Coinbase, one of the main crypto exchanges, found itself dealing with a significant crash while the price of Bitcoin was soaring to dizzying levels.

This interruption prevented many users from accessing their accounts, highlighting the challenges associated with managing the growing demand for digital assets.

Bitcoin falls and causes the crash of the Coinbase exchange

Tumultuous events occurred while Bitcoin, the leading cryptocurrency, experienced a rapid rise, briefly surpassing the $64,000 threshold.

Such rapid price movements often trigger frenetic trading activity, as investors seek to capitalize on the volatility.

However, this sudden surge in demand has overloaded Coinbase’s infrastructure, causing connectivity issues for countless customers.

Brian Armstrong, CEO of Coinbase, quickly addressed the situation, attributing the interruption to a “strong wave of traffic”.

The influx of users trying to buy, sell, or trade Bitcoin proved to be excessive for the exchange’s servers, resulting in widespread interruptions.

Many users have reported seeing zero balances on their Coinbase accounts and experiencing errors when trying to make transactions.

In response to the interruption, Coinbase reassured its users, stating:

“We are aware that some users may see a balance of zero in their Coinbase accounts and may experience errors in buying or selling. Our team is investigating and will provide an update shortly.”

Your assets are safe.

Despite the reassurances, the incident left a bitter taste in the mouths of many users who found themselves unable to capitalize on the movements of Bitcoin’s price.

The repercussions on cryptocurrency

The repercussions of the interruption were not limited to the Coinbase platform.

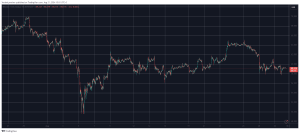

Bitcoin, which had risen to unprecedented levels, quickly retraced its steps as soon as news of the exchange malfunction spread.

In a short period of time, the price of Bitcoin has dropped from around $64,000 to about $59,500, wiping out a significant portion of the gains accumulated earlier in the day.

This episode is not the first time Coinbase has faced similar interruptions during periods of high market volatility.

The stock market has faced similar interruptions in the past, drawing criticism from users and industry observers. Although the company has made efforts to strengthen its infrastructure and improve scalability, the breadth of demand during peak trading periods continues to pose problems.

Despite the temporary setback, Bitcoin’s resilience has shone through. Despite the sharp price drop triggered by Coinbase’s outage, Bitcoin quickly recovered, reclaiming its position above $60,700 at the time of writing.

This resistance underlines the growing institutional adoption and investor interest in Bitcoin, which has pushed its price to new levels in recent months.

While Coinbase works tirelessly to restore normal operations and resolve the underlying issues that led to the interruption, this incident serves as a reminder of the complexities involved in managing large-scale cryptocurrency exchanges.

The unprecedented demand for digital assets, combined with the intrinsic volatility of the market, requires robust infrastructure and proactive measures to ensure users with uninterrupted service.

Conclusions

In conclusion, the recent interruption of Coinbase during the surge of Bitcoin highlights the fragility of the cryptocurrency ecosystem in the face of unprecedented market demand and volatility.

On one hand, such interruptions are undoubtedly concerning for users and stakeholders, but on the other hand they represent a valuable learning opportunity for exchanges and the sector as a whole.

The quick response from Coinbase to the interruption, along with reassurances about the security of users’ assets, highlights the importance of transparency and communication in times of crisis.

Furthermore, Bitcoin’s resilience in the face of a sharp price drop after the interruption reaffirms its status as a formidable digital asset, capable of withstanding tumultuous market conditions.

In the future, it is imperative that cryptocurrency exchanges prioritize improving their infrastructure, scalability, and security measures to better manage trading activity spikes and mitigate the risk of future interruptions.

Furthermore, regulatory oversight and industry collaboration will play a fundamental role in promoting a more resilient and sustainable cryptocurrency ecosystem.

Although challenges persist, the incident serves as a reminder of the resilience and potential of cryptocurrencies, which drive innovation and continuous evolution in the digital asset space.

As the sector continues to mature, proactive measures and a commitment to user centrality will be essential to navigate the complexities of an ever-evolving landscape.