- BNB Chain saw big growth in Q1 with a 70% rise in revenue and a $60 billion market cap but faced challenges in Q2 with revenue dropping and prices falling.

- Despite revenue declines in Q2, BNB Chain’s network activity remained strong, showing potential for recovery in its price.

In the first quarter of 2024, BNB Chain, the blockchain powered by Binance Coin (BNB), showcased remarkable growth across key metrics. According to Coin98 Analytics, the blockchain’s revenue surged by an impressive 77%, reaching $6.62 million. This growth was fueled by a significant fee increase, which soared 70% to $66.8 million compared to the previous quarter.

@BNBCHAIN Q1 2024 Financial Report

All income statement indicators in Q1 showed impressive growth of over 70% compared to the previous quarter$BNB Trading Volume increased by 2.3 times QoQ and 2.8 times YoY

Over 113M $BNB token holders in Q1#BNB $BNB pic.twitter.com/HsnuUGRJ7n

— Coin98 Analytics (@Coin98Analytics) April 4, 2024

Moreover, BNB’s circulating market capitalization experienced a notable uptick, rising by 65% to $60 billion. Trading volume also substantially increased, surging by 2.3 times quarter-on-quarter (QoQ) and 2.8 times year-on-year (YoY). Additionally, the total number of token holders surpassed 113 billion, marking an 80.7% YoY hike.

With more than 1.3 million active users per day and more than 22 million new addresses created during the quarter, the blockchain’s resilience in the face of outside challenges was clear. Surpassing $6.3 billion in Total Value Locked (TVL) on the platform indicates growing investor confidence and utility. The NFT market also saw tremendous expansion, with a 3.4-fold increase in sales volume.

Its status as a premier hub for the development and trade of digital assets was cemented in Q1 alone, with over 9.7 million NFTs generated. BNB’s price action was also moving with optimism due to the positive market sentiment. A notable 30% year-over-year gain was seen in Q1 when the coin’s circulation market valuation soared by 65% to $60 billion.

Q2 Revenue Decline and Price Fluctuations

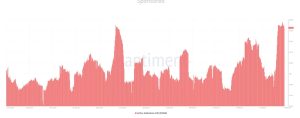

However, as Q2 unfolded, BNB Chain faced challenges that impacted its performance. Analysis of Artemis’ data revealed a decline in fees and revenue during the last seven days of the quarter. In the second quarter of 2024, BNB Chain (BNB) faced a tumultuous period marked by a significant drop in revenue. Despite this decline in captured value, BNB Chain maintained robust network activity, as evidenced by the sustained momentum in daily active addresses and transactions.

Simultaneously, the price of BNB experienced a downturn during Q2. CNF marketplace data revealed that the coin depreciated by over 4% in the past week, with its current trading value at $581. This decline comes amidst broader regulatory scrutiny faced by Binance, the parent company of BNB Chain.

Technical Analysis and Future Outlook

Technically, BNB’s price appears poised for a potential breakout. If it can overcome the $590 resistance level, a further rise towards $640 or even $700 could be on the horizon. However, failure to break through this resistance could lead to a decline towards the $532 support level.

Despite the challenges encountered in Q2, BNB Chain’s strong performance in Q1 and resilience in the face of external pressures highlight its potential for continued growth and adoption. The platform’s thriving ecosystem, characterized by increasing utility, strong user adoption, and innovation in areas such as NFTs, positions it as a leading player in the blockchain space.