Key Insights

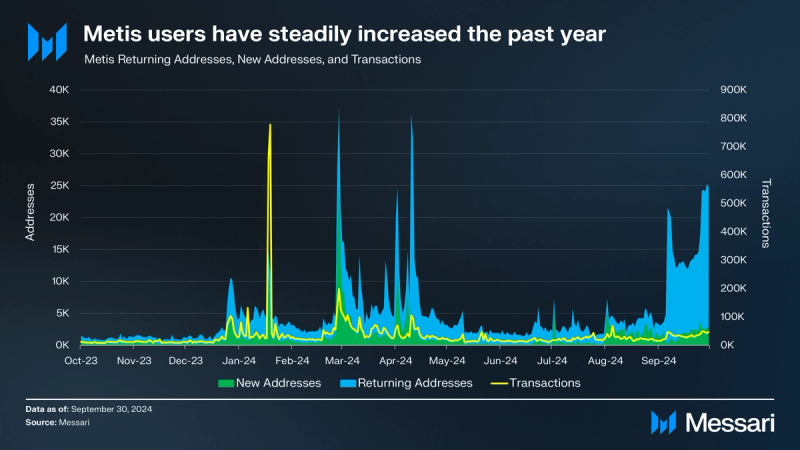

- In Q3 2024, network activity increased, evidenced by a 50% QoQ rise in active addresses and an 11% QoQ increase in transactions, while the average transaction fee dropped to $0.04. This combination of higher activity and lower fees points to improved efficiency across the network.

- The Metis Liquid Staking Blitz continued, with Artemis TVL reaching $11.1 million and Enki TVL hitting $4.5 million. There are at least four new LST protocols set to launch in the near future.

- The Metis Foundation continued strategic investments to foster ecosystem growth and development. These initiatives included an annualized incentive program, a Gitcoin partnership, the launch of Thrive Metis, and the GameFi Quantum Leap Accelerator, all aimed at long-term sustainability.

- Metis integrated independent decentralized sequencer nodes following a competitive selection process. OKX, Hashkey Cloud, and SNZ were the first to join as independent sequencer clients.

- The Metis Foundation’s 2024 roadmap focuses on accelerating decentralization, boosting transaction volume through use cases like gaming and real-world assets, and enhancing security and infrastructure. Key initiatives include supporting new projects via grants and expanding Metis token utility with Holders Mining.

Primer

Metis (METIS) is an Ethereum Layer-2 Rollup that offers simple and fast smart contract deployment within the network. Metis offers many products to blockchain developers including the Metis NFT Bridge, Oracles, Nodes, Data Indexers, and a SubGraph. The platform supports a wide range of decentralized applications and enterprise-level use cases like Aave for lending, Stargate for bridging, and Artemis for TVL , facilitating a friendly experience for developers and end-users.

The native token of the Metis ecosystem is METIS, which serves multiple purposes within the network. It is used for paying transaction fees, staking, and participating in governance processes.

A distinctive feature of Metis is its decentralized sequencer. This system employs dual sequencers operated by the Metis Foundation and select partners, ensuring increased transparency and reducing risks related to censorship and MEV. This architecture enables Metis to offer a robust solution for developers looking to build scalable decentralized applications while maintaining close alignment with Ethereum’s secure infrastructure.

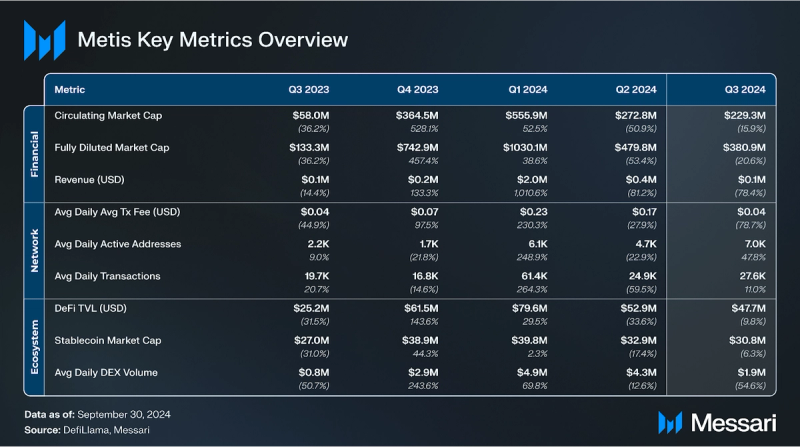

Key Metrics

Analysis

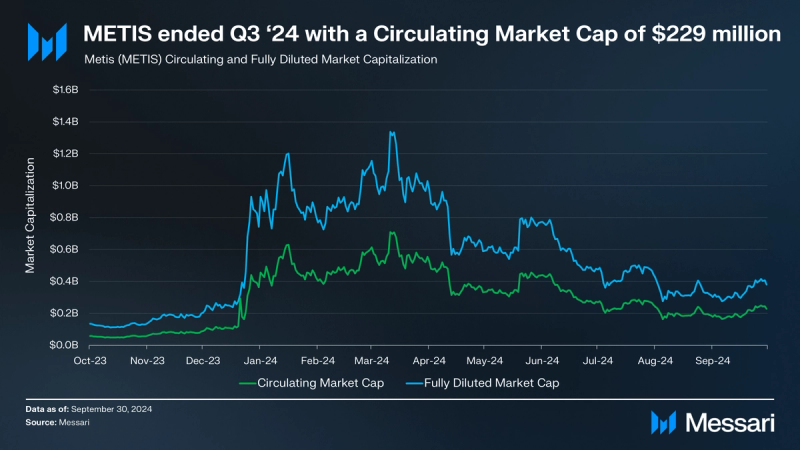

The last year has seen dramatic swings in the valuation of METIS. Between Q3 2023 and Q1 2024, METIS’s circulating market capitalization increased by 10X. However, in Q2 and Q3 2024, METIS retraced along with the rest of the market, resulting in a 59% drop, ending Q3 2024 at $229 million (-16% QoQ). Notably, METIS outperformed ETH which fell by -24% QoQ. The fully diluted market capitalization similarly fell, ending Q3 2024 at $381 million (-21% QoQ). METIS’s market cap ranking dropped from 191 to 194 in the overall crypto market and it ranked as the tenth largest Ethereum Layer 2 by market cap.

The circulating supply of METIS expanded to 6.0 million, representing a 5.9% QoQ increase. Metis has a maximum total supply of 10 million METIS; therefore, 60% of the supply is now in circulation.

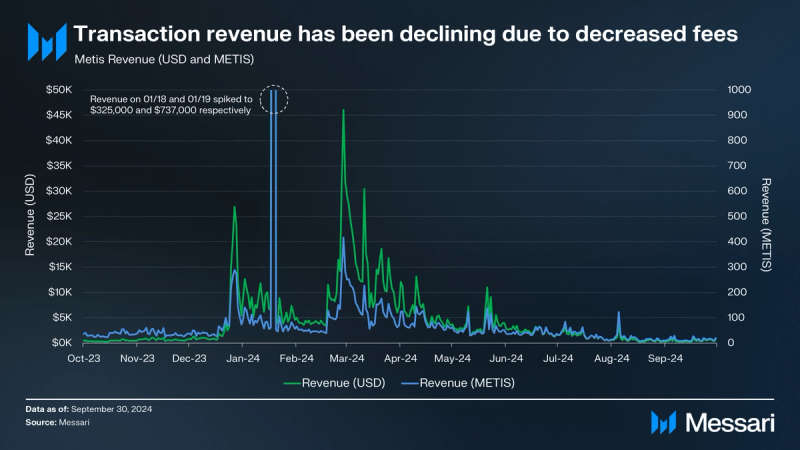

The revenue in USD fell to approximately $100,000, reflecting a 78% decrease QoQ, while the revenue in METIS was 2,100, marking a 61% decrease QoQ. This decline was driven by a continued decrease in the average transaction fee, which fell 79% QoQ to $0.04, even as transactions increased by 11% QoQ. Notably, Metis saw a spike in revenue on January 18th and 19th, with $325,000 and $737,000 respectively, which significantly contributed to the overall drop in revenue, as removing these days would have resulted in a more muted decline.

Metis network activity increased in Q3 2024, with average daily active addresses reaching 7,000 (+48% QoQ); average daily new addresses rising to 1,500 (+47% QoQ); average daily returning addresses growing to 5,500 (+48% QoQ); and average daily transactions increasing to 27,600 (+11% QoQ). The combination of increased network activity and lower transaction fees highlights improved network efficiency.

Over the last year, Metis has made serious investments into the growth and development of its ecosystem. Major initiatives include:

- The establishment of the Metis Ecosystem Development Fund with 4.6 million METIS ($450 million) in December 2023.

- The commitment of 250,000 METIS in January 2024 for ecosystem grants, along with the launch of the MetisEDF Grant Tracker to enhance transparency.

- The introduction of a $4 million annualized incentive program by the Metis Foundation to support new applications.

- A partnership with Gitcoin to launch a $100,000 quadratic funding initiative.

- The launch of Thrive Metis, a $3.6 million annualized initiative to incentivize Web3 developers and community members.

- Metis, in collaboration with ABGA and Google Cloud Web3, launched the GameFi Quantum Leap Accelerator Program, offering $10 million in funding to help Web2 developers transition to Web3 gaming.

The Total Value Locked (TVL) in USD on Metis was $62 million, a decrease of 13% QoQ, while the TVL in METIS increased to 1.6 million METIS, representing a 10% rise QoQ.

Aave maintained its position as the largest protocol with a TVL of $17.8 million. Notably, Aave integrated the METIS token as collateral, allowing users a 30% loan-to-value. Stargate V2 followed with a TVL of $10.4 million, while Hercules V3 ranked third with a TVL of $5.4 million. Netswap and WAGMI rounded out the top five with TVLs of $4.6 million and $1.3 million, respectively, while the rest of the protocols in the Metis ecosystem combined for a TVL of $8.2 million. Comparatively, Metis has a diverse mix of participation in its protocols.

In Q2, the community approved the Metis Liquid Staking Blitz, an initiative focused on accelerating the growth of LST and LST-focused products on Metis by leveraging the Ecosystem Development Fund. Round One concluded in March 2024, and the two LST protocols with the highest number of votes, Artemis Finance and Enki Protocol, were paired with the Metis Foundation sequencer nodes. Both are now live on Metis, with Artemis TVL reaching $11.1 million and Enki TVL at $4.5 million at the end of Q3 2024, bringing the total liquid staked TVL to $15.7 million, which represents a 17.9% increase QoQ.

Additionally, multiple new protocols are going through governance as part of the Metis Liquid Staking Blitz: StaFi, Stake.link, Velix, and Accumulated Finance. As these protocols launch on mainnet, the Metis liquid staked TVL should continue to increase.

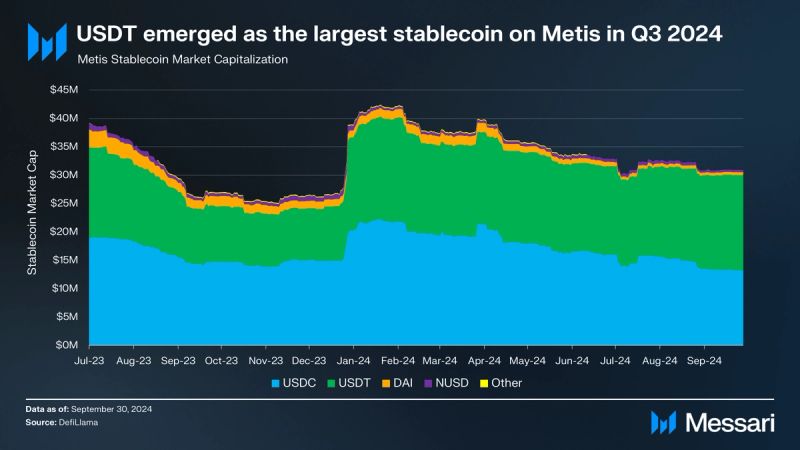

Metis’s stablecoin market cap has been consistent over the past year, with the overall stablecoin market cap at $31 million, a decrease of 6% QoQ, but up 14% YoY. USDC had a market cap of $13 million (-18% QoQ), while USDT became the leading stablecoin by market cap at $17 million (+8% QoQ). Metis ranked 37th among chains by stablecoin market cap.

Decentralized Sequencer

The Metis Decentralized Sequencer, operated by the Metis Foundation and select partners, was launched on March 14, 2024, to enhance transparency and reduce risks related to censorship and MEV. Phase 2 of the sequencer began on April 8, 2024, introducing multiple transactions per block and a robust transaction pool, improving network liveness and censorship resistance. On April 23, 2024, Sequencer Mining went live, distributing transaction ordering and block production among node operators.

In July 2024, Metis added the withdrawal feature for decentralized sequencers on the mainnet, allowing partial or full withdrawals of METIS tokens by node operators. Metis also integrated independent decentralized sequencer nodes after a competitive selection process. In August and September 2024, Hashkey Cloud and SNZ became the first independent decentralized sequencer clients. OKX is slated to launch in October. Additionally, the second round of sequencer node selection will occur in Q4 2024.

Roadmap

The Metis Foundation released its roadmap for the second half of 2024, detailing a series of strategic initiatives aimed at accelerating decentralization, fostering self-sustainability, and driving network growth. A central pillar of the roadmap is the continued deployment of Decentralized Sequencers, which will distribute network ownership, align incentives, and enhance overall ecosystem resilience. This includes enabling high-transaction-volume projects to become Sequencer Nodes.

The roadmap also emphasizes boosting transaction volume through key use cases, such as meme coins, gaming models, and RWAs. To support this, the Metis Ecosystem Development Fund will be leveraged to incubate new projects, onboard startups through partnerships with incubators like P1X and AllianceDAO, and offer grants to drive innovation.

Infrastructure upgrades are also a focus, with plans to reduce gas fees via EigenDA integration, improve Sequencer Node security with fraud-proof mechanisms, and enhance scalability. Strategic partnerships, such as the collaboration with ZKM to unify liquidity across chains, and the introduction of a revenue-sharing model with “Holders Mining,” aim to provide additional utility to the Metis token.

Additional Developments

- Metis released the MetisChamps User Guide, outlining how to participate in the Olympic Games Prediction Challenge. Users can predict outcomes using CHAMPS tokens, earned through tasks on the platform.

- Metis partnered with Arena of Faith to integrate blockchain with high-quality MOBA gameplay, enhancing esports with Web3 features like decentralized settlement and cross-platform compatibility.

- The Metis network underwent a hard fork to implement EIP-3855, which improves smart contract efficiency and compatibility with the Shanghai EVM.

- Chainlink’s Cross-Chain Interoperability Protocol was integrated, enhancing Metis’ capabilities with secure cross-chain messaging and token transfers.

- DFK launched on the Metis network, with the testnet going live in September and the mainnet following shortly after in early October,

Closing Summary

The Metis network has seen dramatic changes throughout the last year, reflecting both the volatile nature of the broader market and the continued investment in its ecosystem. While the valuation of METIS experienced significant swings, the increase in TVL and growing network activity highlights continued network expansion. The successful rollout of multiple initiatives, including the Decentralized Sequencer and the Metis Ecosystem Development Fund, highlight Metis’s commitment to driving decentralization and community involvement.

The Metis Foundation has actively worked to enhance its ecosystem through impactful initiatives like the Liquid Staking Blitz, strategic partnerships, and incentive programs for developers. The second half of 2024 will focus on further decentralizing the sequencer, expanding network capabilities, geographical expansion, new partnerships, and further aligning incentives for contributors, setting the foundation for a self-sustaining network.