Key Insights

- Protected Staking Rewards (PSR) launched in April with over 400 validators. PSR requires validators to put up a bond to be eligible for Marinade Stake; a total of 100 SOL has been recovered since PSR went live.

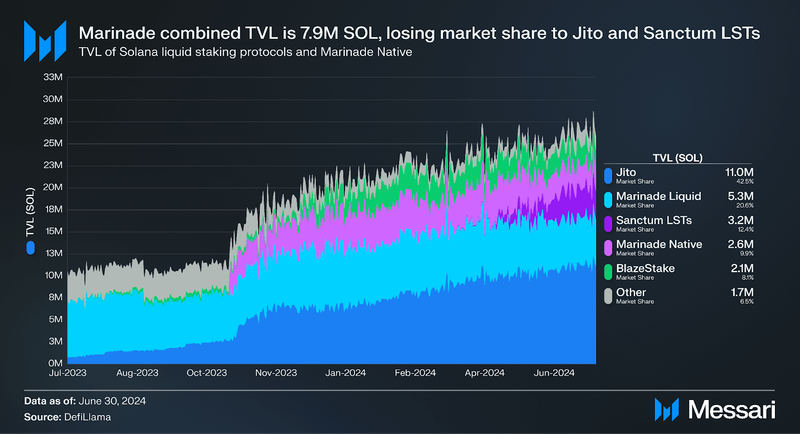

- Marinade’s total TVL decreased by 13% QoQ to 5.3 million SOL. TVL (USD) is up 877% YoY to $1.2 billion. Solana DeFi TVL fell concurrently.

- A proposal to restructure Marinade’s delegation strategy passed in May. The new strategy includes a Stake Auction Marketplace that allows validators to bid for stake.

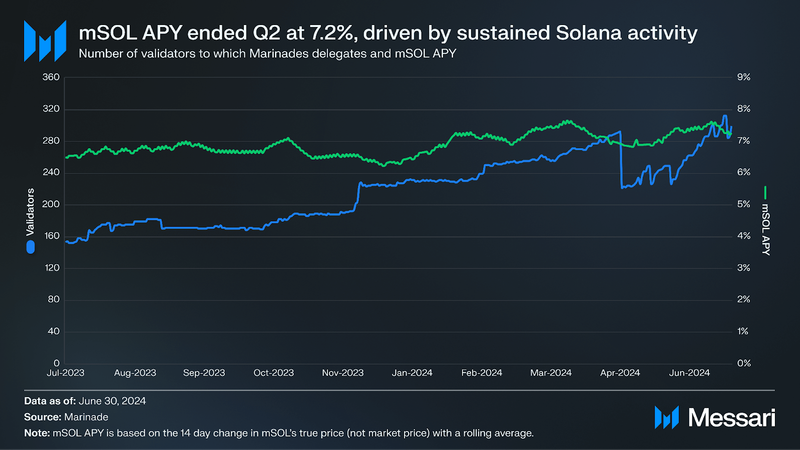

- Given sustained Solana network activity, mSOL APY ended at 7.2% in Q2, a 6% decrease QoQ. Comparatively, jitSOL ended at 8.0% and bSOL ended at 7.2% in Q2.

- A proposal for Marinade Earn Season 3 passed in May. Over three months, Marinade will distribute up to 25 million MNDE tokens to mSOL tokenholders.

Primer

Marinade (MNDE) is an automated staking protocol on Solana that provides liquid and native staking solutions. Marinade was founded during the March 2021 Solana x Serum Hackathon and launched on mainnet on August 2, 2021. A few months later, Marinade’s governance token MNDE was released, with a retroactive airdrop for holders of Marinade SOL (mSOL). Marinade has not raised any venture capital funding or conducted any public token sales. Instead, Marinade’s native token MNDE has mainly been distributed via various campaigns to reward users and contributors. Beyond incentives, MNDE is used for governance on Realms. Previously, Marinade delegates staked SOL to validators based on its algorithmic delegation strategy (60%) and MNDE and mSOL directed stake (20% each), where tokenholders can vote for specific validators or the algorithmic set. After Q2, the delegation strategy was updated with a Stake Action Marketplace where validators bid on stakers SOL deposits. For both the algorithmic strategy and directed stake, validators need to meet certain criteria for eligibility, notably a maximum 7% commission. In April 2024, Marinade launched Protected Staking Rewards (PSR), which also requires validators to put up a SOL bond to be eligible for Marinade stake. PSR enforces an onchain service-level agreement protecting stakers from reduced rewards.

Website / X (Twitter) / Discord

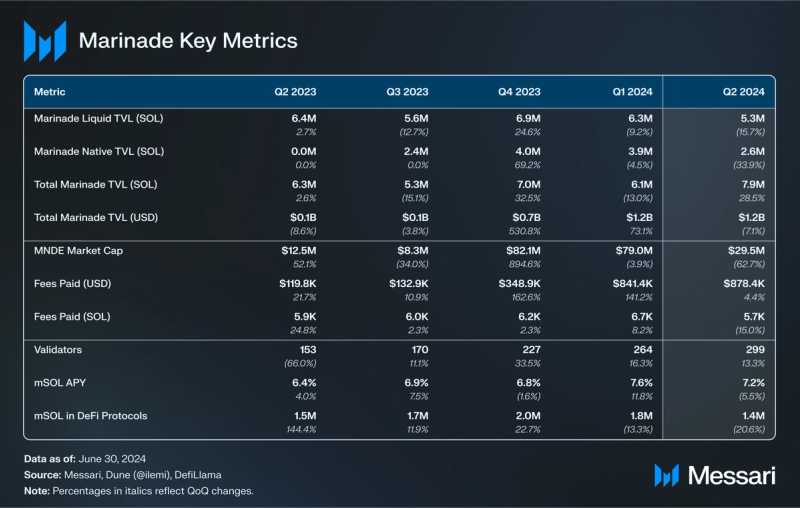

Key Metrics

Performance Analysis

TVL

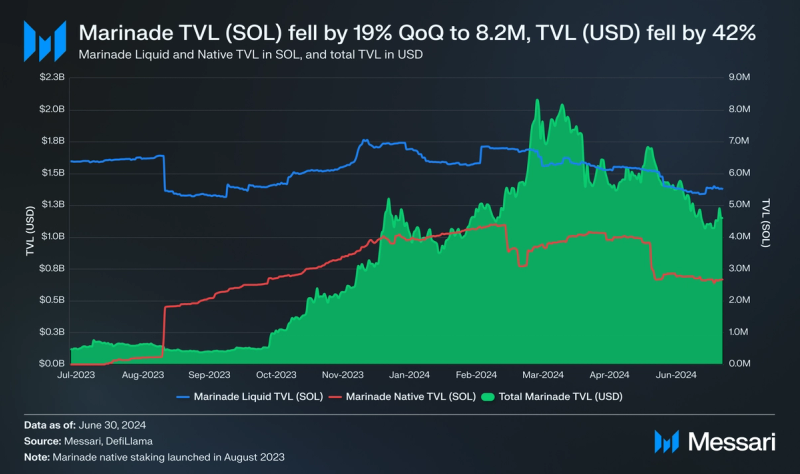

Marinade’s TVL decreased by 19% QoQ to 8.2 million SOL. Marinade Liquid’s TVL fell by 13% to 5.5 million SOL, while Marinade Native’s TVL fell 30% to 2.7 million SOL. However, TVL (USD) is up 877% YoY to $1.2 billion. In part due to SOL’s price depreciation of 28% QoQ, TVL denominated in USD fell by 42%. Total Marinade TVL is correlated to Solana TVL, which decreased by 9% QoQ to $4.5 billion.

Marinade Native launched in Q3 2023, allowing users to stake SOL directly without losing custody of their tokens. This strategy may be more attractive to institutional investors, who are typically less tolerant towards the smart contract risk of liquid staking or the high concentration risk of relying on the performance of a single validator. Marinade Native TVL has grown 8.3% since Q3 2023, and Native comprises 32.9% of the total TVL denominated in SOL.

Market Cap and Fees

In Q2, market cap slid 63% to $29.5 million. Q1 saw increased activity and demand following the announcement of Marinade Earn Season 2, which lasted from January 1 to March 31, 2024. MNDE currently has a fixed supply of 1 billion tokens, of which 266 million tokens circulating. 19 million tokens were unlocked in Q2, and an additional 11 million tokens are slated to be unlocked in Q3.

Total fees paid grew by 4% QoQ to $878,400. Marinade collects the majority of revenue from a 6% fee on Marinade Liquid rewards (which translates to a ~0.42% fee on staked SOL assuming a 7% APY). Additionally, Marinade collects a fee on unstaking, which ranges from 0.1%-9% based on the total liquidity available in the mSOL/SOL LP and the amount being unstaked. Fee growth is highly correlated with Marinade Liquid TVL growth, although the increased fees collected was likely supported by a higher median SOL price, which was $151 in Q2 compared to $108 in Q1.

Beyond Marinade Liquid TVL growth, Marinade DAO looks to generate additional fees through the Stake Auction Marketplace, a feature of their V2 upgrade that allows Validators to participate in an open auction for Marinade’s stake (see more in Validators and APY).

Validators and APY

mSOL APY decreased by 6% QoQ to 7.2%. Concurrently, network activity on Solana maintained elevated levels throughout Q2’24. Validators earn staking rewards based on network performance and activity. When Solana experiences higher transaction volumes (from DeFi, NFTs, etc.), validators process more transactions, which increases the amount of SOL distributed as rewards. SOL’s annualized inflation rate is at 5.2%. The mSOL APY figure is calculated based on mSOL’s “true price,” i.e., SOL in Marinade staking pool / mSOL minted.

A successful proposal to restructure Marinade’s delegation strategy passed in May. The proposal includes the introduction of a Stake Auction Marketplace (SAM) that allows validators to bid for stakes. The updated delegation strategy is designed to optimize the APY for stakers by promoting competitive performance among validators, and encouraging improvement in profitability, predictability, and speed of delegation strategy. The first phase of SAM went live on June 27, allowing validators to test the bidding system and generate simulated results using different bid sizes.

Protected Staking Rewards (PSR) was launched in April 2024, with over 400 validators participating from the outset. PSR enforces an onchain service-level agreement protecting stakers from reduced rewards for reasons such as validator performance issues or commission rugs. PSR requires validators to put up a bond to be eligible for Marinade stake. This allows Marinade to stake to more validators without sacrificing APY to stakers. In May, Marinade reported they had PSR surpassed 100 SOL recovered for Marinade stakers since going live.

Marinade delegates SOL to 299 validators, a 13% QoQ increase. A recent upgrade to the delegation strategy ties validator growth based on Marinade’s TVL strategy.

A successful governance proposal to update Marinade’s delegation strategy was implemented in Q2. Notable changes include:

- Eligibility Criteria: The criteria have been tightened to ensure more precise delegation, including stricter performance measures like 80% credit earned across the last 14 epochs and a cap on node stake (80% of total stake can be from Marinade).

- Concentration Score: Previously based solely on ASO (Autonomous System Organization), the updated formula now includes country, city, and ASO, penalizing nodes with concentrated locations. Accounting for overall stake distribution will improve Solana’s Nakamoto coefficient by delegating more stake to smaller validators.

- Node Stake Impact: Nodes with higher staked amounts will receive lower scores, encouraging smaller validators by capping the eligibility at certain stake levels.

- Validator Count: The algorithmic delegation strategy previously delegated SOL to only the top 100 validators based on its scoring criteria. Under the upgrade, the number of validators receiving stake via the algorithmic delegation strategy can increase above 100. Growth of the validator set will be tied to Marinade’s TVL growth.

- MNDE/mSOL Voting Power: Previously, MNDE/mSOL controlled 20% of directed stake each, but token holders had no good way of adjusting this parameter or benefit from the stake directing. Token holders will now have the ability to vote on the algorithmic delegation of stake.

- Commission and MEV: The impact of the validator commission on the score has been reduced from 10% to 7%, and a new MEV (Maximal Extractable Value) parameter has been added to evaluate validators based on their MEV rewards.

Native staking through Marinade typically yields a slightly higher APY because you aren’t paying the same fees as with mSOL. However, your SOL is locked up and cannot be used in DeFi applications until it is unstaked and goes through the cooldown period.

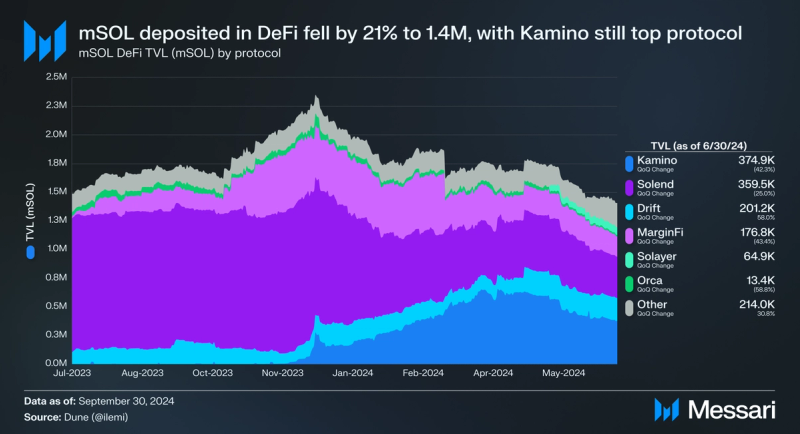

mSOL in DeFi

mSOL deposited in DeFi protocols decreased by 20% QoQ to 1.4 million. Kamino maintained their majority share of mSOL in DeFi throughout Q2. Kamino makes up 21% of DeFi TVL on Solana; their growth has largely been a reflection of global Solana lending dynamics. Kamino launched its token on April 30, airdropping 7.5% of the total supply. KMNO ended the quarter with a $33 million market cap, with 10% of the supply circulating.

Solend previously featured the majority share of mSOL in DeFi, but Kamino surpassed it in Q1. In April, a Solend DAO proposal was passed to list MNDE as an isolated asset in the main pool, which could help reverse MNDE’s downward trend on Solend.

Solayer, a restaking network on Solana, launched at the end of May. It quickly captured over 50,000 mSOL and ended Q2 as the fifth largest protocol by mSOL DeFi TVL.

Following the success of Marinade Earn Season 1 and Season 2, which distributed MNDE based on SOL staked in Marinade Liquid, a proposal for Marinade Earn Season 3 was passed in May. Over three months, Marinade will distribute up to 25 million MNDE tokens to mSOL tokenholders. Previous Seasons allowed tokenholders to earn simply by staking SOL for mSOL; Season 3 will require mSOL tokenholders to deepen liquidity by participating in DeFi.

- Up to 12.5 million MNDE is reserved for providing liquidity in Kamino’s Raydium mSOL/SOL vault.

- Up to 5 million MNDE is reserved to looping Meteora mSOL/SOL LP tokens on Solend.

- Up to 7.5 million MNDE may be paid out to deepen mSOL liquidity in various other pools as well as to provide incentives for DeFi partners.

Competitive Landscape

Solana’s liquid staking rate (the percent of staked SOL that is liquid-staked) increased by 22% QoQ to 6.4% Marinade Liquid’s market share fell by 24% QoQ to 21%, with Jito’s approaching 50%. Including Marinade Native, Marinade’s market share in Q2 was 31%, compared to Jito’s market share of 42.5%.

Jito’s jitoSOL remained Solana’s LST leader. Its supply grew 22% QoQ to almost 1.1 million SOL, giving it a 47% market share. After the quarter ended, a governance proposal was passed to transfer management of the Jito Stake Pool to StakeNet. StakeNet is a network within the Jito ecosystem, designed to improve the security and efficiency of blockchain operations through a system of keepers and on-chain programs.

Sanctum LSTs ended Q2 with 3.2m SOL in TVL, a 4,598% increase QoQ. The Sanctum Infinity Pool, a multi-LST liquidity pool containing 44 LSTs at the end of Q2, saw an 825% increase QoQ with 2.1 million SOL in TVL. The pool prices LSTs by their “floor price” relative to SOL, allowing any LST in the pool to tap into any other’s liquidity. For example, if a user wants to sell xSOL for USDC, but no xSOL/USDC pool exists, xSOL could be swapped to ySOL and sold to USDC using the ySOL/USDC pool.

Sanctum Infinity supports Solana’s top LSTs and a number of single-validator LSTs, many of which Sanctum has helped launch. Single-validator LSTs have offered unique rewards to attract stake, such as Bonk’s bonkSOL LST, which rewards stakers with BONK. Other single-validator LSTs, such as laineSOL and jucySOL, have been airdropping a portion of base and priority fees to stakers. Validators typically do not distribute these fees to stakers. In the past, this has not mattered much as fees made up around 1% of total rewards when combined with inflationary staking rewards. However, with the increase in Solana network activity, these fees have risen notably, averaging 7% in Q2.

While Sanctum benefits Marinade by increasing liquidity for mSOL, it may also disadvantage Marinade as one of the market leaders. Sanctum products lower the barriers to launching LSTs, enabling experimentation and expanding the design space of LST functionality. As MetaDAO notes in its Marinade report, Marinade’s PSR feature could provide a defensible moat against new entrants: a validator would be less likely to provide a bond for a liquid staking protocol that is not yet delegating a meaningful amount of SOL.

Closing Summary

In Q2 2024, Marinade saw several key developments, including the launch of Protected Staking Rewards, updates in delegation strategies that enhanced validator performance, and testing for the new Stake Action Marketplace. Following the success of Marinade Earn Season 2 in Q1 2024, mSOL token holders will now have the opportunity to participate in Marinade Earn Season 3 in the back half of 2024, which aims to boost mSOL/SOL liquidity and strengthen Marinade’s position in the liquid staking market.

The Solana liquid staking market has become more competitive in recent quarters, with newer protocols such as Jito and BlazeStake eating into mSOL’s market share. The landscape is also shifting with the launch of Sanctum Infinity, lowering the barrier to entry for LSTs on Solana. To further spur growth, Marinade DAO will likely look to iterate on its Marinade Earn incentive program and focus on key initiatives, including Protected Staking Rewards and the Stake Auction Market.