SPONSORED POST*

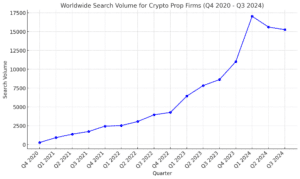

| Keyword | Google Searches |

| Q4 2020 | 270 |

| Q1 2021 | 920 |

| Q2 2021 | 1,380 |

| Q3 2021 | 1,730 |

| Q4 2021 | 2,450 |

| Q1 2022 | 2,520 |

| Q2 2022 | 3,060 |

| Q3 2022 | 3,950 |

| Q4 2022 | 4,270 |

| Q1 2023 | 6,430 |

| Q2 2023 | 7,830 |

| Q3 2023 | 8,630 |

| Q4 2023 | 11,020 |

| Q1 2024 | 17,040 |

| Q2 2024 | 15,610 |

| Q3 2024 | 15,260 |

Why Prop Trading Is Taking Off

Prop trading competitions have exploded, and it’s easy to see why. Tegan Miller from Prop-Firms.com gave four key drives to this surge:

- No Risk to Personal Capital: Traders don’t have to risk their own money. You pay a fee, trade virtual funds, and if successful, you get funded with real capital. It’s a no-brainer for those looking to break into crypto without the fear of losing their savings.

- Real Market Conditions: Unlike demo accounts, prop trading competitions offer real market conditions. Traders experience the ups and downs of crypto trading with live price data, making the experience more realistic.

- Big Profit Splits: The payout structures are highly competitive, with some firms offering up to 90% of profits. When you get funded, you’re trading with the firm’s capital, but the majority of the profit stays with you.

- Rapid Market Access: Crypto prop firms are offering access to an increasing variety of markets, from Bitcoin and Ethereum to newer altcoins. The variety allows traders to diversify and adapt to shifting market trends.

Why the Interest Keeps Growing

Numbers don’t lie—interest in crypto prop trading is soaring. But why now?

- The Accessibility Factor: The low barrier to entry is key. In traditional trading, you need significant capital to trade effectively. Prop trading eliminates that by providing virtual funds to start.

- Learning on the Go: New traders are finding it appealing because they can learn while they trade. Many firms offer educational resources—webinars, live trading sessions, and courses. It’s not just about getting funded; it’s about building trading skills that last.

- Huge Upside Potential: Traders can scale their accounts up to millions of dollars in funding, something that’s almost impossible to do with personal capital alone. This potential for growth has drawn in traders of all levels, from beginners to seasoned pros.

The Dark Clouds on the Horizon

But it’s not all smooth sailing for the industry. A few critical issues are starting to emerge.

1. Legal Troubles in the US

One of the biggest challenges right now is a court case in the U.S. where the CFTC filed a complaint against My Forex Funds. The issue? Whether some firms are pushing the boundaries of what’s legal by offering high-leverage trading without proper oversight. If regulators crack down, it could change the entire landscape for prop trading, especially in crypto.

2. Lack of Transparency

Another sticking point is transparency. Not all firms are upfront about their fees, spreads, or even how profits are split. Some traders have reported issues with payout delays and unexpected fees, raising concerns about the need for greater regulation.

3. Market Volatility

Crypto’s wild price swings remain a double-edged sword. While volatility offers the potential for big profits, it also brings risk. Some traders struggle with the rapid changes in market conditions, especially during extreme events like flash crashes.

The Future of Prop Trading

Despite these challenges, the future looks bright for crypto prop trading. With demand at an all-time high and more firms entering the space, traders are benefiting from better terms and opportunities than ever before.

For those interested, now’s the time to jump in. The potential to trade without risking your own capital, access crypto markets, and profit through funded accounts is too good to ignore. Just keep an eye on the evolving legal landscape, and make sure to do your homework when choosing a firm.

*This article was paid for. Cryptonomist did not write the article or test the platform.