- As a routine measure, the SEC has opened for public comments on the proposed Ethereum ETFs from Grayscale, Fidelity, and Bitwise.

- Although there is increasing concern about the status of ETH according to experts this might not hinder the approval of its ETF.

The U.S. SEC has opened comments on the proposed Ethereum ETFs from Grayscale, Fidelity, and Bitwise. The comments apply to the proposed rule change that two exchanges – Cboe BZX and NYSE Arca – will list and trade shares of the three funds.

Several ETF proposals argue a strong correlation between Ethereum futures ETFs (already approved by SEC) and the spot market, making fraud unlikely (analysis by Coinbase cited). They challenge the SEC’s claim that current regulations are insufficient and emphasize the spot market’s size. Public comment is sought on custody, share creation/redemption, and sponsor fees.

This is a routine procedure that was initially observed before the approval of the Bitcoin ETFs on January 11th. The SEC is set to receive comments from the public for 21 days after publication in the federal register. The public comments will help guide the SEC’s decision to approve or reject the proposed spot Ethereum ETFs.

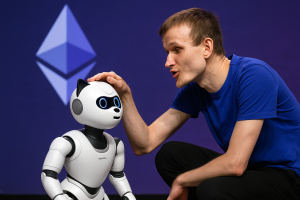

After the approval of a Bitcoin ETF in January, experts anticipated swift approval of an Ethereum ETF especially after the involvement of financial giants such as Grayscale, Fidelity, and BlackRock who all filed for an ETF. However, the SEC has been delaying its decision leading to weeks of frustration and more significantly closing out the chance for any other crypto ETF getting approval.

The popularity of the spot Bitcoin ETFs has demonstrated the interest in the cryptocurrency market and crypto-based products by traditional investment firms. This is no surprise with Bitcoin emerging as the greatest investment asset in the last decade. With even greater gains expected this year, traditional investors can no longer ignore it. This has implored firms such as BlackRock, the world’s largest asset under management firm to launch its ETF which has attracted billions of dollars in the last three months.

BlackRock has also recognized the potential in Ethereum and filed for an Ethereum ETF. BlackRock CEO Larry Fink recently discussed the chances of approval, specifically in regard to recent concerns that the SEC might be looking to classify ETH as a security. As CNF reported, Fink does not believe this classification would hinder the launch of the ETF.

As CNF reported, Bloomberg ETF expert Eric Balchunas recently reduced the probability of the ETF being approved by May 23, the final application deadline, to 25%.

At the time of writing, ETH is trading at $3,273 after a 2% drop in the last 24 hours. This sees the world’s largest altcoin extend its weekly losses to nearly 8% as it struggles to defend the $3,200 support. Recent movements have shown that it enjoys great support above $3,000 which offers a buying opportunity for bulls eyeing the $4,000 resistance in the short term.