Gauging market sentiments is vital for planning your trades.

While many are familiar with the fear and greed index, it is often criticised for being a lagging indicator. Instead, the Put-Call Ratio (PCR) exists to provide a comprehensive way to gauge market sentiments.

The PCR is a powerful sentiment indicator that traders use to assess market optimism or pessimism by analysing the total number of put options versus call options traded on a given day.

This ratio is applicable across multiple asset classes and time frames. Understanding and leveraging the put-call ratio can provide significant strategic advantages for crypto traders.

Understanding the Put-Call Ratio (PCR)

PCR is calculated by dividing the total number of put options traded by the total number of call options traded, usually at the end of each day.

A put option is traded on the expectation that an asset will fall in price, while a call option is traded on the expectation of a price rise. Once the PCR is calculated, these are the key levels to watch:

- Ratios above 1: Signals a higher number of puts being purchased, indicating bearish sentiment.

- Ratios over 0.70 – 0.80: Often seen as a bearish threshold.

- Ratios under 0.50: Usually considered bullish.

When Do Traders Use the Put-Call Ratio?

Traders can use the PCR for various strategic purposes:

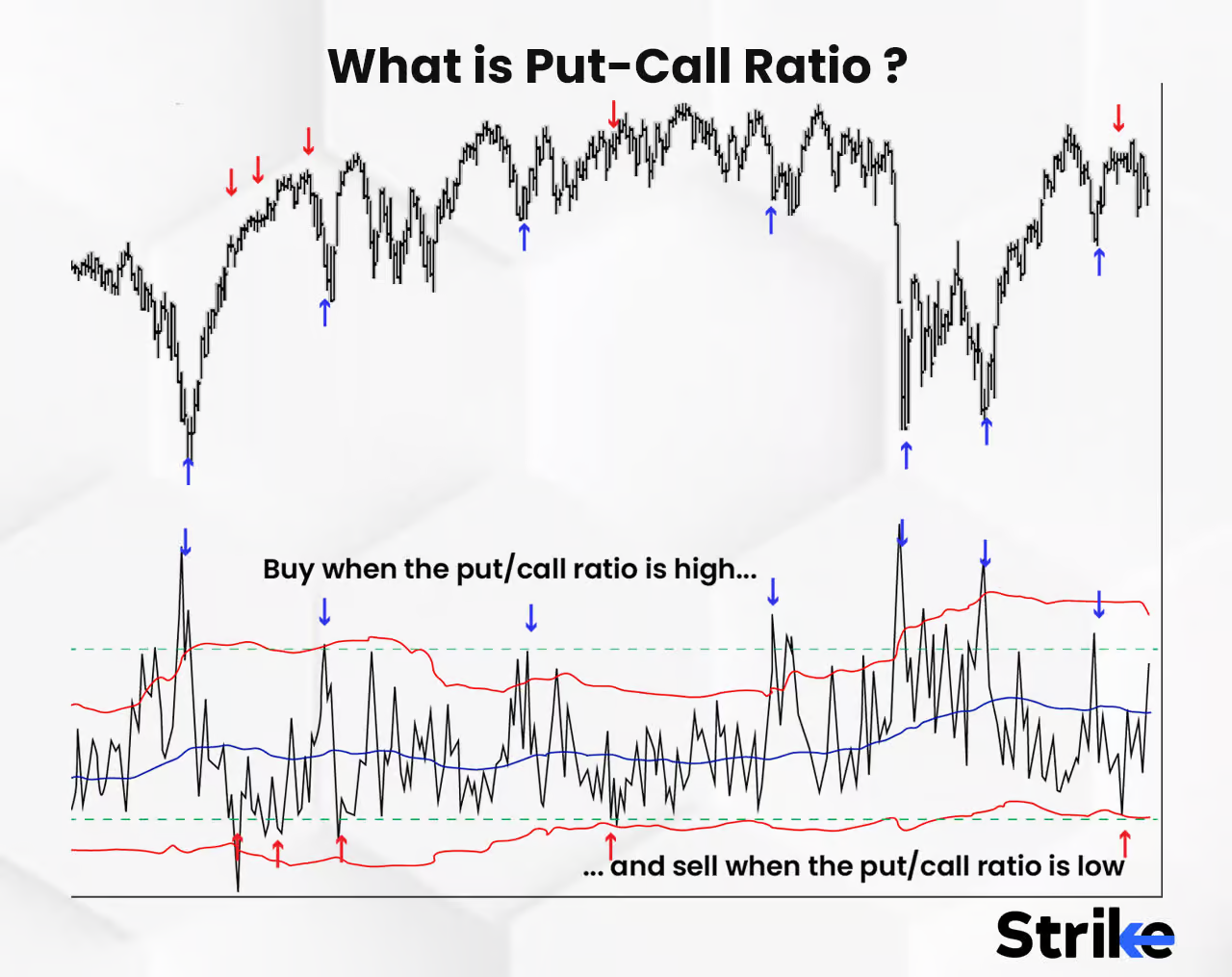

- Identifying Market Extremes: High PCRs near capitulation lows help identify climactic selling exhaustion.

- Trend Confirmation: Falling PCRs validate upside breakouts from trading ranges, while rising ratios confirm downside breakouts. This helps traders align with market momentum.

- Contrarian Trading: Traders often fade overcrowded trades when sentiment heavily tilts towards one side. For example, very low 10-day equity PCRs near 0.40 could mark euphoria, indicating it might be time to enter put options or short positions.

- Event Positioning: Leading into significant events like earnings reports or FOMC meetings, high PCRs can indicate conservative positioning and downside protection, potentially flagging a positive surprise and relief rally.

Below is a chart that shows how the PCR correlates with price action.

Key Takeaways

The put-call ratio, in its various forms, offers traders diverse advantages in identifying high-probability opportunities, planning risk management, confirming trends, anticipating volatility, and profiting from extremes in investor psychology.

While it is a robust standalone indicator, it becomes even more powerful when integrated into a complete trading strategy that includes open interest analysis. By understanding and leveraging the PCR and open interest, crypto traders can gain a significant edge in navigating the volatile and dynamic markets.

Theoreticals aside, if you wish to begin trading crypto derivatives or spot on BitMEX, you can find all our existing products here. For more educational resources on trading, visit this page.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements.

The post Mastering Market Sentiment: How to Leverage Put-Call Ratios and Open Interest appeared first on BitMEX Blog.