- A second XRP Exchange-Traded Fund (ETF) has been filed with the US Securities and Exchange Commission despite the decision by the Agency to contest the securities status of the underlying asset through an appeal.

- According to experts, these ETF filings are politically motivated and are purely strategic.

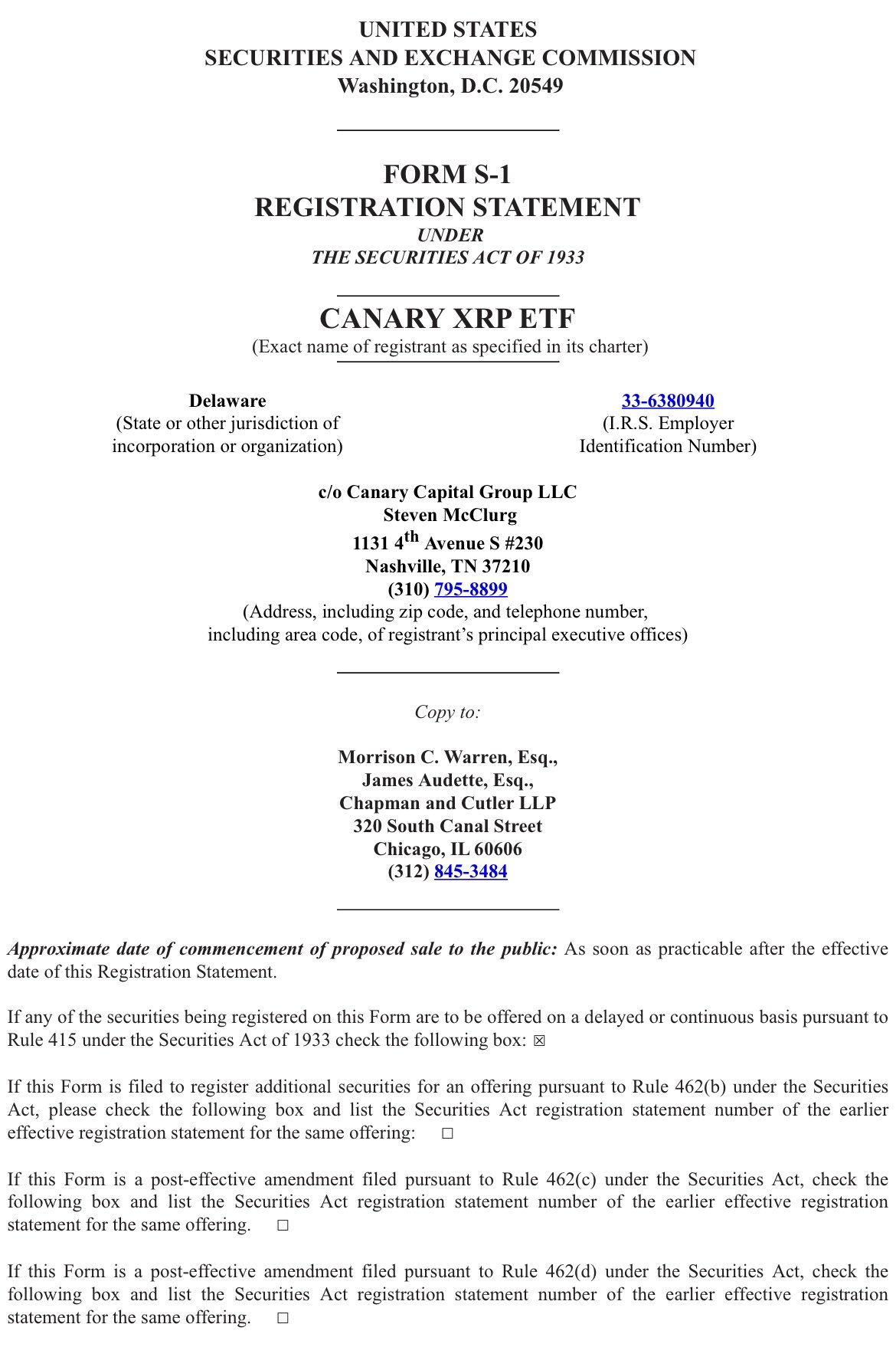

Canary Capital Group LLC has officially filed for an XRP Exchange-Traded Fund (ETF) with the US Securities and Exchange Commission soon after CNF reported a similar move by Bitwise. According to the document at our disposal, this move is meant to provide exposure to the value of XRP held by the Trust.

More About the XRP ETF Filing

In an earlier post by Fox Business reporter Eleanor Terrett, it was highlighted that Canary, which was founded by Steven Mcclurg is a fresh player in the crypto investment space. However, its bold decision was motivated by the signs of a progressive regulatory environment and the growing demand for ETF-related products for leading digital assets.

We’re seeing encouraging signs of a more progressive regulatory environment coupled with growing demand from investors for sophisticated access to cryptocurrencies beyond Bitcoin and Ethereum – specifically investors seeking access to enterprise-grade blockchain solutions and their native tokens such as XRP.

Subjecting the “Registration Statements” to a comprehensive analysis, we observed that this offering is intended to be a continuous one and the Trust is not subject to regulation under the 1940 Act. This implies that investors in the Trust would not receive the regulatory protection afforded by funds registered under the Act.

In the Prospectus Summary section of the filing, it was stated that the Trust would provide investors with the opportunity to assess the market for XRP via a traditional brokerage account without going through the risk of acquiring or holding the asset directly.

The Trust would not use derivatives that would subject the Trust to additional counterparty and credit risk. The sponsor believes that the design of the Trust will enable certain investors to more efficiently and effectively implement strategic and tactical asset allocation strategies that use XRP by investing in the shares rather than purchasing, holding, and trading XRP directly.

The Chance of Approval

The president of the ETF Store, Nate Geraci, recently pointed out that the timing for XRP ETF filings is “likely a call option on the November election.” With a specific focus on Bitwise’s move, Nate stated that the company’s position is “highly noteworthy.” According to him, its filing is strategic as Bitwise is not known for “simply throwing stuff at the wall.”

The point is that XRP ETF is probably coming at some point… Bitwise just early. Politics clearly matter here in the short term, but I think this is all inevitable over time. IMO, Bitwise longer-term roadmap is to offer this in an ETF wrapper. The next step will be full tokenization.

For senior ETF analyst at Bloomberg Eric Balchunas, this is a political action that is a “cheap call” option for US presidential candidate Donald Trump to win the upcoming election. According to him, there is no chance of these ETFs getting approval if Kamala Harris wins as the “call would expire”.

Meanwhile, the SEC has filed a notice of appeal to the July 2023 ruling by Judge Analisa Torres on the programmatic sales of XRP as disclosed by CNF. According to experts, the chance of ETF approval would largely depend on the outcome of the renewed legal battle.

At press time, XRP was $0.53 after declining by 11.5% in the last seven days.