Key Insights

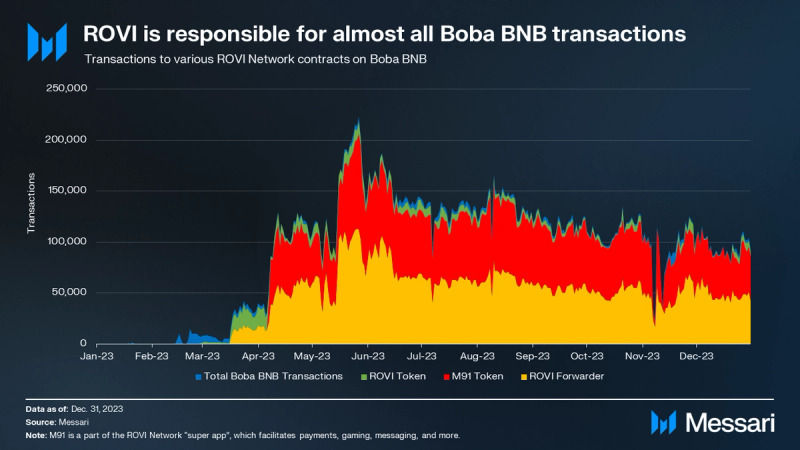

- ROVI Network accounted for 99.7% of Boba BNB transactions, with 9 million transactions in Q4. ROVI Network is a “super app” that facilitates messaging, payments, and gaming.

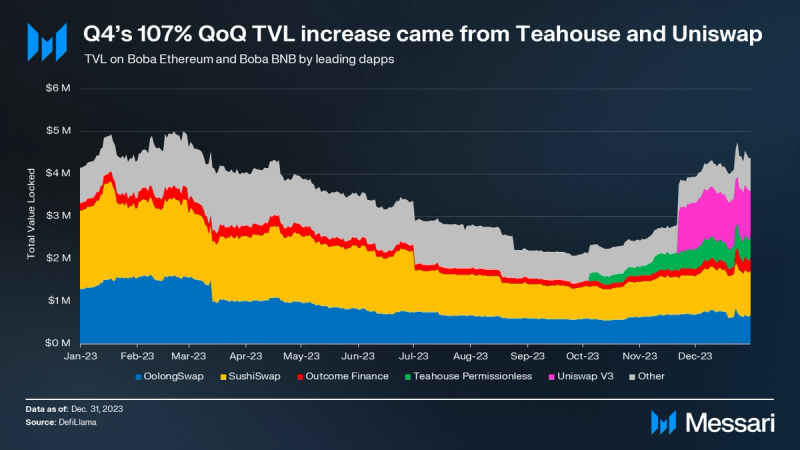

- DeFi TVL increased 107% QoQ, led by Teahouse and Uniswap. This was the first QoQ TVL increase in six quarters.

- BOBA’s circulating market cap increased 187% QoQ, outpacing the overall crypto market cap and moving up in overall rank from 579th to 550th.

- The Erigon sequencer client is being used on devnet and will soon be ready for mainnet. Boba Network is preparing to be the first optimistic rollup on OP Stack to use Erigon in production.

- Hybrid Compute remains a core focus for Boba Network, with new developments being tested on the Anchorage testnet. Hybrid Compute enables developers to leverage offchain computational resources.

Primer

Boba Network (BOBA) is a Layer-2 multichain scaling solution with a focus on gaming. Boba operates on Ethereum and BNB, and it is maintained by Enya Labs. As an optimistic rollup (OR) based on Optimism’s codebase, Boba offers reduced gas fees, increased transaction throughput, L1 security guarantees, and EVM compatibility for smart contracts, such as NFTs and decentralized finance (DeFi).

This network also has unique features that set it apart from other ORs and Optimism forks, such as Hybrid Compute — the ability to connect to offchain computational resources, data, and APIs, a multichain focus, and fast exit bridging to L1.

Boba’s combination of features — specifically Hybrid Compute — enables decentralized applications (dapps) to run at a fraction of the cost of L1 dapps, leverage offchain computation via Web2 APIs, and provide the multichain solutions needed for blockchain gaming. Boba Network was previously active on Avalanche, Fantom, and Moonbeam, but those implementations have since been deprecated. For a full primer on Boba Network, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

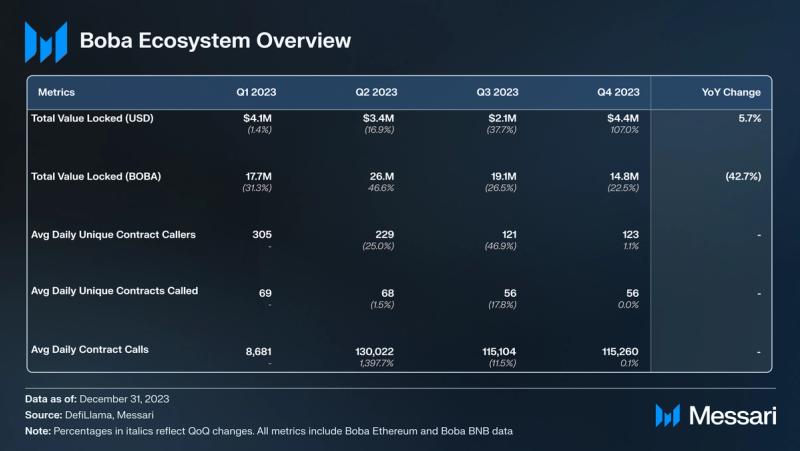

Key Metrics

Financial Analysis

In Q4 2023, the total crypto market cap experienced a sharp increase, largely driven by anticipation surrounding spot BTC ETFs. BOBA’s circulating market cap increased 187% QoQ to $110 million, exceeding the overall crypto market’s growth of 54%. BOBA’s market cap rank among all crypto projects moved up from 579 to 550 during Q4.

BOBA is the native asset of Boba Network, and its primary use cases include settling gas fees, governance, and invoking Hybrid Compute within smart contracts. BOBA also exists as an ERC-20 on Ethereum and BNB. BOBA ended Q4 with a circulating supply of 371.0 million. BOBA primarily experiences inflationary pressure due to staking rewards and unlocks from the initial allocation of the 500 million total BOBA. Until all tokens are unlocked in June 2025, 30 million BOBA will be unlocked each quarter.

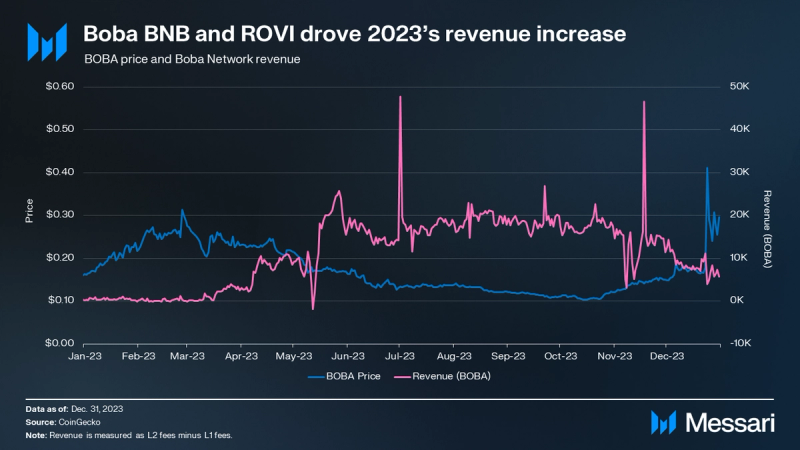

As a rollup, Boba Network implementations mainly focus on execution while outsourcing other core functions — such as settlement, consensus, and data availability — to their respective Layer-1s (L1s). As such, its revenue is measured as total L2 fees minus L1 sequencer fees.

Revenue decreased 63% QoQ denominated in BOBA and 2% QoQ denominated in USD, as BOBA’s price increase offset the latter. This revenue increase came primarily from Boba BNB. The high transaction volume brought in more L2 fees, while the L1 sequencer fees stayed relatively stable. Boba Ethereum’s low activity caused negative revenue on some days, as its L2 fees did not cover sequencer fees.

Network Analysis

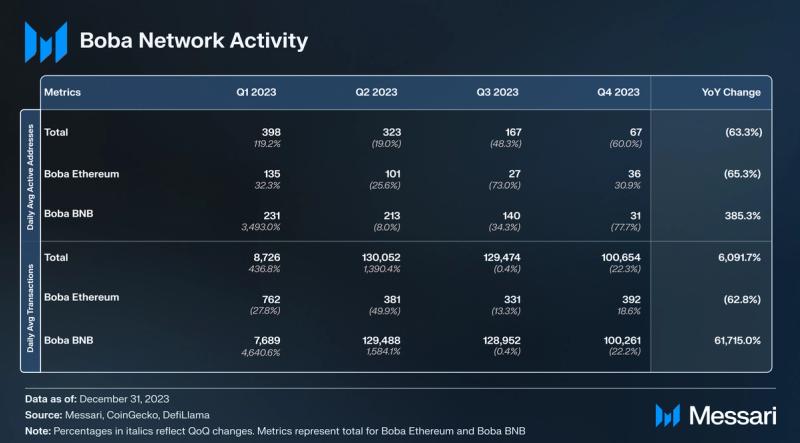

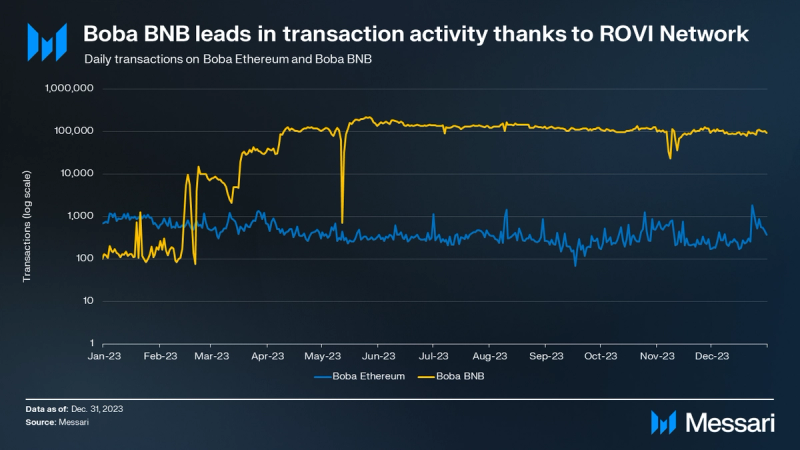

Average daily transactions declined 22% QoQ to 101,000. Despite the quarterly decrease, transactions were up 6,092% YoY. This massive activity increase began in Q2, where transactions increased 1,390% QoQ from 8,700 to 130,000. As stated in the Q2 report, ROVI Network, a multi-purpose “super app,” was responsible for this drastic increase. ROVI calls itself a “super app” because it packages many features into a single solution, like WeChat for the blockchain. Despite the relatively high number of transactions, daily active addresses remained much lower and even decreased for the third consecutive quarter, down 60% QoQ to 67. ROVI Network’s forwarder executes transactions on behalf of users that transact gaslessly, so it barely affects the unique contract callers metric.

Development has continued on the Light Bridge, an interoperability solution between Boba implementations.

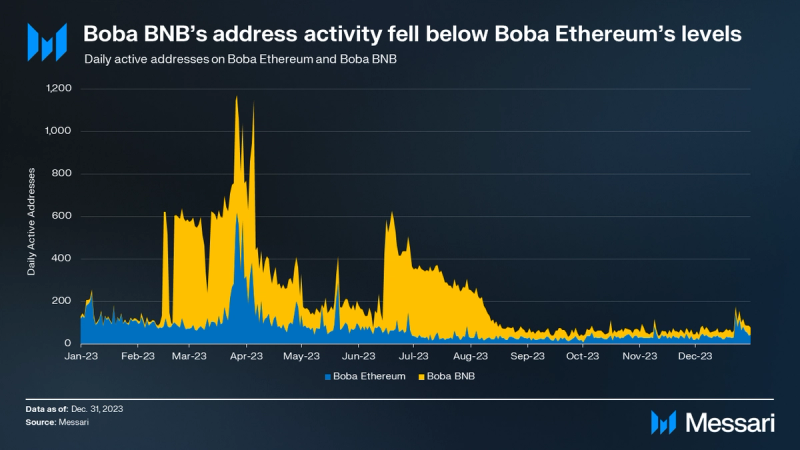

After launching in late 2022, Boba BNB became the leader in 2023 in nearly all activity metrics. However, daily active addresses on Boba BNB have declined for three straight quarters. In Q4, they were below Boba Ethereum in Q4 for the first time since 2022.

Address activity spikes from earlier in the year were not sustained, leading Boba Ethereum to regain dominance in this metric. The most active platform on Boba BNB, ROVI Network, mainly relies on forwarder contracts. This setup skews active addresses downwards in the same way a rollup skews active address activity downwards for its base layer L1.

ROVI Network is overwhelmingly responsible for the high activity on Boba BNB when compared to Boba Ethereum. By the end of Q4, Boba BNB had processed 33 million cumulative transactions. For reference, Boba Ethereum has processed just over 1 million transactions since deployment in 2021. ROVI Network was responsible for 9.03 million of 9.22 million total Boba BNB transactions in Q4.

As part of the Boba Network V0.9 release, the Boba AVAX rollup was deprecated in Q3’23. This Avalanche implementation of Boba Network had negligible dominance in Boba Network’s overall activity metrics.

The average transaction fee increased 7% QoQ to $0.0214. This increase was due to BOBA’s price increase over Q4, as fees measured in BOBA decreased 60% QoQ. Boba BNB’s increased transaction dominance over the past year brought down the overall average fee: Boba BNB fees (average of $0.0200 in Q4) were significantly cheaper than Boba Ethereum fees (average of $0.3612 in Q4).

Ecosystem Analysis

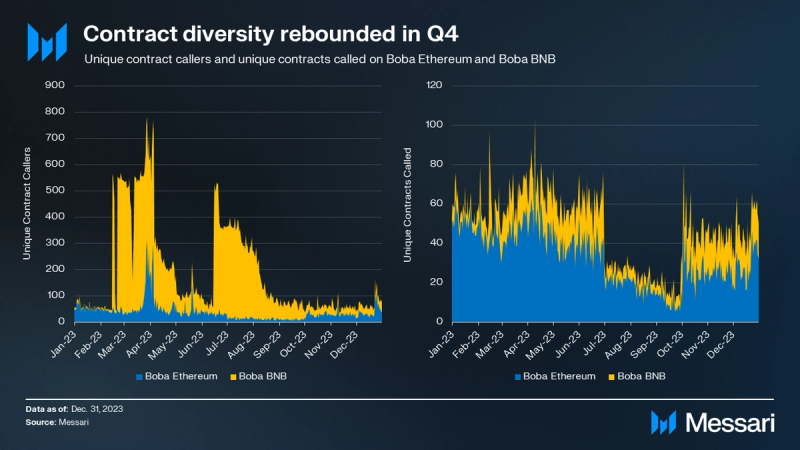

While average daily contract calls were flat in Q4, they were still up over a longer horizon. In Q2, contract calls increased 1,398% QoQ. This metric is heavily attributed to “super app” ROVI Network. Unique contract callers and unique contracts called were also flat, with almost no change QoQ. Unlike total contract calls, these metrics did not see any significant increase since Q1’23.

Due to the architecture of ROVI Network, increased user interaction only scales the total contract calls metric and not unique contracts or contract caller metrics. The major increase in total contract calls starting in February 2022 came from the same addresses becoming more active, specifically ROVI Network’s forwarder contract and M91 contracts.

Boba Ethereum’s established ecosystem continued to have many more active dapps and contracts than Boba BNB. Boba Ethereum contract diversity rebounded in October, after declining in Q3.

ROVI Network

ROVI Network is a multi-purpose infrastructure app that drives the majority of transaction activity on Boba BNB and the Boba Network as a whole. ROVI offers a social recovery wallet, an on/off ramp, and gasless transactions to create a familiar UX for both Web3 and Web2 users. Its token, ROVI, which has 41,000 holders, is used for rewards and staking. ROVI integrates crypto through several pieces of infrastructure, including:

- Messaging, such as with existing platforms WhatsApp and Telegram, via Keyboard91.

- Financial services, such as payments, trading crypto, and earning yield on stables, via M91 Super App.

- Gaming, via Gaming91.

In Q4, three ROVI contracts accounted for 99.7% of all Boba BNB transactions:

- The ROVI token contract had 0.25 million transactions addressed to it.

- The M91 token contract had 4.28 million transactions addressed to it.

- The ROVI Forwarder contract had 4.50 million transactions addressed to it.

Gaming and NFTs

In Q4, Web3 gaming infrastructure project DEGA partnered with Boba Network. This partnership will bring DEGA’s tools to Boba, including character builders, map builders, and AI coding tools.

In Q3, two new game builders announced their intentions to launch on Boba Network. Convival, a gaming ecosystem, will launch on Boba BNB, and Open Games Builders announced that it will be building on Boba.

Brinc, a venture capital and accelerator firm, partnered with Enya Labs in Q3. This partnership may bring more builders that hope to utilize Boba’s unique features, such as Hybrid Compute and a multichain focus.

NFT marketplace XDSea began to integrate with Boba in Q4. Aside from being a marketplace, XDSea also has a suite of creator tools, including a no-code creator console. Many games use NFTs for in-game assets and characters, which is why solid NFT infrastructure is so important to a gaming network such as Boba.

DeFi

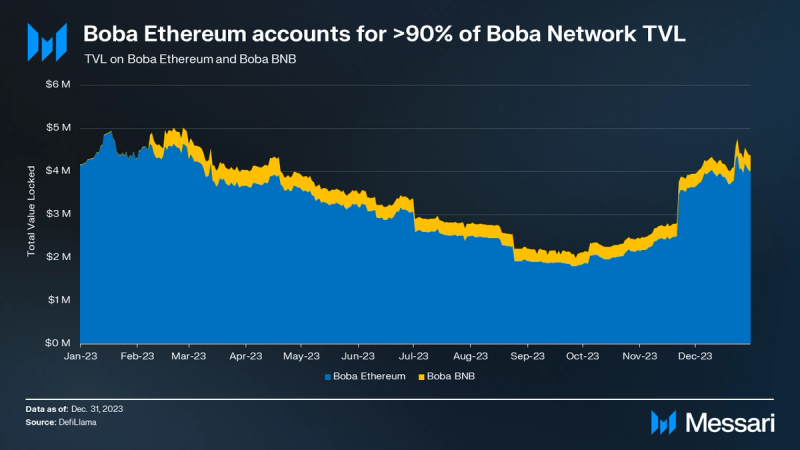

TVL (USD) increased QoQ for the first time in nearly two years, up 107%. This put TVL (USD) up 6% YoY. Boba Ethereum continued to account for the vast majority of Boba Network TVL, with over 90% dominance. Its dominance was largely due to Boba BNB being relatively new (deployed in H2 2022) and Boba Network fully pivoting to becoming a gaming chain. TVL is not the most representative metric for the overall state of the ecosystem given that its focus is on gaming rather than DeFi.

The TVL increase in Q4 came from two protocols: Teahouse and Uniswap. Teahouse is a DeFi platform for cryptoasset management, which launched in Q3’23. It’s launching a three-month incentive program for liquidity providers, which may grow TVL in early 2024. Uniswap is a popular AMM on multiple EVM networks, which launched its V3 AMM on Boba Ethereum in November.

Boba is also home to other DEXs, such as OolongSwap (the first native DEX on Boba), Symbiosis (a cross-chain AMM and bridge), and SushiSwap (another multichain AMM DEX like Uniswap).

A less-traditional DeFi platform called Dexsport launched on Boba Ethereum in Q3. Dexsport is a sports betting platform that launched a Q3 campaign to onboard users and give out rewards. In Q4, Supra Oracles and Pyth Network, two oracles services, integrated with Boba.

Trustworthy oracles are an integral part of DeFi; both newer protocols like Teahouse and older protocols like OolongSwap will benefit from their presence. DIA, while not being a traditional oracle, provides a similar service. DIA has a developer tool for price data provisions. It allows users to monitor pricing for major assets without having to incur any expenses.

Growth and Development

Erigon Client and OP Stack

Enya Labs, a core contributor to Boba Network, has made a significant contribution to Erigon, an L2 Bedrock OP Stack-compatible client. Boba Network is on pace (in devnet) to be the first optimistic rollup on OP Stack to use Erigon as its sequencer client. Enya’s contribution to Erigon includes implementing support for eth_getProof upstream, a complex feature that had remained unaddressed since November 2020. This enhancement is crucial for any project aiming to leverage Erigon as an execution engine in the Optimism ecosystem. It’s particularly noteworthy as other projects have only supported running Bedrock as the replica. This distinction underscores the importance of Enya Labs’ work in augmenting the flexibility and diversity of the ecosystem.

Boba Network should benefit from compatible tooling from these adjacent ecosystems, as building with open-source technology is a positive-sum game. The greater ecosystem would benefit from the adoption of L2s that use zero-knowledge proofs or offchain data as they push UX in multiple directions, such as developments in account abstraction from zkSync and Starknet that align with Boba’s own initiatives.

Hybrid Compute and Gaming

Boba Network aims to be the leading solution for gaming and metaverse applications via its Hybrid Compute feature. This feature intends to solve the problem of closed-off blockchain ecosystems. As it stands, blockchains cannot use any data or compute from outside of their ecosystem without an API or oracle. With Hybrid Compute, developers can:

- Create advanced algorithms that are typically too expensive to run onchain.

- Get millisecond response times.

- Generate random numbers and other resources that typically carry security concerns in decentralized computational environments.

- Access low-cost storage, image, and audio processing.

- Connect to external gaming services such as Unreal Engine.

- Instantly mint NFTs based on game activity.

- View offchain price feeds (e.g., CoinGecko) to create variable pricing/actions.

With Hybrid Compute, developers can leverage legacy Web2 systems and solutions to build higher-quality blockchain games. Boba has an upcoming Anchorage update that will include new developments on Hybrid Compute.

Closing Summary

ROVI Network continued to dominate overall Boba Network activity, accounting for 99.7% of Boba BNB transactions, with 9 million transactions in Q4. However, other sectors saw growth in Q4. Namely, DeFi TVL increased 107% QoQ, led by Teahouse and Uniswap. This was the first QoQ TVL increase in six quarters. Additionally, BOBA’s 187% QoQ market cap increase outpaced the overall crypto market, which was likely a result of the ecosystem growth.

Gaming remains the core focus for Boba Network. Hybrid Compute, which enables developers to leverage offchain computational resources, is the core of Boba’s gaming strategy, with new features being developed on the Anchorage testnet.