Key Insights

- Volume on Matcha increased by 58% QoQ, crossing over $1 billion as it recovered from the decline in Q3.

- Total unique traders on Matcha increased by 16% YoY, though declining by 16% QoQ.

- Ethereum regained the lead in share of trades on Matcha, accounting for 26% of Matcha trades, while the next highest activity chains were Optimism (20%) and Arbitrum (19%).

- Matcha saw a 36% YoY decline in the daily average rate of failed trades (revert rate), from 9.5% to 6.1% using the Standard trading mode.

- In Q4, Matcha added support for cross-chain trading and made a series of updates to its limit order product.

Primer

Matcha is a decentralized exchange (DEX) aggregator that was launched in June 2020 by 0x. As a DEX aggregator, Matcha aims to deliver users the best prices on DeFi trades. Using the 0x Swap API, Matcha finds the best-executed price from over 100 onchain (i.e., AMMs) and offchain (i.e., 0x proprietary RFQ) liquidity sources. This approach enhances price efficiency and optimizes gas costs for users, rendering it a more economical choice than direct trading on platforms like Uniswap or SushiSwap.

Matcha also offers a range of core features that enhance the trading experience. It supports the trading of over 5 million tokens on nine blockchains, including Ethereum, BNB Smart Chain (BSC), Polygon, Avalanche, Optimism, Fantom, Celo, Arbitrum, and Base. Gas fees are conveniently embedded into trades to cover re-submission costs, alleviating concerns over failed transactions and eliminating the need for users to hold native gas tokens. Matcha also provides MEV (Maximal Extractable Value) protection, powered by 0x Swap APIs, to prevent slippage and MEV attacks. Ethereum and Polygon users that utilize Matcha Auto or route trades through RFQ also avoid MEV attacks. Additionally, Matcha supports cross-chain trading across seven different networks (Ethereum, Polygon, Arbitrum, Optimism, Base, BNB Smart Chain, and Avalanche).

Website / X (Twitter) / Discord

Key Metrics

Performance Analysis

Volume and Trades

Matcha’s trade volume recovered in Q4. It increased by 58% QoQ despite seeing no change in the total number of trades. This dynamic implies that the average trade size also grew by 58%, reflecting the bullish sentiment that categorized Q4.

The increase in average trade size may also be attributed to users placing more trust in Matcha due to features like RFQ routing and Matcha Auto, which protect against MEV attacks. In Q4, the average daily percentage of MEV-protected trades increased from 16% to 23%. As DEX traders make higher volume trades, they will increasingly value tools that protect against harmful MEV to ensure the integrity of their trades.

Ethereum stood out in Q4 as it regained the lead in share of trades on Matcha, accounting for 26% of Matcha trades. Meanwhile, Optimism lost 10% of its trade share from Q3, falling to 20% of the Matcha trade share in Q4. Arbitrum remained roughly the same, accounting for 19% of the Matcha trade share. In raw values, every chain except for Fantom saw trade volume increase. However, Ethereum’s outpaced most other chains, increasing its share of Matcha volume to 87%.

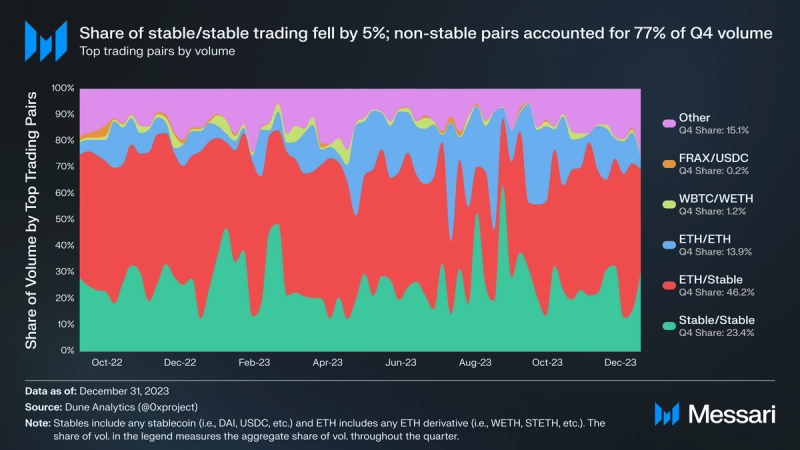

The volume share of ETH (including ETH derivatives) and USD-pegged stablecoins grew 11% QoQ as the most popular trading pairs on Matcha. This growth may have been a result of ETH ETF speculation, given the positive sentiment around the upcoming (during Q4) Bitcoin ETF approval. Other pairs excluding the top five trading pairs accounted for over 15% of the Q4 share, the highest percentage in the past year. This increase in trading of ad-hoc pairs may have been influenced by Matcha increasing its number of indexed tokens to over 5 million tokens in Q4. In the same period, stablecoin-to-stablecoin trading (Stable/Stable) and ETH derivatives (ETH/ETH) trading fell by 5% and 10%, respectively.

Unique Traders

In Q4, Matcha added support for cross-chain trading and implemented a series of updates to its limit order product. While this effort, combined with the updates from Q3, appeared to retain returning unique traders (+16% QoQ), the overall number of unique traders fell by 16% QoQ, following a record Q3 for new unique traders. Regardless, total unique traders have increased 16% YoY, with new traders rising by 7% YoY and returning traders rising by 24% YoY.

Revert Rate

Matcha uses the 0x Swap API and 0x Protocol for its backend processes. The 0x Swap API aggregates liquidity across all supply sources (onchain and offchain), helping traders by filling orders with the best prices. This process requires orders to be stored offchain while trade settlement occurs onchain. The 0x Protocol ensures all parts of the trade are satisfied before executing the swap; if not, the trade is reverted. The revert rate is useful for determining the reliability of the protocol.

In Q4, Matcha maintained low volatility for revert rates. It ended the quarter with an average of only 6% of trades reverted, compared to the market average of 9%. Matcha greatly improved over the past year, with 36% fewer trades being reverted YoY (from 9.5% to 6.1%). This improvement can largely be credited to the various updates made throughout the year by the 0x team, which is responsible for Matcha’s backend infrastructure.

Qualitative Analysis

Matcha Upgrades

Matcha implemented a series of upgrades in Q4, adding new features and improving functionality.

- Added support for Phantom Wallet.

- Added new liquidity support to enable Matcha to access liquidity from Camelot DEX (one of Arbitrum’s largest liquidity sources) and PancakeSwap V3 (BNB Smart Chain’s highest-volume DEX). This feature was accomplished by using 0x’s Swap API to power its DEX liquidity aggregation.

- Added a trade history feature that enables users to view their completed swaps and manage limit orders placed on Matcha.

- Increased token coverage to over 5 million tokens, up from 4 million in Q3’23.

- Launched cross-chain swaps available on seven chains.

- Implemented limit order updates that enhance usability.

Cross-Chain Swaps

Since cross-chain swaps launched in early December, users have been able to trade assets on Matcha across seven different chains. Key aspects of this product are listed below.

- Users maintain custody while using this product.

- Support across seven chains: Ethereum, Polygon, Arbitrum, Optimism, Base, BNB Smart Chain, and Avalanche.

- Only five steps, all on the same interface.

- Matcha has not announced any fees for the service.

- Powered by Socket, an interoperability protocol that facilitates data and asset transfers across chains. (Socket is not a bridge or cross-chain user application, it is developer tooling.)

Limit Orders Updates

Limit orders are a trading tool that enables traders to buy or sell assets at a specified price, ensuring the trader does not pay more or sell for less than this predetermined price. 0x’s limit order product can be used on three chains: Ethereum, Polygon, and BNB Smart Chain. Matcha’s limit order upgrades were released at the start of October in Q4. Below is a recap of these upgrades made available to users going into Q4.

- Shortcuts: enables fixed percentage adjustments to orders, simplifying and speeding up the limit order process.

- Rate Control: lets users set exact order amounts of tokens they want to trade.

- Duplicate Orders: lets users duplicate previous orders — saves time instead of creating repeat orders.

- Order Batch Cancellation: gives users the power to cancel all unfilled orders in one transaction. (This operation costs gas.)

Closing Summary

Matcha continued to ship products and features throughout Q4: it added high-quality liquidity sources, increased support to over 5 million assets, added cross-chain trading, implemented limit order updates, and launched a trade history feature. Some of these additions invariably contributed to the improvement and maintenance of important metrics. Matcha saw trade volume jump by 58%, added 16% more returning unique traders, and maintained low revert rates on trades. Throughout Q4, Matcha continued to ship valuable products and features, positioning itself well to capitalize on the next stage of the market cycle.

——