Fidelity’s director of global macro is updating his outlook on the equities markets, and says that Bitcoin’s (BTC) network currently “remains on track.”

Jurrien Timmer says on the social media platform X that the growth of Bitcoin is primarily driven by its scarcity and central bank monetary policy.

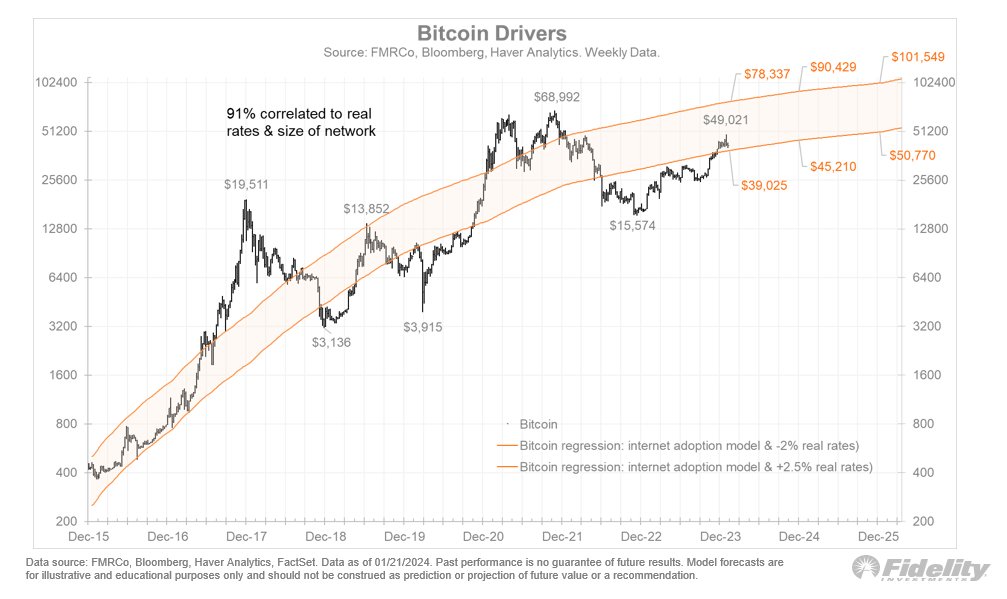

With those key drivers in mind, Timmer says Bitcoin’s adoption curve is right on track, based on the growth of non-zero addresses.

“In my view, the price of Bitcoin is driven by the size and growth of its network, which in turn is driven by its scarcity features (stock-to-flow) and real rates (Fed policy). As the chart shows, Bitcoin’s network is growing in line with a standard power regression curve. That means that the S-curve nature of Bitcoin’s network remains on track.”

Looking at the stock market, the Fidelity analyst says that small-cap stocks are lagging behind larger equities, creating uncertainty as to whether or not a true bull run is underway. Timmer says he has a hunch that like most times in the past, small caps will ultimately catch up to their larger counterparts.

“The rising tide lifts most boats. With new highs for the S&P 500 index, the question is when the rest of the market will catch up and make new all-time highs. Equal-weighted index (SPW) seems close, following the broad-based year-end rally. Small caps remain in a bear market.

History shows that sooner or later the rest of the market does tend to follow suit. Often, small caps break out concurrently with large caps, as was the case during the 1960’s and 1970’s

But sometimes there are lags. In 1991 (following the S&L [savings and loan] crisis in 1990), it took 10 months for small caps to confirm. In late 1998 (following the LTCM [Long-Term Capital Management crisis]) it took 14 months. In the spring of 2019 (following the 20% drop in late 2018), it took 20 months.

With the Russell 2000 still 21% below its high (keeping it in bear market territory), it’s worth asking whether it has ever happened that small caps are in a bear market while large caps are in a bull market. The answer is no, although we came close a few times…

My hunch is they’ll catch up eventually, just like in the past.”

At time of writing, Bitcoin is trading at $39,745, which Timmer says is roughly at “fair value.”

“Bitcoin’s price has traveled back into what I consider its fair value band.

The slope of the curve is based on the internet adoption curve a few decades ago, and the width is based on a real rate band of -2% (top) and +2.5% (bottom).”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/FlashMovie/Sensvector

The post Fidelity Analyst Says Bitcoin Network ‘Remains on Track,’ Updates Outlook on Stock Market appeared first on The Daily Hodl.