Unspent transaction outputs (UTXOs) are an integral component of Bitcoin’s structure, essentially serving as the building blocks of the blockchain. As its name suggests, each unspent transaction output represents a discrete unit of Bitcoin that hasn’t been spent, originating from the conclusion of a previous transaction. They form the foundation of Bitcoin’s ledger, tracking the specific outputs of transactions until they’re used in a new one.

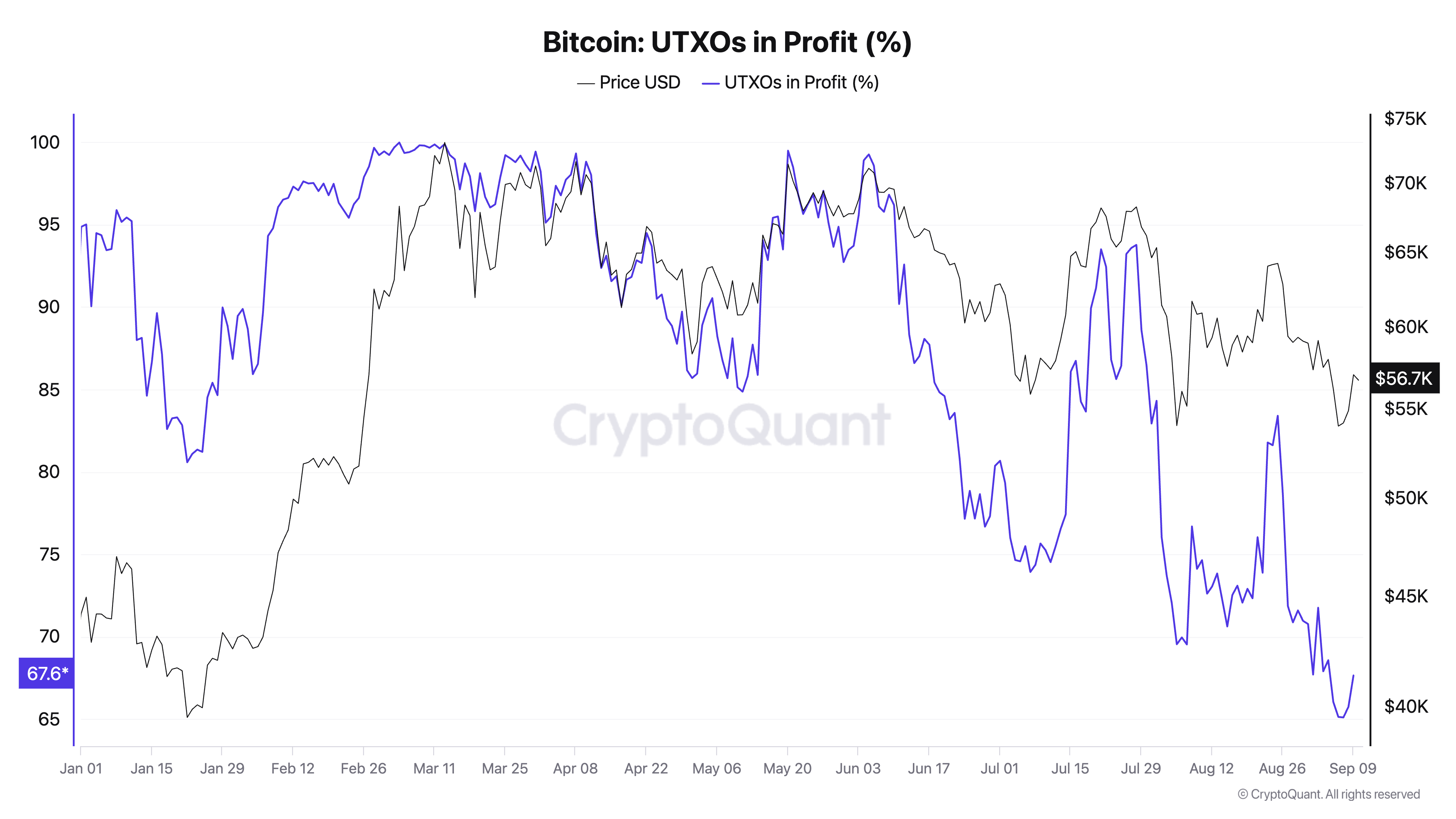

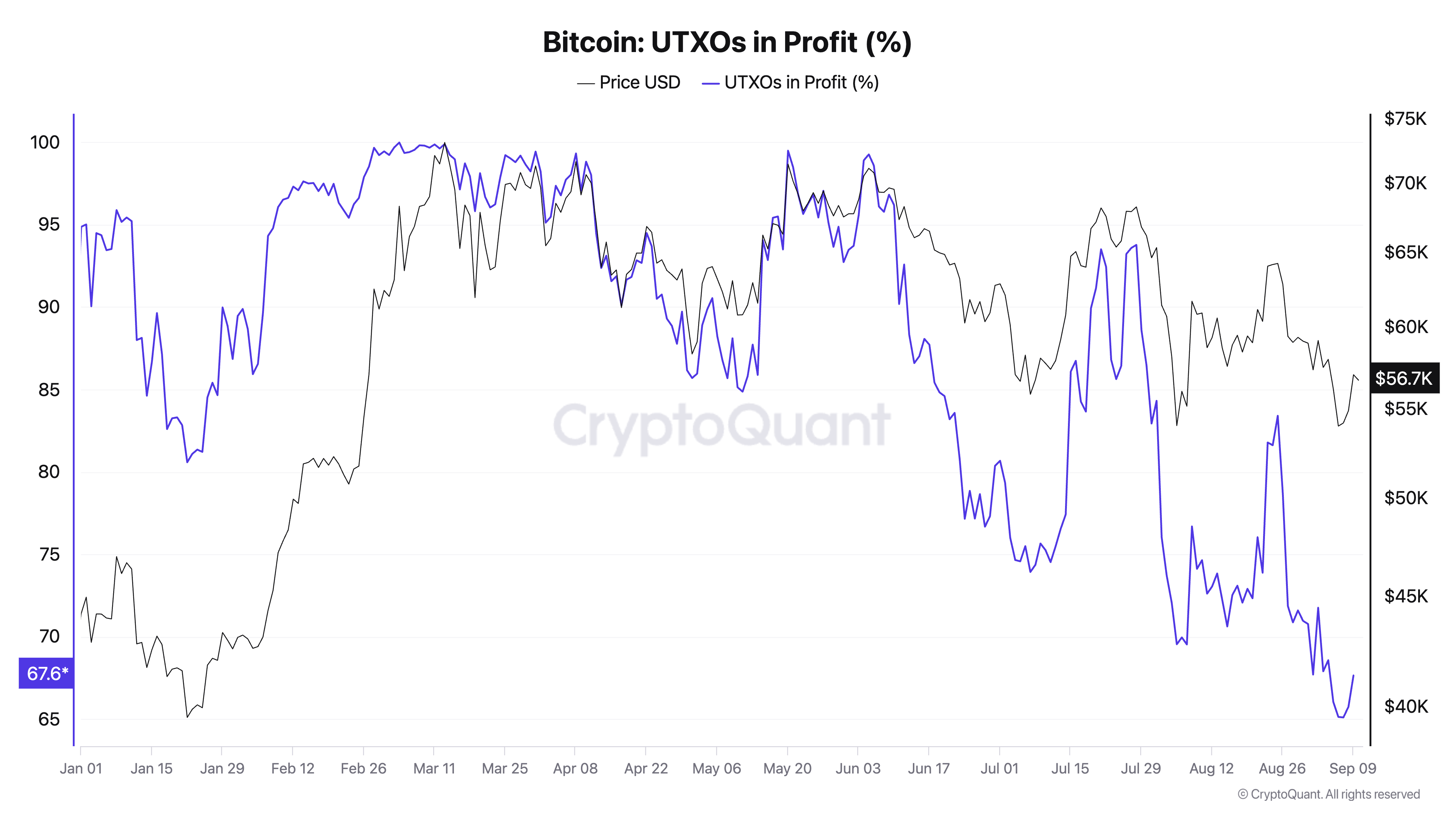

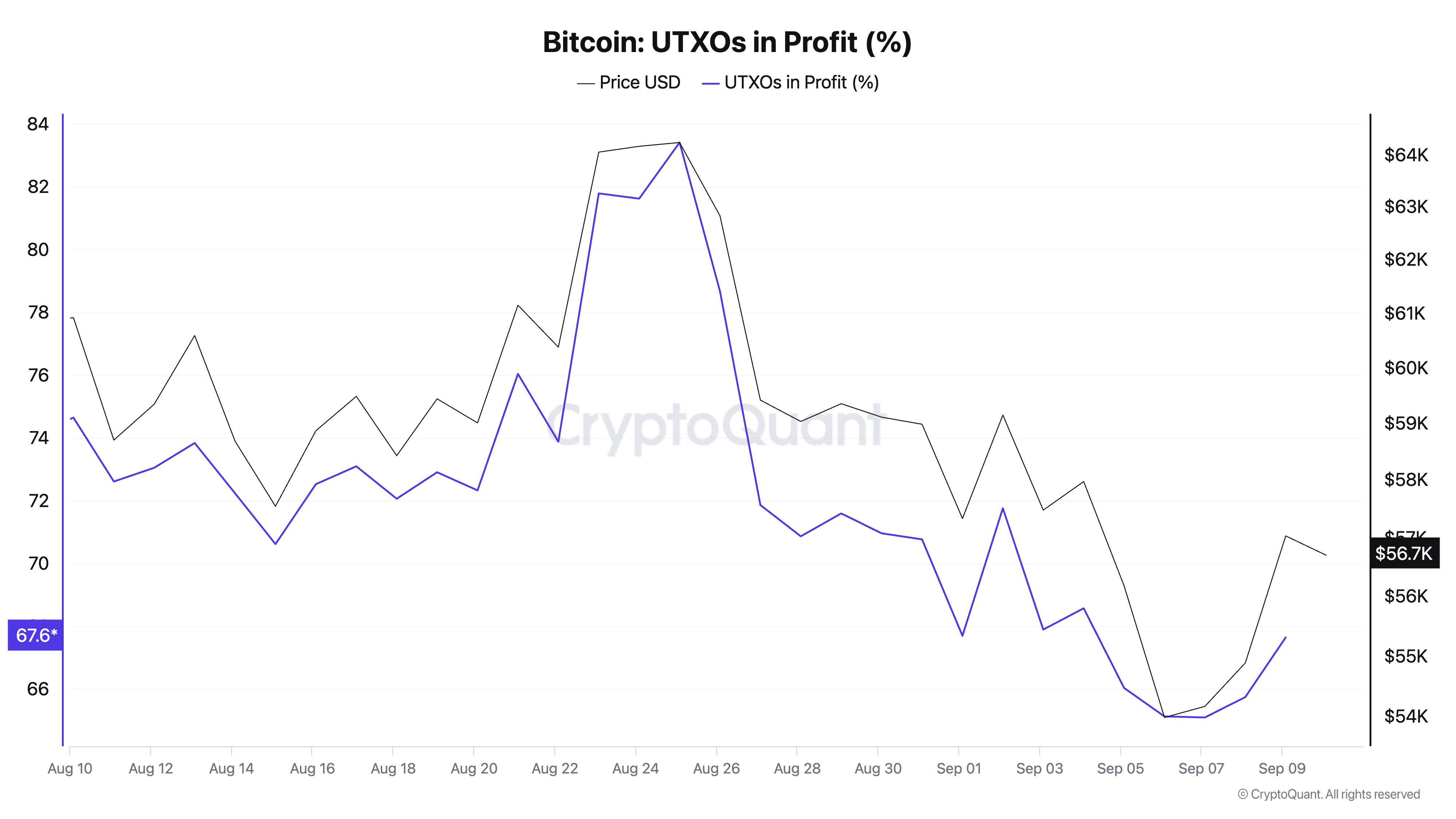

Analyzing UTXOs usually involves tracking whether they’re in profit, meaning the BTC associated with them was acquired at a price lower than its current value. Thus, the percentage of UTXOs in profit is a crucial indicator of market sentiment and the overall profitability of Bitcoin holders. A high percentage signals a strong market where most investors see gains, while a lower percentage points to losses and reflects a more bearish environment.

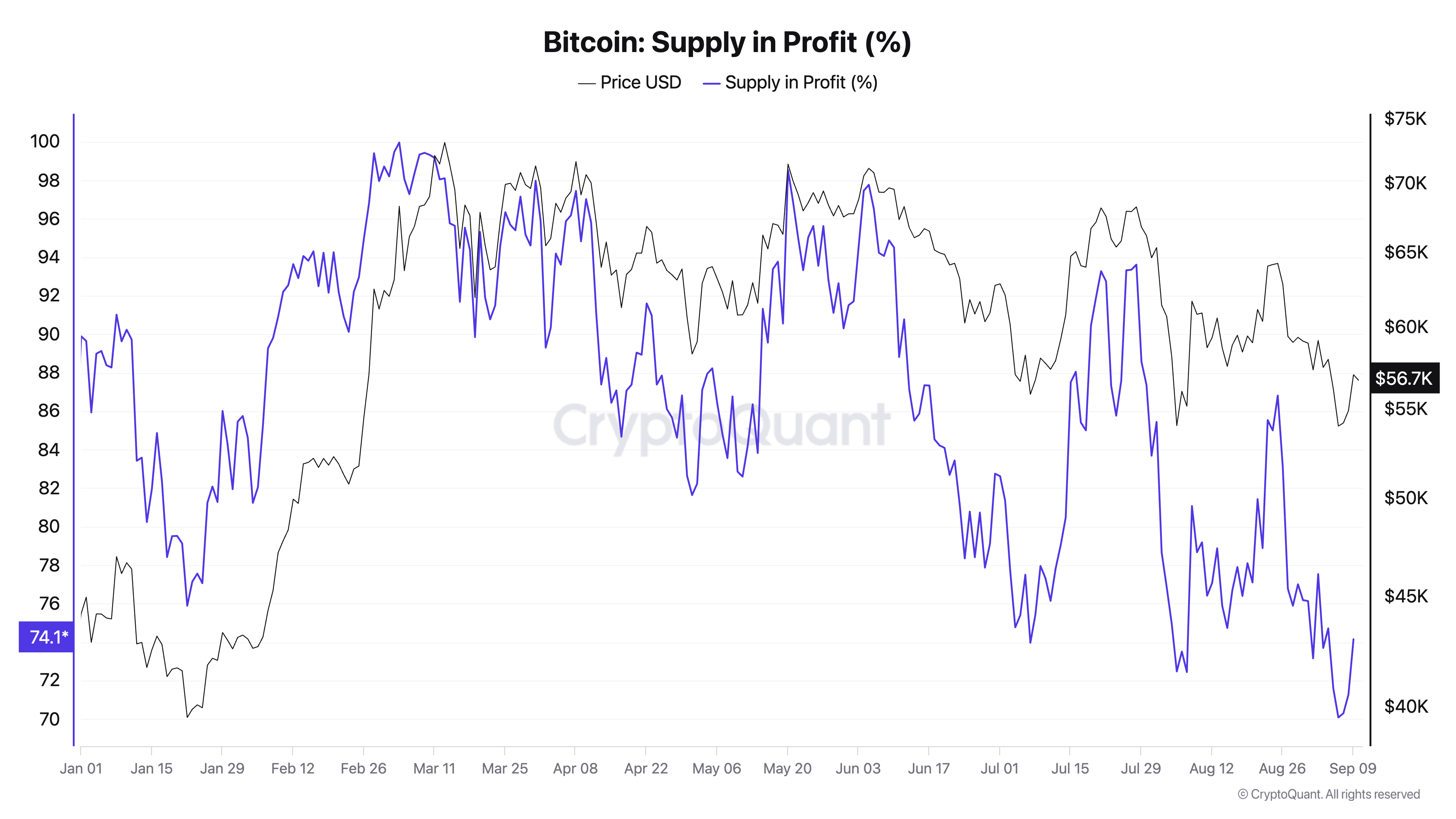

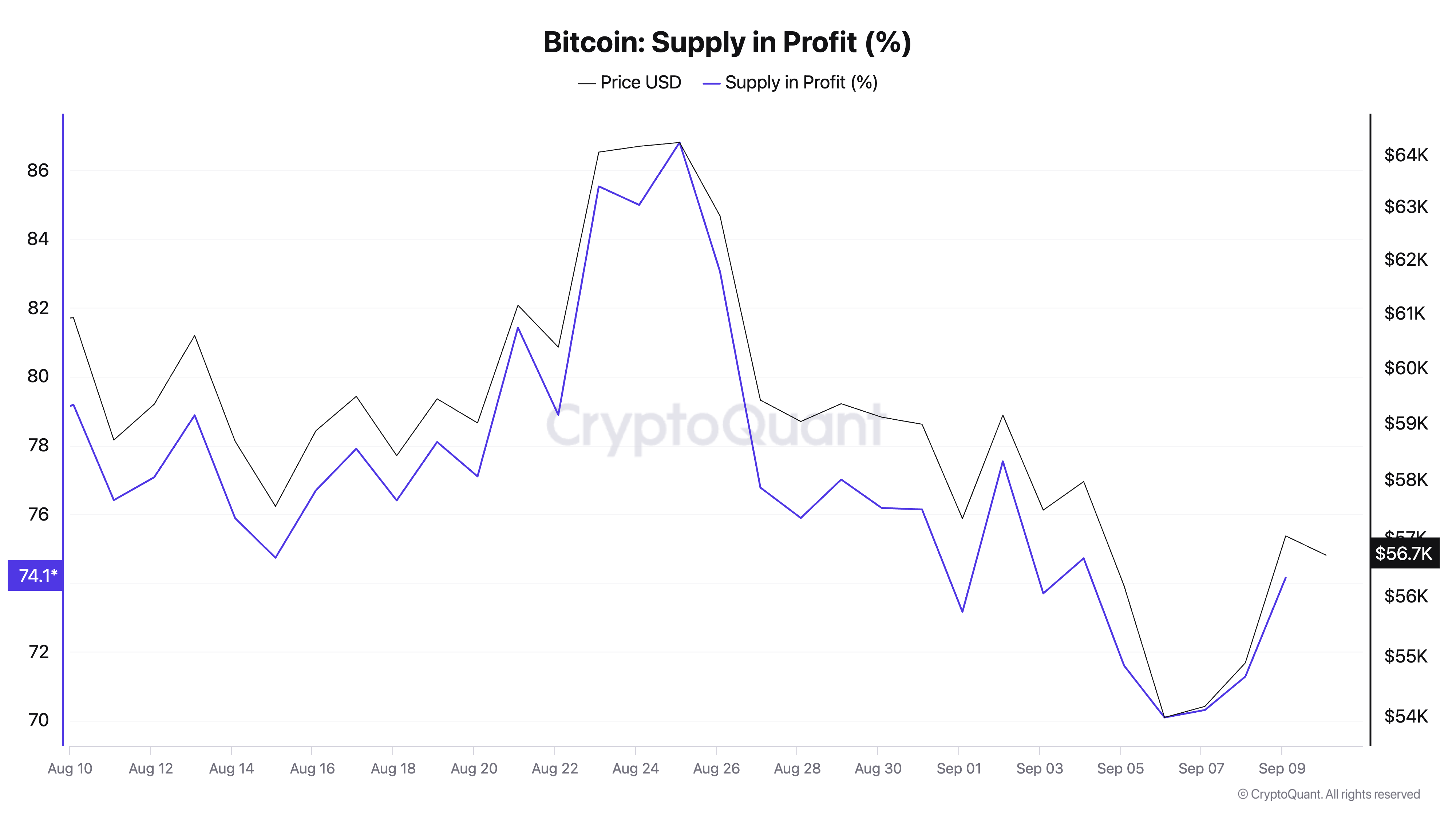

UTXOs differ from Bitcoin’s total supply in a critical way. While the percent of UTXOs in profit tracks individual transaction outputs, the percent of Bitcoin’s supply in profit looks at the total Bitcoin supply and whether the coins are currently above or below their acquisition cost. UTXOs can be numerous and reflect various sizes of Bitcoin holdings, from small fractions to larger amounts.

Conversely, when measuring supply in profit, the focus is on the aggregate volume of Bitcoin, treating the total supply as a whole rather than individual pieces of the blockchain ledger. This difference explains why the percent of UTXOs in profit can diverge from the percent of supply in profit—UTXOs, as smaller units, might be skewed by the activity of smaller traders. In contrast, supply in profit gives a broader picture of the overall state of the market.

For example, when Bitcoin’s price surged at the beginning of March, both UTXOs in profit and the supply in profit hit their year-to-date highs, with both metrics nearing 100%. At this point, nearly all Bitcoin, regardless of how it was distributed across UTXOs or in total supply, was in profit, reflecting the bullish environment that came with Bitcoin nearing $73,000. This period represents an optimal state for holders, with minimal losses and maximum market confidence.

Meanwhile, drops in Bitcoin’s price led to a drop in the percentage of UTXOs and supply in profit. The percentage of UTXOs in profit hit a YTD low of 65.09% on Sep. 7 when Bitcoin dropped to $54,170, while the supply stood slightly higher at just over 70%.

The divergence between these two metrics during periods of price volatility is telling. Given their sensitivity to transaction size and the frequency of movement in smaller amounts, UTXOs fluctuate more dramatically.

As prices drop, smaller holders or frequent traders who acquired Bitcoin at varying levels will likely see their UTXOs fall out of profit quickly. On the other hand, the total supply in profit metric remains somewhat more stable as larger long-term holders who acquired Bitcoin during earlier phases of the cycle may still see their positions in profit. This difference highlights the distinction between short-term market activity and the broader view of Bitcoin’s overall valuation.

Throughout the year, both metrics have closely followed Bitcoin’s price movement, peaking when prices are high and dropping sharply during pullbacks. The fall to yearly lows on Sep. 7, where the percentage of UTXOs in profit and the supply in profit hit significant lows, reflects a shift in market sentiment.

The sharp decline signals increased stress in the market, with a substantial portion of recent buyers now facing losses. This could indicate an environment where capitulation becomes more likely, as holders who purchased during the peak of the price surge may begin to sell to cut their losses. At the same time, a lower percentage of UTXOs in profit suggests increased volatility as smaller holders become more susceptible to selling pressure.

The current values for UTXOs in profit, supply in profit, and Bitcoin’s price paint a nuanced picture of the market. With UTXOs in profit sitting at 67.64% and supply in profit at 74.15% as of Sep. 10, in conjunction with Bitcoin’s price of $57,035, the market appears to be in a phase of cautious consolidation. These values indicate that while a substantial portion of Bitcoin holders are still in profit, many recent buyers, particularly those who entered the market during the later stages of the price surge, are now underwater or close to it.

The disparity between UTXOs in profit and supply in profit offers insight into how different groups of market participants are faring. With supply in profit being higher, it suggests that larger or longer-term holders, who likely bought at lower prices, are better positioned compared to smaller or more recent buyers.

UTXOs, which are more sensitive to smaller transactions, show that more recent or frequent market participants are facing losses. This implies that there has been a recent shift in market sentiment, where short-term traders or smaller investors are feeling the pressure of Bitcoin’s pullback from its highs.

Since Bitcoin’s price is now higher than its recent low of $54,170 on Sep. 7, but both UTXOs in profit and supply in profit remain relatively low compared to earlier in the year, the data suggests the market is in a recovery phase but has not yet fully regained confidence. The lower percentages reflect that while Bitcoin’s price has rebounded slightly, the damage from previous price declines is still evident in the market structure.

This combination of factors typically points to a market in consolidation, where some participants are waiting for more evident signs of a sustained price recovery before re-entering or committing to holding their positions. The market seems to be in a transitional phase — no longer in full bull market territory but not in a total capitulation zone either.

If prices stabilize or rise from current levels, the percentage of UTXOs and supply in profit should start to increase, signaling renewed confidence. However, if Bitcoin’s price dips further, particularly below key psychological levels, it could push more holders into loss territory, heightening the risk of further sell-offs.

The post Bitcoin price stabilizes but profitability gap points to unease appeared first on CryptoSlate.