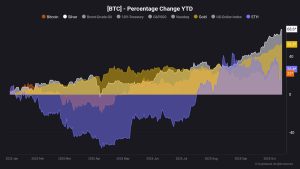

As of February 26, the broader crypto market is experiencing fluctuations, highlighted by Bitcoin‘s marginal loss, which leaves its trading value hovering around $51,200. Bitcoin enthusiasts eagerly anticipate a breakthrough above the $53,000 resistance level – a move that could potentially catapult the largest cryptocurrency towards an impressive $60,000 mark. Yet, despite these high hopes, Bitcoin has remained below this crucial threshold for the past two weeks, leading to a phase of consolidation that keeps traders guessing. Adding to the market’s uncertainty, a number of other cryptocurrencies, including Polkadot (DOT), are also trading at losses.

In contrast, Ethereum and Avalanche (AVAX) have emerged as rays of hope in these turbulent times. Ethereum, outperforming Bitcoin, has seen a small yet significant profit, struggling to stabilize above $3,100 – a two-year high before its recent minor setback. AVAX, trading in profit alongside Ethereum, represents a beacon for investors seeking viable alternatives in a market dominated by Bitcoin’s 50.7% and Ethereum’s 18.56% of the total $1.98 trillion sector valuation.

Amidst this volatile backdrop, the crypto community is turning its gaze towards upcoming events, particularly in the case of ScapesMania (MANIA). Although its presale stage has concluded, the anticipation is building for its forthcoming Token Generation Event and DEX listing.

Ride The Wave of Innovation with ScapesMania

The ScapesMania public sale wrapped up, becoming the talk of the crypto community. The project managed to secure over $6,125,000 at an unprecedented rate and there’s a strong probability that the token’s value might increase exponentially in the future.

The spotlight has shifted to the Token Generation Event (TGE) coming up on February 25 – March 09. The pool of tokens is smaller than it was before, the conditions are better than the market average, so the chance to maximize your potential returns is quickly diminishing. Letting it slip now would be a huge waste, especially since your chance to join is only a click away.

Your Last Chance to Boost Potential Returns Post Listing

The team behind ScapesMania, with years of expertise, has crafted a robust post-listing marketing strategy. Buyback, burn, staking, and all the perks for holders keep attracting new adopters while also ensuring a high level of community engagement. Through DAO governance, backers will be able to influence and benefit from a growing industry.

Moreover, the token’s utility is impressive. It’s not another meme coin whose success relies heavily on trends and hype. ScapesMania ($MANIA) is a well-balanced, meticulously designed project that acts as a gaming ecosystem. As a player in the multi-billion casual gaming industry, it leverages the market’s growth potential. Post-debut, holders can anticipate greater liquidity and easier trading. A solid token management plan will further increase longer-term growth potential.

The community’s excitement about the project is evident so far: the follower count has reached 60K+. Also, the growing interest from crypto whales with deposits of $20,000+ might expedite ScapesMania’s transition from niche to mainstream.

ScapesMania’s smart contract has received approval from prominent security-ranking firms, ensuring peace of mind for holders. Additionally, the PancakeSwap listing is on the horizon, with CEX listings still in the works.

ScapesMania is also notable for a great cliff vesting structure to prevent token dumping, making sure that supply and demand are well-matched for potential growth.

Make sure you don’t pass up the opportunity to leverage all discounts and potentially beat the market with the TGE fast approaching. Be quick if you want to be the first one in line for all the post-listing opportunities, which might be quite lucrative.

>>> TGE ALERT – Keep Up With Latest News <<<

Avalanche (AVAX): Balancing Bullish Hopes and Bearish Fears Post-Outage

Avalanche (AVAX), a prominent layer-1 blockchain, faced a significant hurdle with a major network outage on February 23, taking its system offline for over five hours. This disruption temporarily halted block production, similar to what previously happened with Solana. Kevin Sekniqi of Ava Labs indicated that the problem stemmed from “buggy logic” in the latest software update, causing an overload in transaction gossip.

Although swiftly resolved by disabling the problematic logic, this incident coincided with a challenging period for AVAX’s market value, marked by a nearly 8% decline over the past week amid the release of approximately $365 million worth of locked-up tokens.

Avalanche (AVAX) Technical Analysis

Technically, Avalanche (AVAX) is trading between its first support level at $34.84 and the first resistance level at $40.35.

Source: TradingView

The Exponential Moving Averages (EMA) provide a mixed signal, with the 10-day EMA at $36.85 slightly above the last price, indicating a potential for upward momentum, while the 50-day and 200-day EMAs at $37.54 and $37.24, respectively, suggest a longer-term consolidation trend.

The Relative Strength Index (RSI) at 45.06 points towards a neutral market sentiment, neither overbought nor oversold.

However, the Stochastic %K, at 64.28, suggests a slight bullish momentum, whereas the Average Directional Index (ADX) at 25.71 indicates a lack of strong trend.

The near-zero MACD Level at -0.17 and Momentum at -0.1 further underscore the current indecisive nature of AVAX’s market movement.

Avalanche (AVAX) Price Prediction

In a bullish scenario, if Avalanche (AVAX) breaks past $40.35, it could be headed towards $43.26, with the ultimate short-term target being at $48.77. The recent adoption of AVAX by major institutional players, as well as its inclusion on bitFlyer, Japan’s leading Bitcoin trading platform, supports this positive outlook.

On the bearish side, if selling pressure intensifies, Avalanche (AVAX) could drop towards $34.84, with a further downside risk of testing $32.24 or even $26.73. The delicate balance between these scenarios will likely be influenced by broader market trends, investor sentiment and the ongoing development and stabilization of the AVAX network following its recent technical challenges.

Polkadot (DOT) Navigating Market Volatility After the Coinbase Futures Listing

Polkadot (DOT) garnered attention in the crypto community after its inclusion in Coinbase’s continuous futures agreements. This significant milestone, announced on February 22, placed DOT alongside other major cryptocurrencies like XRP, SOL and DOGE in Coinbase’s perpetual futures offerings. Available on both Coinbase International Exchange and Coinbase Advanced platforms, Polkadot (DOT) PERP market offers various order options to users and highlights the growing stature of DOT in the crypto market.

However, despite this positive news, Polkadot (DOT) was subjected to notable price volatility. DOT saw a 2% decline to below $7.3 in the past week, although it has since made a recovery, bringing its price above $7.6. Yet, the current trading session shows Polkadot (DOT) once again trading in the red, reflecting the ongoing fluctuations in its market value.

Polkadot (DOT) Technical Analysis

From a technical standpoint, DOT is oscillating between its first support level at $7.38 and its first resistance level at $8.3.

Source: TradingView

The EMAs present a mixed signal; the 10-day EMA at $7.76 slightly above the 50-day EMA at $7.64, and both hover near the 200-day EMA at $7.37, indicating a potential consolidation phase.

The Stochastic %K at 57.24 indicates a somewhat positive momentum. The RSI at 49.11 is near the neutral 50 mark, suggesting a balance between buying and selling pressures.

However, the low ADX at 15.09 implies a lack of strong trend direction. The CCI near 0.49 and the MACD at 0.05 both support this view of market indecision.

Polkadot (DOT) Price Prediction

In a bullish scenario, if Polkadot (DOT) can maintain momentum and breach the resistance at $8.3, it could potentially target the next resistance levels at $8.69 and then possibly $9.61, capitalizing on the positive sentiment generated by its inclusion in Coinbase’s continuous futures.

On the flip side, a bearish outlook could see DOT retreating back towards its support levels. A break below the current support at $7.38 might lead to further declines towards $6.85, and in a more significant downtrend, even test the $5.93 mark.

Final Words

Avalanche (AVAX) and Polkadot (DOT) are navigating contrasting paths in the current volatile crypto market. AVAX recently experienced a significant network outage, which, coupled with the release of locked-up tokens, led to an 8% market value decline. Despite these challenges, Avalanche’s (AVAX) technical analysis suggests a potential for upward momentum.

Meanwhile, DOT gained attention with its listing on Coinbase’s perpetual futures but faced price volatility since then. Despite a slight recovery, Polkadot’s (DOT) market value keeps fluctuating, with technical indicators signaling a possible consolidation phase.

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.