Key Insights

- BTC’s price increased 69% QoQ to $71,310, setting a new all-time high as it approached the new halving cycle in April.

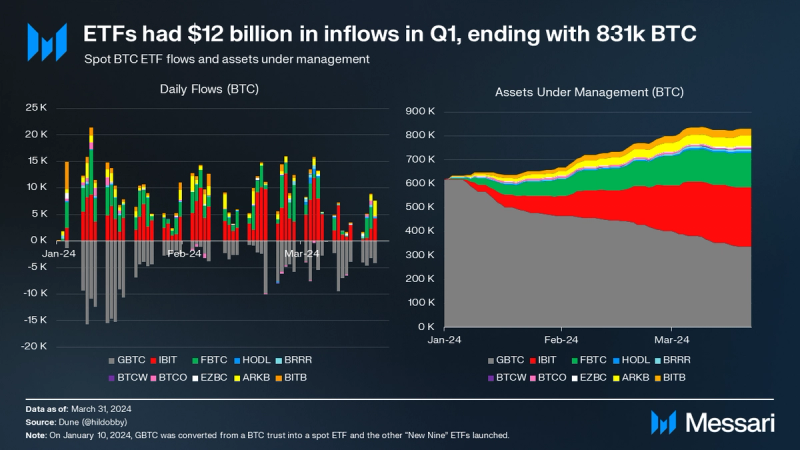

- The success of the spot BTC ETFs was a driving factor in price action, with over $12 billion in inflows in Q1. Spot BTC ETFs now hold 831,000 BTC or $59 billion.

- Inscription transactions and fees were down 40% and 60% QoQ. However, sales volumes on NFT exchanges remained over $10 million per day. The halving in April will bring with it the launch of the Runes token protocol and an Epic sat.

- Miner revenue (USD) was up 34% QoQ, and miners are exploring inscriptions and MEV as additional revenue sources. Several miners haveformalized block-selling to meet Ordinals builders’ demand.

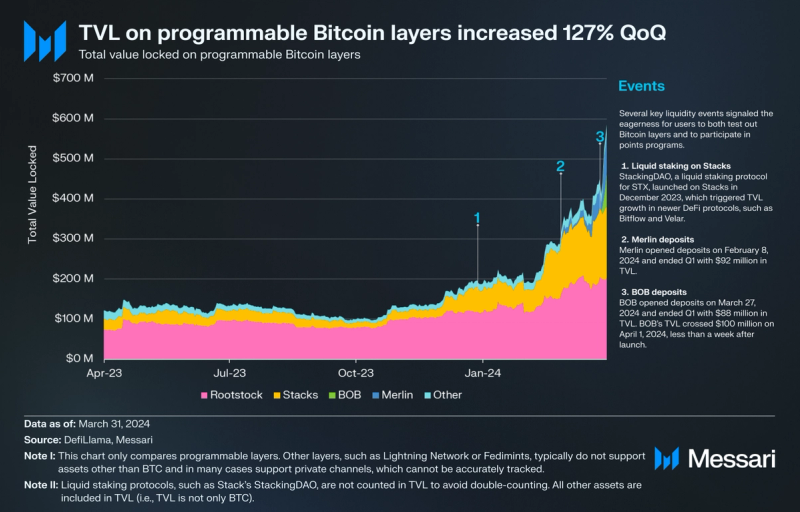

- TVL on programmable Bitcoin layers increased 127% QoQ. Dozens of new layers are being built to scale and to add programmability to Bitcoin, with many of them exploring BitVM-based bridging and state validation.

Primer

Bitcoin (BTC) is the first distributed consensus-based, peer-to-peer payment settlement network. Bitcoin (BTC), the native asset of the Bitcoin blockchain, was the world’s first digital currency without a central bank or administrator. Often referred to as digital gold, bitcoin has a predictable, stable monetary policy that operates autonomously, giving it the ideal store-of-value properties.

To secure its network, Bitcoin uses a Proof-of-Work (PoW) consensus mechanism to solve the “double-spend problem.” PoW requires participants (miners) to contribute computing power to solve arbitrary mathematical puzzles in order to add a new block to the blockchain. Bitcoin is awarded to the miner who solves the puzzle first, thus minting new bitcoins.

Bitcoin has historically been focused on enabling peer-to-peer payments and being a store of value, but not as much on DeFi, NFTs, and other narratives enabled by programmability (i.e., expressive smart contracts and arbitrary computation). Instead, those narratives were deferred to alternative networks. However, Bitcoin is now experiencing a renaissance of programmability, largely thanks to two recent innovations, Ordinal Theory and BitVM. Both innovations leverage offchain indexing or computation, and neither makes any changes to the core protocol. Ordinal Theory emphasized the demand for added functionality, and then BitVM made expressive and trust-minimized L2s seem possible. These innovations have sparked a frenzy of experimentation with onchain assets and modular layers.

Whitepaper / Reddit / GitHub

Key Metrics

Financial Analysis

BTC’s price was up 68.78% QoQ, ending Q1 at $71,310 and setting a new all-time high. This price increase drove BTC’s market cap dominance up to 49.7% in March 2024. This market cap dominance increase is typical of the start of a new halving cycle, as BTC often leads the action in other cryptocurrencies. Several factors contributed to this price increase and all-time high, including anticipation for the supply halving in April 2024.

However, the spot BTC ETFs launched in January were perhaps the largest catalyst, as they collectively had $12.04 billion (212,000 BTC) in inflows during Q1. The ETFs are explored further in the Institutional Analysis section.

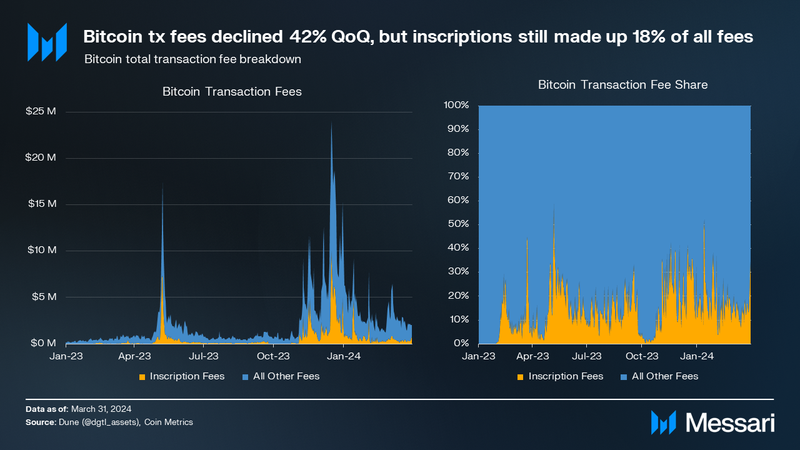

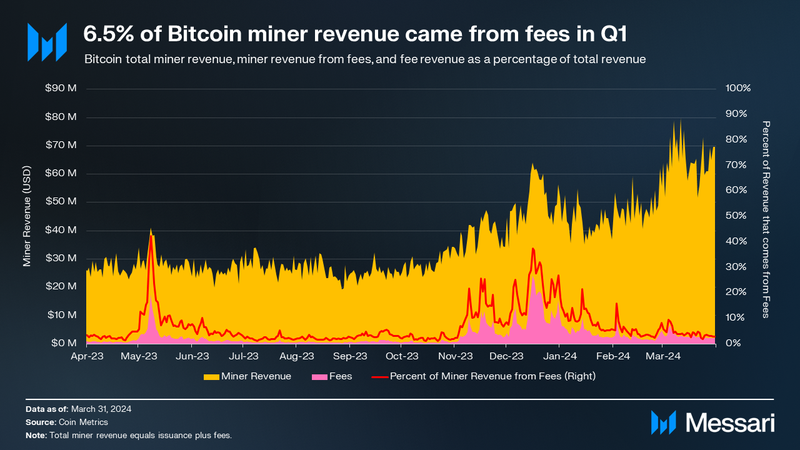

In Q4 2023, inscription activities drove fees up 699.4% QoQ to $502 million. This inscription-mania again proved to be inconsistent after this Q1 decline of 41.9% to $291 million. Despite the decrease in overall fees, inscription-related transactions still generated 18.4% of overall transaction fees, down from 25.8% in Q4 2023.

Bitcoin pays ~$63 million per day for security (900 BTC per day at a price of $70,000). Fees averaged $3.2 million throughout Q1, covering 5% of Bitcoin’s security budget. For context, in December 2023, fees covered roughly 50% of the security budget. 2023 was the first year in Bitcoin’s history where the annual security budget (relative to market cap) was greater than the year prior (from 1.8% to 1.9%), pointing at potential economic sustainability.

Inscriptions alone are currently too inconsistent to reliably cover Bitcoin’s security budget. However, the usage of Bitcoin’s arbitrary blockspace is being further explored by additional protocols. Their innovations could become constant demand drivers and revenue generators, as detailed in the Layers Analysis section below. Fees resulting from this demand will increasingly become more relevant in Bitcoin’s overall revenue, especially as BTC issuance (and hence, the security budget) will halve from 6.25 per block to 3.125 in April 2024. After the halving, the current volume of fees would cover as little as 2.5% of the security budget, rather than 5%.

Network Analysis

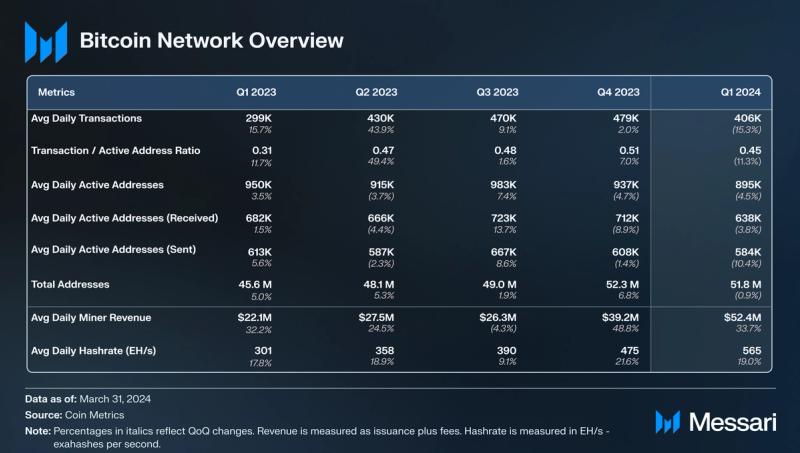

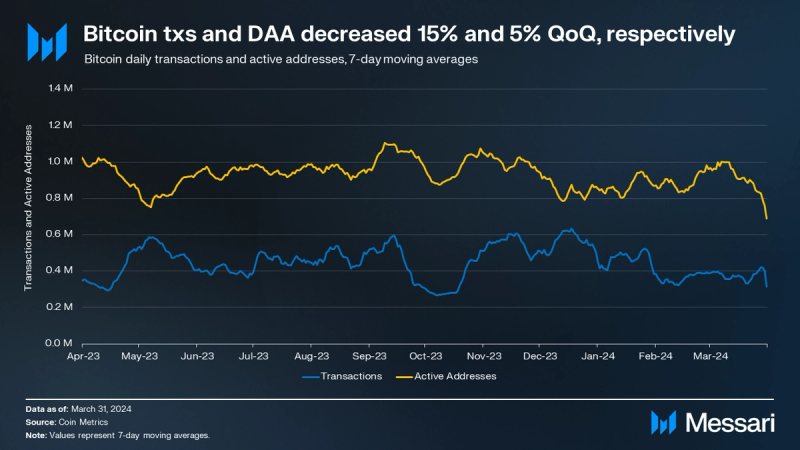

Average daily transactions and daily active addresses decreased 15.3% and 4.7% QoQ, respectively. The ratio of transactions to active addresses decreased for the first time in seven quarters, nearly two years. The changes suggest that the transaction decline may have come from decreased activity from bots or “super users” (users that transact often and account for a large portion of the activity). Regardless of the user makeup, this behavior shift coincides with the decline in inscription-related activities and fees.

Inscription-related activity on the network first took off in February 2023, leading to a 44% QoQ increase in transactions from Q1 2023 to Q2 2023. While Q1 2024’s activity was down QoQ, it was still up 36% YoY from the beginning of the inscription craze.

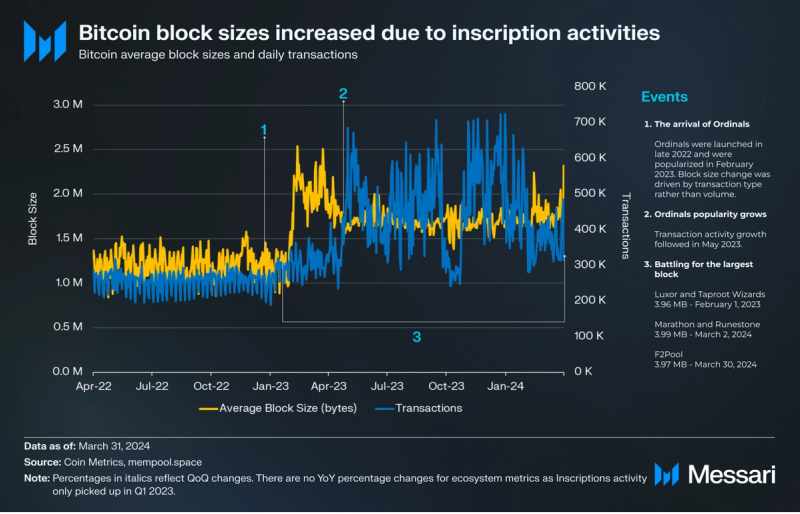

The average block size and number of transactions stayed generally flat throughout 2022 and into 2023, up until Ordinals first gained attention in February 2023. Overall, the average block size stabilized following the increase in early 2023. In addition, transaction activity didn’t see any significant increases until the end of Q2 2023. As such, the increase in average block size likely came from the type of transactions (i.e., inscriptions) rather than the volume of transactions themselves. The effects of inscriptions can be seen in other network metrics as well, such as Bitcoin’s packed mempool.

Ordinals builders and Bitcoin miners have been approaching the maximum size of the 4 MB blocks enabled by Segwit. First, Luxor mined a block at 3.96 MB on February 1, 2023. More recently, on March 2, 2024, Marathon mined a block at 3.99 MB. Following that, F2Pool mined a block at 3.97 MB on March 30, 2024.

Mining and Security

In total, 7.6% of miner revenue came from fees in 2023, compared to 1.6% in 2022. So far in 2024, 6.5% of miner revenue has come from fees. While this is a slight decrease from 2023, it is a significant QoQ decrease compared to Q4 2023, when 11.6% of miner revenue came from fees. The larger the portion of revenue coming from fees rather than issuance, the more economically sustainable the network is, as issuance will continue to decline until reaching zero.

At block 740,000, which will occur in April 2024, the block reward will halve from 6.25 BTC to 3.125 BTC. Because revenue comes almost entirely from this block reward, miner revenue denominated in BTC will be nearly cut in half in Q2 2024. The revenue change denominated in USD is harder to estimate due to BTC’s price action.

MEV

An alternative revenue channel for miners, which has recently grown, is maximal extractable value (MEV, also called miner extractable value). MEV is more prominent on fully expressive networks, such as Ethereum. There, more sophisticated block builders can reorder transactions from decentralized exchanges and other applications to create a profit (e.g., sandwich attacks). However, the recent introduction of alternative tokens from meta-protocols such as Ordinals has created MEV opportunities for Bitcoin miners. As these MEV opportunities are relatively new, the ecosystem lacks clear heuristics for measuring MEV.

NFTs have created consistent MEV opportunities, where miners can arbitrage prices between marketplaces or simply front-run others attempting the same thing. Many of these MEV activities, particularly PSBT mempool sniping, can also be executed by standard users, although a sophisticated block builder can easily front-run such user activities.

MEV is contentious on Bitcoin, as increased MEV opportunities — such as those created by Drivechains — could lead the already-competitive mining business to adopt MEV strategies. This could price out smaller miners that can’t allocate resources to MEV strategies, ultimately leading to increased centralization. This concern is not relevant for other models of layers, such as rollup concepts, where MEV is isolated to the layer’s sequencers. As on Ethereum, this L2 sequencer MEV typically does not trickle down to L1 validators.

Hashrate

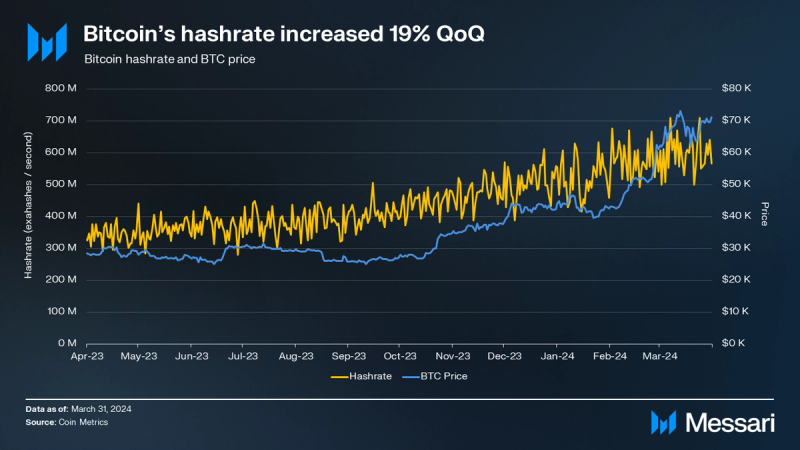

The economic effects of the Q2 2024 issuance halving will be especially relevant in the context of hashrate. As hashrate grows, miner profitability decreases (assuming a constant BTC price). Hashrate represents the security of the Bitcoin network. It increased 19.0% QoQ in Q1.

As Bitcoin programmability gains more interest and the ecosystem grows, hashrate has become increasingly commoditized. Marathon, a large mining company, launched Slipstream to allow customers to rent Marathon’s hash power and create their own blocks. It can also be described as private-mempool-as-a-service and has proven to be profitable. Other miners are also exploring this service, including Terra Pool. There are also decentralized hashrate marketplaces popping up, such as the Lumerin DEX on Arbitrum. This strategy of accepting fees for non-standard block building, also known as out-of-band fees, is not new to mining, there are just new incentives for it

The demand for such a service has grown with increased usage of inscriptions and meta-protocols based on inscriptions, such as Ordinals. Users have been circumventing Bitcoin Core’s standardness rules by using a hashrate provider (miner) directly to create blocks. For example, a single 3.9 MB transaction would violate the standardness rules of Bitcoin Core (the primary client software for running Bitcoin nodes) and not be picked up through the mempool, but would be perfectly acceptable according to the consensus rules of the Bitcoin network itself.

Censorship

A side effect of inscriptions is UTXO state bloat, which can indirectly lead to concerns over decentralization, and in extreme cases, censorship as a response. The number of UTXOs on Bitcoin has increased 102% since the beginning of 2023 to over 170 million. Part of the growth comes from BRC-20s creating a new UTXO with each transfer, which contributes to growing unprunable UTXO sets. Because this state bloat requires more physical resources from full nodes, it could ultimately affect decentralization (i.e., the ability of the average user to operate a node).

Due to the state bloat effect on the network and the general introduction of new asset types, some members of the Bitcoin community see inscriptions as spam and an attack on Bitcoin. Not all Bitcoin spam (i.e., fun) is built the same, but it is similarly rejected by certain users. The OCEAN mining pool raised money in Q4 2023 and announced it would be filtering/censoring inscription transactions, which it sees as an attack on the network. However, other transaction types, such as coinjoins, also fit their criteria and are excluded by the pool.

The OCEAN pool has only created a couple of blocks, but it represents how divided the community is on inscriptions. The Monero community had already successfully implemented a patch back in Q2 to reduce the amount of space available and effectively disable the minting of NFTs on its own network. Other networks faced their own “issues” with BRC-20-inspired tokens. Avalanche, NEAR, Solana, and others have experienced major activity spikes, and Toncoin and Arbitrum even had outages. BRC-20s on Bitcoin can be filtered out, front-run, or forked away, but the majority of the Bitcoin community appears to be interested in keeping the asset class around. This sentiment is evidenced by network activity metrics, community sentiment, and miner fees accepted.

Historically, Bitcoin has seen many versions of censorship apart from OP_Return debates. Major mining pools have been found to comply with OFAC sanctions many times. However, there is an important difference between a miner not including certain transactions in their own block and a miner refusing to build on another miner’s block that included the “banned” transactions. The latter could ultimately break consensus stability. In Q4, OFAC-censored transactions have been missing or had the blocks containing them orphaned by some of the largest miners, which poses a more serious concern for Bitcoin’s neutrality.

Token Analysis

Bitcoin saw new innovation in 2023 through inscriptions, leveraging the SegWit and Taproot upgrades. Ordinal Theory, created in late 2022, birthed the first inscription-based meta-protocol, Ordinals. Ordinals exploded in popularity and revealed a serious appetite for NFTs, memecoins, and overall added functionality in the Bitcoin ecosystem.

Ordinals index individual satoshis (sats) as well as any arbitrary data (images, text, etc.) inscribed on them, effectively creating entirely onchain NFTs. Alternative BTC-derivative asset types, either based on Ordinals or inspired by them, came shortly after. BRC-20s are ‘fungible’ Ordinals. Due to the inherent nonfungible nature of sats (when indexed) and the account-based accounting model used to index them, they’re more accurately non-fungible, like fractionalized shares of an NFT.

BRC-20s

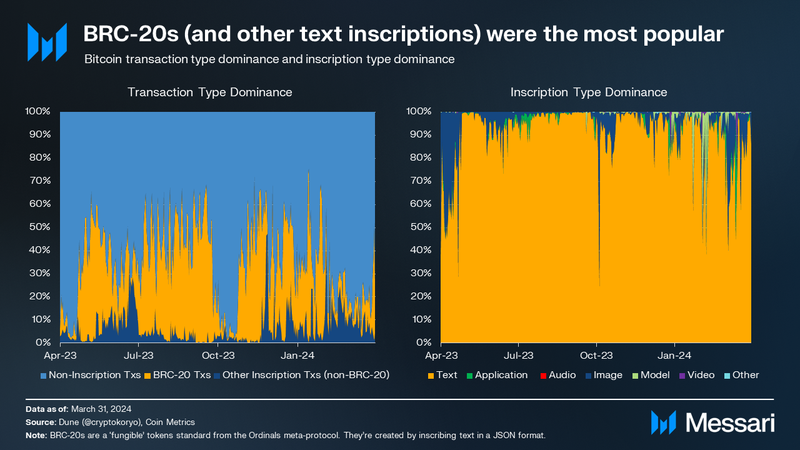

Average daily inscription transactions decreased 40.4% QoQ. However, daily inscriptions were still up 1,464.3% YoY. Even though alternative asset types and token standards, such as Stamps, do contribute to the activity, BRC-20s have been the primary driver of overall inscription activity. Their dominance declined in Q1 for the second quarter in a row, as BRC-20 transactions decreased 51.1% QoQ and other inscription transactions increased 14.2% QoQ.

As of the end of Q1, ORDI was the largest BRC-20 token by market cap, ranking 93rd among all networks (down from being in the top 50 in Q4 2023). Several marketplaces exist for Ordinals (both BRC-20s and NFTs) such as MagicEden, Unisat, and ALEX’s B20 DEX — with many more in development.

The urgency surrounding BRC-20 token launches has created high-fee environments as users seek to outbid each other. Certain inscription types, such as images, are disproportionately expensive (relative to text). However, due to their higher volume and mint behavior, BRC-20s are still the inscription type that contributes most to total inscription fees.

NFTs

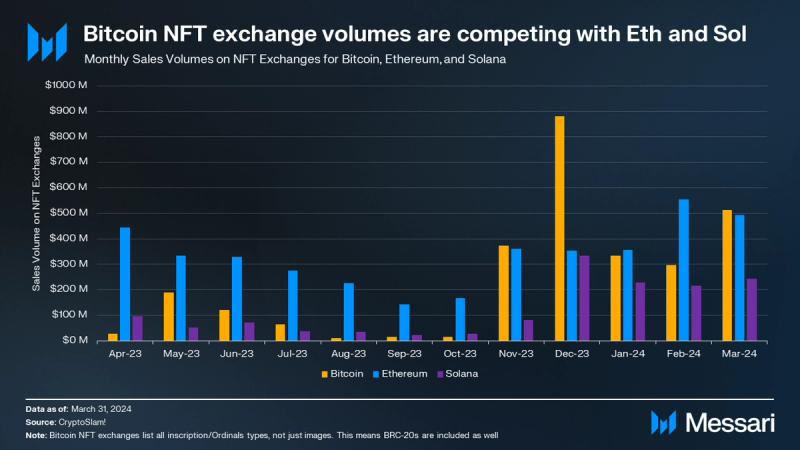

In terms of daily transaction volume, Bitcoin NFT exchanges are already competing with, and even exceeding, the established NFT ecosystems on Ethereum and Solana. Bitcoin has yet to challenge these other networks in other NFT metrics, such as daily transactions (8,000 on Bitcoin versus 25,000 on Ethereum and 117,000 on Solana in Q1) or unique buyers/sellers (5,000 on Bitcoin versus 9,000 on Ethereum and 17,000 on Solana in Q1).

As BRC-20s are also Ordinals, they’re sold on some NFT marketplaces and included in some NFT metrics. However, BRC-20s are treated by many users as fungible and therefore may be more accurately compared to DEX volumes. Bitcoin’s NFT sales volume wouldn’t even crack the top 10 among all networks’ DEX volumes so far in 2024.

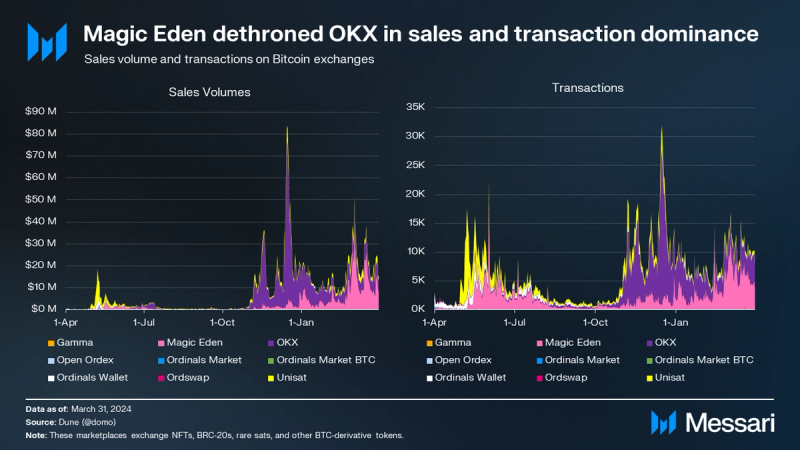

In Q1’24, Magic Eden emerged as the dominant Bitcoin marketplace in terms of both sales volume and transactions. Magic Eden’s sales volume and transactions increased 641% and 221% QoQ, respectively. The top NFT collections by market cap are NodeMonkes and Bitcoin Puppets, at 4,700 BTC and 2,400 BTC, respectively. Both are profile picture (PFP) projects, although the latter has an accompanying BRC-20, PUPS.

Other collections also launched with specific goals. The Quantum Cats project was launched by Taproot Wizards with the express purpose of funding and organizing a Bitcoin soft fork. The project aims to drive discussion and adoption around an opcode (i.e., an instruction in Bitcoin Script) for concatenating other instructions, op_cat, and then ultimately integrating it. This approach is a unique medium for coordination around a technical upgrade and circumvents parts of the traditional path of a Bitcoin Improvement Proposal (BIP).

Some Ordinals builders have innovated with inscriptions. The limitations in Bitcoin programmability have driven creativity among builders, rather than stifle it. Endpoints and attributes cannot be changed on Ordinals, but they can be made dynamic through commitments and “recursion.” Commitments involve including a symmetrically encrypted attribute later revealed onchain, similar to posting commitments for verifiable random functions. By choosing whether to reveal commitments, tokens can “evolve” and be directed through preset paths. Dynamism can also be achieved through recursive inscriptions and reinscriptions. Recursive inscriptions are a misnomer, as they’re not truly recursive, but they can point to another inscription for their attributes. Reinscriptions involve adding more data to an inscription but cannot overwrite data. Reinscribing on a sat that’s used as an endpoint for a recursive inscription allows the network to be used as a dynamic, write-only database.

Runes

Runes are a highly anticipated new fungible token standard that will launch at the halving in April. Unlike BRC-20s, Runes operates in a UTXO model (the accounting model Bitcoin uses) rather than an account-based model. This enables more flexibility and theoretically introduces the ability to integrate Runes tokens into state channels like Lightning Network or client-side validated (CSV) environments like RGB.

Runestone, currently the largest Ordinal collection by market cap with 5,300 BTC, is a placeholder project for a Runes token. There are also other placeholder projects built on current standards, such as RSIC.

With the high value of Runes placeholders and Ordinals projects in general, there’s speculation that the first block of the new epoch (at the halving in April) will be reorganized (reorged), as a form of MEV. A reorg involves a new longest chain being discovered due to multiple miners creating blocks at the same time. In the case of the halving, a reorg could happen due to a miner intentionally building atop their own initial halving block that they know wasn’t first. Doing so would build a longer chain that could overtake the consensus longest chain. In this case, miners would forego rewards from multiple blocks in the process, but they could profit if users were to pay millions of dollars for block 840,000, the halving block.

The value proposition for owning rights to block 840,000 would be the right to create some of the first Runes tokens (and collect an Epic sat, explored further in the Rare Sats section). Early Ordinals projects became valuable simply for being early (e.g., sub1k and sub10k collections). Conversely, the cost of a reorg could make it an easy financial decision for miners with the resources. The concept of miners selling the rights to a block has already been established and formalized by various mining pools and companies, as detailed above in the Mining and Security section.

Rare Sats

Another outcome of Ordinal Theory was rare sats. Rare sats are satoshis with some history associated with them, almost like an organic NFT, with built-in metadata, fractionalized into shared that can be traded like fungible tokens. Because sats are tracked through a consensus method, users can recognize specific sats with special characteristics, such as belonging to certain wallets, being mined by certain people, or being spent in certain events. Rare sats relating to events or history include

- Pizza: sats from the 10,000 BTC used to buy two pizzas in 2010

- First Transaction: sats from the first Bitcoin transaction, where Satoshi Nakamoto sent 10 BTC to Hal Finney

- Nakamoto: sats mined by Satoshi Nakamoto

Other rare sats are not special because of their usage, but rather their positioning according to Ordinal Theory.

- Palindrome: sats whose Ordinal number is the same forward and backward

- Alpha: the first sat in a bitcoin

- Omega: the last sat in a bitcoin

- Epic: the first sat in the first bitcoin of an epoch

No Epic sats are currently listed for sale, but the first sats in each difficulty period (two weeks as opposed to four years for Epic sats) routinely sell for multiple BTC. A new Epic sat will be created during the halving in mid-April and will likely be extremely valuable on secondary markets. Situations like this one could also weigh into the feasibility of a reorg battle over the first block of the epoch, along with Runes.

Layer Analysis

The excitement and demand for programmability extended past base-layer meta-protocols and into the world of Bitcoin layers (i.e., protocols scaling or adding increased functionality to Bitcoin). BitVM opened the door for new bridging mechanisms and ideas for enforcing transaction validity. BitVM is a strategy for executing arbitrary computation anywhere and then verifying it on Bitcoin. It’s important to note that BitVM is an abstract protocol, not a specific instantiation of a protocol; builders can implement BitVM-style verification for various tools or protocols, such as bridges, Super’s 8-bit CPU and Tapleaf Circuits, or Blake3 hash lock verification.

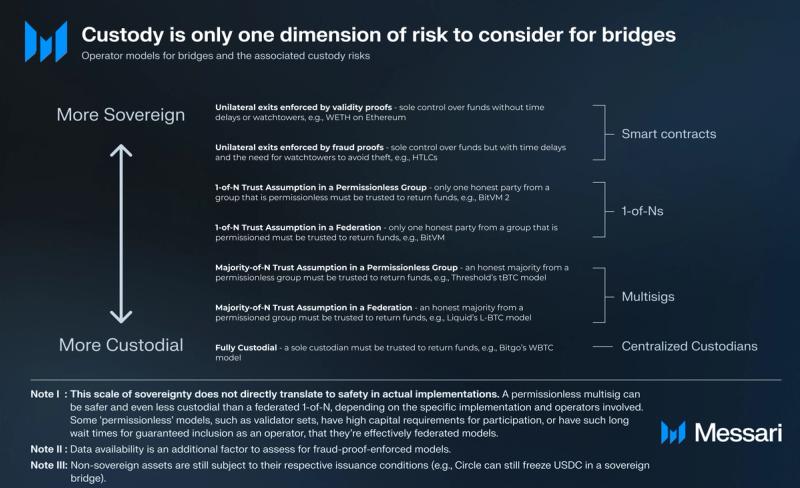

While certain dimensions of Layer-2s (L2s), such as data availability, are more straightforward, they still require some innovation to scale enough to support dozens of layers. Up until recent developments (i.e., BitVM), functions such as the aforementioned trustless bridging and enforcing transaction validity were believed by many to be impossible without a soft fork (i.e., a backward-compatible protocol upgrade).

This development has sparked a frenzy of Bitcoin layers, dubbed the “Bitcoin L2 Season.” The vast majority of Bitcoin layers today are not real L2s, with few exceptions like the state channel-based Lightning Network. Real L2s are primarily defined by unilateral exits. The rest are mainly sidechains working towards less custodial and more Bitcoin-integrated models, such as rollups, as the technology becomes available.

Programmable Layers

In Q1, Incumbents Rootstock and Stacks led programmable layers in terms of TVL at $202 million and $179 million, respectively. Newer layers, BOB and Merlin, grew incredibly fast in Q1, with BOB exceeding $100 million in TVL in the first week of live deposits and Merlin ending the quarter with $92 million in TVL after launching in February. BOB is not yet live, but it does have a points program active with its deposits. Merlin had a similar strategy, launching a points program with deposits before going live. Other layers in mainnet include Core Chain, an EVM sidechain, and Liquid, a partially-programmable federated sidechain.

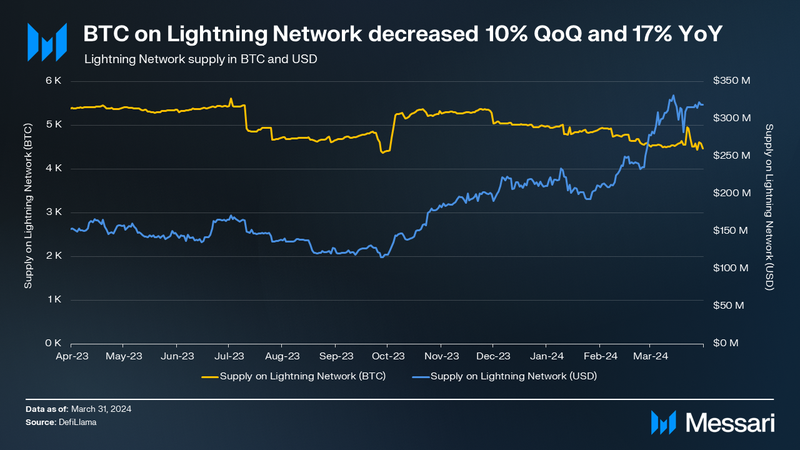

Much of this TVL growth has come from non-BTC assets, as Rootstock and Stacks only have about 3,000 and 300 BTC locked, respectively. This is far shy of Lightning Network’s 5,000 BTC and doesn’t come anywhere close to BTC locked on alt-L1s. Ethereum and TRON host nearly 300,000 BTC combined, with other networks such as Avalanche and BNB hosting several thousand each.

There are over 40 total layers either in mainnet, testnet, or only announced. Many layers, such as Citrea, intend to launch as rollups and are open-sourcing BitVM implementations along the way. Similar to the Ethereum L2 space, many projects — such as Bitlayer and Molecule — are exploring execution environments other than the EVM, such as Cairo or the Solana VM. Even mining companies are getting involved, as Marathon announced its own layer, Anduro.

Ultimately, there is still plenty of work to be done before achieving true Bitcoin rollups. BitVM is currently the most anticipated strategy, but it still doesn’t enable unilateral exits. The first iteration of BitVM detailed a strategy for a bridge with a federated 1-of-N trust assumption. More recently, in March 2024, BitVM 2 was presented, which would enable a permissionless 1-of-N trust assumption. The model would be a significant improvement in risk and custody, as permissionless verification is closer to the optimistic / fraud-proof model popular on Ethereum.

BitVM is not a silver bullet for trust-minimized bridging, and a BitVM-based bridge has yet to reach production while the community still explores the sustainability of various models. Additionally, soft forks are being explored for several functionalities (e.g., CAT, CTV, TXHASH, and CSFS), which would enable covenants and other ways to easily activate real L2s. Even so, any new functionalities would be complementary to existing strategies, not rivalrous. Considering how notoriously difficult it is to organize a fork on Bitcoin, BitVM remains one of today’s most promising routes toward more-sovereign bridges.

Lightning and State Channels

First introduced in 2015, Lightning Network’s state-channel-based scaling approach has gradually become the most popular scaling solution. Lightning uses built-in features on Bitcoin L1, such as multisigs and hashed timelocked contracts (HTLCs), to facilitate the locking and unlocking of BTC with unilateral exits.

Lightning saw increased adoption from custodians in 2023. While this increases accessibility to users, it also contributes to Lightning’s already high centralization. Over 90% of transfers and addresses are facilitated through centralized solutions, with self-custody and self-hosting proving to be too cumbersome for many users.

Lightning exists at the top of the “Bitcoin L2 Trilemma,” as an offchain network. On offchain networks, the risk of self-custody and self-hosting is that users would lose funds if they go offline. Hedgehog is an alternative state channel model that supports asynchronous payments, alleviating some of the aforementioned issues. There are also other models that iterate or improve on aspects of Lightning, such as Ark which offers privacy.

A Bitcoin/Lightning developer disclosed a class of vulnerabilities referred to as replacement cycle attacks in October 2023. To fix these vulnerabilities, a soft fork would be required. Even without the additional functionalities (e.g., smart contracts or privacy) that most other Bitcoin layers aspire to deliver, Lightning has protocol issues of its own to deal with.

ETF Analysis

Nine new Spot ETFs and one ETF conversion were approved and launched on January 10, 2024. The events marked a pivotal moment in BTC’s legitimization by the U.S. government and traditional finance. The ETFs have been wildly successful by almost any standards, pulling in over $12 billion in inflows in the first month.

In under a week, BTC ETFs surpassed silver ETFs in AUM but are still far behind gold ETFs, at $90+ billion. Institutions were eclipsed next, as MicroStrategy — the largest institutional holder — only holds 215,000 BTC.

In total, the ETFs had $12.4 billion in inflows in Q1, or 212,000 BTC, bringing the total AUM to 831,488 BTC. Ignoring GBTC, which had already existed as a BTC Trust, the new nine ETFs took in 493,807 BTC in Q1. Access to the ETFs will only grow throughout the rest of 2024, as advisors will gradually be permitted to sell these new funds to clients.

For reference, all ETFs combined had roughly $598 billion in inflows during 2023. IBIT and FBTC, the two highest-performing BTC ETFs, had $13.9 billion and $7.5 billion in inflows in Q1 2024, respectively. While there are hundreds of live ETFs, only nine pulled in at least $12 billion in inflows for the entirety of 2023, let alone a single quarter.

Of those top nine ETFs by inflow from 2023, here’s how they did in Q1 2024:

- VOO: $23.9 billion

- IVV: $13.9 billion

- VTI: $8.0 billion

- AGG: $4.8 billion

- BND: $3.4 billion

- JEPI: $1.6 billion

- RSP: $1.2 billion

- TLT: -$0.35 billion

- SPY: -$9.1 billion

The ETF issuers have had varying levels of onchain activity, but in general, TradFi incumbents are truly paying attention. After receiving community feedback, the Bitwise team upgraded the wallet format used for funds. With its onchain addresses posted publicly, multiple users actually sent sats to it. The team announced that sats sent to their addresses would be added to NAV and accrue to shareholders, with the exception of tokens coming from OFAC-sanctioned addresses. Bitwise, like nearly all other issuers, uses Coinbase as its custodian. Over 80% of BTC ETF assets are custodied with Coinbase, with the exception of Fidelity’s and VanEck’s funds.

The supplies on exchanges and held by miners decreased 1.7% and 0.5% QoQ, respectively. The AUM of BTC ETFs was roughly 50% of that of exchanges or miners, after only existing for a couple of months. These relationships may change after the halving, particularly for miners, who are collecting that issuance.

Closing Summary

Ordinal Theory emphasized the demand for added functionality, and then BitVM made expressive and trust-minimized L2s seem possible. These developments triggered the current renaissance of programmability in the Bitcoin ecosystem. In Q1, tokens on Bitcoin exceeded billion-dollar market caps, generated over $10 million in daily NFT sales volumes, and primarily drove network activity and fees.

Ecosystem builders are working to introduce more functionality through Bitcoin layers of various architectures. Miners are getting directly involved with the new revenue streams created from said programmability, with some even launching their own layers.

In addition to all of these new ways to utilize BTC on Bitcoin or other decentralized networks, TradFi is diving into BTC with the new spot ETFs, crushing other ETFs in inflows with over $12 billion in Q1. These utilization methods are likely to see continued adoption in 2024 as they mature and new institutions get involved.