Quick Take

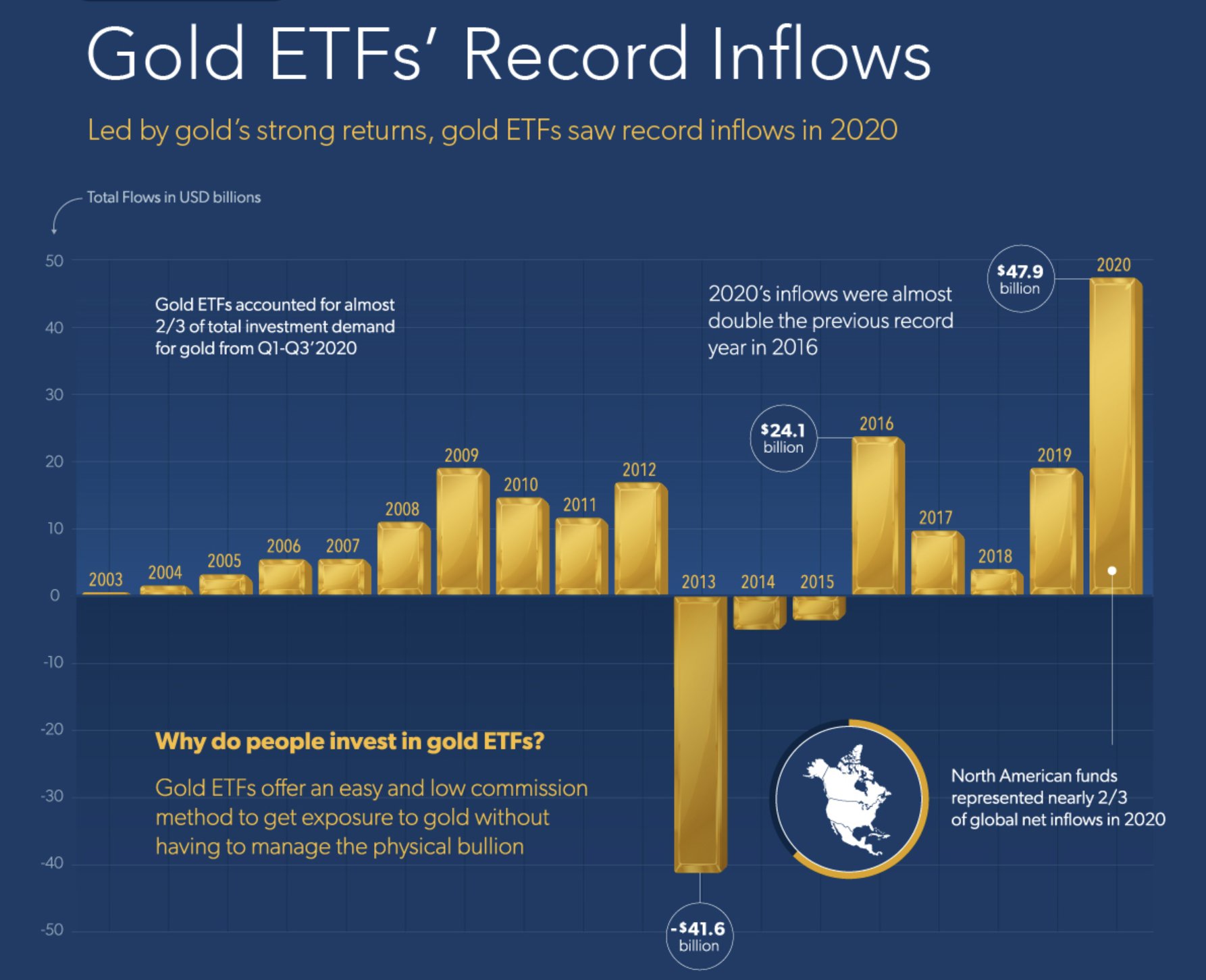

Visual Cap data shared by Matt Hougan, CIO of Bitwise, illustrates the two-decade-long journey of Gold ETFs since the first Gold ETF — GLD — launched in the US in 2004.

The data shows that between 2003 and 2012, Gold ETFs initially attracted substantial inflows due to the convenience they offered over holding physical gold. However, between 2013 and 2015, these funds experienced three consecutive years of outflows.

The trend reversed between 2016 and 2020, with five consecutive years of inflows. North America accounted for almost two-thirds of the global net inflows in 2020, according to Visual Cap.

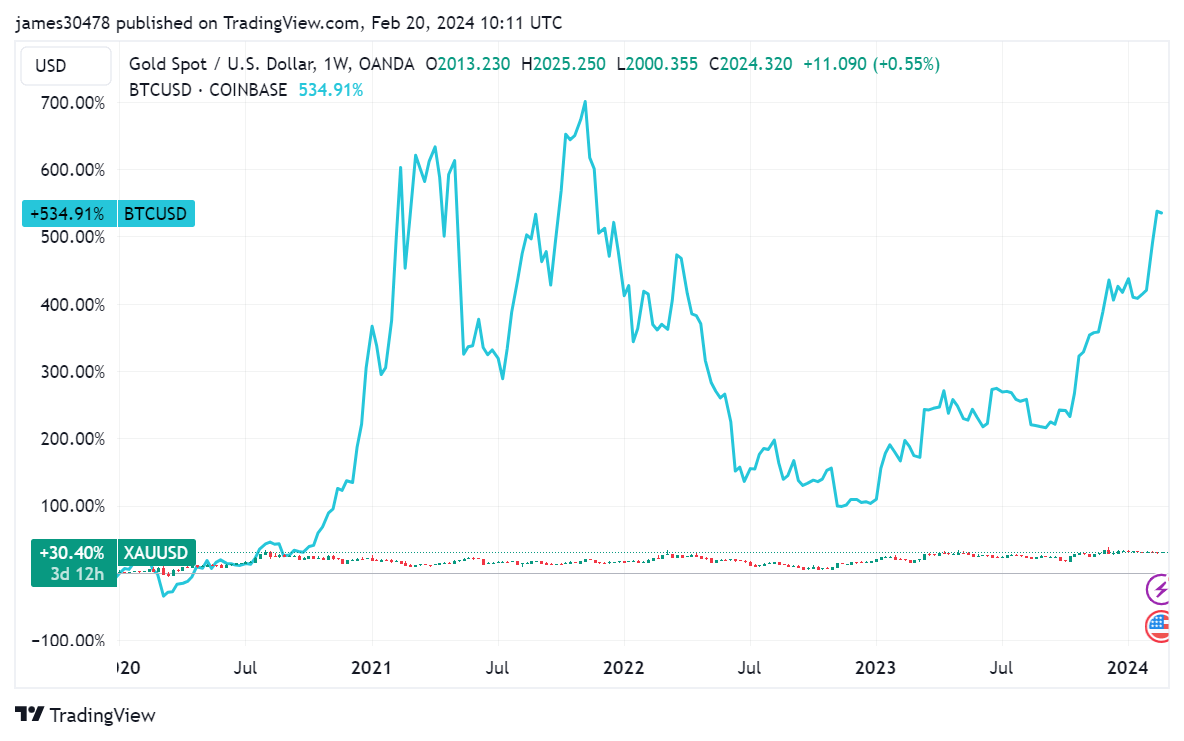

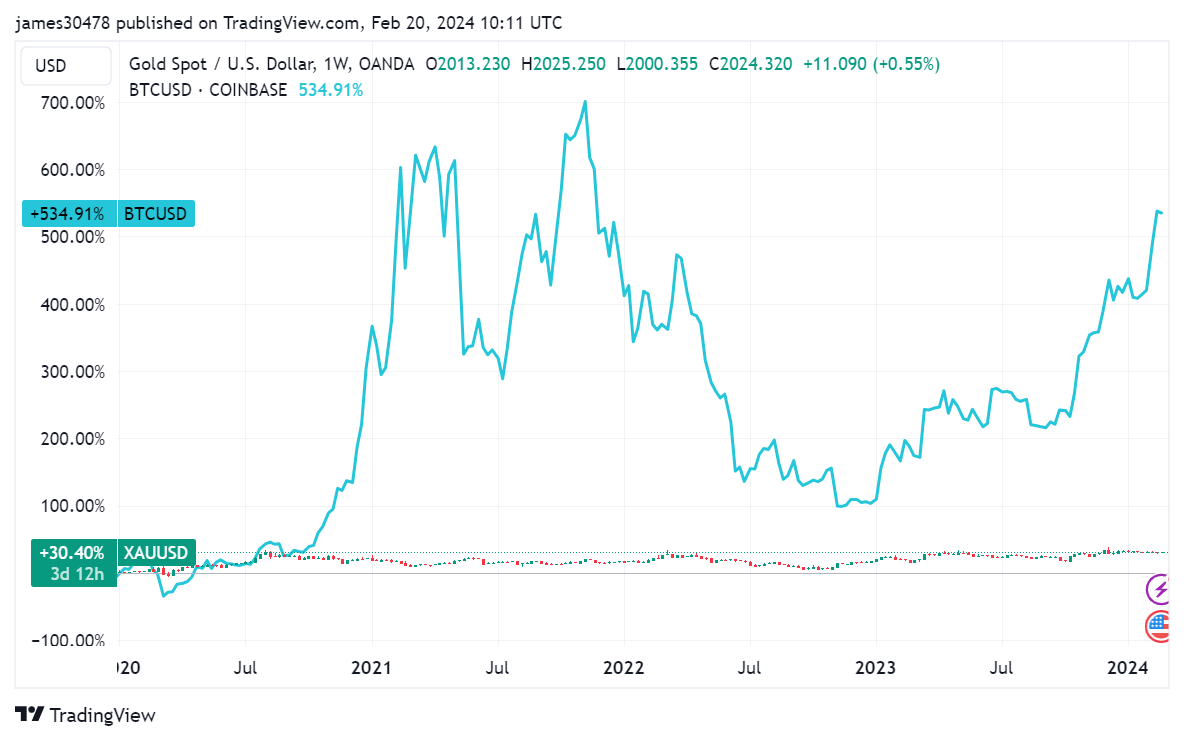

Interestingly, these significant inflows happened during the COVID-19 pandemic, a period of extreme uncertainty. Despite this, gold only saw a modest increase of 30% since the start of 2020, while Bitcoin has appreciated 535%.

In contrast, Bitcoin, often referred to as digital gold, has seen striking success since spot ETFs connected to the flagship crypto were launched five weeks ago. The ETFs have attracted approximately $4.9 billion in net inflows since they began trading.

Recently, as reported by CryptoSlate, the inflow into Bitcoin ETFs has coincided with an acceleration in the outflows from Gold ETFs, suggesting a possible shift in investors’ preferences.

The post Year 18 witnessed unprecedented record flows into gold ETFs – Matt Hougan appeared first on CryptoSlate.