentralized cloud storage space.

The main contributor to the decline in Filecoin’s demand-side revenue is base fees, down 80% QoQ in FIL terms. Filecoin is actively working on reducing costs for onboarding data on its network, e.g., through the Decentralized Storage Alliance (DSA) initiative to reduce decentralized storage costs by 40%.

Supply-Side Revenue

Filecoin’s supply-side revenue consists of:

- Block rewards disbursed by the network to storage providers.

- Storage deal payments that are anchored via legal contracts.

- “Tips” to speed up transactions.

Block rewards accounted for more than 99.9% of supply-side revenue in Q2’23, while “tips” accounted for only a small portion. The minting mechanism of new FIL tokens relies on both:

- An exponential decay model (30% of tokens): Block rewards are highest initially to stimulate participation and then decrease exponentially over time.

- A baseline model (70% of tokens): Block rewards are allocated as storage capacity grows.

By combining these models, Filecoin can maintain participation after block reward distribution in the early stages of the network (see exponential decay model). It also helps continuously reward additional value created for the network through increased storage capacity (see baseline model).

Supply-side revenue in FIL decreased 15% in Q4’23 to 12.6 million FIL (down 4% in USD terms). The decrease was driven by an overall reduction of FIL reward issuance due to the exponential decay model and the baseline minting model. The decrease in FIL reward issuance will likely continue in the coming quarters. For an in-depth discussion and various simulations of future FIL issuance, please refer to Messari’s investigation on the FIL circulating supply.

Ecosystem Overview

The Filecoin ecosystem has been actively developing a funnel of builders. It has regularly engaged in hackathons and accelerators to help early-stage projects and teams receive funding from Protocol Labs or affiliated entities. The ecosystem is channeled toward onboarding various use cases in different sectors: namely, data infrastructure, media streaming, metaverse, and gaming.As of December 2023, over 100 known projects were developed within the Filecoin ecosystem. Most projects that leverage Filecoin offer data services:

- Banyan: Web2-like decentralized storage for enterprises beyond archival.

- Lighthouse: Perpetual data storage service with a one-time payment pricing model.

- Numbers Protocol: Preserve data authenticity for digital media and generative AI.

- Berty: Secure messaging and social media application.

- Dether: Cash on- / off-ramp and diverse financial transactions.

- Tableland: SQL-based cloud database.

- Basinv2: data management and collaboration, used by Tableland, the WeatherXM network, and the Bacalhau computer network.

Media and entertainment-focused protocols include:

- Mona: 3D art gallery in the metaverse.

- NFTwitch: NFT minting platform for Twitch content.

- Huddle01: Decentralized video conferencing.

- OP Games: NFT minting for games.

- FileMarket: Web3 shop builder and marketplace.

- Xone: Metaverse solution that connects artists and fans.

Several use cases aim to leverage Filecoin’s infrastructure to power highly specific data needs:

- Cryptosat: Uses mini-satellites to prevent side-channel attacks and allow for secure verifiability.

- Bela Supernova: Store patients’ health data.

- ZKsig NFTs: Access control to marketplace.

- DataMarket: Data purchase and checkout functionalities.

Qualitative Analysis

Key Developments

Filecoin Watermelon Upgrade (V21)

The Watermelon upgrade (V21) was activated successfully on December 12, 2023. The upgrade simplifies storage provider operations and introduces improvements to the Filecoin protocol and to the FVM.

Sushi Deployment on Filecoin

Sushi is the first DEX to be deployed on Filecoin. Users of Sushi V2 and V3 will be able to trade and provide liquidity on the Filecoin network without bridging or native FIL tokens needed.

Filecoin MetaMask Wallet

The Filecoin MetaMask wallet launched in Q4’23. It allows users to connect to Filecoin decentralized apps using MetaMask, manage Filecoin accounts, send FIL to both native and FEVM accounts, and gain FEVM transaction insights.

Universal Privacy Alliance

Protocol Labs and the Filecoin Foundation joined the Universal Privacy Alliance (UPA) alongside Nym, Oasis, and Aztec. The UPA aims to promote “privacy by design” in technology and create a legal fund to support privacy-centric practices in the industry.

Key Events

FIL Bangalore and ETHIndia

Members of the IPFS, Filecoin, FVM, and libp2p ecosystems took part in the FILBangalore and ETHIndia in December 2023. Over 150 submissions have been sent for the Filecoin projects track. Simultaneously, Pragma saw over 70 submissions to the Filecoin projects track.

FIL Dev Summit

FIL Dev Summit featured dedicated tracks on Filecon retrievals and data availability. While the retrieval track focused on improving data retrieval, the data availability track focused on how to effectively structure data and transfer it efficiently.

LabWeek 2023

Protocol Labs’ annual gathering — LabWeek 2023 — featured discussions on InterPlanetary Consensus (IPC), Filecoin’s DeFi growth unlocked by the Filecoin Virtual Machine (FVM), and new Filecoin projects and developer toolings. Simultaneously, the FilecoinPlus Day introduced key changes to the Notary election process.

Key Governance Decisions

Uniswap V3 Deployed on FVM

The proposal to deploy Uniswap V3 on FVM was passed and successfully executed in October. The deployment of Uniswap contracts on the FVM will likely usher in a new phase of DeFi applications built on the Filecoin network. As Filecoin continues to acquire new users and onboard valuable datasets, it may serve as a base for developing monetizable FVM-enabled use cases around data.

FIP0001v2

FIP0001v2 is a coordination effort to improve and scale Filecoin’s governance. The FIP0001v2 draft proposes five distinct types of Filecoin Improvement Proposals (FIPs): namely, technical FIPs, cryptoeconomic FIPs, community FIPs, security FIPs, and Filecoin Request for Comment (FRC). Detailed information can be found in the FIP0001v2 draft.

Closing Summary

Data storage on Filecoin experienced significant growth in Q4’23, with active storage deals increasing by 23% QoQ and 414% YoY. As Filecoin’s storage capacity continued to decrease 15% QoQ, storage utilization grew from 13% in Q3’23 to 18% in Q4’23.

As of the end of 2023, over 1,800 clients have onboarded datasets on Filecoin, of which 465 were over 1,000 TiB in size, up 10% QoQ and 196% YoY. Revenue from storage fees decreased 58% in FIL terms in Q4’23 (down 58% in USD terms), in line with the overall decline in demand-side revenue across the decentralized cloud storage space.

The proposal to deploy Uniswap V3 on FVM was successfully executed and will likely usher in a new phase of DeFi applications built on the Filecoin network. As Filecoin continues to acquire new users and onboard valuable datasets, it may serve as a base for developing monetizable FVM-enabled use cases around data. Prominent examples include perpetual storage (similar to Arweave), undercollateralized loans to storage providers, and decentralized computing. Should Filecoin continue to onboard demand, it stands a chance at becoming a prominent provider of decentralized storage and cloud services for Web3 and traditional applications.