Key Insights

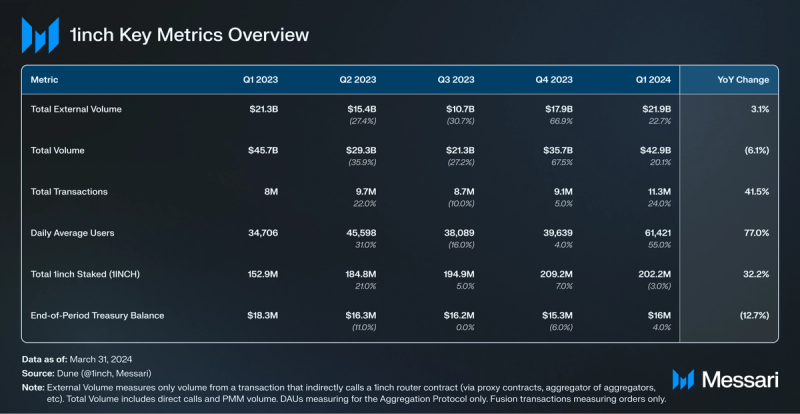

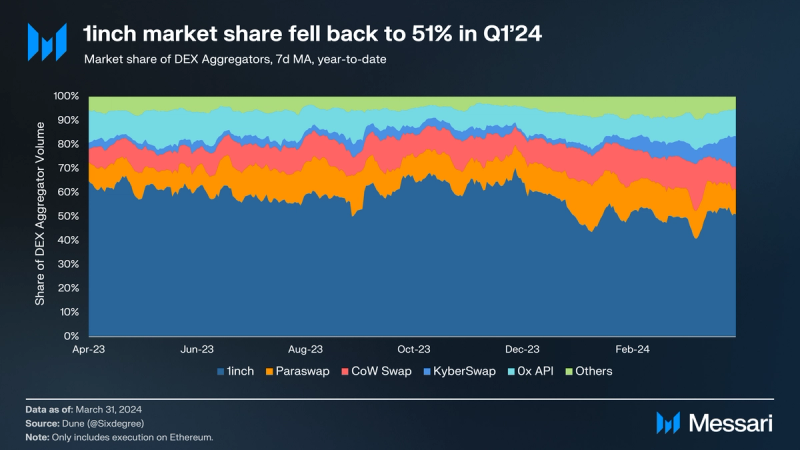

- 1inch increased volumes again in Q1’24 to nearly $43 billion, though its market share fell to 51% from 61% in Q4’23.

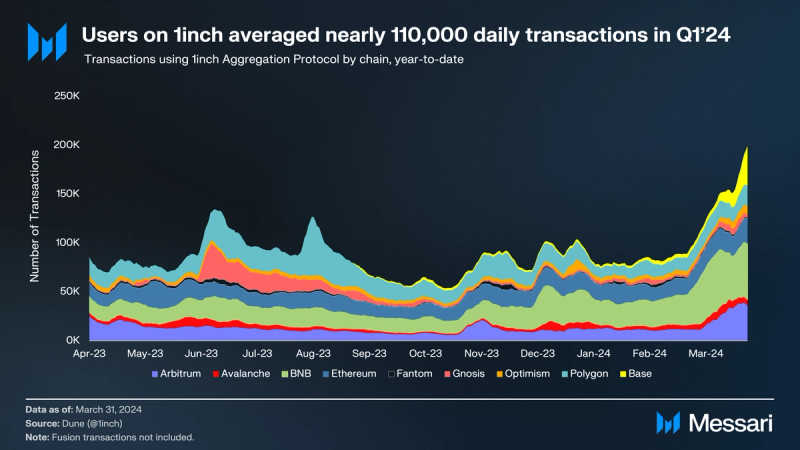

- DAUs surged in the first quarter, rising to over 61,000. The increase in activity was largely driven by the Aggregation Protocol, which averaged 107,000 transactions per day in Q1.

- Volumes on the Limit Order Protocol and Fusion rose by 33%, thanks to larger trade sizes as DAUs on those protocols fell QoQ.

- The DAO funded a legal advisor in the first quarter while also continuing to add key integrations like Velvet, Stripe, and Lido.

- The amount of 1INCH staked decreased over the quarter, and resolvers saw a new leader (Rizzolver) take over as market share leader. Over the last few quarters, the DAO made changes to increase resolver competition, and the changes appear to be paying dividends.

Primer

The 1inch Network (1INCH) is a decentralized finance (DeFi) DEX aggregator and intent-order protocol operating on Ethereum, Arbitrum, Optimism, Polygon, zkSync Era, Avalanche, BNB Chain, Gnosis, Fantom, Klaytn, and Aurora. Launched in 2019, 1inch Aggregation Protocol (AP) allows users to route trades across various markets and realize the best available rate compared to any individual decentralized exchange (DEX). In late 2020, the 1inch Liquidity Protocol introduced a native automated market maker (AMM) to the network, which enabled users to provide liquidity and earn passive liquidity mining rewards.

The network’s third product, the 1inch Limit Order Protocol (LOP), was introduced in June 2021 to support conditional limit and stop-loss orders with no fees. In late December 2022, the 1inch Swap Engine enabled Fusion mode, which is partially based on the existing tech, including the 1inch Limit Order Protocol and the 1inch Aggregation Protocol. This new feature empowers DeFi users to place orders with a specified price and time range without paying network fees. All three protocols, and Fusion mode, are governed by the 1inch DAO using the network’s native 1INCH token.

Note: This report includes data from Ethereum, BNB Chain, Polygon, Optimism, Arbitrum, Avalanche, Gnosis Chain, Fantom, and Base. Data from zkSync, Klaytn, and Aurora are currently not included. We are working to improve access to this data.

Website / X (Twitter) / Telegram

Key Metrics

Performance Analysis

Protocol Usage

As the leading EVM DEX aggregator by volume, 1inch benefits from increased trading activity in the space. Volumes in all three 1inch protocols increased QoQ. The Limit Order Protocol led the way with a 22.5% QoQ rise, rising to an all-time high of $7.9 billion. Fusion volume rose 19.1% to $6 billion, and volumes on the Aggregation Protocol increased 19.6% from the previous quarter to $29 billion. 1inch LOP and Fusion now account for 32% of 1inch volumes, but that volume is driven by fewer daily active addresses. DAUs on the aggregation protocol jumped 55% from Q4’23 to Q1’24, while DAUs on the LOP and Fusion actually fell close to 20% each. During the bull market frenzy, it’s possible that users looking for best execution were less price-sensitive. Rising volumes, however, showed that price-sensitive users traded larger volumes.

Aggregation Protocol volume growth was broad, with all EVM deployments but Polygon and Arbitrum growing average daily volumes QoQ. Aggregation Protocol volumes on mainnet increased by 25% to roughly $217 million per day. Base and Fantom were the leading percentage gainers, with average daily volumes increasing 210% and 183%, respectively. 1inch on Base traded over $7.7 million per day in Q1’24. Arbitrum and Polygon stand out on the other side of the spectrum, with daily average volume falling 6% and 60%, respectively. Arbitrum is still the second-largest 1inch instance, averaging over $38.7 million in volume per day in Q1.

Transactions on 1inch increased again in Q1’24. BNB remained the most active instance of 1inch. 1inch on BNB’s transactions increased from just under 25,000 transactions per day in Q4’23 to over 36,000 average daily transactions in Q1’24, a 60% increase QoQ. Transaction activity on Ethereum rose less, up 11% in the quarter, but it moved to the second most active chain as Polygon daily average transactions fell 20% to 14,000 per day. Overall, transaction counts increased on eight out of nine 1inch deployments in Q1’24.

The increase in activity was entirely driven by the Aggregation Protocol, as average daily transaction counts on both the Limit Order Protocol and Fusion fell in the first quarter. In Q1’24, 1inch saw over 107,000 daily average transactions in its Aggregation Protocol, up 34% from Q4’23. 1inch also averaged significantly more unique daily addresses transacting than in Q4’23. On average, over 61,000 addresses traded on the Aggregation Protocol across chains in Q1’24, up 55% QoQ.

LOP transactions fell over 12% in Q1’24, to just under 10,000 per day. The drop was almost entirely attributable to changes on Arbitrum, where transactions fell by almost 1,000 per day, or 43% QoQ. The Arbitrum divergence stands out because Aggregation Protocol usage increased dramatically while Limit Order Protocol usage fell dramatically. This dynamic could be highlighting the nature of users on the chain leaning into faster markets and wanting instant execution instead of potentially unfilled trades.

Fusion volumes grew 19% in the first quarter to $6 billion. Perhaps more notably, Q1’24 was the first quarter in which the 1inch Labs resolver was not the market share leader in terms of volume executed. Resolvers are a key part of Fusion, an intent-based DEX, as they execute the orders placed by users.

A new competitor, Rizzolver, began competing at the end of September 2023. It grew its market share to 28% in Q1’24, executing over $1.7 billion of Fusion orders. Along with its volume growth, Rizzolver has offered the highest APY to delegates. Competition from other resolvers also evened the market, with the top three resolvers execution share falling from 88% in Q3 to 83% in Q4 and down to 74% in Q1’24. The increased competition is great for traders, and it might even be early signs of success of the new rules implemented by the DAO last quarter around lower delegation minimums and putting a cap on gas bidding.

Market Share Analysis

In the first quarter, the share of 1inch trades executed on Uniswap V3 and V2 increased to over $12.8 billion or 47% of 1inch Aggregation Protocol volume. The mix changed slightly, with V3 volumes rising 34% to over $11 billion and V2 volumes falling 6.5% to $1.6 billion. On the back of the increased activity on BNB, PancakeSwap was the largest percent gainer in the quarter with volume increasing 74% to $2.6 billion. In general, the winners continued to gain market share. The top five protocols executed 77% of 1inch volume in Q1’24, up from 72% in the fourth quarter of 2023.

1inch continued to lead DEX aggregators after carrying 61% market share of 2023 volume. However, first-quarter market share of volume was lower than any quarter last year, falling to 51%. 1inch’s main peers all grew significantly faster, QoQ. The four largest competitors grew volumes over 70%, despite starting from a significantly lower base. Combined, the top four aggregators accounted for 86% of volumes.

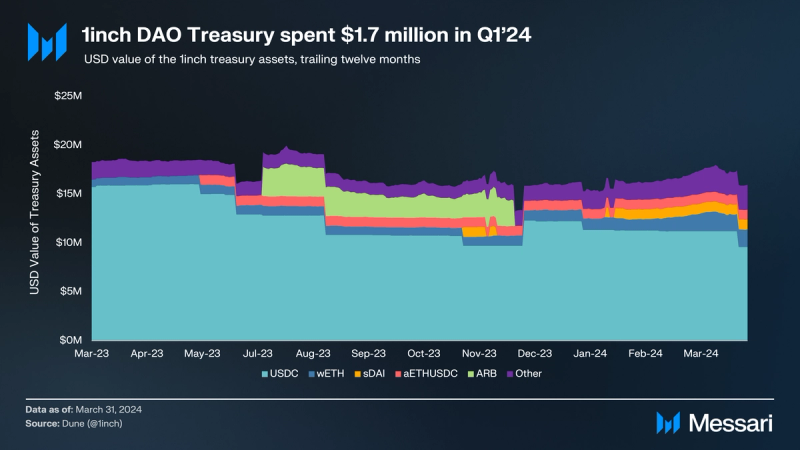

Treasury and Staking

The DAO continues to be mindful of spending while still allocating to growth opportunities for all 1inch users and participants. In Q1’24, the largest payment was the $1.6 million grant for events to continue promoting 1inch at crypto events. The two other large payments in the quarter were a $50,000 retainer fee for legal services and a $73,000 payment for a team to build an alternate, open-sourced front-end for swapping. Otherwise, treasury allocations did not change, and the DAO continues to benefit from interest earned from the $1 million in sDAI and $1 million in aETHUSDC.

After peaking at just under 210 million 1INCH staked in December of last year, the amount of 1INCH staked fell by 3% in the first quarter of 2024. Staking 1INCH gives Unicorn Power (UP), which can be used to vote in governance and delegate to resolvers. Staking and delegating to resolvers create an important value accrual pathway for the token: resolvers give 1INCH rewards to attract delegates so the resolvers can compete in completing Fusion transactions. Some upcoming resolvers like Kinetex Labs and Laertes have paid out over 57,000 1INCH to delegates to help grow their delegation.

Qualitative Analysis

Retainer for Legal Services

The proposed services for 1inch DAO by STORM Partners aim to provide comprehensive legal support tailored to the decentralized and blockchain-based ecosystem. Some operational challenges include navigating cross-jurisdictional regulatory compliance, establishing contractual agreements, formulating a governance framework, addressing members’ liability, and protecting intellectual property, among others. The history of decentralized autonomous organizations (DAOs) is fraught with legal uncertainties due to their novel operational structures that defy traditional legal classifications. As a result, some protocols have turned to specialized legal services that can adeptly navigate the evolving regulatory landscape and safeguard the interests of these innovative entities.

The importance of these services for 1inch DAO cannot be overstated. In the rapidly evolving world of blockchain and decentralized finance (DeFi), DAOs like 1inch face multifaceted legal risks, including regulatory compliance issues, potential member liabilities, and the enforcement of rights and contracts. The services provided by STORM Partners are designed to mitigate these risks, ensuring that 1inch DAO can maintain operational resilience, protect its stakeholders’ interests, and continue its mission to disrupt traditional financial systems. This proactive approach to legal challenges is crucial for the longevity and success of DAOs in a landscape with developing legal precedents.

1inch DAO’s engagement with STORM Partners signals a broader recognition of the need for robust legal frameworks and professional guidance in DAOs and the wider blockchain community. This move also reflects a maturation of the sector. While acknowledging that decentralization offers new opportunities for autonomy and efficiency, 1inch has acted upon the need for a sophisticated understanding of legal and regulatory obligations. This trend towards seeking legal advisory services may set a precedent for other DAOs, indicating a shift towards more structured governance and operational models. This evolution is essential for the broader acceptance and integration of DAOs into the existing socioeconomic fabric, ensuring their sustainability and growth in the long term.

Key Integrations

The 1inch protocol has made significant strides in expanding its ecosystem and enhancing its utility through a series of strategic integrations. Starting on January 26, the 1inch Wallet for Android announced an integration with Stripe. The move introduced a fiat onramp that significantly eases the process for users to convert their fiat currency into crypto directly within the wallet. In addition, the integration broadens access to DeFi services for a wider audience and for builders to use one of the fastest-growing existing payment providers.

Following this, a series of integrations with various DeFi platforms were announced, including Velvet on January 30, THORWallet on the same day, Kinetex on February 8, and Apsis on February 12. Each of these partnerships brings unique value to the 1inch ecosystem. For instance, Velvet’s integration allows for optimized asset management services; THORWallet enhances the wallet’s functionality; Kinetex introduces advanced trading capabilities; and Apsis incorporates the 1inch Swap API for improved swap functionalities. These integrations collectively enhance the 1inch protocol’s utility, making it a more versatile and powerful tool for users across the DeFi landscape.

The integration with Lido on February 21 marks a significant milestone, providing liquidity solutions for users looking to convert stETH/wstETH to ETH. This collaboration addresses a critical need within the DeFi community and offers a seamless solution for liquidity. Ultimately, it will help enhance the overall efficiency of the Ethereum staking ecosystem. These developments signal a broader trend towards more sophisticated and interconnected DeFi services. With these steps, 1inch has not only expanded its reach but also played a pivotal role in shaping the future of decentralized finance.

Closing Summary

1inch usage grew across the board in the first quarter of 2024 with total volumes rising to $43 billion. Unlike Q4, where only volumes showed life, Q1 saw DAUs and the number of transactions jump meaningfully in the 1inch Aggregation Protocol. Larger trades drove the increased volume in the Limit Order Protocol and Fusion. However, 1inch’s peers grew faster in the quarter, bringing 1inch down to 51% DEX aggregator volume market share. The treasury is steady in value, spending under $2 million in the quarter with no new asset allocation decisions. As the DAO and product continue to grow and mature, they have brought on legal services through STORM Partners and attracted large integrations with the likes of Lido and Stripe. Time and again, 1inch has capitalized on the surge in onchain activity.