Key Insights

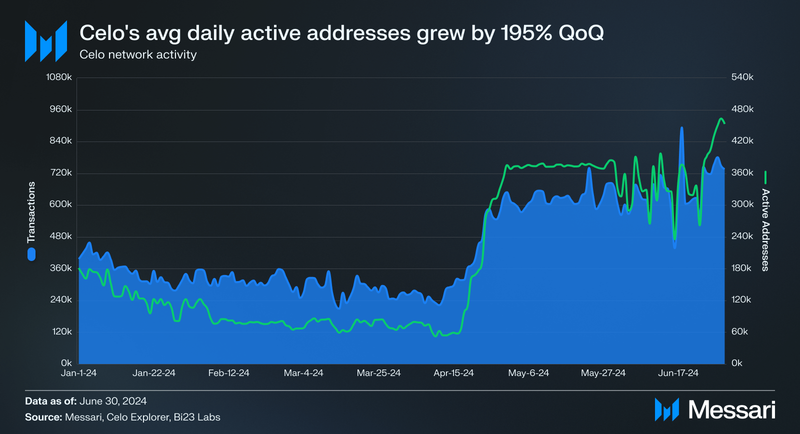

- Celo’s average daily active addresses increased by 195% QoQ to 290,000, with peak activity exceeding 463,300 on June 29. The growth was driven by cUSD transfers, including an increase in MiniPay wallets, among other trends.

- cLabs’ proposal to leverage the OP Stack for Celo’s upcoming transition to an Ethereum L2 was passed. Another proposal was passed to leverage EigenDA for data availability. After the quarter ended, the Dango Celo L2 testnet launched.

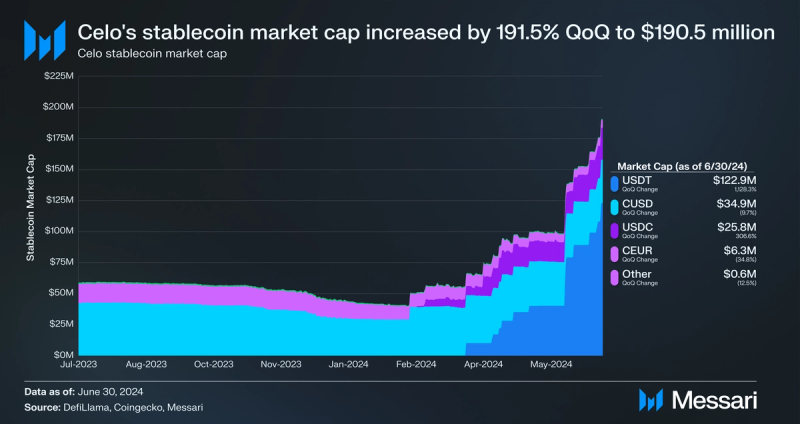

- Stablecoin market cap increased 191.5% QoQ to $190.5 million. This was led by the adoption of USDT on the network, which had a market cap of $122.9 million at the quarter’s end.

- Celo’s first retroactive public goods funding program was announced in early April, offering 250,000 CELO ($152,000). 89 projects received funding, building a wide range of solutions including onchain microlending, universal basic income (UBI) distribution, on- and off-ramping, and mission-driven community coordination initiatives.

Primer

Celo (CELO) is a carbon-negative, mobile-first, and EVM-compatible Layer-1 network built for the real world and designed for fast, low-cost payments worldwide. Celo is currently transitioning to an Ethereum Layer-2 on Optimism’s OP Stack. After raising $36.5 million in two private fundraising rounds, Celo mainnet launched on Earth Day in 2020. Soon after, a public sale for Celo’s native token CELO raised $10 million on CoinList. The development and growth of Celo’s network and ecosystem were initially led by cLabs and the Celo Foundation. While these entities are still involved, Celo’s development and growth have become more decentralized and community-driven, with participation from a globally-distributed and decentralized group of projects, and DAOs including Celo Africa, Celo Europe, Celo Korea, KohCelo (Thailand), Celo Philippines, and CeLatam.

In 2023, Celo began its transition to an Ethereum Layer-2 (“CEL2”), which is estimated to launch in H2 2024. Celo’s L2 will leverage the OP Stack and EigenDA for data availability. Modifications will be made to maintain several of Celo’s current properties, including 1-block finality, reorg resistance, gas payable in stablecoins and community tokens (USDC, USDT, and cUSD), and low, sub-cent transaction fees.

Website / X (Twitter) / Discord

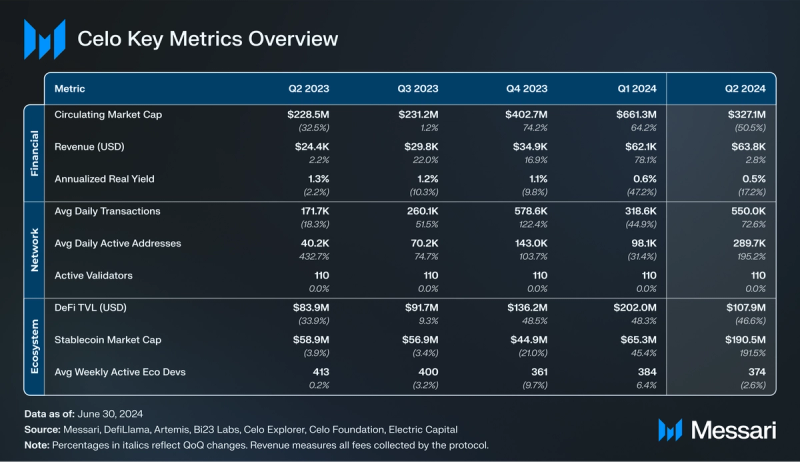

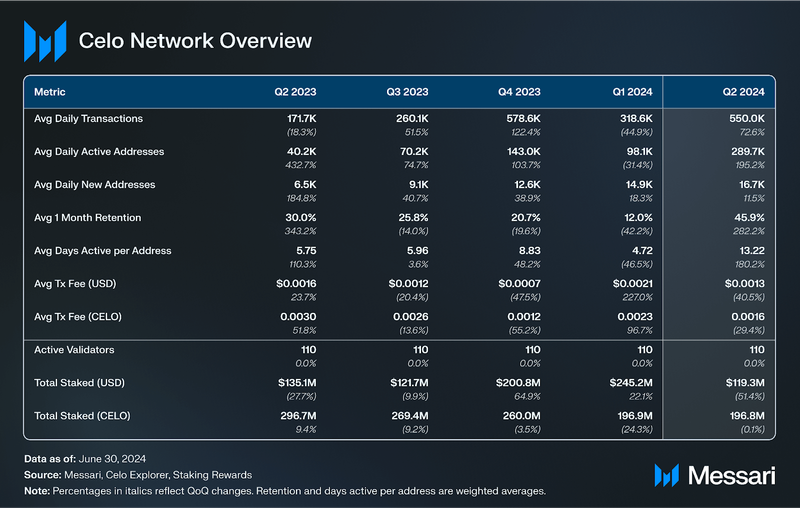

Key Metrics

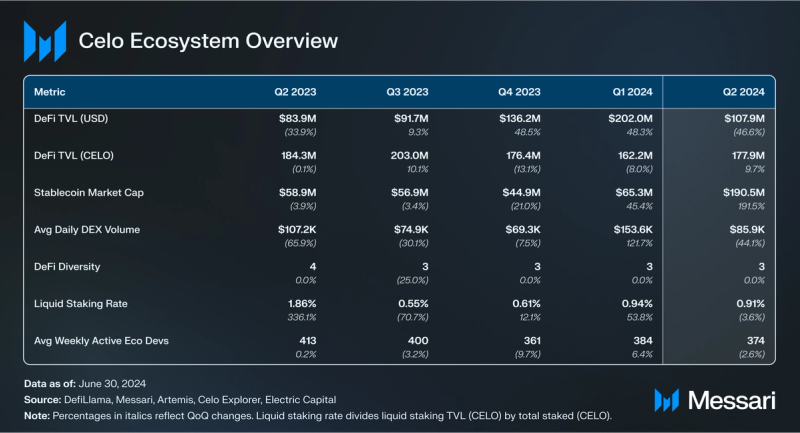

Ecosystem Analysis

DeFi

Celo’s DeFi TVL increased by 10% when denominated in CELO. However, it fell by 47% QoQ to $108 million, indicating that the USD decrease may have been driven by token price depreciation rather than capital outflow.

Mento mints the stablecoins cUSD, cEUR, cREAL, eXOF, cKES and PUSO, which are backed 1:1 by prime stablecoins like USDC, USDT and DAI. Additionally, the Mento reserve holds excess collateral in CELO, BTC, ETH and other digital assets. With the majority of its excess collateral in CELO, decentralized stablecoin protocol Mento’s TVL fell by 51% QoQ to $61 million. In mid-June, Mento Labs launched the MENTO governance token following a successful governance proposal. 5% of MENTO’s total supply is being airdropped to early users in a series of airdrops.

Uniswap’s TVL also fell by 51% QoQ, down to $23 million. Before Uniswap’s Celo integration in Q3’22, Ubeswap was the foremost DEX on Celo. Its TVL peaked in late 2021 at over $83 million TVL, but gradually decreased as previous DAO administrators had become inactive. Last quarter, a governance proposal passed to elect new DAO administrators and migrate the UBE token to a new contract. In mid-June, Ubeswap upgraded to V3 liquidity which is based on Uniswap V3.

Aave will soon join other blue-chip protocols Uniswap and Curve by launching on Celo. After a technical analysis of Celo’s suitability in supporting an Aave V3 instance last quarter, an Aave Snapshot proposal was passed to deploy Aave V3 on Celo.

After its token launch at the end of Q1, ImmortalX, Celo’s leading perps exchange, averaged $195,000 daily volume in Q2, a 44% QoQ increase.

Stablecoins and Payments

Celo’s stablecoin market cap increased by 191.5% QoQ to $190.5 million, with USDT launching at the beginning of the quarter––it is one of the only chains with both USDC and USDT.

Unlike many other networks, Celo users can pay gas fees in stablecoins approved via community governance. This innovation enhances user experience, especially in real-world use cases including onchain savings, lendings, remittances, peer-to-peer (P2P) and cross-border payments. After its launch, USDT was approved as a gas currency, joining USDC which was approved in Q2, another milestone for the ecosystem and its users.

MiniPay, the stablecoin wallet launched by web browser Opera, added several new features in Q2. These include daily login rewards, 10% cashback on select bill payments, and a new on/offboarding experience. Additionally, MiniPay went live in South Africa at the end of May. MiniPay is powered by SDKs FiatConnect and SocialConnect. SocialConnect featured 1.1 million new registered identifiers in Q1, a 12% QoQ decrease. Minipay v2 went live at the beginning of Q3.

In mid-April, wallet and payments app Valora launched Live Links, enabling users to send and accept payments via a link. To promote the launch, it ran a Live Link Treasury Hunt initiative, dropping $2,400 in total prizes via links. Valora also launched an update at the end of the quarter, launching in-app stablecoin earnings by integrating Aave pools.

Near the end of June, Rain expanded to Celo in partnership with Huma Finance. Rain issues Visa Rain cards that are connected to a user’s onchain account.

Other payments-related events from Q2 include Glo Dollar 2.0, HaloFi points, NexusPay’s launch, and El Dorado’s fundraise.

ReFi

Regenerative finance (ReFi) merges DeFi with regenerative economic principles to tackle environmental and social issues using blockchain technology. Since its launch, Celo has been committed to creating a positive social and environmental impact. As such, Celo is one of the leading ecosystems for ReFi projects, including GoodDollar, impactMarket, Toucan, GainForest, EthicHub, and more.

In Q2, several ReFi and RWA-related projects launched on Celo, including:

- Untangled’s launch: In early May, RWA protocol Untangled launched on Celo. Its first pool is backed by a portfolio of French working capital assets originated by French fintech lender Karmen. By the end of the quarter, the pool had $253,000 in TVL. The pool is part of a potential $107 million senior facility agreement with Karmen.

- Haraka pilot: Haraka facilitates micro-loans to local entrepreneurs, leveraging social reputation as collateral. After its launch last quarter, Haraka unveiled a rebrand in June and results from a pilot program. It shared that it has lent over 1 million cKES (~$8,000) to over 100 entrepreneurs thus far.

- impactMarket updates: impactMarket is a platform facilitating microcredit and UBI distribution. It had several updates in Q2, including a token migration featuring new tokenomics and a partnership with payments solution Ammer Group.

- Huma Finance and Arf merger: In mid-April, tokenized private credit platform Huma Finance announced that it merged with liquidity platform Arf. The merger seeks to further the two teams’ ability to facilitate cross-border payments at scale.

To celebrate Celo’s 4th mainnet anniversary, the Celo Foundation released a new Celosapien NFT. The Celosapien is a dynamic NFT, evolving through twelve levels to reflect Celo’s monthly carbon offset progress. At the end of Q2, Celo’s year-to-date net carbon footprint stood at -700 tons of CO2, with offsets largely facilitated by Toucan and Wren.

Other Developments

Other Q2 developments across infrastructure, NFT, and other sectors include Chainlink’s CCIP launch on Celo, the launch of native NFT marketplace Celosphere powered by RaribleX, reputation protocol Talent Protocol’s Talent Passport launch, the ‘Not Your Grail’ NFT mint on Untamed, Allbridge’s Celo integration, Alchemy Pay’s support for Celo USDC and USDT, dWallet’s Celo integration, OMO’s Celo integration, EtherMail’s Celo integration, Chainstack’s Celo integration, and DappLooker’s Celo ecosystem dashboard.

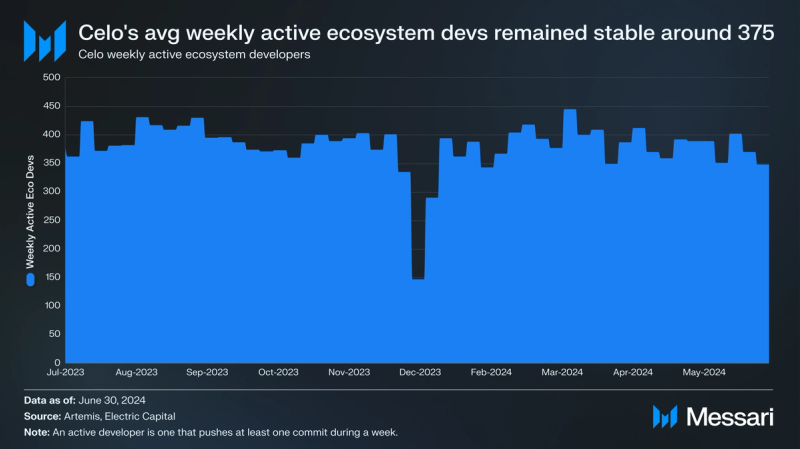

Development and Growth

Celo averaged 375 weekly active developers building projects in Q2, a 3% QoQ decrease. This ranks Celo around 13th among ecosystems according to Electric Capital’s Developer Report. The Celo Foundation, cLabs, and other organizations will look to continue growing Celo’s ecosystem via hackathons, grant programs, and other initiatives. Notable initiatives from Q2 include:

- CeloRPGF0: Celo’s first retroactive public goods funding (RPGF) program was announced in early April. The program offers 250,000 CELO to projects in three categories: ReFi, dApps and Infra, and Community and Adoption. In total, 89 projects received funding, with top recipients including GoodDollar (10,000 CELO), impactMarket (9,587 CELO), and Ubeswap (8,777 CELO). CeloRPGF0 is part of a broader Celo Public Goods program, to which 1.6 million cUSD and 700,000 CELO was earmarked last quarter.

- Celo Camp Batch 9: Celo Camp is an eight-week virtual accelerator program created by the Celo Foundation and Upright in 2020. As with Batch 8, Batch 9 exclusively featured projects building using MiniPay’s wallet on Celo. 24 teams were selected out of over 200 applications from over 45 countries. Program winners will be eligible for a prize pool consisting of $325,000 in cUSD and 100,000 CELO.

- Celo Creators Fund: The Celo Foundation announced a $150,000 Celo Creators Fund at the beginning of the quarter, along with Rarible’s Celosphere marketplace launch. The program’s inaugural community partners are Boys Club, Refraction, Rug Radio, and Hug. The Fund finalists were announced in May, with 30 artists out of over 250 applicants receiving grants.

- Bloom: In late May, the Celo Foundation introduced Bloom, a program offering resources and guidance to ecosystem projects launching tokens.

- Outlier Ventures Base Camp: Outlier Ventures announced an RWA-focused accelerator program in collaboration with the Celo Foundation and Defactor. The cohort was unveiled near the end of June, featuring Credbull, Credible Finance, Haraka, Isle Finance, Moreliquid, and Silver Koi.

- And even more, including Celo Developers’ Build with Celo Transform E-commerce Experiences and Transform Rewards and Loyalty hackathons, prize tracks in the ETHGlobal Brussels and ETH Seoul hackathons, Celo Europe’s Celo Gather Berlin Blockchain Week side event, Celo Africa DAO’s CodeJam, the Celo Foundation’s partnership with Bitkub, and Celo Developers’ partnership with H.E.R. DAO South Africa.

Network Analysis

Usage

Celo’s average daily transactions grew by 73% QoQ to 550,000. Average daily active addresses increased by 195% QoQ to 290,000. Despite the increase in network activity, the average transaction fee fell by 29% QoQ to 0.0016 CELO ($0.0013). Gas fees can be paid in any ERC-20 token approved by onchain governance. The use of alternative ERC-20 tokens as gas currency increased as 92% of Q2 transactions used CELO as the gas currency, down from 95% last quarter. Most of the other transactions used cUSD as the gas currency.

The growth in network activity started on April 18 and was driven by transactions involving the cUSD stablecoin of the Mento protocol. For the rest of the quarter, cUSD’s daily active address count was upwards of 80% of Celo’s total count; cUSD transfers increased as MiniPay wallets grew, among other trends. The increase in cUSD transfers also coincided with a drop in the median transfer value of cUSD, down to around $0.0001.

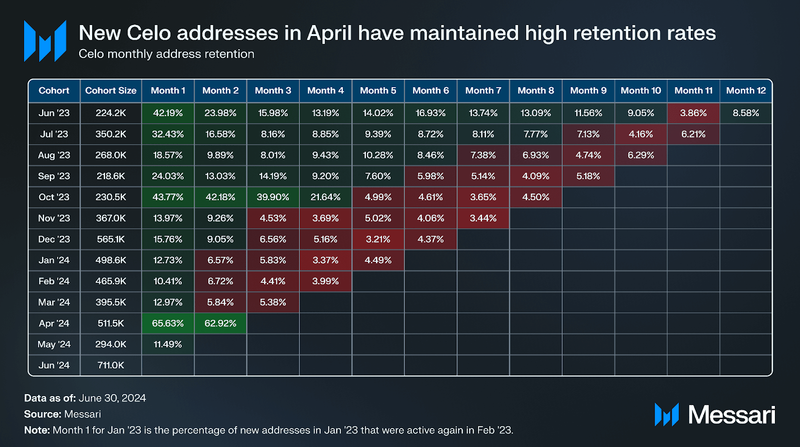

The increase in cUSD active addresses in April was driven mostly by new, rather than returning Celo addresses. These addresses were retained at a higher rate than any other Celo cohort in the past year. The April cohort’s one-month retention rate was almost 66% and its two-month retention rate almost 63%. As a whole, Celo’s average daily new addresses grew by 12% QoQ to 17,000 and its weighted average one-month retention rate by 282% QoQ to 46%.

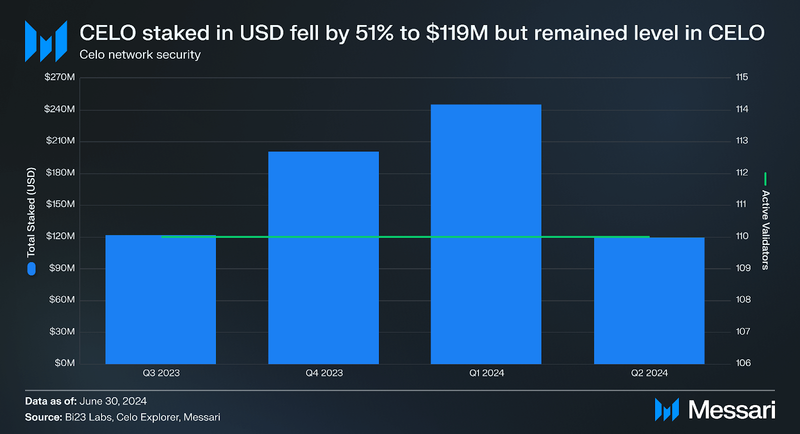

Security and Decentralization

After dropping by 24% last quarter, CELO staked remained flat QoQ at 197 million, representing 37% of the supply eligible to be staked. However, with CELO’s price depreciation, total staked in USD fell by 51% QoQ to $119 million. Meanwhile, the number of active validators on Celo remained at 110. Several validator operators run more than one validator node on the Celo network. At the end of the quarter, there were around 63 unique validator operators.

In Celo’s upcoming transition to an Ethereum Layer-2 (discussed in further detail in the Upgrades and Roadmap section), Celo’s validator set will become a decentralized sequencer set. In addition to running an updated client, validator operators will either need to run an Ethereum node or have access to a trusted one. The sequencers will enable Celo to maintain its 1-block finality secured by CELO stake, while also leveraging a data availability layer and Ethereum for stronger, albeit less frequent, finality guarantees. If validators share divergent blocks on the Celo and data availability layer, they’ll be slashed in order to avoid sequencer-caused block reorgs. The Celo team is exploring the exact design details to mitigate Ethereum reorgs which would result in Celo reorgs.

Upgrades and Roadmap

Since an initial forum proposal in July 2023, the Celo community has been working toward transitioning Celo to an Ethereum L2 (“CEL2”). After weighing different L2 framework options, including from Optimism, Polygon, zkSync, and Arbitrum, a proposal passed in May 2024 to leverage the OP Stack, which advanced to Stage 1 decentralization with the launch of fraud proofs in mid-June.

The OP Stack was selected for its minimal requirement for changes to adapt Celo’s features, its tested reliability across multiple chains, and compatibility with other technologies like Polygon’s Type 1 ZK Prover. The migration to OP Stack is expected to require minimal downtime and no substantial changes for existing Celo applications or end-users. Additionally, in Feb. 2024, the Optimism Foundation offered 2 million OP upfront ($7.7 million at the time of the offer) and 4.5 million OP vested over three years with milestone-based unlocks ($17 million at the time of the offer).

At the end of the quarter, cLabs proposed to leverage EigenDA for CEL2’s data availability layer. The proposal highlights several reasons, including keeping Celo’s transaction fees below $0.01 and additional economic incentives with ETH restaking. The Celo Foundation also announced a grant from the Eigen Foundation to build on EigenDA. The proposal passed after quarter end.

After the quarter ended, the Dango CEL2 testnet launched. While the testnet is being sequenced by cLabs, the goal is to use a decentralized sequencer set powered by Celo’s existing validators.

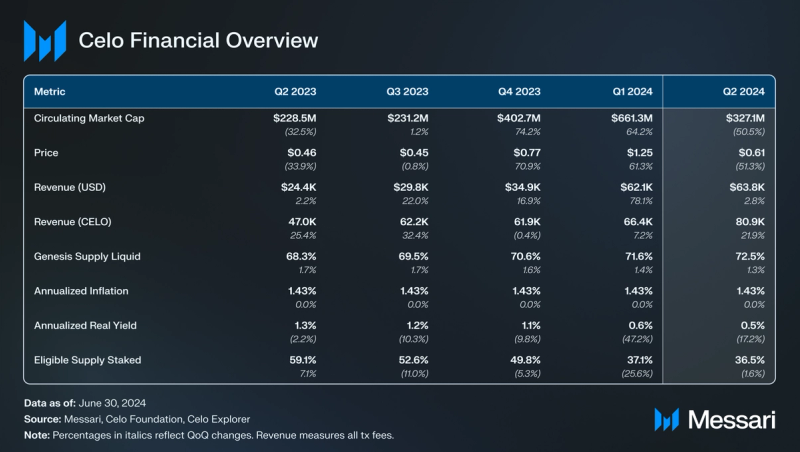

Financial Analysis

As a whole, the crypto market cooled off in Q2. CELO was no exception – its circulating market cap decreased by 51% QoQ to $327 million. CELO’s market cap rank fell from 138th to 167th QoQ.

Despite CELO’s price decline, Celo’s quarterly revenue (gas fees collected by the protocol) increased by 22% QoQ to 81,000 CELO. However, considering CELO’s price depreciation, its revenue in USD grew by 3% QoQ to $64,000.

In accordance with the Ultragreen Money system, almost 19,000 CELO was burned in Q2. For comparison, almost 2.5 million CELO was minted to distribute as staking rewards. Burned CELO decreased slightly QoQ, causing CELO’s inflation rate to increase by 0.3% QoQ to 1.42%. Note that this inflation rate measures the rate of staking rewards less the rate of tokens burned, relative to the genesis supply total of 700 million tokens. The rate of staking reward issuance is set to remain at 1.43% until 2035, when it will then begin decreasing and eventually go to zero.

Beyond validator rewards, CELO also experiences inflationary pressure from genesis supply unlocks. At the end of Q2, 72.5% of CELO’s genesis supply was liquid. The genesis supply here excludes staking rewards and totals 700 million tokens. In Q3’24, another 1% of genesis supply will unlock across the team and advisors, as well as community and operational grants buckets.

Closing Summary

Celo’s transition to an Ethereum L2 took a notable step forward with the successful proposals to use the OP Stack and leverage EigenDA as a data availability layer. The proposals followed close to a year of research and discussion surrounding different stack options. After the quarter ended, the Dango L2 testnet launched. Celo L2 mainnet launch is expected for late 2024.

After native USDC integration in Q1, Celo gained native USDT integration in early April. As of July 16, USDT’s market cap on Celo was $158 million, with the majority of supply held on Binance and Bybit.

Prior to USDT’s growth post quarter-end, cUSD was the predominant stablecoin on Celo. The amount of daily cUSD transfers grew notably starting on April 18, helping drive Celo’s average daily active addresses up by 195% QoQ to 290,000. Starting on April 18, cUSD’s daily active address count was upwards of 80% of Celo’s total count, driven by Opera MiniPay wallet, used in Nigeria, Kenya, Ghana, and South Africa. The increase in cUSD transfers also coincided with a drop in the median transfer value of cUSD, down to around $0.0001, due to usage across emerging markets for everyday financial solutions.