Key Insights

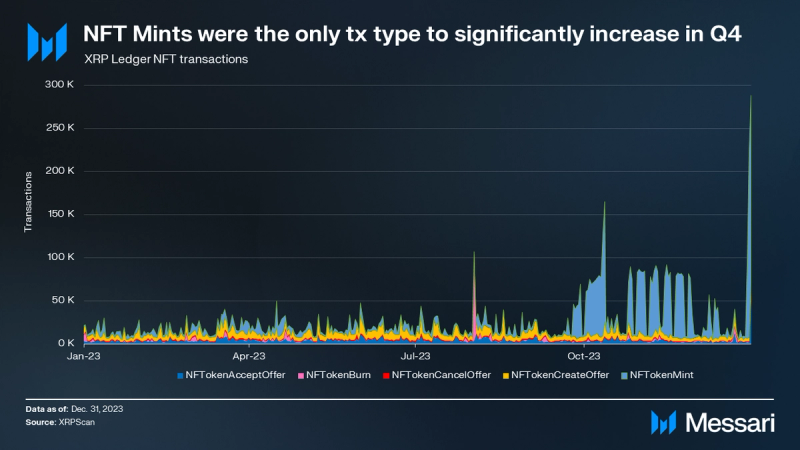

- NFT mints increased 491% QoQ, bringing total NFT transactions up 170% QoQ. In Q4’23, there were 3.4 million NFT mints, over half of all mints, since the XLS-20 standard was released in 2022.

- The total market cap of tokens on the XRPL increased 47% QoQ to $169 million. Sologenic’s SOLO remains the dominant token by market cap.

- XRP’s market cap increased 21% QoQ and 97% YoY, with spikes following the positive regulatory news. The SEC’s case with Ripple was officially dismissed on October 19, 2023.

- Transactions were up 23% QoQ. This was primarily driven by a massive spike in Payments in December for inscriptions-related activity.

- Hooks, Xahau, the EVM sidechain, the DID (XLS-40d), and the XLS-38d bridge continued development. Additionally, there is ongoing voting on the AMM proposal.

Primer

XRP Ledger (XRP) has been running for over a decade, offering cross-currency and cross-border payments, among other features. Core value propositions of the XRP Ledger (XRPL) include fast and cheap transactions (relative to other currency-focused networks) and native functionalities — such as tokens, NFTs, a decentralized exchange (DEX), escrow functionality, and token management.

With these capabilities, the XRPL can execute many of the same functions that other networks do. NFTs, stablecoins, synthetic assets, and other markets found on programmable settlement layers are available on the XRPL. Arbitrary smart contracts are not enabled on the base layer as a design choice to ensure maximum security and stability via simplicity. However, advanced scripting, via solutions such as Hooks, and offchain computation, via sidechains, adds additional functionality and use cases to the overall ecosystem

The XRPL is supported by various development groups and individuals, including Ripple, XRPL Foundation, XRPL Labs (and Xumm), and XRPL Commons. It provides a digital payment infrastructure not just for individuals but also for existing financial entities, such as commercial banks and fintechs, with the community’s deep interest in B2B and B2C solutions for finance. For a full primer on XRP Ledger, refer to our Initiation of Coverage report.

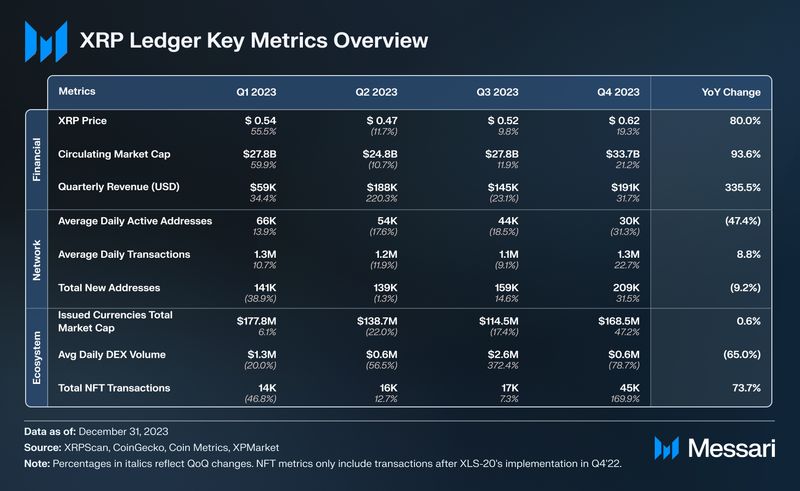

Key Metrics

Financial Analysis

As of Q4’23, the XRPL’s native token, XRP, was the sixth largest cryptocurrency by market capitalization at $33.7 billion. Its circulating market cap increased 21.2% QoQ and 93.6% YoY. Throughout 2023, 4 billion XRP was distributed (8% of XRP supply from the end of 2022). This distribution also contributed to the increase in market cap, albeit not as much as the price spike’s contribution.

On XRPL, transaction fees are burned, applying deflationary pressure to the total supply of 100 billion XRP. Since the XRP Ledger’s inception, around 12 million XRP has been burned, which is a low number relative to the total supply. This low burn rate is due to the relatively low transaction fees (<$0.002 per transaction) on the network. Counteracting the burn rate, there is 1 billion XRP that vests to Ripple per month. Any XRP not spent or distributed by Ripple in that month is returned to escrow. This system will continue until the remaining ~46 billion XRP becomes liquid. After all escrowed tokens become liquid, the deflationary pressure from burned fees will be the only variable related to supply.

Unlike many other cryptocurrency networks, the XRPL does not distribute rewards or transaction fees to its validators. In Proof-of-Association (PoA), rather than receiving rewards, validators are mainly incentivized by supporting the decentralization of the network, similar to a full node for Ethereum/Bitcoin rather than a validator/miner. The PoA consensus algorithm relies on trust between nodes, organized through unique node lists (UNLs).

XRP’s price increased 19.3% QoQ, lagging behind the overall crypto market’s increase of 53.8%. Even so, this Q4 increase had XRP up 80.0% YoY at $0.62. Q4 also marked the end of a multi-year legal battle. The U.S. Securities and Exchange Commission (SEC) charged Ripple with conducting an unregistered security offering for the XRP token in December 2020. After a long-drawn-out legal battle, on July 13, 2023, the district court ruled in a motion for summary judgment:

- XRP, the token itself, is not an investment contract and thus not in and of itself a security — a unique distinction amongst blockchain assets.

- Ripple’s programmatic sales of XRP did not violate securities laws. These sales were made by Ripple on crypto exchanges where the buyer did not know who they were buying from and could not know they were investing in a common enterprise.

- Ripple’s institutional sales of XRP did violate securities laws. These sales were made directly to institutions where the buyer knew they were investing in Ripple.

XRP’s price spiked over 70% on July 14 and peaked for 2023 at $0.82 on July 20 following the news. Following the court ruling, many CEXs, such as Coinbase and Kraken, relisted XRP. The SEC’s motion to appeal has since been denied, and as of October 2023, the case has been dismissed.

The massive revenue spike in June occurred near news from the SEC case, growing to ~20x its daily average for three days. XRPL’s revenue spiked again in Q4, reaching $27,000 on November 11, 2023 — 13x its Q4 daily average.

Revenue is measured as total fees collected by the network. In the case of XRPL, these fees are burnt and not distributed to stakers like on many other networks. The burning of those fees still decreases the overall supply, adding value to the remaining XRP. In this way, revenue still represents a redistribution of wealth from transaction fee spenders to XRP holders.

Network Analysis

Network activity was a mixed bag in Q4. Overall, active addresses decreased 31.3% QoQ. Transactions, on the other hand, increased 22.7% QoQ. While the existing users appeared to be more active, much of the transaction activity actually came from a relatively small group of accounts sending transactions to one single account. Over 30 million transactions were sent to a single account by a group of ~45,000 accounts, seemingly for inscriptions-related activity. Inscriptions are a transaction type popularized on Bitcoin in early 2023 which have popped up on almost every other large network since, even causing outages from the high activity volumes.

The net number of accounts increased by 188,000, driving total accounts up 3.7% to 5.00 million in Q4. New addresses over the quarter increased 31.5% QoQ to 209,100. Deleted addresses declined by 36.7% QoQ. This accelerating account growth is meaningful on the XRPL as accounts require a deposit to be created, which can be reclaimed after deleting an account. As such, the XRPL’s account metrics are more reliable than other networks where account creations can easily be spammed/Sybiled at zero cost.

Addresses on the XRPL can contain destination tags, which enable a single address to receive and track XRP deposits for an arbitrary number of users. As a result, the number of daily active addresses is skewed downward, given that one account (e.g., a centralized exchange) could be responsible for a large number of users. It should be noted that a unique address is required for receiving tokens on most other networks, like ETH on Ethereum or BTC on Bitcoin.

The active recipient metric is determined by the number of addresses that receive a transfer or other transaction, which has been the primary factor behind major activity spikes. The metric spikes came from accounts that were recipients, not senders. This indicates that the network’s activity surges were generally caused by senders distributing tokens to large groups of previously inactive recipients. Many of the senders were wallets distributing airdrops, such as XRPDrops. From July 30 to August 13, the XRPL averaged 122,000 daily active addresses (received), which was 3.3x the daily average in Q3.

Since there were no such spikes in Q4, overall active addresses were down 31.3% QoQ. Historically, active addresses (received) has spiked from activity with CEXs, so it also decreased 40.7% QoQ. However, active addresses (sent) increased 18.8% QoQ. This represents how the activity growth through Q4 was more distributed, rather than being driven by outlier days with massive spikes.

The inequality between the active recipient and sender addresses has been largely due to centralized exchanges and custodians using destination tags and sending Payment transactions. Centralized exchanges and custodians mostly use the Payment transaction type for deposits and withdrawals. As such, the Payment transaction type has consistently had more receiving addresses than sending addresses. In addition, users typically prefer creating wallets on centralized solutions for easy access to the initial XRP required to create a self-custody wallet. After acquiring their initial XRP, many users withdraw to their self-custody wallets, resulting in fewer active senders and many active receivers.

However, in Q4, there was a spike in Payment transaction activity that was not accompanied by a spike in active addresses. This occurred in late December when over 22 million Payments were recorded over the span of one week. Inscriptions were the cause of this activity.

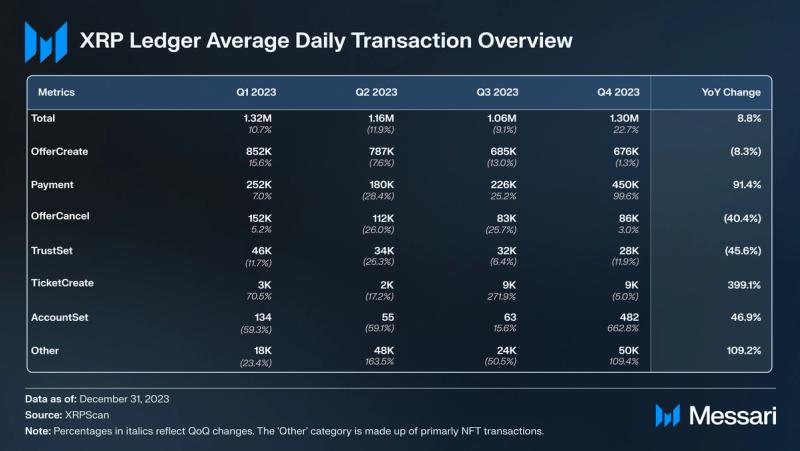

Total daily transactions is a metric made up of 29 different transaction types, such as payments, escrow creations, NFT burns, and account deletion.

OfferCreate, a transaction type that submits an order to exchange cryptoassets, has consistently represented the bulk of transactions. This transaction type only creates an “Order” on the order book and does not necessarily facilitate an exchange unless it completes an existing open Order. OfferCreate initiates a DEX limit order, and Offer objects represent bids/asks on the order book. Offers are consumed to process transactions such as Payments and OfferCancels (triggered manually or by expirations). If an Offer is only partially consumed by a transaction, new Offers are created with the remainder of the original, similar to a UTXO. Offers can be canceled by the OfferCancel transaction. Trust Lines are structures for holding tokens that protect accounts from being sent unwanted tokens, and the TrustSet transaction is used to open or close those Trust Lines.

The increase in Payment transactions had the largest impact on shifting overall transaction dominance. Average daily Payments increased 99.6% QoQ to 250,000. This increase mainly came from a spike of 22 million payments in the last week of December. It led Payments to seriously challenge OfferCreates in transaction dominance for the first time.

Overall, total transactions increased 22.7% QoQ to 1.30 million per day. This was largely driven by the increase in Payments but also due to NFTokenMints. The “Other” category of transactions includes functionalities for NFTs, escrows, multisigs, setting signer keys, and more. NFT transaction types were standardized and enabled by XLS-20 in October 2022, resulting in a sudden spike in transaction dominance. These transaction types are covered in depth in the Ecosystem Overview section.

DEX

A built-in central limit order book processes all exchanges on the XRPL for fungible tokens (also called Issued Currencies or simply tokens). This decentralized exchange (DEX) comes with the benefit of fewer trust assumptions and consolidated liquidity, rather than the inherent vulnerabilities of smart contracts. The majority of transactions come from the native order book DEX. Although there is only one DEX, there are many marketplaces acting as gateways that facilitate access. Gateways, also known as marketplaces, all share liquidity and provide a viable user interface for the average user.

In addition to the existing order book, an automated market maker (AMM) is being voted on by XRPL Mainnet validators, as detailed by the XLS-30 standard. In December, researchers released a formal paper detailing the XRPL-AMM. The amendment was included in the rippled V1.12.0 release in September. AMMs function through liquidity pools that algorithmically price assets rather than creating offers of preset specifications. Liquidity pools create an opportunity for holders to earn a share of trade fees on their tokens by offering them as liquidity. But, at the same time, they introduce trading risks, such as impermanent loss. New transaction types, such as AMMBid, will be enabled if the proposal passes and becomes an amendment.

Review began in October for XRPL GrantsWave 7, which focused on DEX innovation.

Servers

Nodes and validators, known as servers, all run the same client software: rippled. Over 91% of nodes were running the latest version, V1.12.0, as of the end of the quarter. The remaining nodes either have yet to vote or have chosen not to update in order to vote against the implemented amendments. As of the end of Q4, the XRPL is supported by 605 nodes and 125 validators. Nodes decreased from 697, and validators stayed flat at 125 since Q3.

XRPL servers participate in federated consensus as part of the XRPL’s Proof-of-Association (PoA) consensus mechanism. Validators do not stake tokens or receive financial rewards. Instead, the system is based on trust between nodes. Each node sets a list of trusted nodes, known as a unique node list (UNL). The UNLModify transaction, which is used to add/remove nodes from a UNL, was called an average of 3.2 times per day in Q4.

Ecosystem Analysis

Although the XRPL’s ecosystem hosts many of the same features as programmable settlement networks — such as Ethereum, Solana, and Cardano — the XRPL does not yet natively support smart contracts. Arbitrary smart contracts are not enabled on the base layer as a design choice to ensure maximum security and stability. Instead, ecosystem artifacts – such as a DEX and Issued Currencies – are natively built into the protocol. The XRPL supports multiple assets through tokens (also called Issued Currencies or IOUs). They are onchain representations of arbitrary currencies, commodities, units, etc.

Issued Currencies

The total market cap of fungible tokens, known as Issued Currencies, increased 47.2% QoQ to $168.5 million. There are over 3,300 listed assets on the XRPL, but the top token, SOLO, accounted for 45% of the total market cap. Combined, the top three tokens accounted for 67% of the total market cap.

The top tokens on the XRPL by market cap were as follows:

- Sologenic (SOLO) had $75.8 million in market cap and 233,500 holders. SOLO is primarily used to pay transaction fees on the Sologenic gateway.

- Coreum (CORE) had $25.0 million in market cap and 54,300 holders. CORE is the native token of the Coreum sidechain, which was also developed by the Sologenic team.

- CasinoCoin (CSC) had $12.5 million in market cap and 28,500 holders. CSC has utility on CasinoCoin’s Lobby platform for regulated gaming.

XRPL’s security comes from Trust Lines. They require a lockup of 2 XRP to hold an Issued Currency and wallet reserves, which require a lockup of 10 XRP to create a wallet. These requirements make it expensive to enact a Sybil attack on XRPL metrics, such as the number of holders. For this reason, the number of holders is a reliable metric of a token’s adoption on the XRPL. The metric is especially relevant for fungible tokens, which have much higher supplies than NFTs.

The average daily DEX volume of fungible Issued Currencies decreased 78.7% QoQ to $562,000. Sologenic is the leading DEX (i.e., the leading gateway to the native DEX) on the XRPL by volume of Issued Currencies exchanged. Other prominent DEXs (gateways) include XPMarket and onXRP.

Stablecoins and wrapped tokens are increasingly popular on XRPL, relative to other tokens. Gatehub’s ETH, Bitstamp’s BTC, Gatehub’s USD, and Bitstamps USD were four of the top ten tokens by market cap at the end of Q4. Gatehub and Xumm have worked together to offer a total of 14 digital assets on XRPL. The top stablecoins and wrapped tokens (also known as IOUs) on the XRPL are as follows:

- Gatehub Fifth (ETH): $11.0 million market cap and 26,000 holders

- Bitstamp BTC: $9.2 million market cap and 4,000 holders

- Gatehub USD: $4.6 million market cap and 19,000 holders

- Bitstamp USD: $2.9 million market cap and 7,200 holders

Band Protocol, an oracle service, will soon be integrating with the XRPL and its EVM sidechain. This will offer greater data availability for pricing wrapped/bridged assets. Integration on XRPL Mainnet will require a PriceOracle object (XLS-47d) which is currently in development. XLS-47d is planned for release on Devnet in March 2024 and for mainnet proposal in June 2024.

The number of Trust Lines open for a given Issued Currency is generally tightly coupled with the number of holders of said token. The average Issued Currency has around 20-40% more open Trust Lines than holders. On the other hand, stablecoins and wrapped tokens typically have 3-10x more Trust Lines than holders. The number of open Trust Lines may be relatively high because users may keep them perpetually open for quick escapes from network-specific volatility. Alternatively, the relatively low number of holders for stablecoins and wrapped tokens could have skewed the percentage differences more than the absolute values would suggest.

Proposal XLS-39d introduced a clawback function to help protect token issuers. This potential amendment would enable token issuers to reclaim issued assets from holders. It was made with regulation in mind, as it gives more control to issuers.

NFTs

On the XRPL, NFTs are built into the core protocol and do not require smart contracts for creation or transfers, like Issued Currencies (also known as native tokens). NFTs were standardized by XLS-20 in October 2022, bringing benefits such as royalties and anti-spam features. These features help users not only avoid unwanted tokens but also stay legally compliant by avoiding specific tokens and smart contracts that have been made illegal within specific regions.

A proposal, fixNFTokenRemint, to change the construction of NFT sequence numbers passed in Q4 after being initially proposed in Q3.

NFTokenMints were the only NFT transactions to increase in activity in Q4. NFTokenMints increased 490.6% QoQ, contributing to the overall 169.9% increase in total NFT transactions. Other NFT transaction types declined over the quarter: NFTokenCreateOffer (-22.1%), NFTokenAcceptOffer (-6.2%), NFTokenCancelOffer (-14.3%), and NFTokenBurn (-60.2%).

Massive spikes in mint activity drive NFTokenMint to surpass NFTokenCreateOffer as the most common NFT transaction type in Q4. Up until, Q4, NFTokenCreateOffer followed the trend set by OfferCreate of being the most dominant of all transaction types on XRPL.

The boost in mints was a combined effort by multiple projects, such as identity solution XNS and PFP project XRP Family NFT.

Ducati Motorcycles is using the XRPL for the launch of its digital collectibles program. Other enterprise applications of XRPL NFTs include FIFA’s World Cup League (2.7 million NFTs minted) and Xange’s carbon credits program (1.3 million NFTs minted).

As of the end of Q4, 6.1 million total NFTs have been minted with the XLS-20 standard. More than half (3.4 million) of those mints came in Q4 2023. XPUNKS remains the all-time leader in NFT sales volume, but newcomers such as XRP Family NFT have entered the top five despite only being launched in H2 2023.

Sidechains

Multiple sidechains for the XRPL are either in development or were recently launched. The XRPL has stayed true to its vision of minimized L1 complexity, offering increased programmability for both general and specific use cases on sidechains.

Coreum

Coreum (CORE) is an enterprise-grade L1 focused on interoperability and scalability. Coreum runs a WASM VM and is secured by a Bonded Proof-of-Stake (BPoS) consensus mechanism. CORE is used for transaction fees, staking, and validator rewards on Coreum.

Coreum was built by the Sologenic team to service user needs that could not be efficiently managed on the XRPL. The initial focus of the network is to provide security tokenization, such as tokenized stocks from the NYSE and synthetic assets. One of Coreum’s upcoming roadmap initiatives is an IBC integration, granting access to all IBC-connected networks such as Cosmos Hub, Ethereum, and BSC. Users can already transfer between Coreum and the XRPL via the noncustodial Sologenic bridge.

EVM Sidechain

Peersyst’s EVM sidechain proposal offers a proof of concept for bringing smart contracts to the XRPL ecosystem. It aims to grant the XRPL ecosystem access to EVM developers and functionality, with a general-purpose scope. The sidechain is being built on the Cosmos SDK, specifically Ethermint, and connects to the XRPL through the XRPL-EVM bridge. The Devnet is currently live and is creating blocks every ~3.4 seconds using the Comet BFT PoS consensus mechanism, a variant of Tendermint.

The latest version of Peersyst’s EVM sidechain was deployed on Devnet V2 in Q2 2023. Dapps such as identity protocol XRPDomains were deployed on the testnet. Notable additions to the latest version include:

- Support for XRP, IOU, and ERC-20 token transfers via the bridge

- Proof-of-Authority consensus

- Smart contract verification on the block explorer

Additionally, this EVM sidechain is connected to the XRPL using the same bridge design proposed in the cross-chain bridges (XLS-38d) specification. XLS-38d was audited by Bishop Fox in Q3. Bishop Fox’s report results were released in Q4, with zero critical or high-severity risks found.

The bridging of XRP, IOUs, and ERC-20s on this sidechain was implemented following the specifications of the XLS-38d bridging standard. XLS-38d was first proposed by Ripple developers in February 2023 for a cross-chain bridge between the XRPL mainnet and any sidechain. Bridges built by this standard will lock tokens on the XRPL to first mint a wrapped version on the sidechain and then later burn the wrapped tokens to unlock the original assets on the XRPL. A new node type called a “witness server” will communicate between chains. Witness servers together operate the door account connecting the XRPL mainnet.

Root Network

The Root Network sidechain is a blockchain-based NFT system with a focus on UX and metaverse, run by Futureverse. The Root Network is live in alpha, along with its bridge to XRPL and Ethereum. Built from a Substrate fork, the Root Network uses XRP as the default gas token and has EVM support for smart contracts. The Root Network uses a delegated-Proof-of-Stake (dPoS) consensus mechanism (via the ROOT token). The protocol’s roadmap items are aligned with the XRPL, as they seek to integrate the XLS-20 NFT standard and source liquidity from the XRPL DEX. Root Network also plans to offer users social recovery, management of assets, increased wallet flexibility, and a familiar Web2 experience through the account abstraction solution FuturePass.

Hooks

Hooks is a feature to include smart contract functionality in XRPL transactions. While Hooks are not Turing complete and do not enable arbitrary logic, they do allow conditions and triggers to be attached to transactions — similar to scripts on UTXO chains like Bitcoin and Cardano (pre-Alonzo).

Hooks went live on XRPL Labs’ public testnet in Q2. In Q3, the Xahau Launch Alliance (comprised of Evernode, XRPL Labs, Alloy Networks, and Gatehub) released a whitepaper for a sidechain called Xahau Network. Xahau, powered by Hooks, will function similarly to an L2 where developers can build dapps in general-purpose languages such as C and JavaScript. Evernode was one of the recipients of XRPL Grants Wave 5. Xahau also plans to add the native token XAH with its own tokenomics.

Hooks enable several programmed features. These include scheduling payments, distributing a set percentage of funds to a creator for royalties, or imposing limits/restrictions on transactions for both volumes and counterparties.

Enterprise Solutions

Ripple is one of the leading companies developing technologies to leverage the XRPL for institutional and government use cases. The company is focused on utilizing XRP and the XRPL to drive its On-Demand Liquidity service and CBDC initiatives.

The XRPL continues to be at the forefront of CBDC explorations by various governments. The new Ripple CBDC platform is based on the same blockchain technology used by the XRPL. Ripple is working with more than 20 countries on CBDC plans and hopes to leverage the XRPL to realize those visions. Most recently, the Central Bank of Colombia began working with Peersyst and Ripple toward a CBDC.

In Q3, Ripple announced the six finalists for the second Ripple CBDC Innovative program that kicked off in Q2. Judges will look to distribute $200,000 in prizes to participants building CBDC-based products.

Closing Summary

Activity on the XRPL expanded in several directions in Q4; most notably, NFT mints increased 491% QoQ, and inscriptions drove Payment transactions up 100% QoQ. These activities drove overall transaction activity up 23% QoQ. On the financial side, the total market cap of tokens on the XRPL increased 47% QoQ, and XRP’s price increased 21% QoQ.

As current base layer functionalities, i.e., NFTs and now Inscriptions, continued to grow in activity, the necessary infrastructure for new functionalities matured. On the XRPL base layer, the voting for the AMM is ongoing through Q1’24 and the DID (XLS-40d) continued development. Offchain solutions — such as Hook, Xahau, the EVM sidechain, and the XLS-38d bridge — continued to move towards production, which will add more dimensions to the overall XRPL ecosystem in 2024.