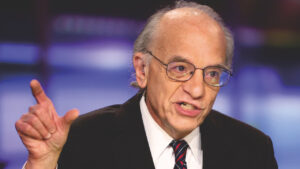

- Institutional investors will pump over $1 trillion into crypto through ETFs and push Bitcoin to new heights, Bitwise chief investment officer Matthew Hougan has told investors in a recent note.

- “Keep calm and take the long view,” Hougan advised investors amid BTC volatility, insisting that the wave of institutional interest would push the top crypto to $150,000 in the current bull run.

“1% down, 99% to go.” This is Matt Hougan’s view on the inflow into Bitcoin ETFs by institutional investors. The Bitwise CIO believes that a trillion dollars will flow into crypto from the deep-pocketed investors and that the money that has gone into the ETFs is just a downpayment.

According to data from Farside, Bitcoin ETFs have attracted over $26 billion since they launched in mid-January. BlackRock leads the race, bringing in $14 billion, while Fidelity has recorded inflows topping $7.5 billion. Ark and Bitwise have attracted $2.3 billion and $1.6 billion, respectively.

This inflow is believed to have played a big part in BTC hitting new highs two months ago at just under $74,000. However, according to Hougan, an ETF expert, we’re just getting started. In his note to investors, Hougan broke down the crypto ETF market and why he believes that most of the money has yet to flow into Bitcoin.

1% Down; 99% to Go. Reflections on the ETF launch.

An excerpt from Bitwise CIO @Matt_Hougan‘s weekly memo to investment professionals.

Lately the crypto markets have been volatile, with bitcoin bouncing between $60,000 and $70,000. The media gets breathlessly worried about…

— Bitwise (@BitwiseInvest) March 27, 2024

Hougan, the former CEO of ETF.com, noted that BTC is currently in a short-term holding pattern that will likely be swayed by the halving on April 20. However, an approval of Bitcoin ETFs by US heavyweights like Morgan Stanley, Goldman Sachs and Wells Fargo for their wealthy clients could be a game changer.

He noted:

But long-term, we believe bitcoin is in a raging bull market. Not only is it up nearly 300% in the past 15 months, but there are strong reasons to think that will continue.

ETF Expert: Keep Calm, Bitcoin Will Skyrocket

It is an open secret that the ETF approval in January was a landmark for Bitcoin. These institutional products allow some of the more sophisticated investors to include Bitcoin in their portfolios. As Hougan noted, each of these players controls billions of dollars, and together, they are estimated to hold at least $100 trillion. A portion of this money will seep into Bitcoin, but this process will take years, not a few months.

He noted, “…imagine global wealth managers allocate just 1% of their portfolios to bitcoin on average. It’s not crazy: While past performance does not guarantee future results, a 2.5% allocation to Bitcoin has enhanced a traditional 60/40 portfolio’s risk-adjusted returns in every three-year period in Bitcoin’s history.”

A 1% allocation across the board would mean ~$1 trillion of inflows into the space. Against this, $12 billion is barely a down payment. 1% down, 99% to go.

With $26 billion in institutional inflows pushing BTC from $46,000 on January 12 to a new all-time high of over $73,680 this month, $1 trillion would push the top crypto to twice that and more.