Today, the price of Bitcoin has returned to $67,000: the analysis of the movements of the last few days indicates that it has stopped being negatively influenced by the trend of Ethereum.

The price of Bitcoin today: the complete analysis

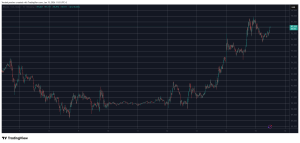

Today, Friday, July 26, 2024, the price of Bitcoin has returned above $67,000.

It is the exact same level it had on Tuesday before the launch on the USA stock exchanges of the new ETH on Ethereum spot.

Just on Tuesday, after this launch, the price of BTC had dropped to $66,000, but the next day, that is yesterday, it had dropped even further.

Thursday the 25th in fact had dropped to $64,000, with a brief dip to $63,500 that quickly recovered.

In reaction to that brief dip below $64,000 yesterday, the price of Bitcoin had returned to $65,000, and during the night it first climbed back to $66,000 and then this morning even to $67,000.

In fact, it has drawn a short and contained descending parabola that lasted only three days, and then recovered in less than 24 hours.

The price of Ethereum

To understand the price dynamics of BTC mentioned above, it is necessary to analyze what happened to Ethereum in the same period.

Tuesday, before the launch of the new ETFs, the price of ETH was around $3,500.

On the launch day, there was a small drop that brought it just above $3,400, and this level held even for the following day, Wednesday.

Yesterday, however, the $3,400 level did not hold anymore, and the decline extended to $3,100.

Even the price of ETH bounced back last night, but it did not manage to get much above $3,200.

On the contrary, the current price is 6% lower than it was just before the launch of the ETF on the stock exchange, while Bitcoin, as mentioned earlier, has erased all losses since then.

The problem of Ethereum

The problem that caused the price of ETH to drop, and did not allow it to return to $3,500 today, are the sales of the new Grayscale ETF (ETHE).

This new ETF is actually the transformation of a fund that has existed for seven years into an ETF, and which had 11 billion dollars of ETH before hitting the stock market on Tuesday.

With the transformation into an ETF, it was finally able to start liquidating any excess ETH in its portfolio on a daily basis, something it couldn’t do before. And so on the first day, it recorded outflows of over 480 million dollars, the second day almost 330, and the third day, yesterday, more than 340.

In total more than 1.1 billion dollars of outflows in just three days.

On the first day, all ETHE outflows were largely absorbed by the other new ETFs, but already on the second day, they failed to absorb about 133 million. Yesterday, they failed to absorb 152 million, and so in three days, the total net outflows were nearly 180 million dollars.

These overall net outflows necessarily mean large sales of ETH, especially in the last two days, and this is why the price of Ethereum has dropped and has not yet managed to climb back to the levels prior to the landing on the US exchanges of spot ETFs.

The separation between Bitcoin and the price of Ethereum: today’s latest analyses

The trend of BTC price on Tuesday 23 was similar to that of ETH, and so was Wednesday 24.

To tell the truth, however, if you analyze the price ratio between Ethereum and Bitcoin, that is, the trend of ETH price expressed in BTC, you notice that on Tuesday it was slightly rising, driven by the success of the ETF launch, but by Wednesday it had already started to fall.

Wednesday 24 Ethereum lost all the appreciation it had gained the day before against Bitcoin.

Yesterday the turning point: the price of ETH in BTC dropped significantly, and this decline lasted until this morning. It had not been this low since May 20th that the price of Ethereum in BTC was so low.

But the definitive detachment of the two trends, although probably temporary, occurred today, with the price of Bitcoin at +6% from yesterday’s low, while that of Ethereum recovering only 4.5% from yesterday’s low, without even managing to return to Wednesday’s values.

Given that the sales of ETH by Grayscale’s ETF will most likely continue for a while, it is to be expected that this decoupling may persist for a few days, or even for a few weeks.

Moreover, today’s rebound, which already started yesterday, constitutes a clear sign of strength of BTC at this moment, and confirms the upward trend that should last until the beginning of August, even if slight.

Finally, it should not be forgotten that tomorrow at the Bitcoin conference in Nashville, Donald Trump will speak, and this seems to be bringing a bit of euphoria to the BTC market.