Key Insights

- BNB Smart Chain (BSC) processed a record 32 million transactions in a single day and 4.6 million average daily transactions in Q4’23, up 30% QoQ and up 35% YoY.

- BSC grew its revenue by 27% QoQ and saw its market capitalization increase by 48% QoQ.

- The number of active validators on BSC grew from 32 to 40, up 25% QoQ and up 54% YoY. This growth was spurred by the implementation of BEP-131 and BEP-159.

- Venus Protocol overtook PancakeSwap in DeFi TVL share on BSC, accounting for 39% of the total share; PancakeSwap accounted for 37%.

- BNB Chain launched the mainnet of BNB Greenfield, marking the start of a BNB Chain-native storage network that synergizes decentralized cloud storage with the smart contract functionality of (BSC), thus creating a powerful infrastructure stack for Web3-native and AI-focused projects.

Primer

BNB Chain (BNB) is an ecosystem of blockchains where each chain serves a particular function. The three core components of BNB Chain are as follows:

- BNB Smart Chain: smart contract layer (will add staking and governance functionality)

- BNB Beacon Chain: current staking and governance layer (will migrate functionality to BSC and be discontinued)

- BNB Greenfield: storage network

- opBNB: optimistic rollup (with plans to upgrade to a zero-knowledge rollup)

The metrics in this report will focus on BNB Smart Chain (BSC). BSC is an EVM-compatible, layer-1 blockchain secured by a form of Proof-of-Staked-Authority (PoSA) that combines aspects of Proof-of-Authority (PoA) and Delegated Proof-of-Stake (DPoS). In PoSA on BSC, the validator set is of fixed size and is elected by stake weight (staked plus bonded). In addition, validators must continue staking assets to secure the network, and validators chosen to produce blocks are rotated (not based on stake weight). For a full primer on the BNB Chain ecosystem, refer to our Ecosystem report.

Website / X (Twitter) / Telegram

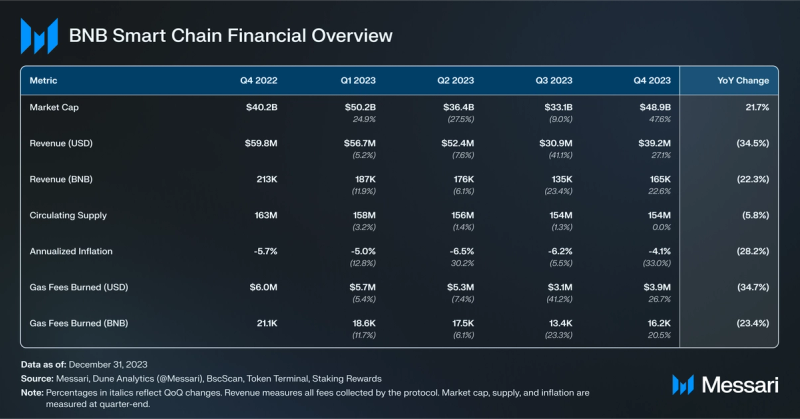

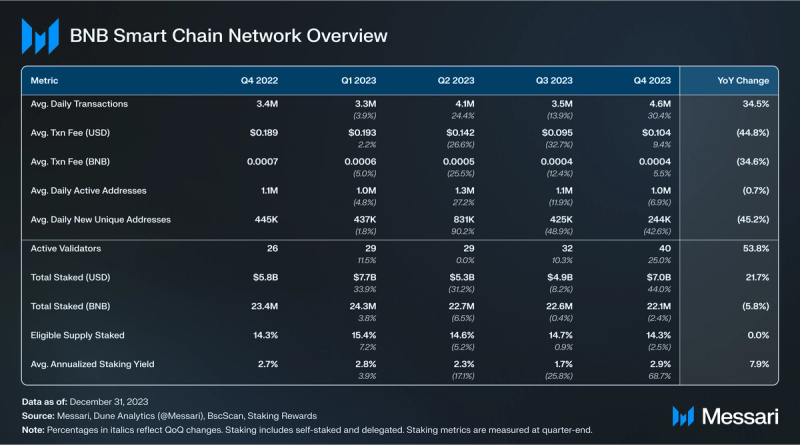

Key Metrics

Performance Analysis

Financial Overview

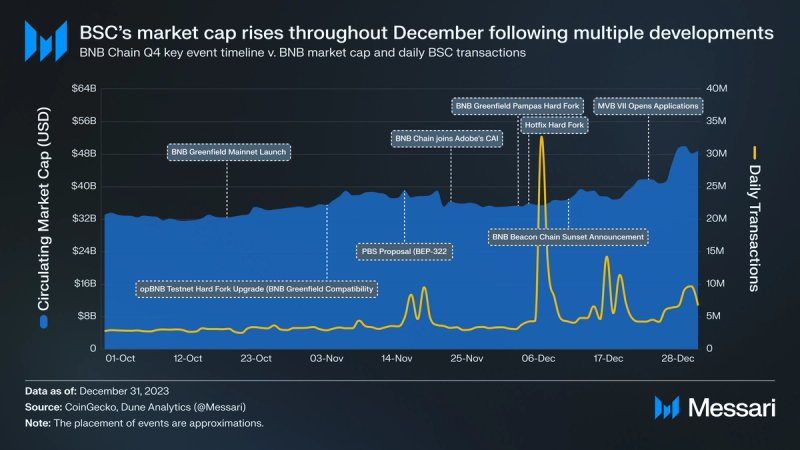

As the third-largest Layer-1 protocol by market capitalization, BSC had a productive quarter, experiencing a positive change in all of its financial metrics. It saw QoQ growth in market capitalization(+48%), revenue measured in USD (+27%), and gas fees burned in BNB (+21%). As such, the protocol ended the year with a 4% annual deflation in Q4. Many of BNB Chain’s initiatives appeared to impact the progress of the protocol throughout the year.

BNB Smart Chain (BSC) generated over $39 million in revenue in Q4, an increase of 27%. Revenue denominated in BNB, which measures all fees collected by the protocol, grew by 23%, indicating an increase in activity. Though already trending upward, the spikes in revenue from December may be attributed to inscriptions-related activity, which led BSC to experience a record 32 million transactions on December 7, 2023. Additionally, speculation on BSC’s native asset, BNB, led the market capitalization to increase by 48% QoQ, recovering from two consecutive quarters of decline. The renewed interest in BNB may be a result of the activity facilitated by the blockchain.

Network Overview

A few of BSC’s most impressive improvements throughout the year include a 35% YoY increase in daily transactions, a 45% YoY reduction in the USD cost of an average transaction fee, and a 54% increase in the number of active validators. The year’s technical developments showed that BSC can experience heightened activity while still lowering costs for users and improving the decentralization of the protocol.

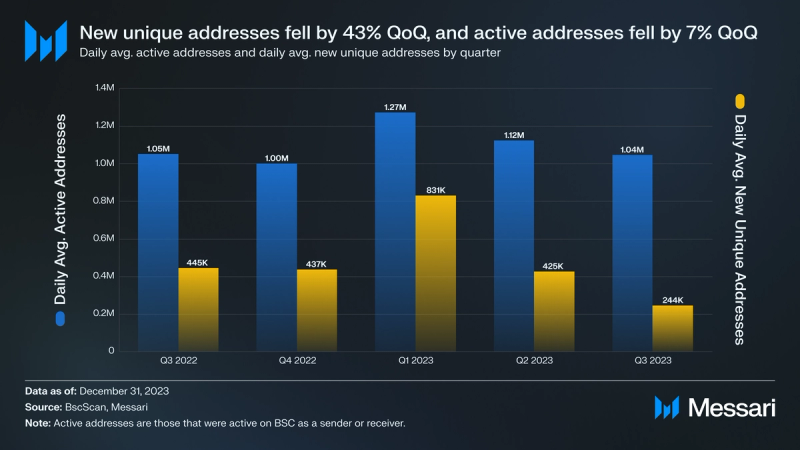

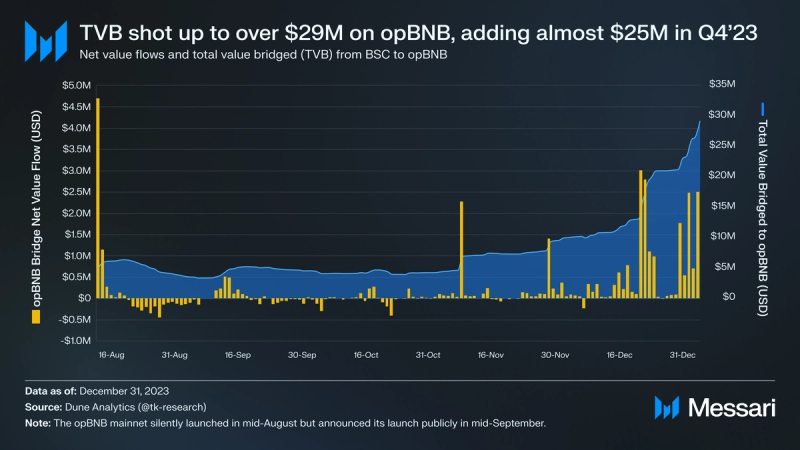

Active addresses are those that were active on BSC as a sender or receiver. Daily average active addresses fell 7% QoQ, and daily average new unique addresses fell 43% QoQ. The decline in new unique addresses may be a result of new users trying opBNB, which launched the previous quarter, rather than BSC. In Q4, opBNB added nearly $25 million in bridged assets, indicating movement to the new chain. Additionally, users of XCAD Network and Galxe, two of BSC’s most used SocialFi applications, saw declines in unique active wallets of roughly 36% QoQ and 64% QoQ, respectively. Regardless, these falls in active addresses have not significantly impacted BSC’s onchain activity.

BSC had a record quarter, averaging roughly 4.6 million daily transactions, an increase of 30% QoQ and 35% YoY. It experienced multiple spikes in transactions in December largely due to inscriptions-based activity. The use of inscriptions originated on Bitcoin as a workaround to create NFTs and tokens, given that Bitcoin lacks native support for smart contracts. On smart contract platforms like BSC and other EVM-compatible blockchains, inscriptions are an alternative to traditional token creation methods.

On Bitcoin, data is inscribed directly onto satoshis (Bitcoin’s smallest unit of measurement) in transactions. EVM-based inscriptions are similar; however, EVM chains use “calldata,” which is optional data sent in a transaction and is read-only and cost-effective. Creating BEP-20 tokens requires smart contract development and can be costly, but inscribing data within a transaction is simpler and cheaper. Of all EVM-based blockchains, BSC has the largest number of addresses that have minted inscriptions.

On December 7, 2023, BSC processed a record 32 million transactions, of which, many were inscription-related. And the average transaction fee cost for that day was only $0.27 USD, which was 74% less than the average transaction fee cost during all of Q4. This event showed BSC’s ability to scale activity while providing steady fees for the user.

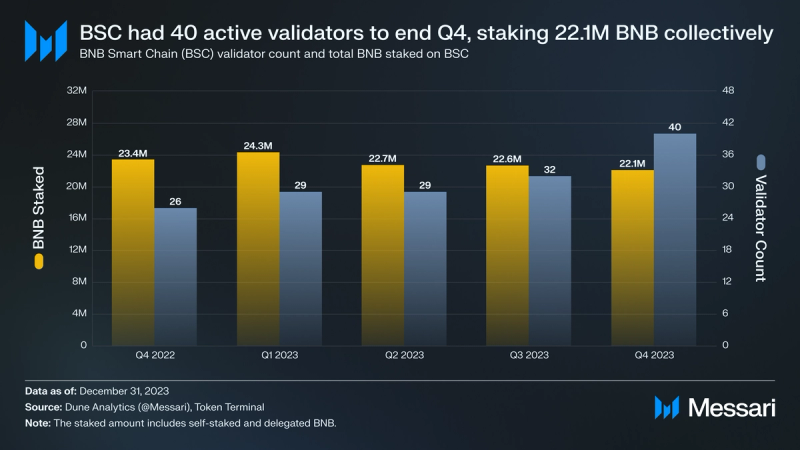

The size of BSC’s validators followed an upward trend throughout the year, adding eight validators in Q4, a 25% QoQ increase, and a 54% YoY increase. The implementations of BEP-131 and BEP-159 in Q3 were instrumental in increasing the size of BSC’s validator set over the past two quarters. BEP-131 introduced candidate validators onto BSC, which essentially created the role of backup validators should there be any issues with active validators. Also, BEP-159 introduced a permissionless validator election mechanism.

While the amount of BNB staked decreased by 2% QoQ, the value of BNB staked increased 44% to $7 billion, further increasing the security of the system. Having a higher dollar value of staked assets in PoS protocols increases the difficulty for newer malicious actors to attack the system due to the higher entry point for staking. To further increase BSC’s security, BEP-322 was proposed to introduce a standardized mechanism for Proposer-Builder Separation (PBS). Potentially beginning in Q1’24, this proposal would improve transparency, encourage competition through multiple MEV (maximal extractable value) solution integrations, and stabilize MEV-focused products.

Ecosystem Overview

Ecosystem Growth Strategy

The drivers of BNB Chain’s network activity and fundamental value accrual include its growth strategy to attract developers and grow its ecosystem. BNB Chain has established several growth initiatives that were run throughout Q4 2023, including:

- Most Valuable Builder (MVB) Accelerator Program — Applications for the seventh season of this program, in collaboration with Binance Labs, opened in December 2023. Teaming up with CMC Labs, this program aims to incubate 100 new projects and will take place between February and March 2024. It features a 10-week accelerator, builder grants, and operational resources for applicable teams.

- Gas Grants Program — The Gas Grants program, which ran in October and November, incentivized projects that contributed to the BNB Chain ecosystem by providing them with gas fee grants proportional to their monthly gas fee volume. The total pool for these gas grants was fixed at $200,000 in BNB tokens each month, with individual projects receiving up to $15,000 monthly. In October, 21 projects received grants, and 22 projects received grants in November.

- DAU Incentive Program — BNB Chain transitioned its Gas Grants program to the DAU Incentive Program in December. It awards up to $200,000 monthly, and individual projects can earn up to $90,000 from the prize pool. The total prize pool varies, equaling the sum of gas fees of eligible projects up to $200,000. Eligible projects are ranked based on their average DAU during the month they participate in the program.

DeFi

Throughout Q4, BSC’s DeFi TVL grew from $3.2 billion to $4.3 billion, a QoQ increase of 33%. To avoid double-counting, liquid staking TVL was excluded from the figure. However, Wrapped Beacon ETH’s TVL measured in USD rose from $1.3 billion to $1.8 billion, up 40% QoQ.

Despite an exploit in early December, Venus Protocol recovered and overtook PancakeSwap in TVL share, accounting for 39% of the total share; PancakeSwap took 37%. While the top five protocols collectively accounted for 85% of BSC’s DeFi TVL, hundreds of other protocols accounted for over 15%, worth $656 million. Despite the concentration of TVL among top protocols, the dollar value of TVL of BSC protocols outside the top five indicates the financial strength among even smaller protocols. BNB Chain actively promotes newer protocols with multiple initiatives, cohosting meta-governance grants with PancakeSwap. In Q4, they selected four early-stage projects to receive the meta-governance grants: Cakepie, StakeDAO, Breakfast Finance, and Redacted Cartel.

Stablecoins

BSC hosts a diverse ecosystem of stablecoins that has become dominated by USDT over the past year. This change can be largely attributed to the other large stablecoins seeing higher percentage outflows than USDT, which increased TVL by 6% YoY. Most notably, the largest outflows came from BUSD (-88% YoY), which held the largest share of BSC’s stablecoin TVL in Q4’22 and Q1’23. BUSD lost much of its value throughout the year due to admissions of a gap in collateral, the NYDFS ordering Paxos (the BUSD issuer) to cease issuance, and Coinbase suspending BUSD trading. Regardless, BSC still fostered a diverse stablecoin environment worth $4.6 billion in Q4, with $113 million held in 26 other stablecoins outside of the top five in the ecosystem from the past year (USDT, BUSD, USDC, DAI, and TUSD).

Other

After a record Q3 for NFT secondary sales transactions, participation of unique buyers and sellers, and secondary sales volume measured in BNB (though not USD), BSC saw NFT-related metrics fall in all areas. NFT marketplace transactions fell by 86% QoQ, leading secondary sales volume to drop by 63% QoQ. Buyers and sellers also decreased, falling by 65% and 85%, respectively. It’s difficult to compare this to the broader market given that BSC NFT activity spiked during Q2’23 and Q3’23, while Ethereum’s (the largest market) NFT activity spiked in Q1’23. Regardless, BSC and Ethereum saw activity start to pick up near the end of Q4’23, which may continue into 2024 as the next stage of the market cycle begins.

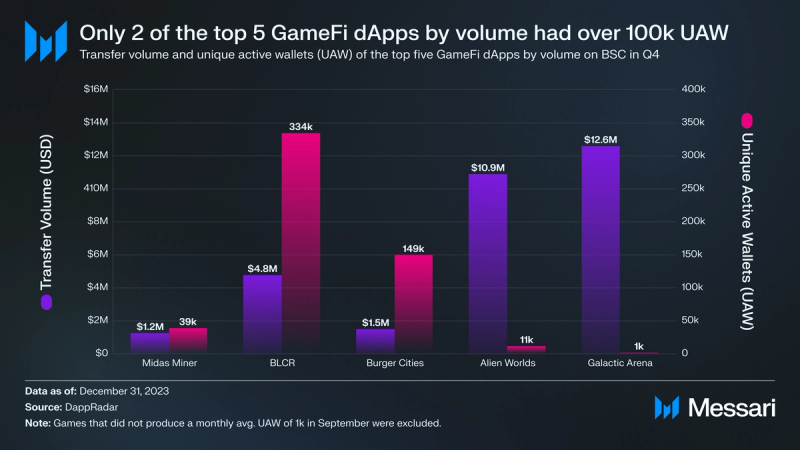

Gaming continues to be a significant sector of BSC, attracting users and generating transfer volume. However, individual games on BSC struggled to generate activity in both areas simultaneously. Of the top five games by volume, only BLCR and Burger Cities attracted over 100,000 unique active wallets in Q4. The games with the highest volume, Alien Worlds and Galactic Arena, accounted for the lowest numbers of unique active wallets (11,000 and 1,000, respectively). Regardless, the top five games by volume generated $30.9 million in transfer volume in Q4, up 70% QoQ from the previous quarter’s $18.2 million.

opBNB is an EVM-compatible optimistic rollup that helps scale execution throughput for BSC. After launching in the middle of Q3, opBNB had just short of $5 million bridged to its ecosystem from BSC. In Q4, almost $25 million was bridged to opBNB, resulting in a total of $29 million bridged to the new chain. Throughout Q4, opBNB saw very few outflows of value. In addition to liquidity being added to opBNB, in mid-December, the rollup processed a record 71 million transactions in a single day, driven by inscription-based activity similar to what drove BSC transactions.

Development

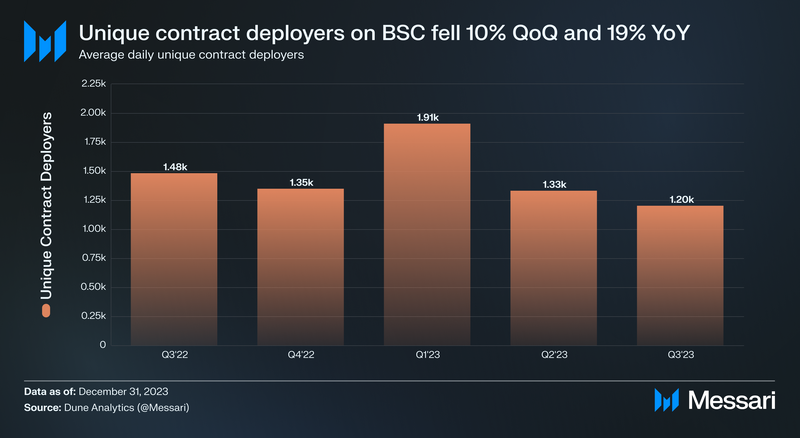

The number of unique contract deployers on BSC fell 10% QoQ and 19% YoY, primarily reflecting the state of developers in the broader market. The number of monthly active developers saw a 24% decline over the past year. Regardless, development on BSC remains relatively strong. According to Electric Capital’s Developer report, it is one of 17 ecosystems that drew in over 1,000 new developers. Among other EVM chains, BSC received the largest percentage (37%) of Ethereum’s multichain contract deployers and is the second-most popular EVM chain — behind Ethereum — for deploying initial new contract code, receiving 19% of initial deployments.

Qualitative Analysis

Launch of BNB Greenfield

BNB Greenfield launched on mainnet in October 2023. It is a blockchain and storage network that synergizes its natively offered decentralized cloud storage with the smart contract functionality of BNB Smart Chain (BSC). As such, it can be utilized for a wide range of uses, including decentralized hosting, IP infrastructure, data management, and more. Currently, some Web3-native and AI-focused projects are leveraging the joint infrastructure to power their protocols.

Though BNB Greenfield does not support a generalized application layer like the EVM, it includes a native cross-chain bridge between itself and BSC. The bridge enables developers to integrate BSC smart contracts with BNB Greenfield’s decentralized storage services. BNB Greenfield and opBNB also underwent upgrades in Q4 to achieve the same type of compatibility. By the end of the quarter, the network boasted 13 active validators and 190GB of uploaded storage.

opBNB Progress update

Following its launch in mid-August, opBNB DAU reached over 2 million in Q4. Additionally, opBNB emerged as a leader in adding total transactions during 2023 among L2s, reaching a daily high of 71 million transactions in late December. While undergoing all this growth, opBNB provided stable fees for users, often under $0.0008. The new rollup has proven to be an active chain that maintains low costs and handles high activity.

Sunsetting BNB Beacon Chain

BNB Beacon Chain was used as BNB Chain’s staking and governance layer. However, bridging between BSC and BNB Beacon Chain adds complexity and introduces security vulnerabilities. For this reason, BNB Chain plans to migrate BNB Beacon Chain functionality to BSC. Through a series of hard forks and upgrades, BNB Chain plans to sunset BNB Beacon Chain by June 2024.

Technical Developments

BNB Chain continued improving BSC throughout Q4. The main technical developments are listed below.

- Hotfix Hard Fork — This hard fork upgrade went live on December 7, 2023. It fixed bugs that could have led to block synchronization failures in some BSC client implementations or disrupted block building for validators.

- Kepler Hard Fork — This hard fork is planned to go live on January 23, 2024. It will introduce incentive optimizations for fast finality and implement EVM compatibility aligning with Ethereum’s Shanghai Upgrade. It will also implement the following BEPs:

- BEP-319 aims to move the reward adjustment logic from BEP-126 (which enabled sub-8-second finality on BSC) to a smart contract. There, validator rewards pertaining to the Fast Finality feature will be governable through community voting. It will also ensure more balance in reward distribution and extend the deadline to submit malicious voting evidence.

- Shanghai-focused BEPs include BEP-216, BEP-217, BEP-311, and BEP-312. These BEPs aim to make smart contract development more efficient and economical, preventing excessive resource consumption during contract creation, reducing gas costs for complex transactions, and enhancing security.

- Proposal for Standardizing Proposer-Builder Separation (PBS) — Still in discussion, BEP-322 aims to address the fragmentation of MEV (maximal extractable value) solutions on BSC. Of the 40 total active validators, 23 have adopted MEV solutions, some with different providers. The different architectures of various solutions make it difficult for validators to synchronize with different MEV providers. Additionally, without BSC client support, MEV services remain unstable. BEP-322 proposes a unifying solution to improve transparency, encourage competition through multiple MEV integrations, and stabilize the products.

Content Authenticity Initiative

BNB Chain joined Adobe’s Content Authenticity Initiative (CAI) in November 2023. CAI is an open-source standard and suite of tools designed to establish content authenticity and provenance. Its users can enable provenance signals in their products and identify when AI was used to generate or alter content. These standards will be important for BNB Chain, as BNB Greenfield will be used as a storage layer for much of the data-heavy content in the ecosystem. The integration of the CAI Content Credentials will enhance transparency, data ownership, and content verification on the network.

AvengerDAO

AvengerDAO recently released its annual report for BNB Chain, providing an in-depth analysis of the security events that unfolded on BNB Smart Chain (BSC) during 2023. It revealed that fiat losses dropped by 64% QoQ from $43.7 million in Q3 to $15.6 million in Q4 2023. This improvement was largely due to a 51% reduction in hacks, experiencing 86 in Q4 compared to 130 in Q3.

Closing Summary

In Q4, BNB Chain launched the mainnet of BNB Greenfield, a blockchain with a native storage network that synergizes decentralized cloud storage with the smart contract functionality of BNB Smart Chain (BSC). Additionally, BSC saw QoQ improvements in multiple metrics like revenue (+27%), market capitalization (+48%), transactions (+30% QoQ), and active validators (+25% QoQ).

BSC processed a record 32 million transactions in a single day while maintaining gas fees 74% below the quarter average. As crypto enters the next stage of the market cycle, BSC will be positioned to capture value as it launches new products and implements more developments to enhance the robustness of its core protocol.

——