The EIGEN token of EigenLayer recently debuted with a fully diluted value (FDV) of 6.51 billion dollars, experiencing a 12% change and attracting the attention of investors. But what is happening now with the token and what are the forecasts?

Let’s see all the details in this article.

The unique vision of EigenLayer (EIGEN) for the future of digital tokens

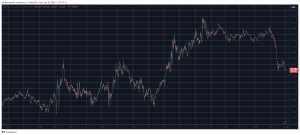

As mentioned, the token EIGEN of EigenLayer made its entrance into the crypto market with great promises, initially reaching a value of $4.26 before dropping to $3.77.

Listed on important platforms such as Binance and MEXC yesterday, the token attracted the interest of investors with a debut at 3.9 billion dollars and a fully diluted value of 6.51 billion dollars.

Unlike traditional governance tokens, EIGEN from EigenLayer is defined as a “Universal Intersubjective Work Token”. That is to say, an innovative approach that aims to solve challenges of universality, isolation, measurement, and compensation.

According to a post on their blog, the token will indeed incorporate social consensus and forking to perform a series of digital operations, distinguishing itself in the landscape of digital tokens.

However, despite the initial enthusiasm, EigenLayer has recorded significant outflows in recent months. Specifically, the total value locked (TVL) has dropped from 20 billion dollars in June to about 10 billion dollars currently.

The decline mentioned above was partly caused by some stakers who left their positions after receiving airdrop, affecting the stability of the protocol.

Some characteristics of EIGEN

Built on Ethereum, the EIgenLayer protocol allows deposits of ether (ETH) and offers its users the possibility to secure additional networks in exchange for extra returns.

This flexibility has been one of the main attractions for investors, even though recent price fluctuations and alternative uses of the token have generated uncertainties in the market.

Looking to the future, EigenLayer continues to pursue its vision in order to redefine the concept of digital tokens through technical innovations and unique governance concepts.

With its distinctive approach and ambitions to support global adoption, the fate of EIGEN remains tied to the changing dynamics of the cryptocurrency market.

However, it is also significantly influenced by its ability to navigate the challenges of an ever-evolving competitive landscape.

Millionaire airdrop: Justin Sun and the future of the EIGEN token

Justin Sun, founder of Tron, recently received an airdrop of over 5.24 million EIGEN tokens from EigenLayer, with a total value of approximately 8.75 million dollars.

This airdrop is part of the liquid staking protocol of EigenLayer on Ethereum, designed to increase the security and effectiveness of the ETH in staking.

After receiving the tokens, Sun immediately transferred the entire amount to the exchange HTX, thus indicating, according to some, the potential intention to sell them.

In any case, the transfer of EIGEN tokens to HTX could have a significant impact on the liquidity of the cryptocurrency.

Not by chance, with a greater number of tokens available for trading, the exchange could attract a higher number of traders, thus increasing the overall trading volume and, consequently, the visibility of EIGEN on the market.

Other significant players in the crypto landscape, such as Blockchain Capital and Galaxy Digital, have also received significant airdrops of EIGEN. Their decision to sell or hold the tokens will have the potential to influence market dynamics in the coming months.

The Eigen Foundation has also announced an additional token release, aimed at expanding participation within its ecosystem. This movement could generate even more interest in the cryptocurrency and attract new investors.

With a cryptocurrency market characterized by high volatility, analysts are closely observing these developments.

In particular, experts evaluate how the choices of the major holders of EIGEN could impact the future of EigenLayer and the Ethereum ecosystem as a whole.