Quick Take

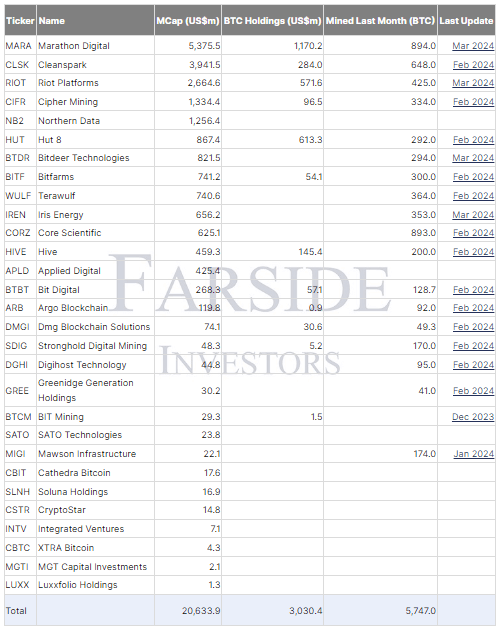

The Bitcoin mining industry has reached a significant milestone, surpassing a market capitalization of $20 billion, now standing at $20.6 billion, according to Farside data.

This milestone emphasizes the growing significance of public miners within the Bitcoin ecosystem, contributing approximately 28% of the global hash rate. They are valued at around 1.55% of Bitcoin’s current market capitalization of roughly $1.327 trillion.

Despite this significant milestone, numerous mining companies have faced challenges this year in terms of share price returns.

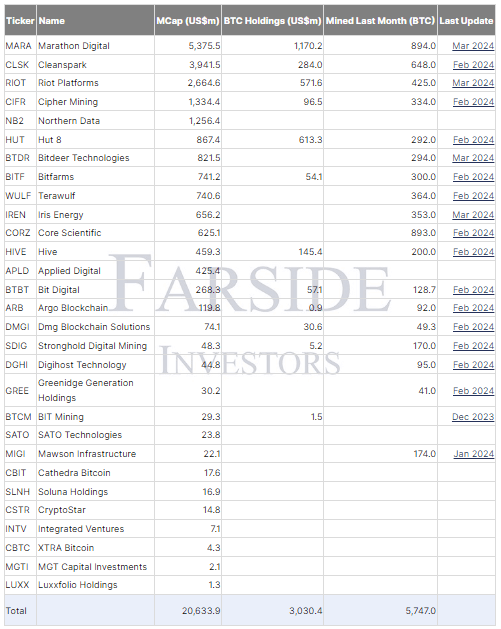

Notably, CleanSpark stands out as an exception, boasting a remarkable 51% increase year-to-date. Interestingly, the WGMI Bitcoin mining proxy ETF has seen a 4% decline year-to-date.

Contrary to earlier speculations, the introduction of Bitcoin ETFs hasn’t negatively impacted Bitcoin proxy equities. This is evident from MicroStrategy’s impressive 222% surge since its introduction.

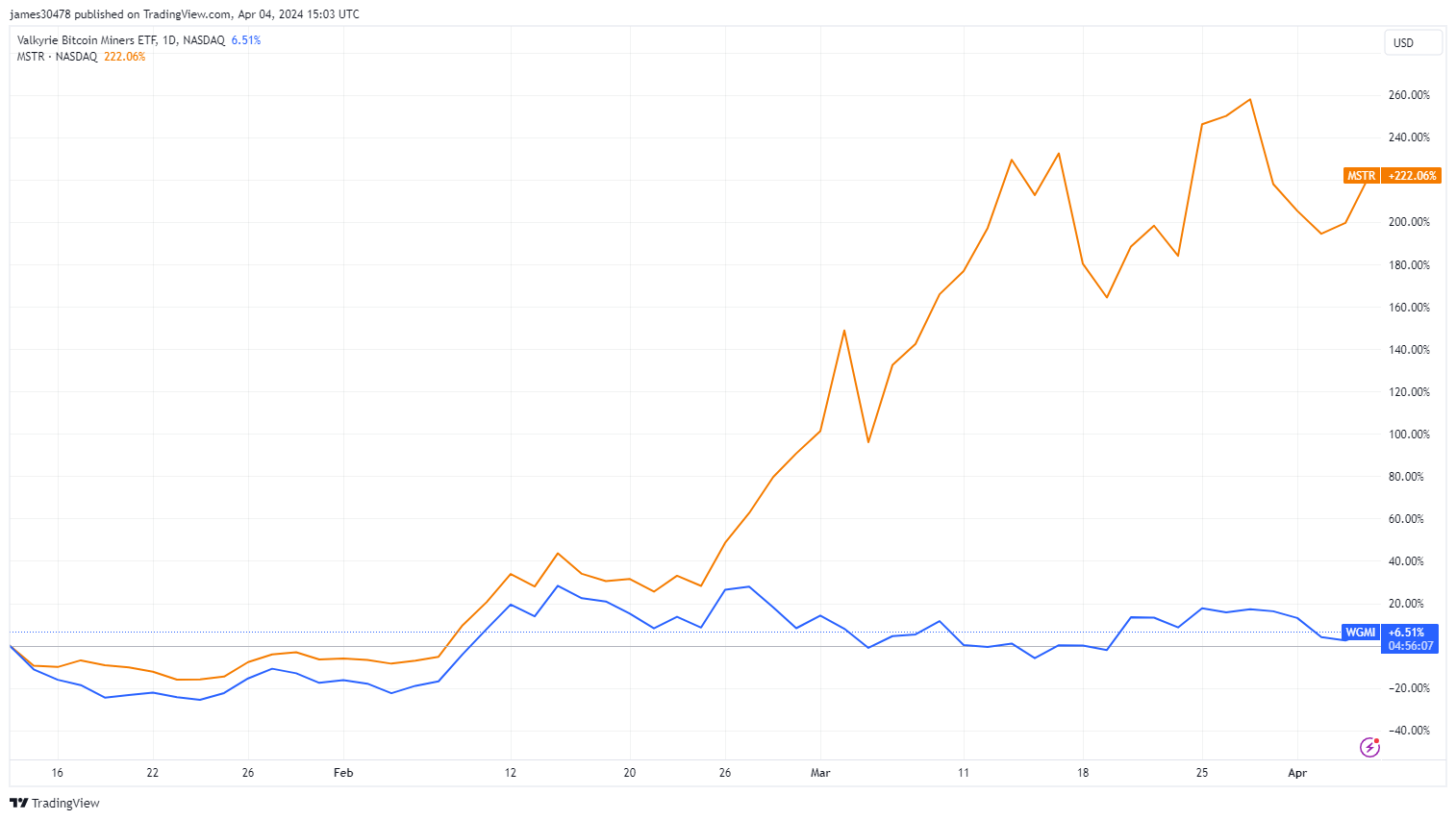

One significant factor contributing to the bearish price action for miners is the impending Bitcoin halving event, slated to reduce block rewards from 6.25 to 3.125 BTC.

Despite Bitcoin’s 50% price increase YTD, transaction fees for miners—essential revenue sources—have remained low, post the inscription frenzy earlier in 2023. Keeping a close eye on transaction fee levels will be imperative for gauging the mining industry’s future prospects.

The post Bitcoin mining market cap eclipses $20 billion as industry continues growing amid challenges appeared first on CryptoSlate.