Key Insights

- Chromia is a data-centric Layer 1 platform that is engineered for horizontal scaling to handle parallel tasks, optimized for high-performance AI and gaming applications.

- Launching its mainnet in early Q3 2024, Chromia recently integrated with Ultiverse, an AI-driven gaming studio.

- Applications building on Chromia operate as sidechains, and Chromia’s database-centric approach is ideal for applications requiring complex queries and indexing.

Introduction

Chromia stands out among Layer-1 blockchains due to its innovative approach during Ethereum’s early scaling challenges. As ETH’s gas fees climbed, alternative Layer-1 (alt-L1) solutions were developed to optimize scalability. Chromia distinguishes itself from these other solutions by leveraging relational databases for efficient data storage and retrieval.

Just as Ethereum adopted a modular approach to address its shortcomings, the design space for alt-L1s has significantly evolved. Both integrated and modular strategies now strive to attract applications and developers by offering specified tradeoffs in functionality and performance. Chromia positions itself towards data querying capabilities via its modular blockchain and is attracting gaming and AI projects by handling computationally intensive data storage.

Background

Chromia was created in 2019 by the Swedish-backed Chromaway. Chromaway’s founding team — Or Perelman, Henrik Hjelte, and Alex Mizrahi — have deep roots in crypto, tracing back to the inception of Bitcoin and Ethereum. Mizrahi, in particular, made early contributions to the concept of the Proof-of-Stake (PoS) consensus mechanism and played a pivotal role in Colored Coins. This pioneering project introduced the idea of “tokens,” which Ethereum later popularized. The Chromia team recently welcomed Yeou Jie Goh, previously the head of portfolio at Defiance Capital. In January 2024, he stepped into the role of Head of APAC at Chromia.

Arrington Capital led Chromia’s latest funding round in 2019, and its seed round occurred in 2018, led by TGE Capital. Chromia hasn’t raised capital in 5 years, and all private sale and investor tokens are fully vested.

The Chromia whitepaper was published in May 2019, and the team aims to launch its mainnet in Q3 2024. These extended development timelines were primarily due to the Chromia team developing its wallet, block explorer, bridge, and blockchain in-house. As the mainnet launch approaches, the robustness of these innovations will soon be tested.

Technology

Chromia’s modularity exists in separating the settlement and execution layers. The structure in which the state machine stores information uses a relational database. Ethereum, on the other hand, uses an account-based structure.

Postchains

Postchains are the most important innovation in Chromia design. Postchains are designed to store data, including blockchain metadata and application state, within a relational database. Additionally, they enable a single database to host multiple blockchains and permit one blockchain to access data from another once the data has been committed. This approach streamlines inter-blockchain interactions by allowing chains to query easily shared data, reducing complexity.

ICMF and ICCF

Chromia sends data between chains through two protocols called ICMF (Interchain Messaging Facility) and ICCF (Interchain Confirmation Facility).

ICMF leverages the anchoring hierarchy for sending messages across chains and facilitates various internal cross-chain communications, including managing application updates.. It first allows chains to post messages to a topic and then allows other chains to subscribe to any messages on that specific topic. Using the anchoring hierarchy as a communication channel, ICMF guarantees messages’ eventual delivery and order. It also does not require that chains be in the same cluster to communicate.

ICCF also uses anchoring hierarchy, but instead of sending a message, it constructs a proof of a transaction. It then submits this proof client-side to the receiving blockchain, which validates it using the anchoring structure. While ICCF is faster and more efficient, it requires client-side interaction and has no guarantees, as the client can fail. In this scenario, ICCF would need to recreate and resubmit the proof. ICCF proofs are used for cross-chain transfers, implemented in Chromia’s FT4 token standard.

Both optimize the development process for developers by enabling them to utilize PostgreSQL for data storage and querying. The traditional virtual machine architecture is not readily compatible with Chromia’s relational data model, as it necessitates encoding queries. To address this, Chromia adopted Rell (Relational Language) for its programming needs. Designed to be similar to Python and Kotlin, Rell aims to reduce the learning curve for developers, facilitating easier adoption and transition.

Consensus

Each application on Chromia has its own blockchain. These blockchains are run by a set of nodes using a lightly modified version of Practical Byzantine Fault Tolerance (PBFT) consensus, called eBFT. Each blockchain within Chromia is associated with a set of validators and is hosted on a subset of nodes that establish consensus on any modifications to the application state. Chromia software runs on nodes controlled by individuals or organizations called providers. Chromia currently has four clusters, a group of network nodes collectively running the same blockchains. Mainnet launch will ultimately reveal the actual throughput and scalability of the network; however, the current appnet projections include:

- ~1 second confirmation times

- > 500 transactions per second (TPS) per sidechain

- > 100,000 updates and reads per second

For clusters, Chromia has internally tested around 33,000 TPS for three clusters, and the team has indicated it would scale linearly with an increase in clusters.

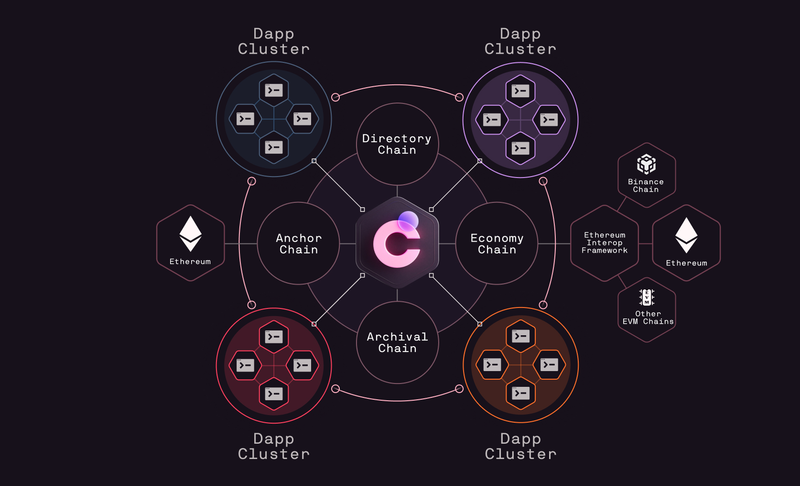

Chromia achieves horizontal scalability by dividing its structure into multiple blockchains, where each node processes data exclusively to its designated chain. This model enhances scalability by ensuring that updates on one blockchain do not impact others, effectively creating a cohesive “system” of blockchains integral to Chromia’s architecture.The system chains include:

- Directory Chain tracks all providers, nodes, application blockchains, and their validators.

- Economy Chain keeps track of token distribution and is for CHR only.

- Anchoring Chain defends attacks against a subset of nodes. It also records block hashes from other chains, helping to detect consensus failures. Chromia has one cluster anchor chain, which anchors all chains upstream from the original chain.

Source: Chromia Whitepaper

Thus, applications building on Chromia operate as sidechains. Chromia’s database-centric approach is ideal for applications requiring complex queries and indexing. In this model, applications compensate nodes for hosting services. Doing so allows developers to set their own policies based on the resources allocated to an application. Essentially, nodes seek compensation for server provision without concern for the application’s function. However, this method can lead to inefficiencies: uniform compute allocation across nodes can result in some underutilization while others reach total capacity.

Chromia addresses this by introducing varied node classes tailored to specific needs, including application demands, provider capacity, and hardware availability. This flexibility lets applications fine-tune their hosting fees based on their unique requirements. Within the Chromia ecosystem, hosting fees and transactions utilize CHR as the standard currency.

Tokenomics

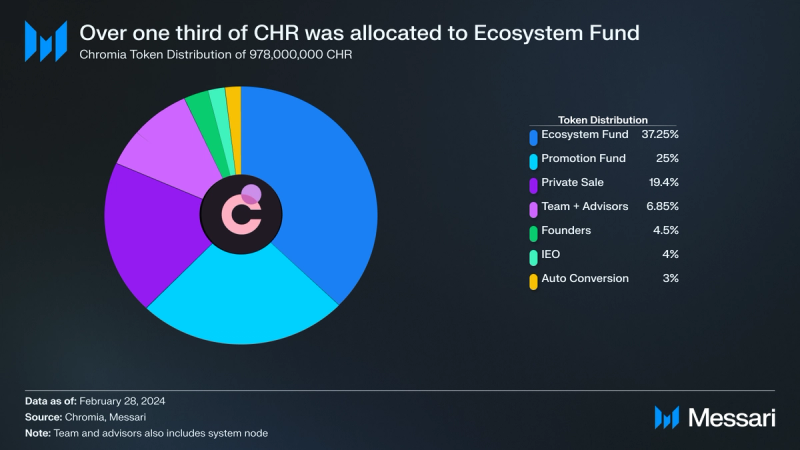

One billion CHR tokens were created upon network launch. However, 22 million tokens were burned in May 2020, resulting in a maximum supply of 978 million CHR. In May 2019, 49 million CHR were initially unlocked during the token generation event.

The full distribution breakdown is as follows:

- 37.25% to the ecosystem.

- 25% to the promotional fund.

- 19.4% to private sale investors.

- 4.5% to the founders.

- 4% to CHR’s initial launch.

- 3% to the auto conversion contract.

- 2.93% to the team.

- 2% to Chromia’s system node.

- 1.92% to Chromia’s advisors.

CHR was initially issued as an ERC-20 token, but once Chromia launches on mainnet, it will convert to Chromia’s native token. As of writing, CHR has a fully diluted market cap of $316 million with a token price of $0.41. The remaining token distribution includes 9.4 million for founders, 57.1 million for promotional activities, and 16.5 million reserved for the auto-conversion contract, activating with the mainnet launch. This allocation represents an approximate value of $34 million USD, vested monthly until the complete token release in December 2024. Chromia tokens serve multiple key functions within the Chromia ecosystem:

- They are utilized by dApps to cover hosting fees, thereby rewarding the nodes like Ethereum uses tokens for transaction fees to compensate block producers.

- Chromia tokens act as the primary currency within the Chromia economy.

Additionally, users can stake CHR tokens to earn rewards for contributing to network security, and providers can leverage their stake for governance purposes.

Network Activity

Chromia incentivizes providers to secure their network by requiring them to stake CHR. The staked CHR acts as collateral and would be forfeited in cases of node misbehavior. Any user can stake Chromia tokens to earn an annual governance reward of 10% APR, although this rate may be subject to future adjustments. Once staked, CHR tokens are frozen for two weeks. The staking contract is available on both the Ethereum and Binance Smart Chain (BSC) networks, enabling users to participate using standard ERC-20 wallets like MetaMask. Additionally, all applications wishing to be hosted on the Chromia testnet must stake at least 100 CHR.

In January 2024, the team released a staking update introducing a delegation mechanism, which marked a significant advancement towards improved governance. Chromia added new providers to enhance the staking interface’s responsiveness. Following these updates, the provider list will be dynamically populated by accessing the Directory Chain in real-time, ensuring an up-to-date roster of potential delegates. As of writing, 28% of all circulating CHR is staked natively on the network.

While the network is still in testnet, its appnet currently has seven live applications, twenty providers, and twenty-six active nodes. Chromia’s most popular application is My Neighbor Alice. This fully onchain multiplayer game mixes digital farming, NFT trading, and community and is built exclusively on Chromia. My Neighbor Alice’s Alpha Season 4 has generated over 1.8 million transactions despite only launching in January 2024.

Another application on Chromia, Fanzeal, is the digital collectibles marketplace for VFB Stuttgart, a top German soccer team. It aims to bring sports and entertainment onchain. In addition, Chromia has partnered with several game studios leading into its upcoming mainnet.

Roadmap

Chromia is positioning itself as the central crypto gaming chain as it seeks to cement its growth and presence. From a technical standpoint, Chromia launched its block explorer, completed an EVM asset bridge, and finalized its Chromia CLI to simplify the deployment of Rell-based applications in Q4 2023.

Chromia is set to introduce the Economy Chain, a system chain that parallels the Directory Chain and Anchoring Chain in its network structure. The Economy Chain is designed to achieve several vital objectives for the network’s operation. First, it will accommodate the Native Fees app. The app allows for the leasing of containers using CHR tokens and streamlines the distribution of payments to network providers. Furthermore, the Economy Chain will function as the primary conduit for the official bridge, facilitating the transfer of CHR tokens between Ethereum and Binance Chain. It also plays a critical role in the circulation of CHR tokens, acting as the origin point for tokens entering the ecosystem from Chromia’s side.

Before its mainnet launch, Chromia faces two key challenges: implementing a native fee system to compensate network providers with CHR tokens and finalizing integrating its FT4 (Chromia’s token standard) bridge to support native CHR transactions. These updates are anticipated to be completed in Q1 2024.

From a business development perspective, Chromia partnered with Ultiverse, an AI-gaming hub, and Chain of Alliance. Although Chromia is not yet operational, the anticipated launch of these projects is expected to draw considerable attention to the platform.

In February 2024, Chromia also announced a strategic partnership with RSTLSS, a platform that enables users to design personalized digital assets effortlessly. The collaboration aims to make digital creation accessible to everyone. Chromia aims to streamline the app experience to be universally symbiotic. RSTLSS is focused on ensuring its user-generated content (UGC) beta is accessible, even to those without programming knowledge. Through this collaboration, the main drivers for enhancing the Chromia gaming ecosystem include cross-game asset sharing, intellectual property crossovers, and expanding RSTLSS’s innovative tooling to more games.

Furthermore, Chromia integration with Rell enables relational database querying capabilities. This helps position Chromia as a promising network for broader applications, including AI. The platform’s efficient data storage and retrieval system presents a compelling case for developers, especially when most blockchains struggle to handle extensive computational demands.

Conclusion

With its modular architecture rooted in relational database principles, Chromia presents a distinct proposition in the crowded Layer-1 ecosystem. The programming language Rell introduces advanced data storage capabilities, enabling comprehensive onchain data management directly on the network.

Chromia’s mainnet launch is further heightened by the growing emphasis on AI and gaming. Significant competition exists with other Layer-1 networks targeting niche sectors such as gaming. Chromia’s current market valuation of approximately $340 million lags behind peers like Beam and ImmutableX, valued at $1.7 billion and $3.8 billion, respectively. However, Chromia differentiates itself with a more tailored and hands-on approach to application integration. This strategic focus on business development and application onboarding will be critical for Chromia’s success.