Key Insights

- Everclear introduces the first Clearing Layer, a decentralized network coordinating global liquidity settlement between blockchains. Solvers and bridges can use Everclear to rebalance funds cross-chain with less than 2bps fees.

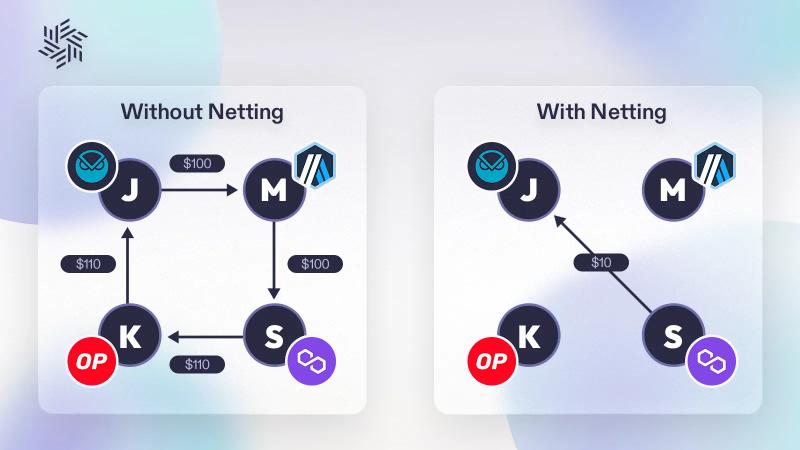

- Everclear settles transactions through “netting,” a process that matches intents from one domain to opposing intents from another, reducing the cost and complexity of rebalancing while increasing capital utilization.

- NEXT is the governance token for Everclear’s decentralized autonomous organization (DAO), driving community participation and directing the protocol’s development.

- Everclear’s vbNEXT token upgrade and mainnet beta launch mark pivotal moments for the Clearing Layer, enabling cross-chain liquidity rebalancing to scale more efficiently.

- This year, Everclear delivered the first chain abstraction use case, delivering over $1 billion in TVL to Renzo Protocol via Layer-2 restaking.

Introduction

Liquidity fragmentation across blockchains has emerged as a major challenge in the cryptocurrency space. Fragmented liquidity between blockchains has historically led to high costs and low capital utilization for solvers, market makers, and centralized exchanges (CEXs). Traditional bridging solutions are inefficient, and canonical bridges often require several-day wait times. As the number of new blockchains continues to grow, rebalancing strategies must evolve to accommodate these changes.

Everclear, previously Connext, is the first Clearing Layer – a decentralized network coordinating the global settlement of liquidity between blockchains. Through a process called netting, Everclear reduces the cost and complexity of rebalancing liquidity between blockchains, providing a solution to the problem of liquidity fragmentation across such blockchains.

Background

Everclear (NEXT) originally launched as Connext in 2017 and was created as a Layer-2 (L2) scaling solution for Ethereum. Under Connext, the protocol operated using state channels, enabling users to batch multiple Ethereum transactions offchain independently. On June 3, 2024, the protocol underwent a significant shift, rebranding to Everclear and adapting its model to address liquidity fragmentation across blockchains.

Everclear’s core leadership team comprises industry pioneers Arjun Bhuptani (Co-Founder and Chief Researcher, Everclear Foundation) and Layne Haber (Co-Founder and Chief Executive Officer, Proxima Labs). The pair have been innovating in the cryptocurrency space since 2017. Bhuptani has extensive experience researching and developing L2s. Additionally, Haber has expertise in building decentralized autonomous organizations (DAOs) as the co-founder of Moloch DAO, one of the first DAO frameworks, alongside Bhuptani. The Everclear Foundation’s team also includes seasoned leaders such as Dima Khanarin (Chief Executive Officer, ex-Fuel), Matthew Hammond (Head of Growth, ex-Celo), and Andrew Szwec (VP of Product, ex-Rhino-fi), among others.

Technology

Everclear’s technology directly addresses the challenges faced by market makers, intent-based bridge applications, new blockchains, and CEXs due to fragmented liquidity. For example, DeFi projects must replicate their smart contracts, liquidity, and strategies across new blockchains, which are both operationally and financially demanding. As another example, Solvers and CEXs face complex, expensive rebalancing needs due to limited blockchain support. Everclear’s Clearing Layer streamlines these processes by leveraging intent protocols and solver networks, drastically reducing liquidity rebalancing costs and supporting multiple blockchains seamlessly.

Everclear is built on an L2 Arbitrum Orbit rollup, launched with Gelato’s Rollup-as-a-Service (RaaS) solution. This partnership enables Everclear to run a single, custom clearing blockchain focused on liquidity rebalancing. As an Orbit rollup, Everclear plans to leverage EigenDA for data availability, ensuring efficient transaction processing across multiple blockchains. By acting as a shared computer network, Everclear streamlines the settlement process to coordinate interchain flows, reducing costs and complexity.

Introducing The First Clearing Layer

Everclear has created the first Clearing Layer, a decentralized network designed to coordinate global liquidity settlement between blockchains.

The protocol facilitates cross-chain liquidity rebalancement by separating intent capture and transaction settlement into different components. This process of abstraction through intent protocols and solver networks allows for a more seamless rebalancing of cross-chain liquidity, with the protocol handling the backend complexities of such asset transfers.

As a Clearing Layer, the protocol presents:

- Cost Reduction Through Netting: Everclear reduces the cost and complexity of transaction settlement, citing a 10x multiple for fee mitigation.

- Programmable Settlement: Everclear can utilize any available settlement strategy, such as CCTP for USDC. Solvers act as an overspill when there is insufficient netting liquidity.

- Permissionless Liquidity and Blockchain Expansion: Everclear provides immediate liquidity for new blockchains, allowing new intent-based bridges and chain-abstracted apps to launch more efficiently.

Intent Protocols and Solver Networks

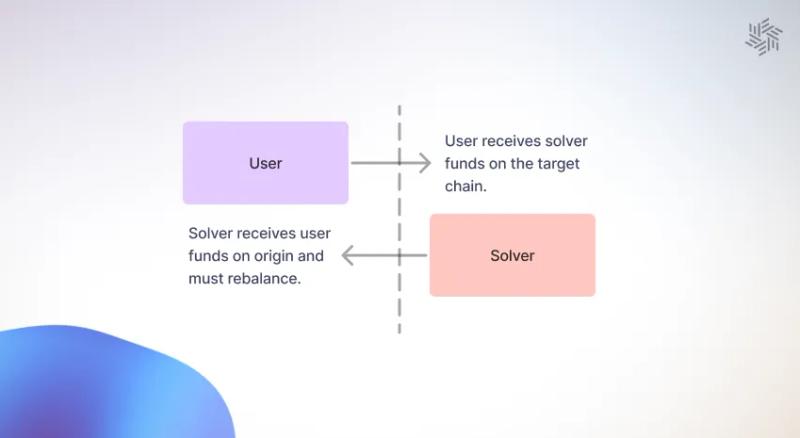

Interchain protocols have traditionally routed solver liquidity to less active blockchains, leading to the inefficient rebalancing of liquidity by solvers. Historically, bridging platforms have operated under two main architecture types: (i) M-of-N Bridges and (ii) Intent Bridges.

- M-of-N Bridges use a multi-signature or Proof-of-Stake (PoS) system to verify cross-chain interactions. Examples include Multichain, Stargate, Axelar, and Wormhole.

- Intent Bridges rely on solvers to settle transactions in real-time, with the reconciliation of funds occurring later.

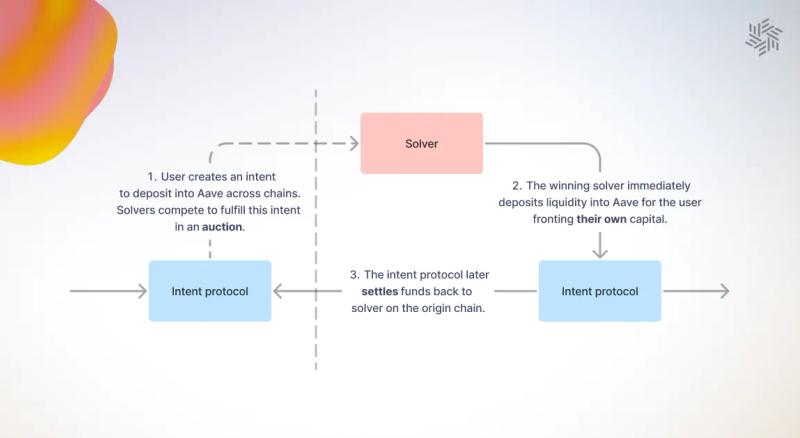

- Everclear’s intent protocol streamlines cross-chain liquidity rebalancing by abstracting complexities. When a user’s intent is captured, it’s either netted against other flows or supported by the market-maker network to fulfill the order. By default, the system processes both netted and filled invoices as they reach the clearing blockchain.

Rebalancing Transactions through Netting

Everclear simplifies cross-chain liquidity rebalancing using a process known as netting, which optimizes the movement of assets by balancing intents on opposing blockchains. Netting allows for more efficient use of capital, as it offsets transactions between blockchains, reducing the number of onchain transactions. This leads to lower gas fees and faster transaction times for market makers, solvers, and CEXs. For example, on Oct. 28, 2024, the average rebalancing transaction fee on Everclear was 2.3bps.

For example, if a user intent captured a user’s desire to move USDC from Optimism to Arbitrum, it would be netted against a new intent moving USDC from Arbitrum to Optimism. This intent is originally converted into an invoice within Everclear’s Hub domain and awaits an opposing transaction to be matched. Once matched, these invoices come together to form a settlement object. If opposing liquidity is not found within 30 minutes, the intent enters a Dutch auction where solvers compete to front the capital needed to process the transaction. The rebalancing occurs after the auction is completed and the transaction is finalized. After a user’s intent is captured, Everclear’s solver networks are leveraged to match the intent from one domain to an opposing intent from another domain in an attempt to net them. Liquidity is routed through the most efficient cross-chain path, with capital being fronted by solvers to allow for efficient transaction settlement.

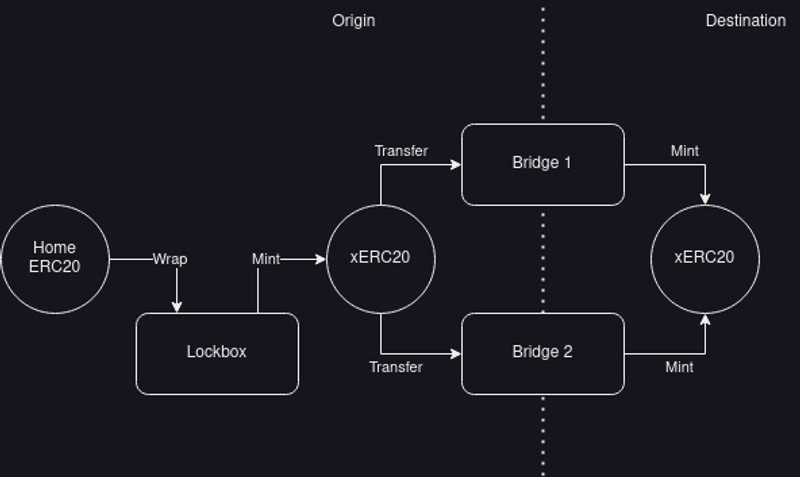

EIP-7281 (xERC20) Token

Everclear has employed a native ERC-7281 (xERC20) token standard. The xERC20 token standard is an open-source cross-chain standard that addresses some of the shortcomings of ERC-20 tokens, working to fix problems with token sovereignty, fungibility, and security in the bridging of tokens.

Currently, exchanging assets cross-chain is typically accomplished by interacting with a bridging platform, which locks tokens on one blockchain and wraps them on another for use thereon. This process faces multiple challenges:

- Fungibility: Bridging tokens across blockchains creates a replica of the desired token rather than entirely moving the asset over to a different blockchain.

- Security: Bridging platforms are often vulnerable to onchain attacks and smart contract vulnerabilities, leading to lost user funds.

- Sovereignty: Token issuers permanently cede control of their transferred tokens while utilizing bridging platforms.

- Liquidity: When there is not enough liquidity on either blockchain to facilitate the transfer of assets, users may face high slippage and fees.

Everclear works to solve these shortcomings through:

- Complete Ownership: With the xERC20 standard, token issuers have full control over their own native xERC20 tokens on each blockchain, rather than relying on bridge-controlled tokens. Issuers retain the authority, while bridges are granted permission to mint tokens from the issuer’s contract under predefined rate limits.

- Fungibility and Low-Slippage: xERC20’s burn-and-mint mechanism ensures users always receive the same “official” token when bridging across blockchains. It does not require token issuers to bootstrap liquidity pools, which allows users to benefit from low-slippage cross-chain transactions.

- Enhanced Security: Token issuers can choose which bridges they partner with and set detailed risk parameters, such as minting limits. This allows issuers to precisely manage their exposure to specific providers and ensure a secure, controlled cross-chain experience.

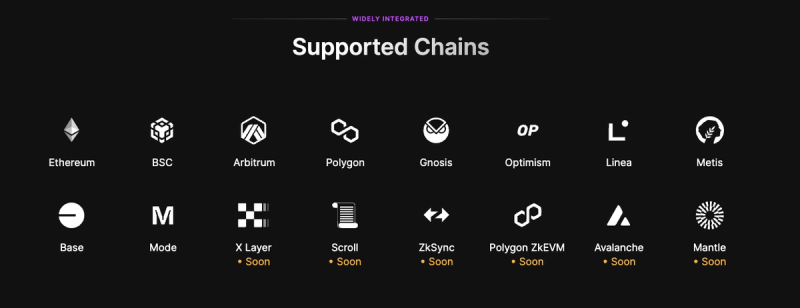

Everclear introduced the xERC20 token standard (EIP-7281) that has been widely integrated among popular Layer-1 and Layer-2 blockchains (e.g., Ethereum, BSC, Arbitrum, Polygon, Gnosis, Optimism, Linea, Metis, Base, Mode), and protocols (e.g., Renzo, Puffer, Omni Network, Hyperlane). In the future, Everclear hopes to integrate with other base layer blockchains (e.g., X Layer, Scroll, ZKsync, Polygon zkEVM, Avalanche, and Mantle). Notably, the xERC20 (EIP-7281) token standard is an open, public, and bridge-agnostic standard, unlike other proprietary standards.

NEXT Token

Officially launched on Sept. 5, 2023, NEXT is a governance token that can also be staked to earn a share of the protocol’s fees. More specifically, NEXT (i) is used to govern the Everclear DAO, (ii) can influence the decision-making of the protocol’s liquidity provisioning, and (iii) can be staked in return for a share of protocol fees through a vote-bonding mechanism, vbNEXT.

Of note, Everclear suggests that true protocol decentralization should be permissionless. The protocol aims to reduce the need for repeatable governance processes (e.g., routing, blockchain support, and token listing) by automating these processes directly into the underlying protocol, a process called “ungovernance.”

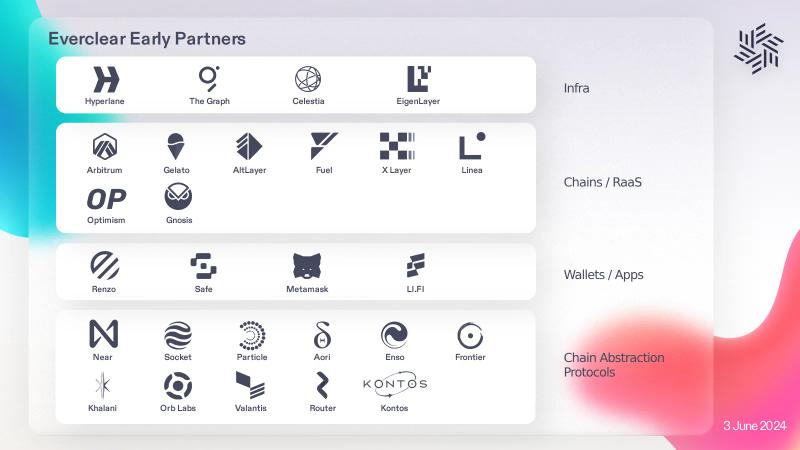

Launch Partners

Everclear’s launch partners and project backers include notable (i) infrastructure partners, (ii) blockchains and Rebalancing-as-a-Service providers, (iii) wallets and apps, and (iv) chain abstraction protocols:

Tokenomics

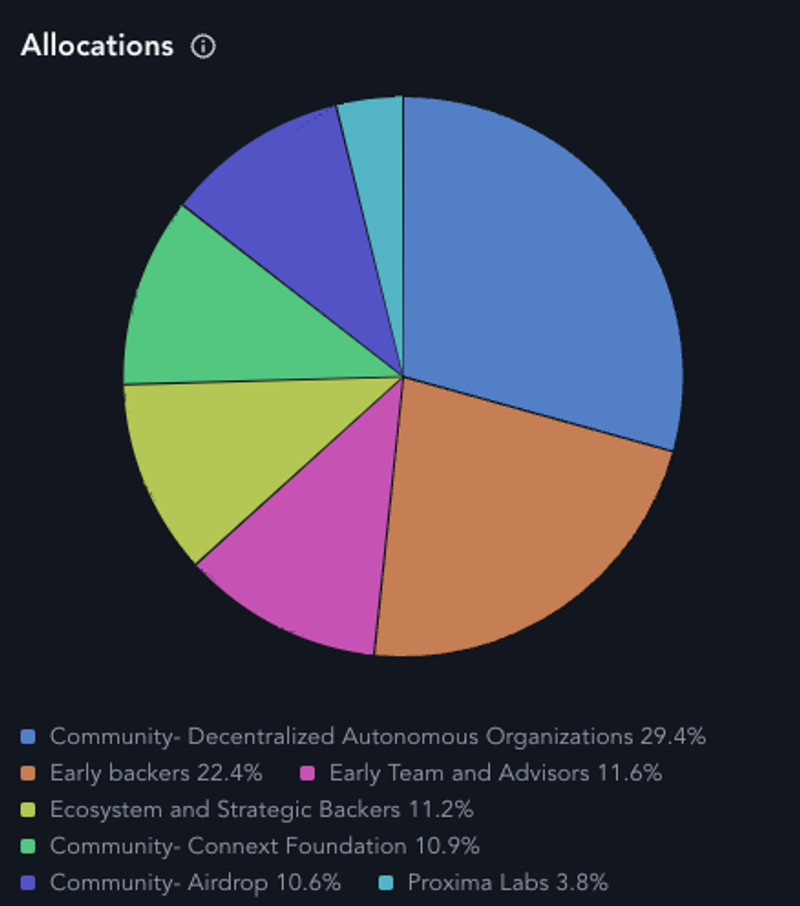

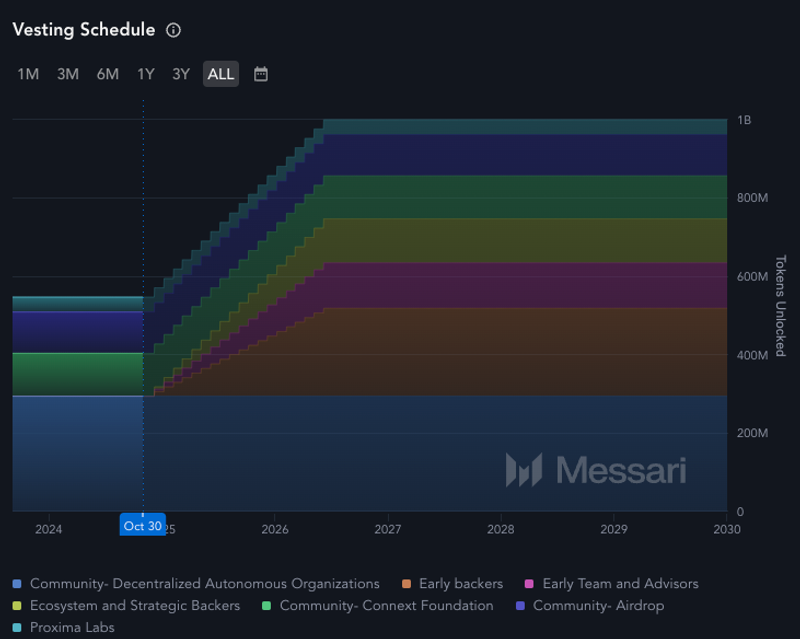

1.00 billion NEXT tokens were allocated across five major categories:

- Community: 509.43 million NEXT (50.94% of the maximum token supply), separated into three categories:

- 294.35 million NEXT (29.44% of the maximum token supply) for “Decentralized Autonomous Organizations.”

- 109.45 million NEXT (10.94% of the maximum token supply) for the “Connext Foundation.”

- 105.63 million NEXT (10.56% of the maximum token supply) for the community through an airdrop.

- Early Backers: 224.34 million NEXT (22.43% of the maximum token supply).

- Early Team and Advisors: 116.10 million NEXT (11.61% of the maximum token supply).

- Ecosystem and Strategic Backers: 112.35 million NEXT (11.24% of the maximum token supply).

- Proxima Labs: 37.78 million NEXT (3.78% of the maximum token supply).

NEXT tokens allocated to (i) the community and (ii) Proxima Labs were 100.00% vested upon the token generation event. However, NEXT tokens allocated to (i) Early Backers, (ii) Early Team and Advisors, and (iii) Ecosystem and Strategic Backers are subject to a 15-month lockup period followed by an 18-month linear release, where 1/19th of the tokens will be released on Dec. 6, 2024, and the remaining tokens will unlock linearly in equal monthly 1/19 allotments until all tokens are fully unlocked (33 months after the NEXT Airdrop).

As of September 26, 2024, a total of ~547.21 million NEXT have been unlocked, which accounts for ~54.21% of the maximum token supply.

A further breakdown of NEXT token allocations as of Oct. 30, 2024, can be seen here.

Airdrop

The NEXT token airdrop, constituting 10.56% of the maximum token supply (105.63 million NEXT), proceeded as a cross-chain token airdrop using the ERC-7281 token standard. The airdrop was announced on Aug. 17, 2023, and users were granted access to the token claim beginning on Sept. 5, 2023, while the claim ended on March 5, 2024. Users were able to claim NEXT directly to Arbitrum, Optimism, Polygon, or Gnosis Chain.

Governance

Everclear uses Snapshot, an offchain open-source voting platform for its governance process, where NEXT tokenholders and delegates can create proposals and vote on polls without gas fees. The platform uses IPFS to enable verification of data stored offchain. Anyone can audit this data, and those with an Ethereum Name Service (ENS) domain may create an account on the platform and initiate proposals.

Most recently, the Everclear DAO introduced vbNEXT, a vote-bonded token model designed to incentivize solvers, blockchains, and protocols to maintain rebalancing.

The vbNEXT token model provides blockchains, solvers, and protocols with two functions:

- Stake to earn protocol fees: Tokenholders can stake NEXT to earn fees generated by the protocol.

- Liquidity allocation: vbNEXT enables the protocol to guide liquidity towards underutilized blockchains.

Prior notable DAO proposals include:

- Community Sub-DAO Creation: The formation of a secondary DAO to provide ongoing support for the Everclear community, including maintaining operations and overseeing project and task completion.

- Rollup Ecosystem Education Partnership: An educational content partnership with “The Rollup,” aiming to enhance product awareness, increase engagement, and support the protocol’s product vision.

- Protocol Expansion Proposal V2: Allows the Everclear Foundation to choose which blockchains to support without requiring a DAO governance proposal.

Roadmap

Everclear pioneered the “chain abstraction” vision in 2023. In partnership with Renzo Protocol, Everclear powered the first chain abstraction use case, enabling L2 restaking and driving over $1 billion in additional TVL for Renzo. Everclear allowed Renzo users to restake from Arbitrum, BNB Chain, Base, Mode, Blast, and Linea to receive ezETH without interacting with Ethereum mainnet directly, serving as a rich example of chain abstraction. Everclear’s robust infrastructure positions the Clearing Layer well to replicate past successes with new protocol partnerships in the future.

The protocol’s mainnet beta launched in September 2024, onboarding its first set of users (e.g., Router Protocol, Tokka Labs, Dialectic, and Aori). Next, the protocol expects to start facilitating liquidity distribution through their new vbNEXT token model. Apart from vbNEXT, Everclear is working on a protocol upgrade that will bring an order of magnitude improvement to capital utilization in the system by leveraging the L2. This will allow solvers, market makers, arbitrageurs, and intent-based bridges to utilize the Clearing Layer for greater efficiency and rebalancing costs. In the future, the protocol hopes to integrate with Fuel, Blast, non-EVM ecosystems, and blockchains with strong decentralized application presences.

The project team also intends to expand the protocol through:

- Onboarding solvers, market makers, intent-based bridges, and CEXs as platform users.

- Shipping new iterations of the protocol, which will further reduce transaction fees (<1.5bps) and improve latency.

- xERC20 token integrations with major protocols.

Closing Summary

Everclear has made considerable progress in tackling cross-chain liquidity fragmentation, emerging as the first Clearing Layer designed to streamline liquidity rebalancing through its innovative netting process. By efficiently matching and settling transactions across blockchains, Everclear reduces costs and abstracts away cross-chain complexities for market makers, solvers, and CEXs. The protocol’s recent vbNEXT token upgrade and launch of its mainnet beta further strengthen Everclear’s infrastructure, positioning the protocol to continue to meet increasing demands of cross-chain liquidity management.