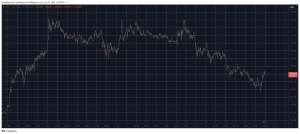

Today’s crypto market experienced volatility, but Bitcoin managed to sustain the $50,000 level due to substantial investor attention amid expectations of the global financial market’s downturn in the coming months. Recent US data revealing higher-than-expected inflation rates in both the Producer Price Index (PPI) and Consumer Price Index (CPI) affected monetary policy and investment strategies.

In such circumstances, there would likely be a shift in investments towards virtual currencies as investors kept seeking alternatives to traditional government securities. The anticipation of Fed rate cuts, now expected in July, further bolsters the prospect of increased investment in riskier assets like cryptocurrencies.

Amid these economic signals, Bitcoin and four selected altcoins are poised for a potential bull run.

Ride The Wave of Innovation with ScapesMania

The ScapesMania public sale wrapped up, becoming the talk of the crypto community. The project managed to secure over $6,125,000 at an unprecedented rate and there’s a strong probability that the token’s value might increase exponentially in the future.

The spotlight has shifted to the Token Generation Event (TGE) coming up on February 25 – March 09. The pool of tokens is smaller than it was before, the conditions are better than the market average, so the chance to maximize your potential returns is quickly diminishing. Letting it slip now would be a huge waste, especially since your chance to join is only a click away.

Your Last Chance to Boost Potential Returns Post Listing

The team behind ScapesMania, with years of expertise, has crafted a robust post-listing marketing strategy. Buyback, burn, staking, and all the perks for holders keep attracting new adopters while also ensuring a high level of community engagement. Through DAO governance, backers will be able to influence and benefit from a growing industry.

Moreover, the token’s utility is impressive. It’s not another meme coin whose success relies heavily on trends and hype. ScapesMania ($MANIA) is a well-balanced, meticulously designed project that acts as a gaming ecosystem. As a player in the multi-billion casual gaming industry, it leverages the market’s growth potential. Post-debut, holders can anticipate greater liquidity and easier trading. A solid token management plan will further increase longer-term growth potential.

The community’s excitement about the project is evident so far: the follower count has reached 60K+. Also, the growing interest from crypto whales with deposits of $20,000+ might expedite ScapesMania’s transition from niche to mainstream.

ScapesMania’s smart contract has received approval from prominent security-ranking firms, ensuring peace of mind for holders. Additionally, the PancakeSwap listing is on the horizon, with CEX listings still in the works.

ScapesMania is also notable for a great cliff vesting structure to prevent token dumping, making sure that supply and demand are well-matched for potential growth.

Make sure you don’t pass up the opportunity to leverage all discounts and potentially beat the market with the TGE fast approaching. Be quick if you want to be the first one in line for all the post-listing opportunities, which might be quite lucrative.

>>> TGE ALERT – Keep Up With Latest News <<<

Ethereum (ETH): Navigating the Future with Upgrades and ETFs

Ethereum (ETH) was recently on a rise due to its ongoing development and deeper integration into the financial sector. With a market cap exceeding $3 billion, Ethereum (ETH) avoids the SEC’s classification as an unregistered security, a testament to its robust framework and utility. Adding to the positive market sentiment is the anticipation surrounding Ethereum (ETH) ETFs that are expected to get approval later this year and broaden altcoin’s investor base.

The introduction of spot Bitcoin ETFs and the anticipation of major network upgrades like Deneb and Cancun, aimed at enhancing the network’s capacity, reducing gas fees and improving interoperability with other blockchains, also contributed to Ethereum’s (ETH) price rally. As of February 2024, Ethereum’s (ETH) value hovered around $3,000, reflecting a market responsive to both its technological advancements and the regulatory environment.

The future of Ethereum (ETH) looks promising as evidenced by price predictions suggesting a potential rise to $15,000 by 2025. Ethereum’s (ETH) ongoing upgrades, alongside the growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs), underpin these optimistic forecasts. However, regulatory scrutiny and competition from other blockchais can slow down Ethereum’s (ETH) upward trajectory. To sustain its growth and adoption rate, Ethereum (ETH) needs to balance innovation with regulatory compliance.

Solana (SOL): Recovery and Resilience

After a tumultuous period marked by network outages and market volatility, Solana (SOL) showed signs of recovery. Solana’s (SOL) price was bolstered by strategic moves and ecosystem advancements, demonstrating potential for even more ambitious growth. Effectively, Solana’s (SOL) improved efficiency and diversified offerings contributed to a renewed investor interest.

Solana’s (SOL) price experienced fluctuations, reflecting the broader market’s dynamics and its own network-specific developments. Despite these challenges, predictions indicate a potential increase in Solana’s (SOL) price, with expectations of reaching $114.52 by the end of the year and further growth anticipated in the following years.

The outlook for Solana (SOL) is cautiously optimistic given that its ability to recover from setbacks and continue innovating could determine its future price movements. Solana’s (SOL) focus on scalability, efficiency and the development of its DeFi and NFT offerings could drive further adoption and price appreciation. However, Solana (SOL)’s journey is not without obstacles, as network stability and competition from other blockchains remain significant challenges.

Ondo (ONDO): A Newcomer with Potential

The launch of Ondo (ONDO) marked a significant entry into the decentralized finance (DeFi) space. Focusing on providing liquidity solutions for tokenized real-world assets, Ondo (ONDO) quickly gained attention, which reflected in its price movements since its release. The expansion into the APAC region and a strong market share in tokenized Real World Assets (RWAs) highlight Ondo’s (ONDO) ambitious growth strategy.

Since its debut, Ondo (ONDO) has shown the volatility typical of new tokens, with initial surges followed by corrections. Despite this, price predictions remain positive and suggest a gradual increase in value as Ondo (ONDO) develops and expands its offerings. Ondo’s (ONDO) integration of traditional financial products in a decentralized framework is a unique value proposition that can attract even more investment.

Ondo’s (ONDO) future in the DeFi sector appears promising considering its innovative approach to integrating real-world assets into the blockchain. Ondo’s (ONDO) success will depend on its ability to maintain security, scalability, and user engagement. While the potential for growth is substantial, Ondo (ONDO) must navigate the challenges of regulatory compliance and market competition to realize its full potential.

Osmosis (OSMO): Stability Amidst Volatility

Recognized for its decentralized exchange (DEX) platform in the Cosmos ecosystem, Osmosis (OSMO) weathered a year marked by significant volatility. But eventually, Osmosis (OSMO) closed with double its initial value, a testament to the robust market confidence and burgeoning interest in its distinctive offerings. The recent overhaul of Osmosis’ (OSMO) tokenomics and surge in social volume are signs of an energetic community and lay down solid foundations for growth.

Osmosis (OSMO) projects a rise in price, mirroring its continuous developments and the overall sentiment of the broader crypto market. The Osmosis (OSMO) price predictions span from bullish to cautious, while the platform’s technological advancements and facilitation of cross-chain interoperability underpin those forecasts that feature an increase in value over the coming years.

Osmosis (OSMO) will be able to succeed if it bolsters platform security, improves user experience, and cultivates a robust community. Despite market volatility and competition posing challenges for the DEX, Osmosis’ (OSMO) inventive strategy towards interoperability and liquidity provision places it favorably for future expansion. The adaptability of Osmosis (OSMO) will determine its trajectory within the Cosmos ecosystem and broader crypto market.

Conclusion

n the current bull run, fueled by a shift away from traditional government assets towards cryptocurrencies amid inflationary pressures and anticipated Fed rate cuts, the crypto market’s resilience is notably highlighted by the potential of altcoins such as Ethereum (ETH), Solana (SOL), Ondo (ONDO), and Osmosis (OSMO) to significantly multiply investments. With their innovative technologies and expanding ecosystems, these four tokens are well-positioned to benefit from the broader market’s growth: Ethereum’s (ETH) ongoing network upgrades and regulatory environment, Solana’s (SOL) recovery and technological advancements, Ondo’s (ONDO) unique approach to DeFi, and Osmosis’ (OSMO) role in cross-chain interoperability collectively underscore the diverse opportunities within the crypto space.

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.