Key Insights

- Merlin Chain has emerged as a leading EVM-compatible sidechain with Bitcoin-native assets. Merlin Chain achieved a TVL of over $3.5 billion at its peak in March 2024.

- Merlin Chain is committed to transitioning to a Bitcoin Layer-2 (L2). Merlin Chain is a Bitcoin sidechain built using the Polygon CDK, designed to transition into a Bitcoin zero-knowledge (ZK) Layer-2 solution.

- Merlin Chain’s ecosystem revolves around Bitcoin-native assets. Ordinals, BRC-20s, BRC-420s, and Runes can be bridged to Merlin Chain for use throughout Merlin Chain’s applications.

- Merlin Chain has completed two funding rounds. The rounds took place in February and April 2024, and the investors included OKX Ventures, Foresight Ventures, KuCoin Ventures, Spartan Group, Amber Group, Waterdrip Capital, Presto Labs, IOBC Capital, Hailstone, and others.

Introduction

With the rise of Bitcoin-native assets like Ordinals, BRC-20s, and Runes, Bitcoin scaling solutions have been developed to improve the user experience, reduce fees, and bring smart contract functionality to Bitcoin. Scaling solutions such as Merlin Chain are scaling via Layer-2s (L2s), a similar method of scaling as Ethereum. As of Oct. 7, 2024, Merlin Chain operates a Bitcoin sidechain but plans to transition to a Bitcoin L2 once the appropriate technology has been developed to support this transition. Merlin Chain’s commitment to making Bitcoin-native assets productive assets through the current sidechain implementation and their commitment to developing the technical infrastructure to enable the transition of Merlin Chain from a sidechain to a Bitcoin L2 have helped establish Merlin Chain as the leading Bitcoin scaling solution by TVL.

Background

Merlin Chain was founded in January 2024 by Jeff Yin, who previously founded Bitmap Tech. The Bitmap Tech team is known for creating the BRC-420 protocol, the BRC-420 “Blue Box” Ordinal collection, Bitmap.Game, and Recursive. Merlin Chain launched its mainnet in February 2024.

As of Sept. 16, 2024, Merlin Chain is an EVM sidechain for Bitcoin native assets, such as Ordinals, BRC-20s, Runes, and more. Merlin Chain is designed to improve the onchain experience of using Bitcoin by reducing transaction fees and attracting users and liquidity through an improved user experience. The Bitmap Tech team partnered with Lumoz, a Rollup-as-a-Service (RaaS) protocol, to develop Merlin Chain using the Polygon chain developer kit (CDK).

In the future, Merlin Chain plans to iterate on top of its current architecture to develop a Bitcoin zero-knowledge (ZK) Layer-2 (L2) that posts ZKPs back to Bitcoin for verification. A Bitcoin L2 that posts ZKPs back to Bitcoin has yet to become technically or economically feasible due to challenges related to verifying zero-knowledge proofs (ZKP) on Bitcoin. However, recent developments by Merlin Chain partners BitcoinOS and NuBit are aiding Merlin Chain’s vision of making a true Bitcoin ZK-rollup a reality.

In February 2024, Merlin Chain launched its mainnet and an incentivization campaign called Merlin’s Seal. Merlin’s Seal was designed to attract users and TVL by rewarding participants who bridged Bitcoin native assets, ETH, USDT, and USDC, and staked them on Merlin Chain. Participants initially accrued M-points, representing a share of 20% of the total supply of MERL, Merlin Chain’s native governance token. Merlin Chain achieved a peak TVL of over $3.5 billion in March 2024.

Technology

The following section on Merlin Chain’s technical architecture is divided into its current scaling framework and proposed architecture. Currently, Merlin functions as a validium-based sidechain, leveraging zkEVM technology and a Data Availability Committee (DAC) to manage Bitcoin-native assets such as Ordinals and Runes. Looking ahead, Merlin Chain aims to evolve into a Bitcoin ZK-rollup, incorporating advanced features like decentralized oracles, ZKPs, and Bitcoin-native data availability, positioning the network for enhanced scalability, security, and utility within the broader Bitcoin ecosystem.

Scaling Architecture

Layer-1 blockchains like Ethereum and Bitcoin have faced congestion when transaction demand has surpassed network capacity, leading to slower confirmations and high gas fees. Blockchain fee mechanisms prioritize transactions by allowing users to pay higher fees during network congestion, incentivizing miners or validators to process them first. This market-driven approach ensures that transactions offering greater rewards are included in blocks more quickly, while lower-fee transactions may be delayed or excluded until network demand decreases. Layer-2 (L2) rollups have emerged as scalability solutions to address issues related to high network demand causing prohibitively expensive fees. Rollups process transactions off the base layer, offchain, on the L2, reducing the computational load on the L1 while ensuring data integrity by periodically posting transaction history back to the base layer for verification, helping enhance throughput without compromising security.

Validiums are an alternative scaling solution similar to rollups. They use zero-knowledge proofs (ZKPs) to verify the state of an L2 chain without publishing transaction data back onto the L1. Instead, validiums post only the validity proofs to the L1, while transaction data is stored offchain. Because posting validity proofs requires less data than posting full transaction history, Validiums are more cost-effective than rollups, reducing gas fees for users. However, by relying on offchain data storage, typically through a Data Availability Committee (DAC) or other solutions, Validiums are considered less secure than ZK-rollups, which store both proofs and data onchain.

Sidechains vs. Layer-2s

Merlin Chain and its competitors position themselves as Bitcoin L2 scaling solutions, though the term ‘Bitcoin L2’ is currently more of a marketing term than a technical reality for several reasons. Firstly, sidechains do not inherit Bitcoin’s security; instead, they rely on their own consensus mechanisms, which introduce trust assumptions. Secondly, sidechains have permissioned withdrawals, meaning users must trust the validators or federations for withdrawal approvals. Finally, as of Sept. 27, 2024, Bitcoin’s scripting language, Script, lacks the capability to support advanced functionalities like rollups and complex smart contracts, which means L2s are unable to rollup to Bitcoin.

Merlin Chain’s Current Architecture

Currently, Merlin Chain operates as a sidechain for Bitcoin-native assets like Ordinals and Runes. Merlin Chain was built by Lumoz, a Rollup-as-a-Service (RaaS) protocol that uses Polygon’s CDK validium architecture, which consists of a zkEVM with a Data Availability Committee (DAC). A DAC ensures offchain transaction data validity and availability. DAC nodes fetch, validate, and sign data from the sequencer, then store it in a local database, making it accessible to the network while guaranteeing its integrity. The Polygon CDK validium architecture defines Merlin Chain as a zkValidium that utilizes Polygon zkEVM’s offchain prover to generate zero-knowledge proofs published as validity proofs.

At present, Merlin Chain does not post proofs to Bitcoin because the network lacks the capability to verify them. Achieving a true ZK-rollup requires posting proofs and ensuring they can be verified, with L2 operations constrained by that verification. Merlin Chain intends to complete the transition once the verification process is fully developed. The team is actively exploring various approaches to accelerate the readiness of a Bitcoin ZK-rollup solution. In this pursuit, Merlin Chain has partnered with BitcoinOS and Nubit to develop the necessary technology for ZKP verification on Bitcoin, but their solutions are still under development.

Bridging to Merlin Chain

Merlin Chain’s native bridge, Merlin Bridge, is a cross-chain bridge that enables users to transfer supported assets primarily from Bitcoin to Merlin Chain. A number of third-party bridges, such as UniCross, Meson, FreeLayer2, Orbiter Finance, Owlto Finance, and Chaineye, also support a limited number of assets for bridging to Merlin Chain.

When users bridge to Merlin Chain, Bitcoin-native assets enter a Multi-Party Computation (MPC) custody address jointly managed by Cobo and Merlin Chain. Cobo is a digital asset custody platform that offers institutional-grade custody solutions to secure assets. Merlin Chain then issues a tokenized representation of the underlying assets on Merlin Chain.

M-Tokens

During Merlin Chain’s Merlin’s Seal event, announced on Feb. 7, 2024, users could bridge and stake assets in exchange for M-Tokens. M-Tokens are voucher tokens representing staked assets on Merlin Chain. Initially, assets were locked and unable to be unstaked and bridged out of Merlin Chain until Merlin Chain enabled unstaking on April 25, 2024. Merlin’s Seal participants earned M-points representing a claim for a share of 20% of the MERL token supply. The MERL token launched on April 19, 2024. M-Tokens no longer receive M-Points but remain redeemable 1:1 for the underlying assets staked in Merlin’s Seal. M-BTC is the leading M-Token on Merlin Chain and continues to have deep onchain liquidity with over $7.5m in liquidity in the largest M-BTC/BTC liquidity pool on Merlin Swap as of October 17, 2024.

Merlin Chain’s Proposed Architecture

Merlin Chain’s current sidechain architecture represents an initial solution for scaling Bitcoin-native assets. While the long-term goal is to transition to a full Bitcoin ZK-rollup, this will depend on future technological advancements. In the interim, Merlin Chain has outlined a framework for a proposed Bitcoin L2 that includes components such as a ZK-rollup network, decentralized oracles, Bitcoin-native data availability, a two-step ZKP submission process, and fraud proofs anchored to Bitcoin. This framework reflects Merlin Chain’s commitment to building a scalable and secure Bitcoin L2 solution. While working toward this goal, Merlin Chain has partnered with BitcoinOS, which is developing a solution for verifying ZKPs made possible by recent developments in their BitSNARK technology. Merlin Chain has also partnered with NuBit to explore integrating Nubit’s Bitcoin native data availability solutions.

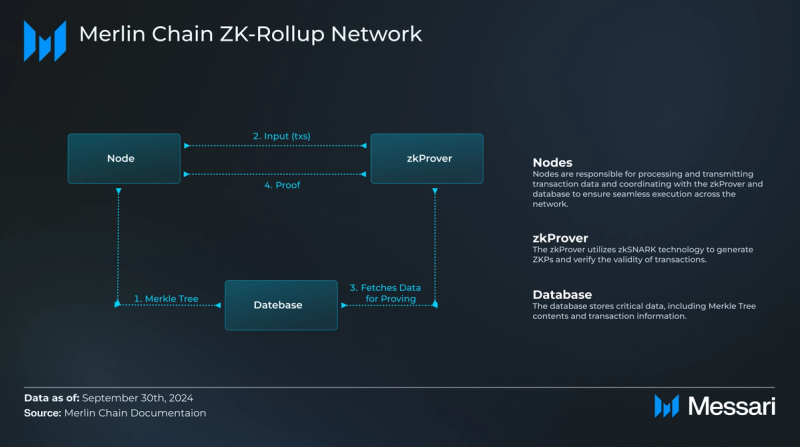

ZK-Rollup Network

Merlin Chain’s proposed Bitcoin L2 solution leverages a ZK-rollup network, zkProver, and database to enhance scalability while anchoring transaction data to Bitcoin for security. Integrating ZKPs and zkSNARKs minimizes L1 resource consumption, reducing costs and improving efficiency. The architecture supports EVM compatibility, enabling seamless smart contract interoperability. Additionally, recursive STARKs manage large-scale user demand, ensuring fast transaction finality. This solution positions Merlin Chain as a key player in developing scalable Bitcoin-native infrastructure.

Nodes: Nodes are responsible for processing and transmitting transaction data and coordinating with the zkProver and database to ensure seamless execution across the network.

- Nodes transmit the Merkle Tree data to the database and store it.

- Nodes input transactions into the zkProver for processing.

- Nodes interact with the zkProver to ensure transaction validity and correctness.

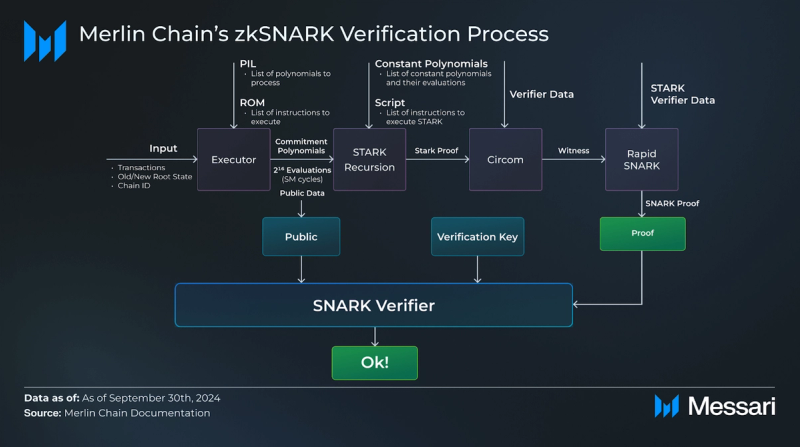

zkProver: The zkProver utilizes zkSNARK technology to generate ZKPs and verify the validity of transactions.

- The zkProver contains 13 types of state machines divided into main state machines and sub-state machines.

- It executes complex mathematical calculations using Polynomial Identity Language (PIL) to describe state transitions and constraints during transaction execution, converting them into polynomial constraints and verifying them on smart contracts.

- The zkProver interacts with nodes and the database to gather information, generating verifiable proofs, including Merkle Root, sibling keys, and hash values.

- The zkProver sends the transaction proofs back to the nodes for verification and recording, ensuring the legality and security of transactions.

Database: The database stores critical data, including Merkle Tree contents and transaction information.

- The database receives and stores Merkle Tree data transmitted by the nodes.

- It provides the zkProver with the necessary information to generate transaction proofs.

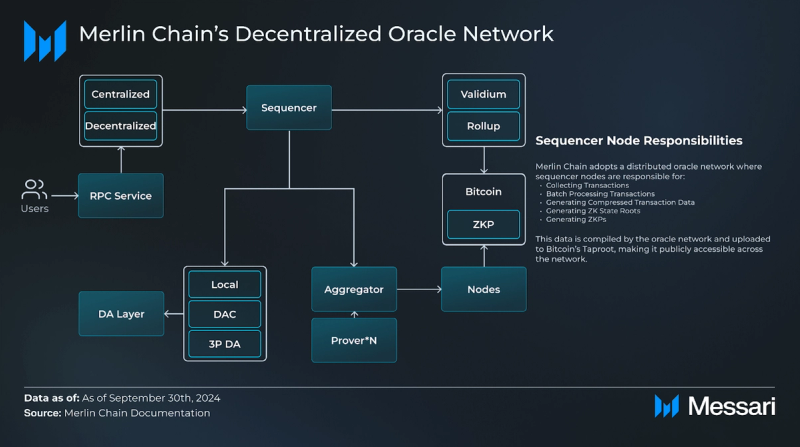

Decentralized Oracle Network

Merlin Chain’s proposed Decentralized Oracle Network utilizes a distributed system where sequencer nodes batch and compress transaction data, ZK state roots, and proofs, which are then compiled by the oracle network and uploaded to Bitcoin. This ensures public data accessibility, with fraud-proof mechanisms providing final confirmation on Bitcoin. While raw data is stored offchain, state roots are anchored on Bitcoin, allowing users to retrieve and verify transactions via ZKPs. The network supports the staking of $BTC, $MERL, and BRC-20 assets, with smart contracts automating staking and rewards, offering real-time monitoring and flexible withdrawals.

Data Availability

Merlin Chain has partnered with Nubit to develop a data availability (DA) solution designed to make Merlin Chain’s state publicly accessible, enabling anyone to view and store its data. This initiative is critical to transitioning Merlin Chain into a fully operational Bitcoin L2. Nubit’s Bitcoin-native DA solution is still in development and not yet ready for integration with Merlin Chain, but it represents a key component of Merlin’s long-term scalability strategy.

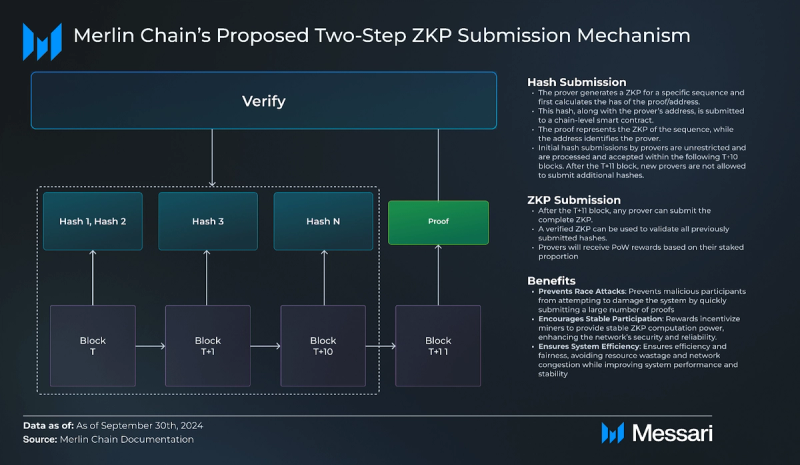

Two-Step ZKP Submission Mechanism

Merlin Chain plans to implement a two-step ZKP submission mechanism developed by Lumoz to achieve decentralized Proof-of-Work (PoW). This mechanism incentivizes miners to stay online, maintaining a stable computational environment and enhancing the network’s security and reliability. Provers submit a hash of their proof and address to a chain-level smart contract, with submissions open for 10 blocks (T+10). After the T+11 block, any prover can submit the full ZKP to validate the hashes. Provers are rewarded for securing the network, incentivizing continuous ZKP computation, preventing race attacks, and improving system efficiency by reducing resource wastage and network congestion.

Fraud Proofs Based on Bitcoin

Merlin Chain plans to introduce a fraud-proof mechanism to ensure data integrity, involving two key roles: the Prover and the Verifier. The Prover converts the program into a binary circuit, organizes the data into a Merkle Tree, and submits a summary to a Taproot address. The Verifier checks this summary and can challenge the Prover if any discrepancies are suspected. The Prover must then provide proof to confirm the data’s accuracy, ensuring secure and transparent data verification.

Strategic Partnerships

Merlin Chain has established strategic partnerships to develop and advance its current architecture into a Bitcoin L2. Lumoz, a Rollup-as-a-Service provider, established Merlin Chain’s zk-validium, while Cobo provides institutional-grade custody and staking infrastructure. Particle Network aids with decentralized identity and data storage, and BitcoinOS offers BitSNARK technology and the Grail Bridge for trustless cross-chain asset transfers. Nubit supports data availability solutions. These collaborations collectively enhance Merlin Chain’s scalability, security, and decentralization as it evolves into a Bitcoin-native Layer 2 solution.

Lumoz

Merlin Chain has partnered with Lumoz, a RaaS provider, to develop its architecture using Polygon’s CDK. This collaboration enables Merlin Chain to implement zk-validium technology, enhancing scalability and transaction efficiency while maintaining security positioning it as a future Bitcoin Layer-2 solution.

Cobo

Merlin Chain has partnered with Cobo to secure assets bridged from Bitcoin L1 to Merlin Chain using MPC-TSS (Multi-Party Computation – Threshold Signature Scheme). This technology distributes private key shares between Cobo and Merlin Chain, ensuring no single party has complete control over the keys. The jointly managed MPC wallet secures assets that have been bridged to Merlin Chain by preventing single points of failure. This partnership enhances the security and integrity of bridged assets on Merlin Chain.

Particle Network

Merlin Chain has partnered with Particle Network to integrate BTC Connect, enabling Bitcoin-native wallets to interact with EVM-compatible dApps without requiring a wallet switch. This is made possible through account abstraction (AA), which simplifies wallet management by decoupling user accounts from traditional private key dependence. AA leverages a paymaster, a contract that covers gas fees for users, ensuring more seamless transactions. This integration enhances asset transfers between Bitcoin and Merlin Chain, allowing Bitcoin-native wallets to interact directly with EVM dApps.

BitcoinOS

Merlin Chain has partnered with BitcoinOS to accelerate Merlin Chain’s transition from a sidechain to a Bitcoin L2. BitcoinOS, designed to address Bitcoin’s scalability and computational constraints, introduces BitSNARK, an optimized zkSNARK verifier tailored for Bitcoin. Unlike general-purpose computation, BitSNARK focuses on zkSNARK verification, allowing trustless proof validation directly on the Bitcoin blockchain with minimal computational overhead. This integration enables Merlin Chain to leverage secure and decentralized L2 rollups, establishing a more efficient and scalable Bitcoin-native solution.

Building on the partnership between Merlin Chain and BitcoinOS, integrating BitcoinOS’ Grail Bridge further strengthens Merlin Chain’s transition to a Bitcoin Layer 2. The Grail Bridge allows for trustless asset transfers between Bitcoin and Layer-2 networks by utilizing BitSNARK technology, ensuring secure cross-chain transactions without relying on centralized intermediaries. This integration will enable Merlin Chain to shift away from centralized custody and bridging models and adopt a trustless bridging solution that aligns with its strategy to enhance scalability and decentralization. Merlin Chain will use zkSNARK verification to streamline L2 rollups while maintaining Bitcoin-native security and transparency across its ecosystem.

Nubit

Nubit and Merlin Chain are collaborating on integrating Nubit’s Bitcoin-native data availability solutions into Merlin Chain’s Layer 2 architecture. While this integration promises to improve scalability and data integrity by leveraging full and light nodes, the solution is still under development and has not yet been implemented. The partnership also includes plans to integrate Nubit’s modular indexer for trustless verification of protocols like BRC420. As these technologies are developed, they aim to enhance Merlin Chain’s decentralization and security, strengthening Bitcoin’s broader ecosystem.

MERL Token

Merlin Chain launched its native governance token, MERL, on April 19, 2024. The token is a BRC-20 token primarily used to govern and secure the network through delegating and staking to consensus nodes. MERL can also be used to pay transaction fees on Layer-3 (L3) networks built on top of Merlin Chain. Merlin Chain L3 networks are not yet live. However, the MOBOX team behind the Merlin Chain ecosystem project Dragonverse Neo is developing the MOSE Merlin Chain L3 designed to improve the Bitcoin gaming experience.

Governance

MERL token holders participate in decentralized governance by voting on key proposals within the Merlin Chain ecosystem. This ensures the network evolves according to the collective interests of its participants.

Staking/Delegating to Consensus Nodes

MERL can be staked to secure the network, prevent Sybil attacks, and align stakers with ecosystem success. Staking participants may also delegate tokens to consensus nodes, supporting decentralization and scalability.

Transaction Fees

MERL is also used to pay transaction fees within the ecosystem, particularly on prospective Layer 3 networks, facilitating seamless and efficient transactions.

Native Liquidity

MERL serves as native liquidity and collateral within the ecosystem, supporting lending mechanisms and ensuring the network’s liquidity and financial stability.

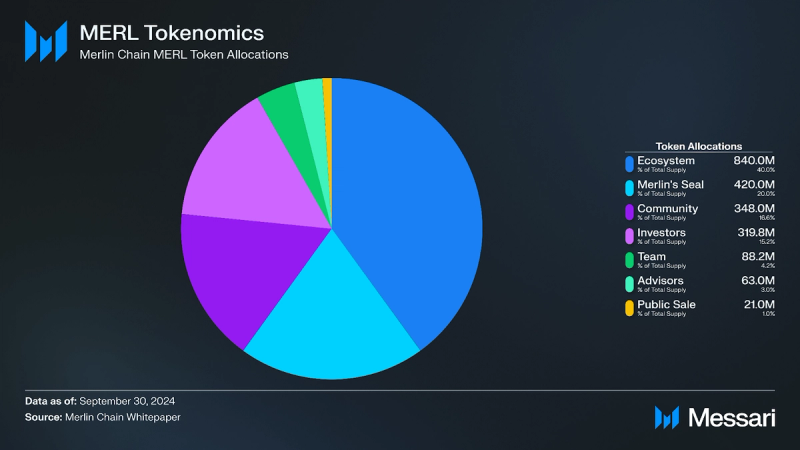

Tokenomics

MERL tokens were allocated across eight areas:

- Private Sale A: 28 million MERL (1.3% of the total supply) were allocated to private sale A investors with a 6-month cliff and 18-month vesting schedule.

- Private Sale B: 292 million MERL (13.9% of the total supply) were allocated to private sale B investors with a 12-month cliff and 36-month vesting schedule.

- Public Sale: 21 million MERL (1% of the total supply) were allocated to public sale investors with no cliff and a vesting schedule that distributes 50% at one month, 25% at two months, 12.5% at three months, 6.25% at four months, 3.125% at five months and 3.125% at six months.

- Merlin’s Seal: 420 million MERL (20% of the total supply) were allocated to the Merlin’s Seal incentivization campaign with no cliff and a vesting schedule that distributes 50% at one month, 25% at two months, 12.5% at three months, 6.25% at four months, 3.125% at five months and 3.125% at six months.

- Advisors: 63 million MERL (3% of the total supply) were allocated to Merlin Chain advisors with a six-month cliff and 30-month vesting schedule.

- Team: 88 million MERL (4.2% of the total supply) were allocated to the Merlin Chain team and will be released over 24 months after a 24-month cliff.

- Community: 348 million MERL (16.57% of the total supply) were allocated to the Merlin Chain community.

- Ecosystem: 840 million MERL (40% of the total supply) were allocated to the Merlin Chain ecosystem.

Fundraising

Merlin Chain completed two funding rounds to accelerate its development. On February 3, 2024, the team announced an undisclosed round backed by OXK Ventures, Foresight Ventures, Waterdrip Capital, MH Ventures, KuCoin Ventures, and others. This was followed by a strategic funding round on April 16, 2024, which saw participation from investors such as Spartan Group, Amber Group, Presto Labs, IOBC Capital, and Hailstone.

State of the Merlin Chain Ecosystem

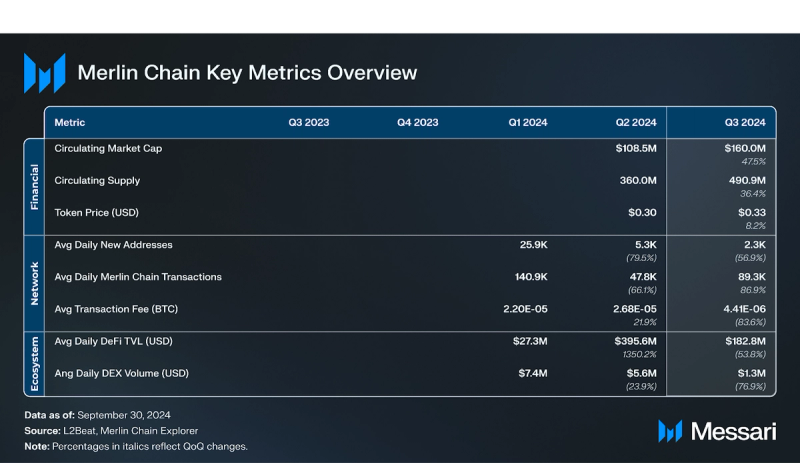

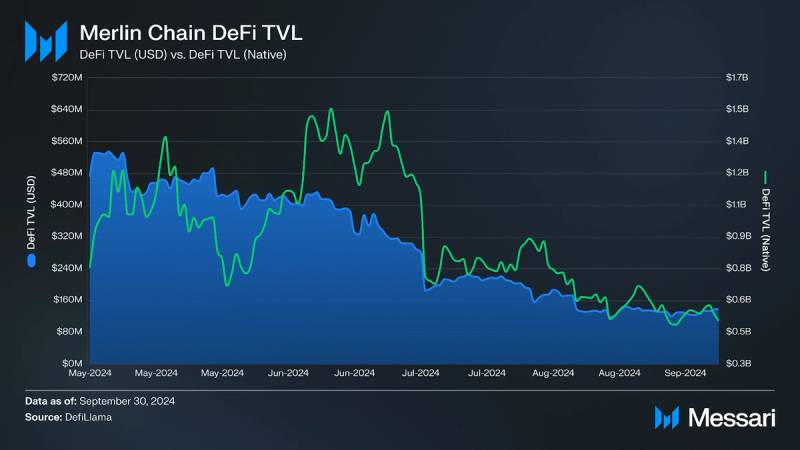

Merlin Chain’s key metrics reveal mixed financial, network, and ecosystem trends. In Q3 2024, the circulating market cap increased significantly by 47.5%, reaching $160 million, while the circulating supply grew by 36.4% to 490.9 million tokens. The MERL token price remained relatively stable, rising by 8.2%, settling at $0.33. On the network usage side, average daily new addresses saw a notable decline of 56.9%, and average daily transactions increased by 86.9%, indicating intensified usage among existing participants. The ecosystem metrics showed a significant dip in average daily DeFi TVL by 53.8% to $182.8 million and a steep decline in average daily DEX volume of 76.9%.

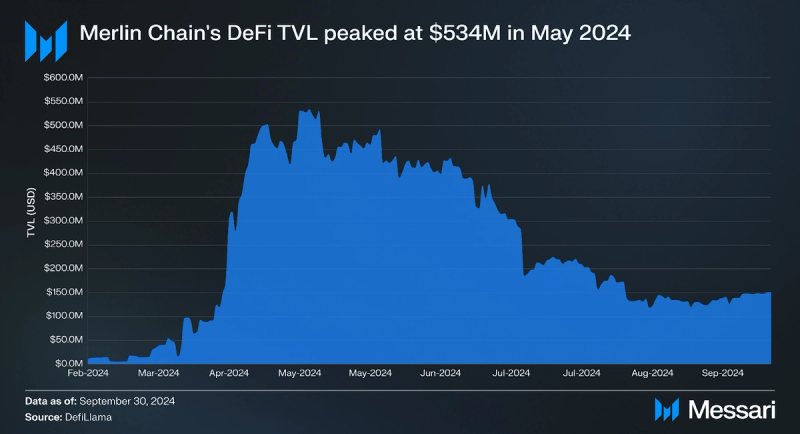

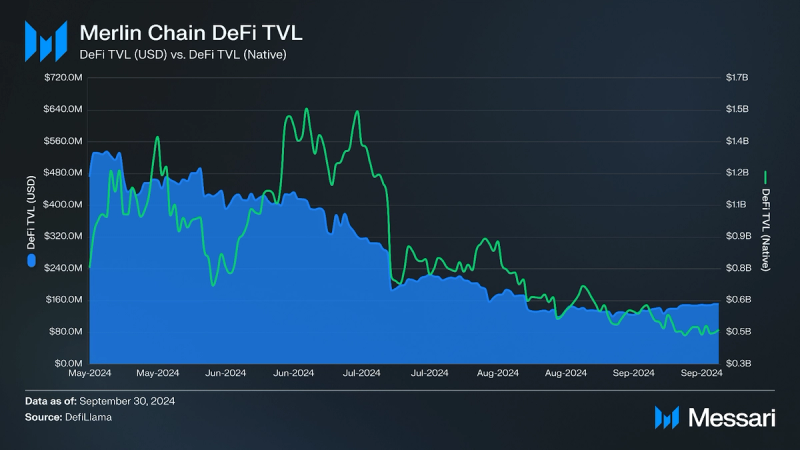

Merlin Chain has a robust ecosystem of applications with a strong focus on DeFi applications for Bitcoin native assets. On Feb. 7, 2024, Merlin Chain announced the Merlin’s Seal program to reward users who bridged assets to Merlin Chain with M-points, which were redeemable for Merlin Chain’s governance token MERL. The Merlin’s Seal campaign helped Merlin Chain achieve a peak TVL of $3.5 billion in March 2024.

DeFi

DeFi is currently the leading sector on Merlin Chain, as Merlin Chain is designed for users to bridge their Bitcoin-native assets to Merlin Chain for access to an EVM smart contract platform specifically for Bitcoin-native assets. Merlin Chain’s DeFi TVL has fallen from its peak of $534.4 million in May 2024 to $131.5 million as of September 30, 2024, according to DefiLlama. Merlin Chain’s DeFi ecosystem is led by Solv Protocol, Avalon Finance, Surf Protocol, Merlin Swap, and Pell Network, each of which has more than $15 million in TVL at the time of writing.

Solv Protocol: Solv Protocol is a Bitcoin liquid restaking protocol integrated with the Merlin Chain ecosystem that gives users access to Bitcoin yield opportunities. Since its April integration, Solv has introduced a BTC vault and points system, enabling users to deposit Merlin Chain’s M-Token M-BTC into Solv Protocol for SolvBTC, which earns rewards through integrations with Babylon and Ethena. SolvBTC offers multiple utilities within the ecosystem, including liquidity provision on Avalon Finance and trading on Surf Protocol. Solv’s Merlin Chain integration has amassed over $400 million in TVL, making it a key player in driving liquidity, DeFi growth, and access to Bitcoin yield opportunities on Merlin Chain.

Avalon Finance: Avalon Finance is a decentralized lending protocol on Merlin Chain, specializing in borrowing and lending for Bitcoin (BTC) and Bitcoin Liquid Staking Derivatives (LSDs). Utilizing an isolated pool mechanism, Avalon enhances capital efficiency and reduces risk by creating dedicated pools for each asset. With over $65 million in TVL on Merlin Chain and over $380 million in TVL across all deployments, it is the largest BTC-focused lending platform by TVL on Merlin Chain. Supported assets include MERL, M-BTC, M-ORDI, M-STONE, BTC, uniBTC, SolvBTC, SolvBTC.bbn, SolvBTC.ena, M-USDT, M-USDC, and more.

Surf Protocol: Surf Protocol is a decentralized derivatives trading platform on Merlin Chain, offering up to 50x leverage for long and short positions on BTC, ETH, MERL, ORDI, SATS, PEPE, WIF, BNB, SOL, NOT, DOG, ULTI, and RUNECOIN. Liquidity providers (LPs) take the opposite side of all trader’s positions through the Surf Vault. Surf Protocol has achieved a cumulative derivatives volume exceeding $1.75 billion since December 2023 and over $20 million in TVL as of the time of writing. Surf Protocol has established itself as a leader in the derivatives trading space on Merlin Chain.

Merlin Swap: Merlin Swap is the leading decentralized exchange (DEX) on Merlin Chain, utilizing an automated market maker (AMM) model to offer fast, low-cost token swaps and liquidity provision. Users can trade a wide range of Bitcoin-native assets and earn rewards through liquidity pools while participating in yield farming by staking liquidity provider (LP) tokens. Merlin Swap enhances the trading experience for Bitcoin-native assets by offering users a familiar Uniswap-style interface, a functionality not available on the Bitcoin mainnet. By enabling seamless interaction with Bitcoin-native assets, Merlin Swap significantly improves the user experience of Bitcoin-native assets while driving liquidity and DeFi growth on Merlin Chain.

Pell Network: Pell Network is an omnichain restaking protocol that enhances blockchain security. BTC holders can restake their Liquid Staking Derivatives to secure Decentralized Validated Services (DVSs) across multiple networks, including Merlin Chain. By offering a universal trust layer based on BTC, Pell reduces the need for new protocols to build costly validator sets, making it easier for developers to secure their applications. This approach improves the scalability and affordability of cryptoeconomic security and creates passive income opportunities for BTC stakes, positioning Pell as a key infrastructure player on Merlin Chain and in cross-chain DeFi.

Gaming, NFTs, and More

Merlin Chain’s Gaming and NFT ecosystems are built around enabling the use of Bitcoin-native assets within its applications. To date, over $35 million in Bitcoin-native NFT collections have been bridged to Merlin Chain, with the largest collections being BRC420 and bitmap collections, representing $20 million and $8 million in TVL, respectively. Flagship applications like Dragonverse Neo provide real utility for these assets, integrating them into gameplay. Other notable Ordinal collections on the chain include NodeMonkes, Bitcoin Puppets, Quantum Cats, Bitcoin Frogs, and Runestones, broadening Merlin’s ecosystem appeal.

Dragonverse Neo: Dragonverse Neo, developed by MOBOX, is a 3D open-world fantasy anime game and the flagship entertainment application on Merlin Chain. Dragonverse Neo features a dynamic, player-driven universe inspired by Genshin Impact and Pokemon. Dragonverse Neo allows users to explore unique customized game environments known as REALMs with their DragonPals. REALMs can also be created and customized through Dragonverse Neo’s 3D game editing studio, and DragonPals possess specific skills that help users in these REALMs. Through its Web3 crafting platform, Dratopia, players can construct their own virtual homesteads using in-game items. With backing from Binance Labs and Animoca Brands, Dragonverse Neo is gaining traction as a flagship decentralized game within the Bitcoin community, offering unique co-creation and governance experiences.

Closing Summary

Merlin Chain is a Bitcoin sidechain built using the Polygon CDK, designed to transition into a Bitcoin ZK Layer-2 solution. Its architecture includes a ZK-rollup network, a decentralized oracle network, Bitcoin-native data availability, and a two-step ZKP submission mechanism. Launched in February 2024, Merlin Chain reached a peak TVL of over $3.5 billion, making it the largest Bitcoin sidechain by TVL. Its ecosystem revolves around Bitcoin-native assets such as Ordinals, BRC-20s, and Runes, with applications spanning DeFi, gaming, AI, and SocialFi sectors. Positioned to redefine Bitcoin scalability and utility, Merlin Chain is at the forefront of expanding Bitcoin’s role in the broader Web3 ecosystem.