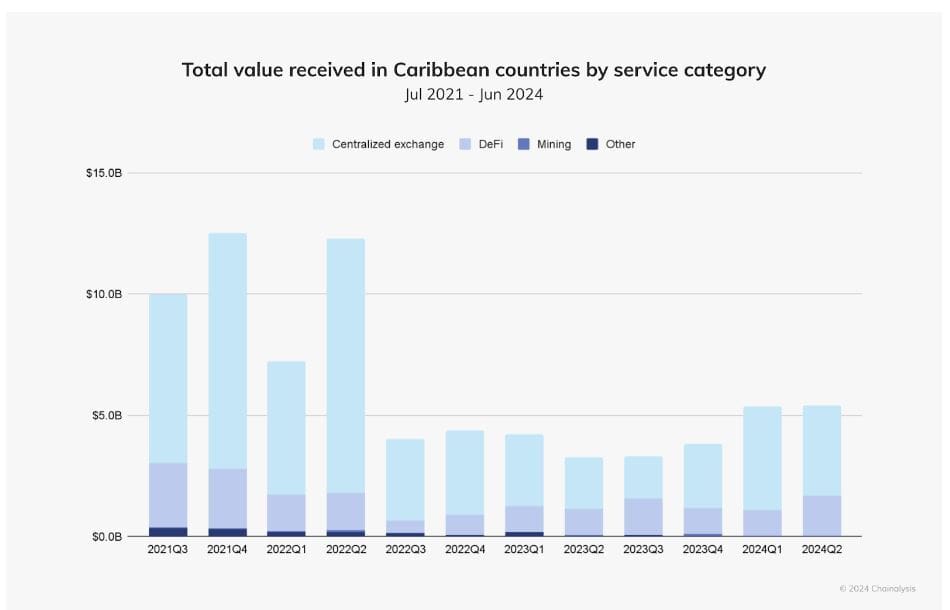

After the downfall of FTX, the Caribbean’s cryptocurrency landscape entered a phase of doubt and decreased engagement, leading to a loss of trust in crypto platforms. However, starting in late 2023, there has been a notable revival in such activities across the region.

Prominent blockchain analysis company Chainalysis said that users in the region increasingly favoring well-known centralized exchanges (CEXs) like Coinbase and Binance.

Caribbean’s Resurgence in Crypto Activity

The latest edition of Chainalysis’ 2024 Geography of Cryptocurrency Report, shared with CryptoPotato, highlighted a significant uptick in overseas clients establishing legal entities in the Web3 and blockchain sectors within the Cayman Islands, in particular, over the past year.

These ventures typically involve Layer 1 and Layer 2 solutions and span a variety of uses, such as artificial intelligence (AI), cross-chain infrastructure, gaming, and data/cloud storage. This was revealed by David Templeman, who is a Specialist Financial Investigator for the Cayman Islands Bureau of Financial Investigation.

“The fallout from the various collapses (FTX, TerraUSD/Luna, Celsius Network, and Three Arrows Capital) has placed pressure on the industry to learn from mistakes and put in place better oversight and guardrails. There is a strong community of blockchain and Web3 companies within the Islands both physically present and legally domiciled here.”

Chainalysis believes that this resurgence in crypto activity in the Caribbean could potentially solidify the sub-region as a key hub for adoption in the future.

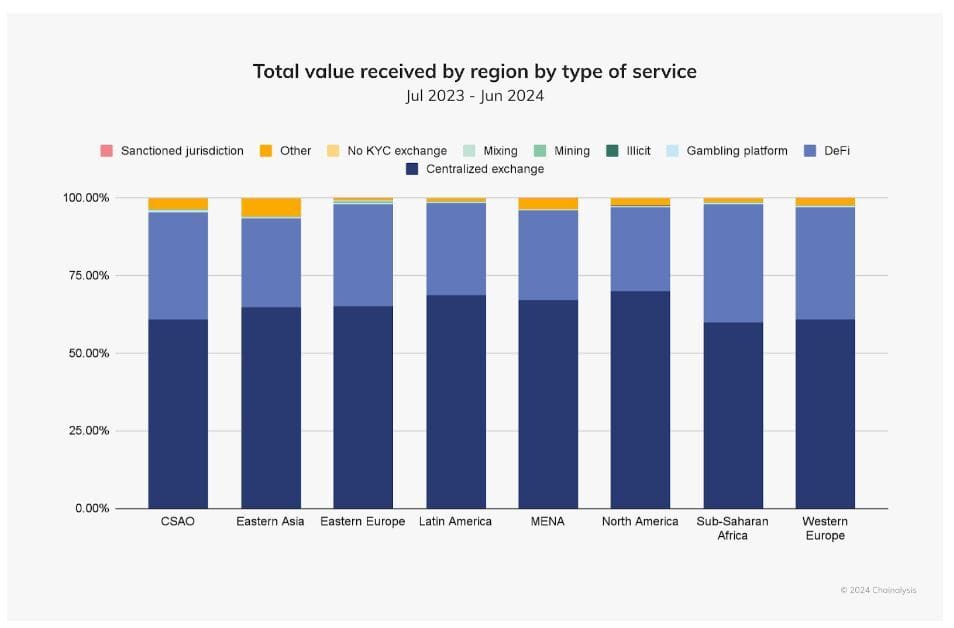

In general, Latin America is the second fastest-growing region for cryptocurrency adoption, with a year-over-year (YoY) growth rate of around 42.5%. Chainalysis found that the most widely used service among Latin Americans is centralized exchanges (CEXs), utilized by 68.7% of users, which is slightly below the rate in North America.

Institutional and professional investors, particularly those transacting over $10,000, primarily drive the region’s transaction value.

Latin America’s Crypto Renaissance

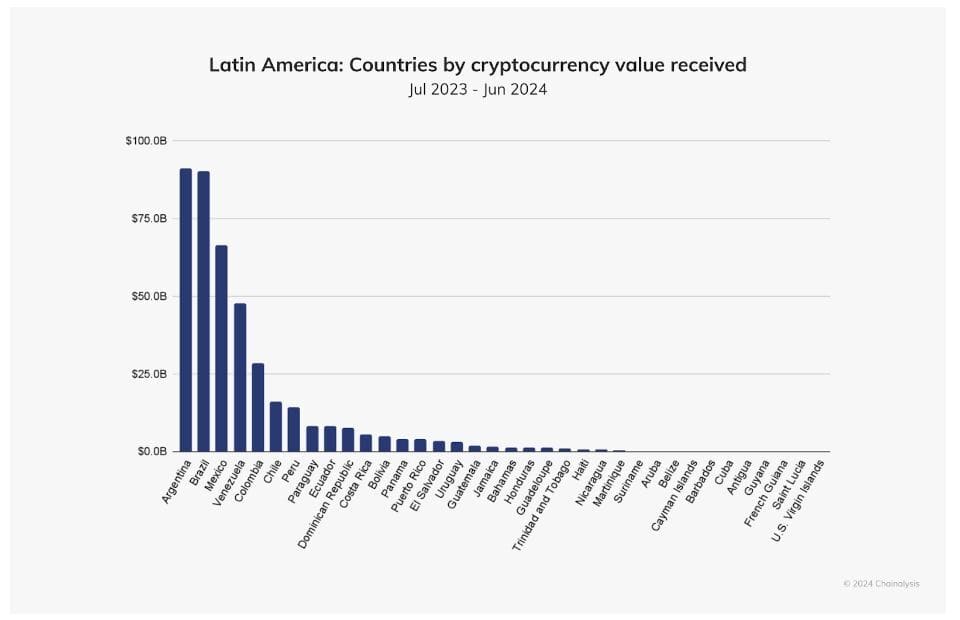

Argentina leads with an estimated cryptocurrency value received of $91.1 billion, marginally ahead of Brazil at approximately $90.3 billion. Argentina ranks as a leader in the stablecoin market within Latin America, accounting for 61.8% of stablecoin transaction volume. This figure also surpasses Brazil’s share of 59.8% and is significantly higher than the global average of 44.7%.

Meanwhile, Brazil’s institutional crypto activities reflect a renewed interest from major financial players, as the monthly value of transactions exceeding $1 million increased by roughly 29.2% between the last two quarters of 2023 and about 48.4% from Q4 2023 to Q1 2024.

Additionally, Venezuela has slowly emerged as one of Latin America’s fastest-growing crypto markets, witnessing a year-over-year growth of 110%, which far exceeds that of any other country in the region, despite the uncertainties surrounding the Maduro regime.

Interestingly, DeFi is another aspect of cryptocurrency growth in Venezuela. While centralized services have dominated the value received since 2022, there has been a growing interest in DeFi, especially noticeable by late 2023.

The post Caribbean’s Revival Mirrors the Growing Adoption in Argentina, Brazil, and Venezuela appeared first on CryptoPotato.