Levana is a decentralized perpetual swaps platform that aims to provide users with a secure and efficient trading experience. Founded in early 2021, Levana initially launched on the Terra blockchain but has since expanded to the broader Cosmos ecosystem, including the Osmosis, Sei, and Injective platforms, following Terra’s collapse in May 2022.

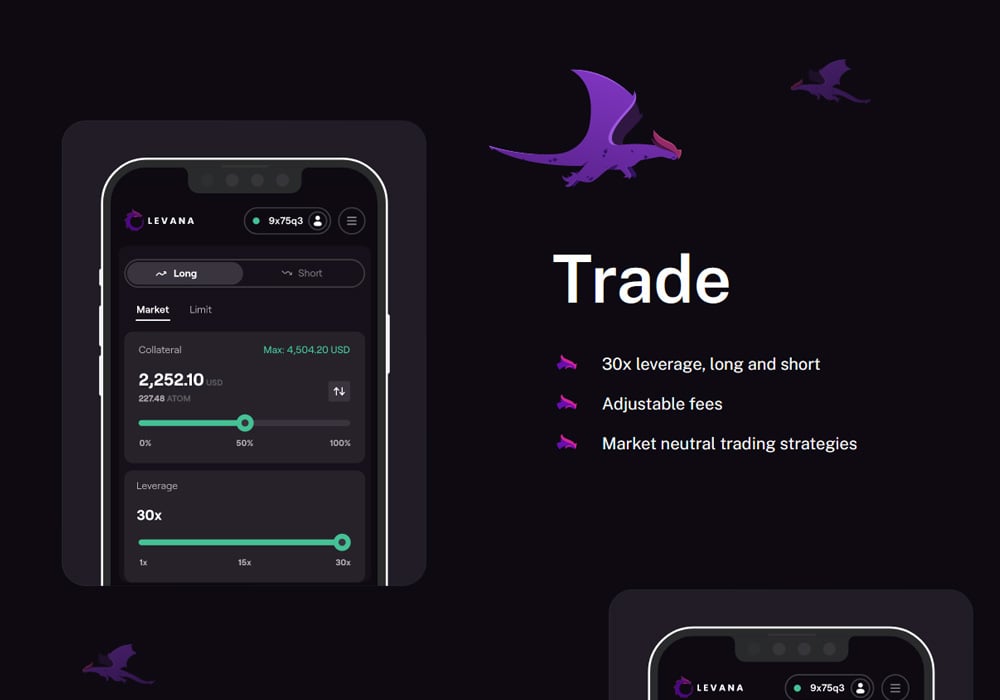

As a fully-collateralized platform, Levana offers users the ability to trade native tokens with up to 30x leverage and low fees. The platform’s unique “well-funded” model sets it apart from other perpetual swaps platforms by locking in the maximum profit for each position in advance, effectively eliminating the risk of insolvency and bad debt for users.

Levana’s trading mechanism relies on spot market prices for entering, exiting, and calculating PnL, rather than using an internal “mark price” like some other platforms. The platform also employs funding payments to incentivize balanced positions between long and short open interest.

Levana offers both stablecoin and crypto-denominated trading pairs, with the latter allowing for infinite max gains on long positions.

Quick Verdict: Levana is a resilient, fully-collateralized perpetual swaps platform that eliminates insolvency risk through its innovative “well-funded” model, offering users up to 30x leverage on both stablecoin and crypto trading pairs across multiple blockchain ecosystems.

Quick Facts

- Levana is a fully-collateralized perpetual swaps platform that allows users to trade native tokens with up to 30x leverage and low fees. It offers commodities and liquidity pools, and its well-funded model eliminates insolvency risk for users’ profits and losses.

- Levana’s unique “well-funded” approach locks in the maximum profit for each position in advance, ensuring there is no possibility of bad debt or insolvency. This is achieved by having liquidity providers supply collateral to support positions in exchange for earning fees.

- Levana does not use an internal “mark price” like other perps platforms. Instead, it relies on the spot market price for entering, exiting, and calculating PnL. Funding payments are used to incentivize balanced positions, based on the difference between long and short open interest.

- Levana offers both stablecoin and crypto-denominated trading pairs. Crypto-denominated pairs allow infinite max gains on long positions. The protocol also employs a delta neutrality fee to maintain balance and prevent manipulation.

- After launching in early 2021 on the Terra blockchain, Levana had to pivot following Terra’s collapse in May 2022. It has since expanded to the broader Cosmos ecosystem and is operational on the Osmosis, Sei, and Injective platforms. This demonstrates Levana’s resilience and adaptability.

What Is Levana?

A popular model for perpetual swaps is the constant-product virtual AMM, a virtual market users can trade. The protocol relies on a special payment referred to as a funding payment to keep the market price in line with the spot price.

Although this design allows a perpetual swaps DEX to exist without an order book, it has critical flaws. The AMM model is brittle and has an open interest imbalance risk so Levana goes back to design a leveraged perpetual swaps financial model that is well-funded as a core principle.

As every transaction is reflected publicly, on-chain order book DEXs like Levana can help transparency and decentralization better.

Here are some of the key features on Levana:

- Guarantees for settlement: This helps traders to get better guarantees for settlement in any future market conditions with a very low liquidation margin ratio.

- Liquidation price is solely based on the spot price feed.

- Offering risk premium for liquidity providers: There’s a risk premium for liquidity providers when they take on spot market meltdown risk. This yield can be found in a market of supply and demand for liquidity to be used as collateral.

- No funds required for risk: Protocol doesn’t require a risk fund and the DAO Treasury has no insolvency risk.

Benefits of Levana

A trader’s unrealized profit is a liability to the protocol and that liability is well-funded when the maximum profit is locked for specifically that position. By making all positions well-funded, traders are guaranteed a fair settlement payout in any market conditions.

In addition, bad debt is impossible for a position by construction, so there is no risk of insolvency to the protocol as a whole. Traders also don’t need to be in a rush to perform liquidations just in time before the position goes into bad debt.

Levana is the only well-funded platform where all positions are fully collateralized, preventing insolvency. As it’s integrated into Cosmos, users are able to enjoy exclusive trading options for commodities like gold, Chinese yuan, euro, British pound, and silver.

This mechanism also creates a decentralized supply-and-demand free market for liquidity with yield denominated in the collateral asset. It offers a unique feature allowing users to profit from fees or trader losses. Not only that, Liquid Stake Derivative Markets available are to support collateralized markets in crypto assets, turning non-working assets into working assets.

How to Get Started with Levana?

Levana is designed to support three main user types, including directional traders, liquidity providers, and cash and carry traders.

Directional Traders:

Users want to trade one of Levana’s more than 30 different markets and three different blockchains. Start by selecting a network in the upper right corner. Then, choose a market either from the dropdown menu or the markets page.

You are required to deposit collateral (USDC or specific crypto assets). Then, open a long or short position, setting take profit and stop loss. You are able to update the position to adjust strategy with lower fees than closing and reopening, track profit, and position details (like liquidation price, and fees), through the trading page, and view historical positions and overall P&L.

By signing up, you can receive notifications through email, Telegram, or Discord for updates on positions.

Liquidity Providers:

If you are a liquidity provider, go to the earn section of Levana Finance and select a market to provide liquidity. Deposit into LP or XLP pools, with the latter having a 45-day unbonding period, then you will earn fees from trader fees and borrow fees, paid in the collateral type deposited.

LPs and XLPs carry risks as counter-traders to traders’ wins and losses.

Cash and Carry Traders:

You have maintained delta neutrality through Levana’s trading interface and holding spot or futures elsewhere. Moreover, you also can seek high-yield markets for shorting, balancing exposure to underlying assets like Bitcoin.

What Makes Levana Well-funded Mechanism Unique?

Perpetual markets are different from traditional spot markets, as they allow users to trade based on the price action of an asset without actually owning the asset itself. Leveraging price fed from oracles, allows users to speculate on the price movement of various assets without the need for physical ownership.

Although Levana competes in a crowded market with approximately 100 to 150 competitors, including all trading platforms that offer leveraged trading, both centralized and decentralized, some things make the new Levana Perps outstanding from others.

First of all, is on-chain functionality. As said, on-chain order book DEXs can allow for greater transparency and decentralization. Therefore, Levana operates entirely on-chain, allowing for end-user verifiability of all transactions and operations, unlike competitors that may rely on off-chain order books.

Secondly, by opening a liquidity provision, Levana enables anyone to become a liquidity provider by directly depositing single-sided assets, which democratizes the ability to earn from the protocol’s success.

The last point is solvency assurance. Levana ensures it remains solvent under any market condition by using innovative mechanisms such as mandatory take profit and stop loss for trades and capping the total amount of earnings possible per trade. This approach also contrasts with some decentralized finance platforms that risk insolvency or bankruptcy when markets move too quickly or strongly in one direction.

Furthermore, Levana stands out as the first DeFi platform that enables users to collateralize any asset with up to 100x leverage available on selected assets on Osmosis, Injective, and Sei.

The platform is able to offer 30x leverage markets on the native tokens of both Injective & Sei. As such, this not only expands trading opportunities but also contributes to the formation of siloed markets, where liquidity pools are separated, reducing the susceptibility to vulnerabilities.

Protecting multiple layers of liquidity pools can help your funds to be better protected against potential attacks or liquidity drains.

Conclusion

Levana has emerged as a notable player in the decentralized perpetual swaps space, offering users a secure and capital-efficient trading experience.

By employing a fully-collateralized, “well-funded” model, Levana effectively mitigates the risks of insolvency and bad debt that have plagued some other platforms.

Through its use of spot market prices for PnL calculations, funding payments to balance long and short open interest, and the offering of both stablecoin and crypto-denominated trading pairs, Levana has created a robust and versatile trading environment.

The platform’s ability to adapt and expand to multiple blockchain ecosystems, particularly after the collapse of its initial launch blockchain, Terra, demonstrates its resilience and commitment to serving its users.

As the DeFi space continues to evolve and mature, platforms like Levana are likely to play an increasingly important role in providing traders and investors with secure, efficient, and innovative ways to access the benefits of perpetual swaps.

With a unique approach to risk management and a focus on user experience, Levana is well-positioned to continue its growth and solidify its position as a leading perpetual swaps platform in the decentralized finance ecosystem.

The post Levana: Revolutionizing Perpetual Swaps with a Well-Funded Approach appeared first on Blockonomi.