Key Insights

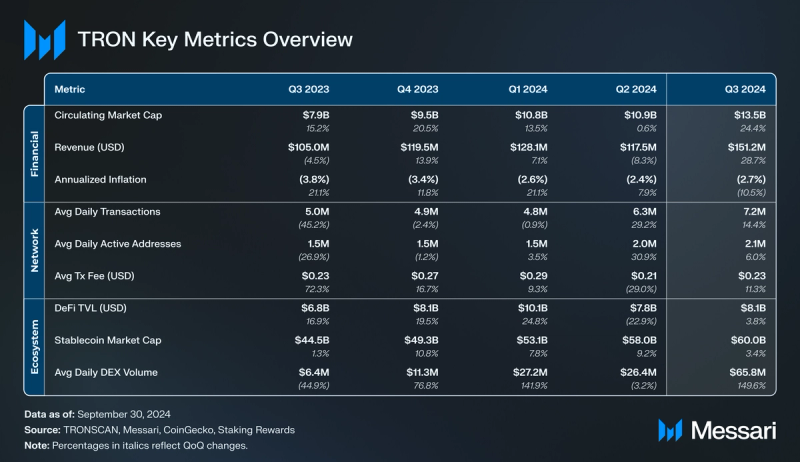

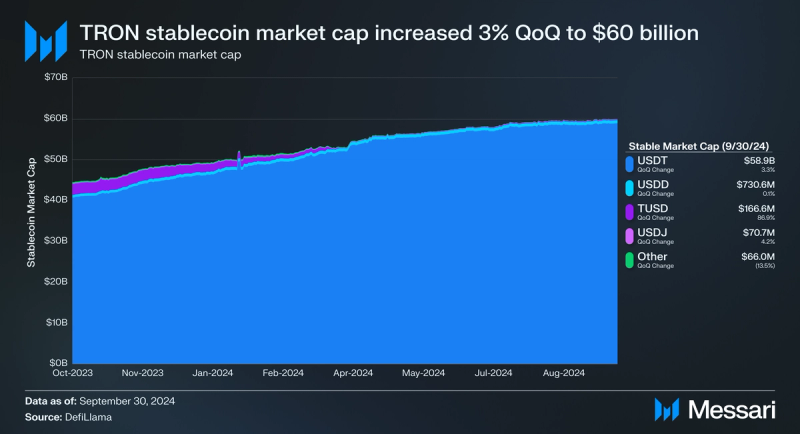

- TRON had positive growth across many key metrics in Q3, including market cap (+24%), revenue in USD (+29%), DeFi TVL in USD (+4%), stablecoin market cap (+3%), and average daily DEX volume (+150%).

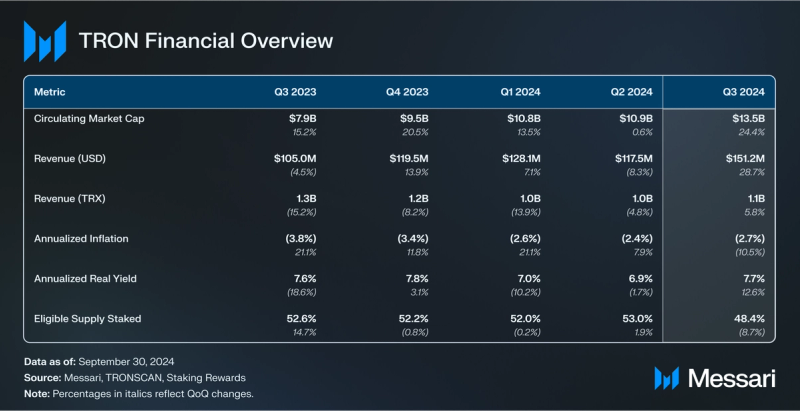

- Revenue in USD was at an all-time high in Q3 at $151.2 million. Revenue in TRX also increased by 6% QoQ from 9.96 billion to 1.05 billion.

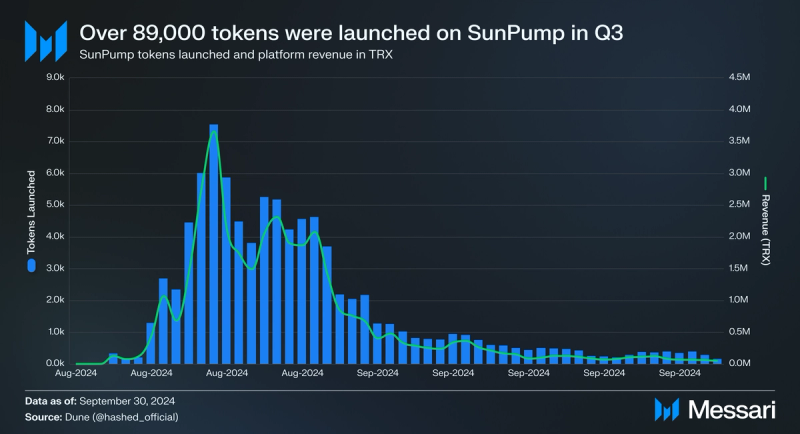

- The launch of SunPump, a token launcher platform geared for memecoins, played a pivotal role in Q3. Over 89,000 tokens were deployed on SunPump in less than two months.

- Total TRON staked in USD was up 14% QoQ to $6.54 billion. By the end of Q3, TRON had the sixth-highest dollar value of funds staked across all Pos networks.

- USDT on TRON finished the quarter at $58.94 billion (up 3% QoQ from $57.06 billion). Additionally, over half of all USDT in circulation is on TRON.

Primer

TRON (TRX) is a public open-sourced blockchain network using a Delegated-Proof-of-Stake (DPoS) mechanism. It utilizes an election mechanism that determines which validators participate in consensus. All TRX stakers vote onchain on which candidates they want to become Super Representatives. In each epoch, the top 27 most voted-for candidates become Super Representatives within the active set and take turns producing blocks. An election occurs every six hours.

The TRON Virtual Machine (TVM) powers applications on the network and uses “Energy” and “Bandwidth” instead of gas, like its Ethereum Virtual Machine (EVM) counterpart. Bandwidth is gas spent on transactions whereas Energy is gas spent on smart contract calls. Energy and Bandwidth can be acquired by staking TRX or by burning TRX to pay for the Energy/Bandwidth required to execute a smart contract call or transaction. The TVM is EVM-compatible and offers developers affordable and fast smart contract execution.

Website / X (Twitter) / Discord

Key Metrics

Financial Overview

Market Cap and Revenue

TRX’s circulating market cap increased for the seventh consecutive quarter in Q3, up 24% QoQ from $10.9 billion to $13.5 billion. Furthermore, TRX outperformed other large-cap cryptocurrencies as its market cap amongst all tokens (excluding stablecoins) rose one spot from 10 to 9. TRX/BTC was also up 24% QoQ. Notably, since TRX is a deflationary token, its price increased by more than just the circulating market cap due to a decrease in circulating supply.

TRON utilizes a resource model to execute transactions onchain. To summarize, the resource model is based on distributing Bandwidth and Energy to stakers. As long as stakers have acquired enough resources, they can use those resources to transfer tokens and execute smart contracts for free. Users must cover transaction fees with TRX if they utilize more computing power than their resources. Furthermore, all TRX used to pay transaction fees is burned. As such, revenues for TRON are derived from the TRX token burns coming from transaction fees.

TRON had a record quarter for USD revenue in Q3. Revenue in USD was up 29% QoQ from $117.5 million to $151.2 million, an all-time quarterly high. Revenue in TRX was also up, increasing 6% QoQ from 9.96 billion to 1.05 billion.

TRON experienced a sharp uptick in revenue in Q3 due to the popularity of SunPump, a token launcher platform geared for memecoins (More information about SunPump can be found in ‘Ecosystem Overview’). SunPump activity began picking up on August 16 and proceeded to go parabolic over the following two-week period. From August 16 to August 31, over 270.3 million TRX was burned (~$42 million), accounting for nearly 27% of TRON’s Q3 revenue. Additionally, more TRX was burned on August 21 (34.7 million TRX) than on any other day in TRON’s entire existence.

Supply Dynamics

The circulating supply of TRX is affected by two parameters: TRX that is burned and TRX minted to reward stakers and block producers. All transaction fees paid in TRX are burned, leading to deflationary pressure on the supply of TRX. Additionally, new TRX enters the circulating token supply as rewards for stakers and block producers. These rewards work out to roughly 5.06 million TRX minted per day. Therefore, the circulating supply of TRX will decrease over time as long as more than 5.06 million TRX is burned daily.

As previously mentioned, TRX is one of the few deflationary Layer-1 network tokens. In Q3, the supply of TRX decreased from 87.20 billion to 86.62 billion. After annualizing this decrease in circulating supply, TRX has an annualized inflation rate of -2.7%. Annualized inflation was down QoQ, decreasing 11% from -2.4%.

New TRX is minted as rewards for stakers and block producers. TRON incentivizes participants in its staking mechanism through a combination of the following:

- Block Reward – Super Representatives earn 16 TRX for each block produced (subject to change through onchain governance). After producing a block, the Super Representative’s chosen commission ratio is kept, while the remaining TRX is distributed amongst the representative’s associated voters.

- Vote Reward – The 28th to 127th most voted-for Super Representatives become Super Representative Partners for the next epoch. While partners do not participate in block production, they still receive voting rewards, as well as the TRX stakers that voted for said partners. For every block produced, 160 TRX is rewarded to Super Representatives and Super Representative Partners in proportion to their respective TRX stakers’ votes.

The annualized real yield for staking slightly increased in Q3, up 13% QoQ from 6.9% to 7.7%. This increase was due to more TRX being burned in Q3.

Network Overview

Usage

Q3 marked the second straight quarter of increasing levels of onchain activity (transactions, active addresses, new addresses, etc.) for TRON. Average daily transactions increased 14% QoQ from 6.3 million to 7.2 million.

TRON saw increasing levels of onchain activity (transactions, active addresses, new addresses, etc.) in Q3. Average daily transactions increased 29% QoQ from 4.8 million to 6.3 million. As for average daily active addresses, it grew 6% QoQ from 2.0 million to 2.1 million.

Average daily new addresses continued their upward trend in Q3, up 5% QoQ from 198,000 to 208,500. Approximately 10% of all active addresses in Q3 were new addresses, up slightly QoQ by 1%.

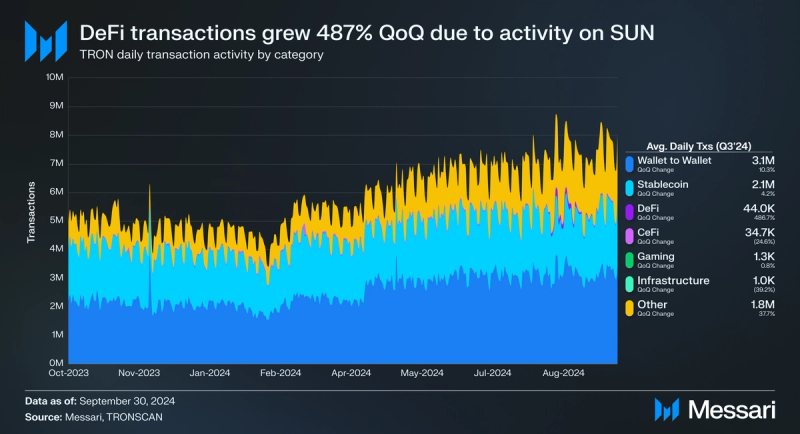

The majority of transactions on TRON continue to come from wallet transfers and stablecoins. Wallet transfers were up 10% QoQ from 2.8 million to 3.1 million, and stablecoin transfers were up 4% QoQ from 2.0 million to 2.1 million. Collectively, wallet transfers and stablecoin transactions represented 73% of transactions in Q3, down 6% QoQ from 78%. The biggest gainer in market share terms was DeFi transactions. The launch of SunPump and subsequent trading activity from memecoins on SUN caused a sharp increase in DeFi transactions in Q3, up 487% QoQ to 44,000. DeFi transactions represented nearly 1% of all transactions on TRON in Q3. “Other” transactions also had a large QoQ increase, up 38% QoQ from 1.3 million to 183 million. “Other” transactions include account creation, SR account creation, account permissions update, proposal initiation, and other non-smart contract interactions on the network.

Wallet transfers and stablecoins have historically dominated average daily active address activity on TRON. Q3 was no different, as an average of 1.6 million addresses conducted a wallet transfer per day (+10% QoQ). However, as for stablecoin transactions, they decreased by 1% QoQ to 624,800. Similar to transactions, active addresses interacting with DeFi increased QoQ by 263% to 6,700. Finally, active addresses interacting with gaming increased by 2% QoQ to 900.

Security and Decentralization

TRON uses a Delegated Proof-of-Stake (DPoS) election mechanism and the Practical Byzantine Fault Tolerance (PBFT) consensus algorithm to secure the network. A DPoS election occurs every six hours, in which 27 Super Representatives (SRs) take turns producing blocks. Those who wish to run a node on TRON can pay 9,999 TRX to become an SR candidate.

There may be centralization concerns about having only 27 SRs participating in securing the network. But, at the end of Q3, over 419 SR candidates (up from 416 in Q2) received votes. This increasing diversity of candidates helps mitigate centralization concerns and promotes a more distributed governance model, enhancing the network’s resilience and security. The growing number of SR candidates should challenge the voting population to distribute votes to new candidates. Additionally, no singular entity received more than 10% of all votes. The entity with the most votes was Binance Staking, which received 3.36 billion votes out of 41.36 billion votes in the most recent election (8% of all votes).

Although there may be some benefits to a democratic voting system for block production and a growing set of SR candidates, neither feature fully does away with centralization risks. Metrics such as the geographic diversity of nodes may also factor into a network’s level of centralization. As of Q3 end, 7,954 TRON nodes (up from 7,474 in Q2) were distributed across 78 different geographic locations around the globe, with the highest concentration in Europe (~39%). Many Layer-1 networks struggle with the geographical concentration of their nodes. Too many nodes in the same location could jeopardize the health of a network due to geopolitical risks, regulations, and acts of nature, among other reasons.

To stake TRX on TRON, users can choose between Stake 1.0 and Stake 2.0. The new staking mechanism, Stake 2.0 (TIP-467), went live in April 2023. It implemented a new layer to separate low-frequency staking operations and high-frequency resource delegating operations. Stake 2.0 also introduced resource re-delegating without unstaking and improved resource utilization. Of note, all newly staked TRX after April 2023 is staked via Stake 2.0, but any TRX previously staked via Stake 1.0 remains valid.

Across both staking options, the staking ratio (the proportion of TRX’s total supply actively being staked) fell, decreasing slightly to 48% in Q3. However, more users continued to switch to Stake 2.0 over 1.0 in Q3. Stake 2.0 ended the quarter with 20.50 billion TRX staked (+30% QoQ), whereas Stake 1.0 finished with 21.42 billion TRX staked (-30% QoQ). In sum, 41.93 billion TRX was staked at the end of Q3, a decrease of 9% QoQ. Due to an increase in TRX price, however, total staked in USD was up 14% QoQ from $5.76 billion to $6.54 billion. Compared to other PoS networks, TRON had the sixth-highest dollar value of funds staked by the end of Q3, up two spots from last quarter.

In order to take over the network through a two-thirds attack, a malicious actor would need to control 18 of the 27 SRs, or essentially two-thirds of the total stake. At the end of the quarter, this threshold was 27.95 billion TRX ($4.36 billion).

Bandwidth is the gas spent on transactions while energy is the gas spent on contract calls. Users can stake TRX to acquire either resource accordingly:

- The amount of bandwidth obtained from an account’s stake = (the amount of TRX staked for obtaining bandwidth / the total amount of TRX staked for obtaining bandwidth in the whole network * 43.2 billion)

- The amount of energy obtained from an account’s stake = (the amount of TRX staked for obtaining energy / the total amount of TRX staked for obtaining energy in the whole network * 90.0 billion)

The vast majority of TRX on TRON is staked for bandwidth. Notably, the amount staked for bandwidth was down 29% QoQ from 38.59 billion to 27.46 billion. As for energy, staking increased 89% QoQ from 7.64 billion to 14.47 billion, in part due to higher gas fees from memecoin trading. The amount staked for each resource is correlated with consumption. Daily bandwidth consumption was up 15% QoQ from 1.83 billion to 2.12 billion, and daily energy consumption was up 32% QoQ from 83.98 billion to 110.76 billion.

Technical Developments

TRON passed a series of proposals in Q3 aimed at reducing onchain congestion and gas fees.

- Proposal 92 (Aug 25) – Raised the total energy limit on TRON to 120 billion. 20 of 27 super representatives approved of the proposal.

- Proposal 94 (Sep 12) – Raised the total energy limit on TRON to 150 billion. 21 of 27 super representatives approved of the proposal.

- Proposal 95 (Sep 19) – Modifies the threshold of the dynamic Energy model to 5 billion, modifies the fee of one unit of Energy to 0.00021 TRX, and modifies the maximum increase factor (in basis points) of the dynamic Energy model to 34,000. 22 of 27 super representatives approved of the proposal.

- Proposal 97 (Oct 3) – Raised the total energy limit on TRON to 180 billion. 21 of 27 super representatives approved of the proposal.

Ecosystem Overview

DeFi

DeFi TVL on TRON had mixed results in Q3. TVL denominated in TRX fell 17% QoQ from 62.59 billion to 51.91 billion. However, TVL denominated in USD was up, growing 4% QoQ from $7.80 billion to $8.09 billion. This dynamic indicates that TRX price increases drove the TVL increase in USD, not capital inflows. Compared to other networks, TRON remained the second-highest network by TVL, beating out third-place BNB Smart Chain ($5.40 billion) by $2.69 billion.

The top three protocols by TVL on TRON are JustLend, JustStables, and SUN. JustLend, the largest protocol by TVL, saw its TVL fall 1% QoQ from $5.80 billion to $5.75 billion ($46.4 million decrease). However, despite this decrease in TVL, net borrows on JustSun increased from $87.9 million to $101.3 million (+15% QoQ), perhaps signaling a greater appetite for leverage on TRON. Furthermore, in past quarters, over 90% of JustLend’s TVL was BTCB. By the end of Q3, only 48% ($2.74 billion) of JustLend’s TVL was BTCB, with TRX representing the second most at 27% ($1.56 billion. By the end of Q3, JustLend’s TVL dominance was 71% (down 4% QoQ).

JustStables, a collateralized debt position (CDP) protocol, had a TVL increase of 9% QoQ (up $132.3 million to $1.58 billion). All TVL on JustStables is in the form of TRX tokens. Additionally, the amount of TRX deposited on JustStables decreased by 13% QoQ from 11.58 billion to 10.11 billion TRX, meaning that the TVL increase was due to the price appreciation of TRX. Because of this price increase, JustStables TVL dominance was up 5% QoQ to 20%.

SUN had the biggest TVL gains in Q3, in part due to the launch of SunPump. TVL increased by 39% QoQ from $542.4 million to $755.4 million. SUN consists of three different AMMs (V1, V2, and V3). By the end of Q3, V1 TVL was $365.7 million (48% of TVL), V2 TVL was $200.4 million (27% of TVL), and V3 TVL was $184.6 million (24% of TVL). Additionally, SUN’s TVL dominance increased to 9% (up 34% QoQ). In sum, JustLend, JustStables, and SUN represented over 99% of DeFi TVL on TRON.

SunPump

On August 12, SUN launched SunPump. SunPump is a token launcher platform that allows any TRON user to deploy their own token, typically memecoins. SunPump uses a bonding curve for initial price discovery, and once a token reaches a market cap of $69,420, $12,000 of TRX liquidity from the bonding curve is paired with the remaining tokens as a liquidity pool on SUN. The associated liquidity pool tokens are subsequently burned, ensuring guaranteed liquidity for the token.

Traction on SunPump began picking up after several key announcements were made, including:

- Aug 13 – Crypto exchange HTX announced they would list popular memecoins from SunPump that satisfied certain requirements.

- Aug 14 – Crypto exchange Poloniex announced they would list popular memecoins from SunPump that satisfied certain requirements.

- Aug 15 – $10 million ecosystem boost incentive program for memecoins on SunPump announced.

- Aug 16 – Popular onchain token explorer Dexscreener announced they would add support for TRON.

SunPump activity peaked on August 20 when over 7,500 tokens were created in a single day, generating 3.7 million TRX (~$585,000 at the time) in platform revenue. By the end of the quarter, over 89,000 tokens had been created on SunPump, generating 34.5 million TRX (~$5.4 million at quarter end) in platform revenue. Additionally, many popular memecoin communities emerged out of SunPump, including SunDog, Tron Bull, Invest Zone, and more.

DEX Volume

DEX activity on TRON reached its highest levels since 2022 due to the launch of SunPump. For Q3, average daily DEX volumes increased 150% QoQ from $26.4 million to $65.8 million. The effect of SunPump is most evident through the increase in volume routed through SUN V2, which hosts liquidity pools for bonded memecoins from SunPump. The average daily DEX volume on SUN V2 was up 982% QoQ in Q3, from $2.6 million to $27.9 million.

Essentially all DEX volumes on TRON occur on SUN. In June 2023, SUN introduced a concentrated liquidity (CL) AMM to its product suite (SunSwap V3). Q1’24 marked the first time since SunSwap V3’s introduction that the majority of volume on SUN was routed through the V3 AMM. Despite the rise in volumes on SUN V2 from memecoins, this trend continued in Q3, with SUN V3 accounting for 51% of all volume on TRON (average daily of $33.3 million).

Stablecoins

The stablecoin market cap on TRON has been steadily trending upward over the past year, and Q3 continued that trend. Stablecoin market cap increased by 3% QoQ from $58.02 billion to $59.97 billion. USDT accounts for the vast majority of stablecoins on TRON, boasting a market share of 98% (flat QoQ). The market cap of USDT on TRON ended the quarter at $58.94 billion (up 3% QoQ from $57.06 billion). Additionally, approximately 51% of all USDT in circulation is on TRON (down 3% QoQ).

Three other stablecoins on TRON had QoQ increases in Q3. The second largest stablecoin on TRON, USDD, was up 0.11% QoQ from $729.9 million to $730.6 million. USDD’s market share, however, decreased by 3% QoQ to 1%. The biggest QoQ gainer in percentage terms was TUSD, which was up 87% QoQ from $89.1 million to $166.6. Rounding out the top four is USDJ, which ended the quarter at $70.7 million, up 4% QoQ from $67.8 million.

Another useful metric for evaluating stablecoins is transfer volume. This metric measures the dollar value of stablecoins moving onchain, not just when interacting with DEX-based smart contracts. The average daily USDT onchain transfer volume was up in Q3, increasing by 4% QoQ from $13.86 billion to $14.38 billion.

Ecosystem Growth

TRON DAO continues implementing strategies to grow the ecosystem beyond stablecoins, with initiatives such as the TRON DAO Grants Program, a $100 million AI development fund, and the TRON Grand Hackathon seasons.

On July 25, TRON launched HackaTRON Season 7. The hackathon offers a prize pool of $650,000, including $500,000 in TRX and $150,000 in energy prizes, aiming to attract both experienced developers and newcomers to the TRON platform. HackaTRON Season 7 featured five competition tracks: Web3, Artistry, DeFi, Builder, and Integration, encouraging diverse blockchain solutions. Sponsors for the hackathon include Google Cloud, BitTorrent File System, Just Ecosystem Dapps, HTX DAO, SUN Ecosystem Dapps, and ApeNFT. This initiative promotes innovation within the TRON ecosystem and helps identify and nurture talent that can contribute to TRON’s long-term growth and development.

On September 10, 2024, TRON, in collaboration with Tether, and TRM Labs, announced the launch of the T3 Financial Crime Unit (T3 FCU) to address cryptocurrency-related crimes. This private sector initiative aims to address growing concerns about illicit activities involving USDT on the TRON blockchain. With USDT’s market cap exceeding $118 billion and over half of its supply circulating on TRON, robust security measures became necessary.

The T3 FCU has demonstrated early results, having frozen over $12 million in USDT linked to various scams since its inception in July 2024. These actions were taken in response to illicit activities identified between July and September 2024. These scams included blackmail, investment fraud, and other illicit activities, with at least 11 known victims identified.

One of TRON’s major initiatives for 2024 is to continue expanding into the Bitcoin ecosystem. In Q1, Justin Sun announced that TRON will be developing a Bitcoin Layer-2 solution. Its goal would be to create a secure way for the Bitcoin ecosystem to access TRON’s pool of stablecoin capital ($59.97 billion by Q3 end). The roadmap for TRON’s Bitcoin Layer-2 solution has three parts:

- Road Map Stage α – This stage involves integrating various TRON-based tokens into the Bitcoin ecosystem via cross-chain technology. Also, TRON DAO Ventures plans on investing in user-friendly wallets and tools to help simplify the user experience on Bitcoin.

- Road Map Stage β – This stage involves various partnerships and collaborations with other protocols and projects building Bitcoin Layer-2 solutions. As a part of this stage, TRON announced a new partnership with Bitcoin Layer-2 project Merlin Chain in February. The partnership aims to unlock new growth for the TRON ecosystem by driving cross-chain capabilities and new DeFi opportunities.

- Road Map Stage γ – This final stage involves developing a Layer-2 solution that incorporates the TRON, BitTorrent, and Bitcoin networks.

Closing Summary

In Q3, TRON continued its strong growth across key metrics, with TRX’s circulating market cap rising 24% QoQ, marking seven consecutive quarters of growth. This was fueled by TRON’s deflationary token model and increased network activity, with average daily transactions up 14% and average daily active addresses up 6%. TRON maintained its position as the second-largest network by DeFi TVL, growing 4% QoQ to $8.09 billion, driven by a rise in TRX prices.

SunPump, a new memecoin launch platform, boosted TRON’s DeFi activity, leading to a 150% QoQ increase in DEX volumes and a sharp rise in DeFi transactions. Stablecoin usage on TRON remained strong, with USDT continuing to dominate the ecosystem, accounting for 98% of the network’s stablecoin supply. TRON’s ecosystem also saw growth through initiatives like HackaTRON Season 7, its Bitcoin Layer-2 project, and the launch of the T3 Financial Crime Unit.