Key Insights

- Breakpoint had over 130 presentations with a focus on products, especially mobile. Two crypto-native phones made presentations, the Seeker phone (Solana Mobile Chapter 2) and JamboPhone2.

- Over 500 blinks have been created since Dialect and Solana Foundation launched them in June.

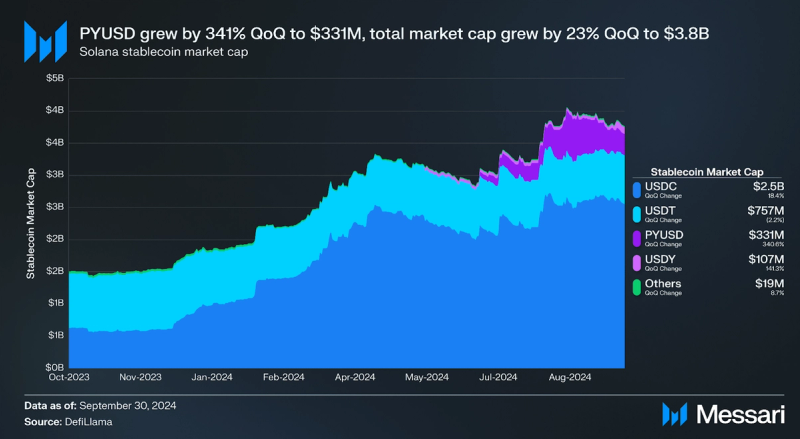

- PYUSD ended the quarter with a $331 million circulating market cap on Solana, a 341% increase. Adoption could continue to increase once Confidential transfers are activated on mainnet.

- Frankendancer is live on mainnet, and Firedancer is live in non-voting mode.

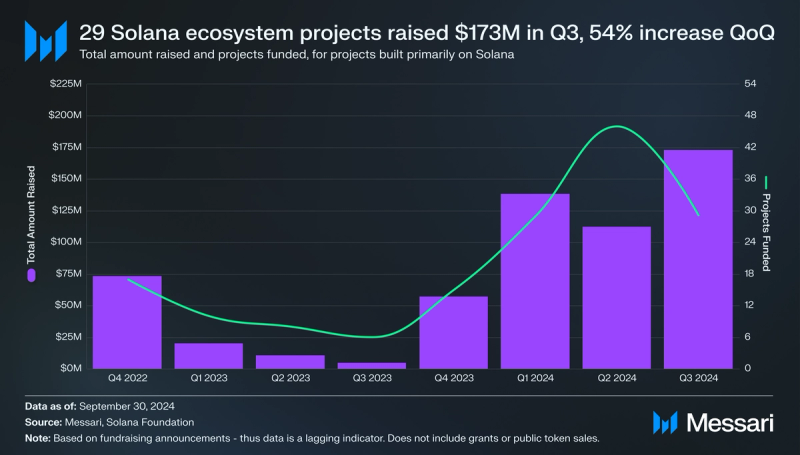

- 29 projects announced $173 million in fundraising announcements.

Primer

Solana (SOL) is an integrated, open-source blockchain with the goal of synchronizing global information at the speed of light. Solana optimizes for latency and throughput, sacrificing some verifiability. It seeks to accomplish this through features such as its novel timestamp mechanism called Proof-of-History (PoH), block propagation protocol Turbine, and parallel transaction processing. Since mainnet launch in March 2020, several network upgrades have brought further network performance and resilience, including QUIC, stake-weighted Quality of Service (QoS), and local fee markets.

Network and ecosystem development and growth are supported by the non-profit Solana Foundation, Solana Labs, as well as many third-party organizations, including Anza, Colosseum, Helius, and Superteam. Solana Labs has raised over $335 million in private and public token sales. The Solana ecosystem features a growing set of projects across many sectors, including DeFi, consumer, DePIN, and payments.

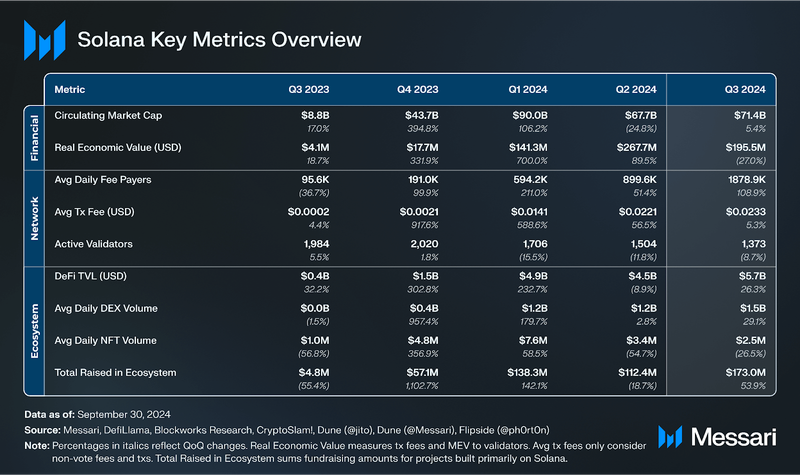

Key Metrics

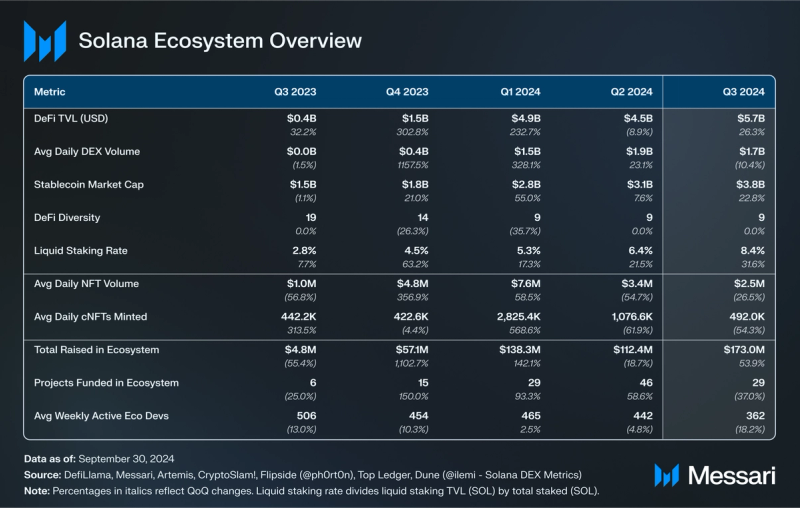

Ecosystem Analysis

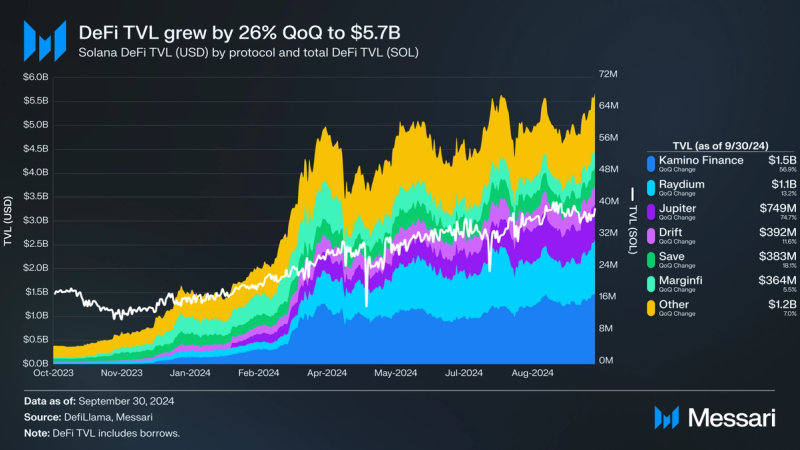

DeFi

Solana’s DeFi TVL grew by 26% QoQ to $5.7 billion, ranking it third among networks, surpassing Tron in late September. DeFi TVL denominated in SOL grew by 20% QoQ to 37 million SOL.

Lending

Kamino took the lead in TVL on Solana with a 57% growth rate QoQ, ending with $1.5 billion and a 26% market share. This growth can be attributed to PYUSD and jupSOL being added to the platform. The dApp currently offers 10% APY to PYUSD suppliers in its JLP market and 9% in its main market. As of writing, there is $224 million of PYUSD supplied and $386 million of the jupSOL provided. In September, Kamino introduced Kamino Lend V2, which brought two new aspects to the product. The market layer will allow permissionless market creation, and the vault layer will aggregate liquidity across markets to deliver risk-optimized yields. These primitives will allow Kamino to offer two new products: Lending Orderbook and Spot Leverage. V2 is expected to be implemented in Q4 2024.

Jupiter Perps saw the largest jump in TVL at a 75% growth rate QoQ, ending with $749 million and a 13% market share. MarginFi took the biggest hit in terms of market share, while the protocol’s TVL only grew by 6% QoQ to $364 million – down 55% from $811 million in early April.

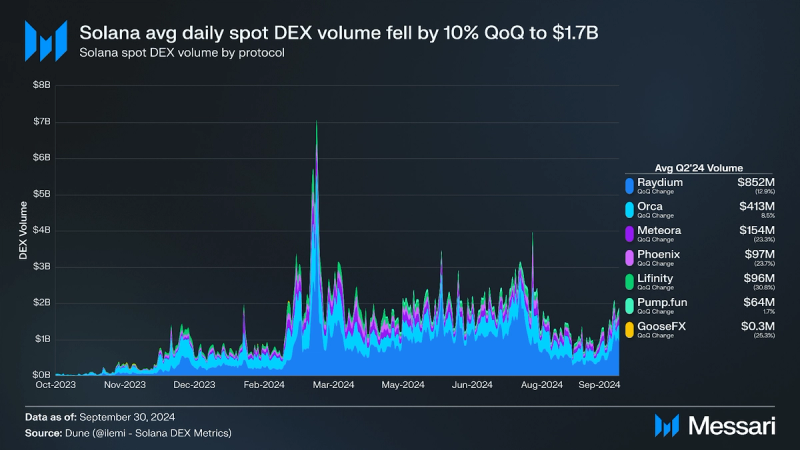

DEXs

DEX volume reduced slightly over Q3, as memecoins traded less. However, activity began increasing again in late September. Average daily spot DEX volume fell by 10% QoQ to $1.7 billion. The memecoin craze slowdown can also be seen in the top tokens by Q3 token pair trading volume. Only WIF and POPCAT made the top 10 this quarter; however, MOODENG was 16th after taking over social media during September, reaching a market cap of $350 million in 20 days. PYUSD and INF also broke into the top 10 due to the PYUSD incentives on Kamino and more LSTs being launched on Sanctum.

Raydium’s average daily volume decreased by 13% QoQ to $852 million but still held 51% of all market share. Raydium launched Burn and Earn for token teams in Q3, which will allow teams to lock liquidity and earn trading fees earned by the token pair locked in their liquidity pools. Raydium was also a beneficiary of Moonshot, gaining mainstream popularity once the Moodeng token went viral. Moonshot is a mobile app similar to Pump.fun that allows users to load up an account with Apple Pay and other onboarding tools. Raydium saw an increase in volume of $350 million from Moonshot generated tokens in Q3. Meteora saw $113 million in volume from Moonshot generated tokens. Orca saw a 9% increase ($413 million) QoQ in average daily volume, reaching 25% market share.

Jupiter remained the primary Solana trade source, accounting for 43% of Q3 spot DEX volumes. Raydium took over as the primary trade source for a few days in early July, but by the end of Q3, the protocol accounted for 27% of DEX volumes. Notable Jupiter updates from this quarter include:

- Jupiter Mobile: At Breakpoint, the Jupiter team showcased their mobile app, which went live early in Q4. The app allows users to onboard easily with Apple Pay, Google Pay, or credit cards.

- Ape Pro: This is a direct competitor to Pump.fun and Moonshot Users will be able to trade memecoins with a Google account. It only has 0.5% fees, mints new tokens, and works on mobile.

- The Jupiter team also acquired SolanaFM, a Solana explorer, and Coinhall, the top aggregator on Cosmos.

Jupiter perps averaged $505 million in daily trading volume, a 27% QoQ increase – ending the quarter with a 60% market share. Other main perps exchanges include:

- Drift: Drift’s average daily perps volume fell by 19% QoQ to $120 million. In mid-May, the Drift Foundation released the DRIFT token, airdropping 12% of its total supply. The token governs Drift DAO, which consists of a Realms DAO that elects a security council and governs general protocol development and a Futarchy DAO for distributing grants. DRIFT ended the quarter at a $159 million market cap, with around 24% of the token circulating.

- Zeta: Zeta’s average daily perps volume fell by 87% QoQ to $10 million. In mid-May, it announced a $5 million fundraise led by Electric Capital and its plans to build an app-specific rollup on top of Solana. At the end of Q2, Zeta launched its token, airdropping 10% of its total supply. ZEX ended the quarter at a $8 million market cap, with around 17% of the token circulating.

- FlashTrade: After its full launch in Q1, FlashTrade gained traction at the end of Q2, averaging $104 million daily volume in March. In Q3, FlashTrade averaged $69 million, increasing 44% QoQ.

Stablecoins

Solana’s stablecoin market cap grew by 23% QoQ to $3.8 billion, ranking it 5th among networks.

At the end of May, PayPal expanded its PayPal USD (PYUSD) stablecoin to Solana, joining only Ethereum as a supported network. The stablecoin, issued by Paxos, was approved by the New York State Department of Financial Services. Beyond low transaction costs and high throughput, PayPal cited token extensions as a critical reason for deploying on Solana.

PYUSD features several extensions, notably memo fields and transfer hooks, which enable developers to add programmable logic to transfers. They have expressed interest in confidential transfers as this feature enables transfer token amounts to remain hidden from everyone except the transfer source, destination, and an optional third-party auditor that the issuer can add. Confidential transfers are not yet live on Solana, as they require the activation of further syscalls. When the token extension goes live, they can turn it on, but currently, there are no plans to do so.

PYUSD ended the quarter with a $331 million circulating market cap on Solana, a 341% increase. While the token has officially launched, it’s still awaiting integrations to enable more adoption. Centralized exchanges are already working to incorporate token extensions to support PYUSD. At the beginning of Q3, several Solana dApps, including Jupiter and Kamino (along with an incentives campaign), onboarded PYUSD.

Regardless of these developments, USDC remained the dominant stablecoin on Solana, growing its Solana market cap by 18% QoQ to $2.5 billion. Circle expanded its Web3 services to Solana in June, bringing its Programmable Wallets and Gas Station features. These APIs enable developers to embed secure, multichain wallets into their apps and sponsor transaction fees on behalf of users. The rollout will occur in phases, with future releases supporting NFT transfers and program interactions.

Other notable DeFi-related events include:

- Restaking: Solayer Labs announced a $12M fundraising round led by Polychain.

- Bitcoin Related: Coinbase is planning on bringing cbBTC to Solana. Stacks plans to bring the decentralized sBTC to Solana. Zeus, a permissionless communication layer between Solana and Bitcoin, is expected to launch on mainnet in Q4’24. deBridge plans to bring native BTC to Solana, with more details to follow.

Liquid Staking

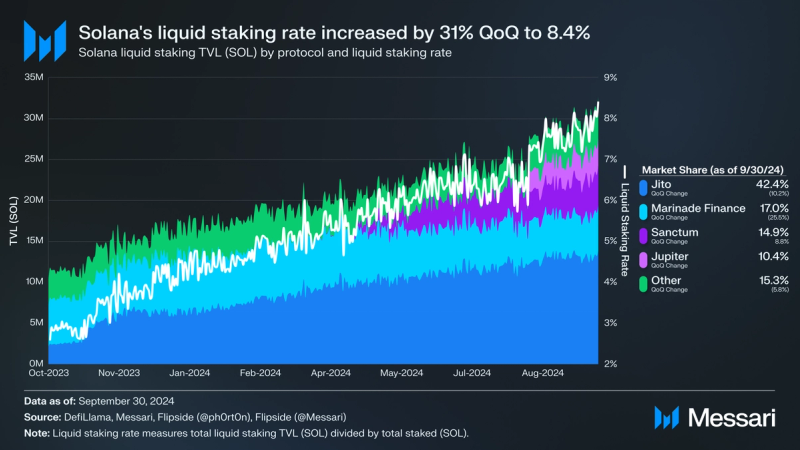

Solana’s liquid staking rate (the percent of liquid-staked SOL) increased by 31% QoQ to 8.4%. With 66% of eligible SOL supply staked, the liquid staking rate must continue growing to enable an ecosystem built on yield-bearing SOL.

Since launching in Q1, Sanctum has quickly gained adoption, with Sanctum LSTs accounting for almost 25% of Solana LST market share, including jupSOL, a 79% QoQ increase. Its adoption was accelerated by several market structure shifts, namely stake-weighted QoS (SWQoS). To help alleviate network congestion issues in April, a Solana network upgrade further leveraged SWQoS. SWQoS incentivizes applications and infrastructure providers to run a validator and accumulate stake to provide a better UX for their users.

As a result, several projects have launched their own validators, including Jupiter, Drift, DRiP, and Helius. Along with other projects, these four launched single-validator LSTs to improve distribution and offer unique perks. For example, DRiP distributes free Droplets to hausSOL holders, and dSOL is available as collateral on Drift.

Solana also does not currently support a native functionality for validators to return block rewards (base and priority transaction fees) to delegators. This native functionality only exists for inflationary rewards. Historically, this has not mattered much since fees used to constitute around 1% of total validator rewards (excluding MEV). But since the end of March, the share has risen to 5-10%, spurring validators to redistribute fees to compete on APY. To do so, many validators have chosen to use a single-validator LST due to its more straightforward fee redistribution mechanism.

LSTs are also experimenting with different methods of distributing staking rewards. For example, Cubik’s iceSOL distributes all staking rewards to public goods funding on Cubik. wifSOL DCAs all staking rewards into WIF and distributes the WIF back to delegators.

In total, Sanctum has 73 LSTs after adding over 39 LSTs in Q3. The abundance of LSTs is only possible because of Sanctum Infinity, a multi-LST liquidity pool that allows supported LSTs to tap into each other’s liquidity. Top Sanctum LSTs by stake include Jupiter’s jupSOL (3.3 million SOL), Bybit’s bbSOL (655,000 SOL), and Helius’s hSOL (354,000 SOL).

In early April, Sanctum announced a $6.1 million raise led by Dragonfly. It later launched points program Sanctum Wonderland, where participants could collect pets representing LSTs and level them up via community quests. In early June, it introduced CLOUD, announcing a future airdrop and token sale via Jupiter’s LFG and Meteora Alpha Vault. CLOUD ended Q3 with a $72 million market cap with around 18% of the token circulating.

Jito’s jitoSOL remained Solana’s LST leader. Its supply grew 26% QoQ to almost 14 million SOL, giving it a 42% market share. In Q3, the management of the Jito Stake Pool transitioned to StakeNet. StakeNet is an open-source protocol for decentralizing Solana staking pool operations. The transition brings increased transparency, enhanced security, greater efficiency, and community governance to Jito. In July, Jito also introduced Jito (Re)staking, infrastructure for hybrid staking, staking, and VRTs. The code consists of the Vault Program and the Restaking Program. The Vault Program manages the creation and operation of Liquid Restaking Tokens (VRTs). The Restaking Program manages the creation and management of Node Consensus Operators (NCN) and operators.

Marinade’s mSOL supply grew by 5% QoQ to 5.6 million SOL, giving it a 17% market share. Its native staking product, Marinade Native, has an additional 267 million SOL. Marinade unveiled its Stake Auction Marketplace in mid-June, where validators can bid on staked SOL. The feature will be rolled out in phases; the live marketplace went live on August 14.

Consumer

NFTs

NFT volume declined after renewed activity at the end of 2023 and into 2024. The average daily NFT volume fell by 27% QoQ to $2.5 million. Magic Eden maintained the majority share of volume, with $217 million in Q3 – a 44% decrease QoQ. Tensor’s volume decreased by 22% QoQ to $101 million. While overall volume is down, NFTs on Solana lead on creator royalties.

The Tensor Foundation released the TNSR token in early April, airdropping 14.8% of the total supply. TNSR ended the quarter with a $52 million market cap and around 13% of the total supply circulating. Magic Eden has continued to run its rewards program ahead of an expected token launch in Q4.

Social and Creator Platforms

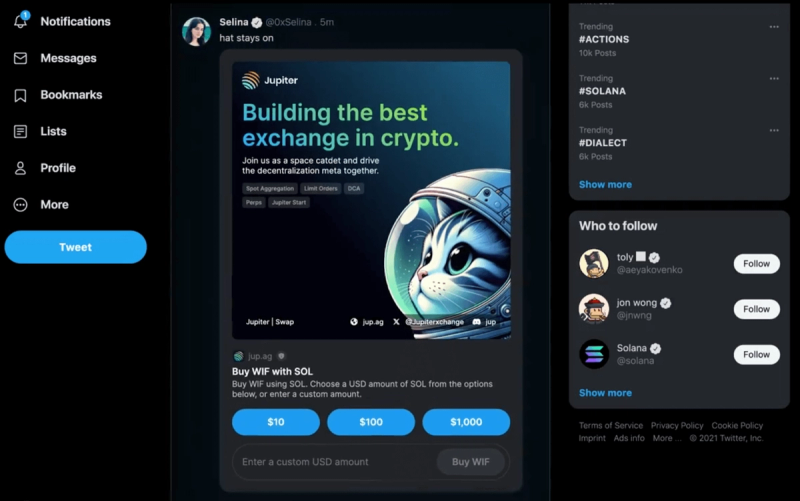

Blinks are sharable links that convert Solana Actions into metadata-rich URLs. These links allow supported clients, such as browser extension wallets or bots, to display enhanced capabilities, enabling immediate transaction previews in wallets or expanded interactive buttons. Currently, only blinks from registered partners will unfurl directly on Twitter. Users also need to enable blinks in their browser extension wallet’s settings for blinks to unfurl.

Many top Solana projects have created blinks, including Jupiter, Tensor, Sphere, and TipLink. Blink builders can apply for micro-grants via a Superteam Earn track (up to $1,000 per grant) or larger grants directly from the Solana Foundation (distributing up to $400,000). At the time of writing, there are 488 blinks.

Other consumer-related events include:

- Solana Mobile: At Token 2049, the Solana Mobile team unveiled their new mobile phone, Seeker. Previously known as Chapter 2, the phone will have a better camera, longer battery, and internal hardware wallet built in collaboration with Solflare. The phone will have a 108+32 MP camera, 6.36” display, 128 GB of storage, and 8 GdB of memory. The phone will also have a fingerprint scanner for extra security and 4 free months of Helium Mobile coverage. The phone is expected to ship in mid-2025 with the preorder window still open. There have already been over 140,000 pre-orders to date.

- Jambo: At Breakpoint, Jambo unveiled JamboPhone2, which will support the Solana network. This phone will cost $99 and allow users to access JamboGPT, the JamboPlay dApp store, and rewards from ecosystem partners. Pre-orders are open.

Gaming

There were a host of gaming-related announcements this quarter, especially at Breakpoint:

- Photo Finish Live: The Photo Finish team announced that they have published their mobile app to the Apple App Store. It is now the first real-money racing game on the app store.

- Aurory: The team showed the state of development for their new game, Seekers of Tokane. The build is open for testing.

- Star Atlas: Shortly after Q3 ended, the Star Atlas team released a 4.5-minute update on their development status. During Q3, the team launched SURGE (their shooter combat game mode), dropped Crew Packs, and hosted Impact Summit. Impact Summit ran in parallel with Breakpoint.

- Shaga Controller: After seeing the success of the Solana Mobile Saga and the number of pre-orders for the Seeker phone, the Shaga team has announced a hardware device that is a gaming controller with a hardware wallet baked into it. The public presale went live on September 10, with expectations of shipping in late 2025.

- Play Solana: The Play Solana team also announced a gaming hardware device; however, this device comes with a screen. The device is called PSG1 and can be pre-ordered now. It is expected to ship in Q2 2025. It is important to note that this is an independent team unaffiliated with Solana Labs/Foundation.

- Moonwalk Fitness: At Breakpoint, the team delivered a product keynote, announcing their mobile app’s upcoming release to the iOS and Google Play store. Moonwalk allows users to create a group of users, and if you hit the step goal, you get your deposit back. If you don’t hit the step goal, everyone in the group splits that deposit.

- Nyan Heroes: In Q3, Nyan ran their open playtest on the Epic Games store and introduced three new hero classes and a new game mode – Payload.

DePIN

Solana is becoming a hub for DePIN applications, hosting Helium, Hivemapper, Render, and Teleport.

Notable Q3 events include:

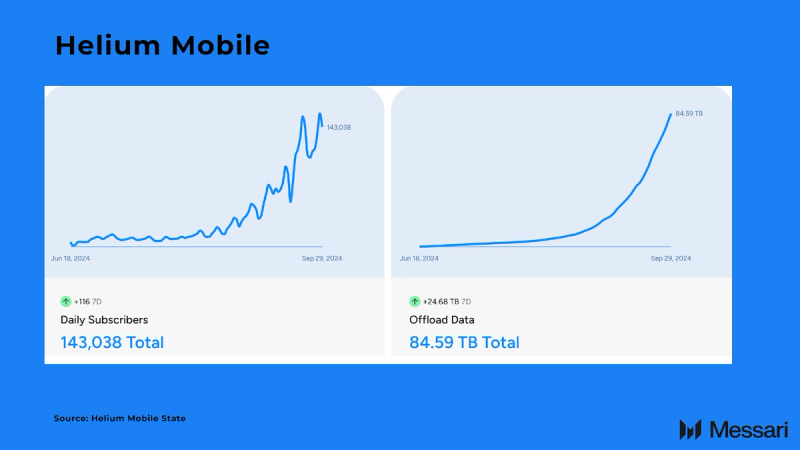

- Helium Mobile: Near the end of Q2, Helium Mobile started its Offloading beta program that allows legacy U.S. mobile carriers to offload mobile data to Helium. The program went live in August, and hotspots can now be paid to offload data. At quarter’s end, there were 143,000 daily subscribers and 85 terabytes offloaded. This has resulted in $21,000 in data credits being burned.

- Helium Network Extension: In September, Helium proposed Helium V3, which will allow other DePIN projects to leverage Helium’s existing infrastructure network. The proposal is still in discussion with the community, and nothing has been implemented.

- XNET: XNET migrated to Solana in August, where it announced a partnership with a US mobile carrier to offload paid mobile data.. At the end of the quarter, XNET had offloaded over 22 terabytes of data from over 1.1 million users.

- Grass: In early September, the Grass team released an airdrop allocation checker and plans to launch their token in Q4. They also announced a Series A raise for an undisclosed amount led by Hack VC.

- Hivemapper: At the end of the quarter, Hivemapper had mapped about 10.2 million miles, 27% of global coverage. During Hivemapper’s Keynote at Breakpoint, CEO Seidman announced that they are selling data to three of the top ten global mapmakers, one of which is HERE Technologies.

- Energy DePIN: We are seeing a rise in interest in Energy DePIN. Specifically with Multicoin’s $12 million investment in Fuse Energy. Fuse combines renewable energy services with decentralized infrastructure through its mobile app, allowing users to track energy use and adjust consumption based on renewable availability. Watch their Breakpoint keynote here.

Payments

With low transaction costs, sub-second finality, and a network of several thousand nodes, Solana promises to help power mainstream payment flows—so says Visa, which expanded its USDC settlement pilot to Solana in Q3 ’23.

Notable events from Solana-native payments infrastructure companies and applications this quarter include:

- Spherenet: At Breakpoint, the Sphere team announced Spherenet, a private and permissioned SVM shared account ledger for fintech. This was built in collaboration with the Anza team. Arnold Lee went on the Lightspeed podcast to explain the Spherenet roadmap and why this will be important for cross-border payments.

- Solana-based debit cards: Four teams announced a Visa debit card backed by Solana-based stablecoins at Breakpoint:

- Squads Labs: Fuse Pay powered by Bridge

- Kast: Solana Card

- Sanctum: Cloud Card

- Reap: Reap Card

- Sky deployment to Solana: At Breakpoint, Sky’s (formerly MakerDAO) founder, Rune Christensen, announced that USDS, sUSDS, and the governance token SKY will be bridged to Solana by Wormhole.

- Helio at Breakpoint: The Helio team displayed their succes, while also announcing Shopify Blinks powered by Helio. Bringing Shopify payments directly to X.

- Other payment-related developments: The travel booking company Travala will now accept payments via the Solana network. Sling Money, Zar, and Huma Finance will all deploy on Solana, bringing more on/offramping platforms to the ecosystem. Huma Finance is leading the charge to define a new subcategory in payments on Solana called PayFi, which was showcased at a side event at Breakpoint. Stripe went live with it’s crypto pay-ins product on Solana leveraging Paxos on the backend

Infrastructure

Notable infrastructure-related events from Q3 include:

- Embedded Wallets: Phantom launched their embedded wallets at Breakpoint, allowing users to create a wallet using just an email, Google account, or Apple account. In July, Privy added support for the Solana network.

- ZK Compression: Light Protocol and Helius introduced scaling primitive ZK Compression at the end of June. On September 18, ZK Compression went live on mainnet. ZK Compression functions similarly to compressed NFTs: it stores account data in an offchain Merkle tree in the ledger data and posts its root onchain. However, it works for any token or account, not just NFTs. Furthermore, it uses SNARKs to compress Merkle proofs, making verification more efficient. Helius co-founder Mert shared that the state cost for an airdrop to 1 million addresses is $50 with ZK Compression compared to $260,000 without it. Beyond enabling new application use cases, ZK Compression may also provide an alternative to Solana’s state for certain types of state-hungry applications. One tradeoff, at least in the short-term, is a reliance on indexers to ensure access is readily available to compressed accounts and associated data. In times of high traffic, this dependency could lead to the inability to update the Merkle tree. However, this will likely be a non-issue over the longer term as economic incentives and an open-source indexer implementation lead to more indexer options.

- AirShip: Helius released AirShip at the end of September to demonstrate the power of ZK Compression. According to Nick from Helius, this is the easiest, fastest, and cheapest way to mass-airdrop tokens. Developers can airdrop tokens to Solana mobile holders, an NFT collection, different token holders, and a CSV of addresses.

- Filecoin: The entire Solana Ledger is now stored on Filecoin. This is over 1 TB of data. The Old Faithful project was successful with the help of Triton and Dcent.

Growth

In Q3, a total of 29 projects announced funding rounds, a 37% QoQ decrease. However, those projects raised a combined $173 million, a 54% QoQ increase. This is the highest funding amount in a quarter since Q2’22.

Hackathons and Accelerators

In Q3, Colosseum held its Radar Hackathon with 1,359 project submissions. Winners will be announced in Q4. The full list of projects is live.

In July, RadiantsDAO unveiled the winners of the Bonkathon, powered by the Solana Foundation and Bonk DAO. The first place winners of the tracks are below:

- Consumer-Facing Apps: Chomp Beta and ChompBot – a free to play question card game.

- Gaming: Intrant Inferis – a third-person dungeon battler built for mobile.

- Public Goods: LivingIP – complementing existing DAO and ecosystem tooling.

- DeFi: DeStreet – social trading layer on top of existing Solana DEX infrastructure.

- AI: Bonkhemist – AI – powered alchemy experience with real-world value through BONK minting.

- Solana Continuation: Paylana – a payment platform that allows users to use cryptocurrency easily and conveniently.

All winners can be seen here.

PayPal USD and Portal also held a hackathon. There were over 40,000 PYUSD in prizes, and the top 2 projects will be showcased at the Solana Hacher House in Hong Kong in Q4.

Institutional Growth

Q3 saw multiple institutions expand onto the Solana network. At quarter end, Solana had the third most tokenzied treasuries at $123 million, behind Ethereum ($1.6 billion) and Stellar ($422 million. Notable Q3 institutional events:

- In July, Libre gave investors from Hamilton Lane and Brevan Howard digital access to onchain funds. This was the first asset manager to launch a fund on Solana.

- Franklin Templeton plans to launch a money market fund on Solana, being the first SEC pursuant asset manager to issue securities on Solana.

- Société Générale’s digital assets subsidiary, SG Forge is adding support for Solana. SG Forge will launch the first MiCA-compliant stablecoin, EUR CoinVertible (EURCV), on Solana. At quarters end, the stablecoin had a $37 million market cap on Ethereum.

Events

Q3 Events

- Breakpoint: The event was held in September with lots of product announcements. A report into the state of the Solana ecosystem at Breakpoint from the Solana Foundation was published, but you can also find every on-stage session on the Solana Foundation’s YouTube Channel.

- mtnDAO: The month-long coworking space returned to Salt Lake City in August.

- Others: Hacker House Hong Kong, IslandDAO, Solana after Breakpoint in Bali, Solana Summit, Bengaluru Startup Village and Hacker House, Founders’ Villa Season 2, and more community meetups.

Q4 Events

Network Analysis

Usage

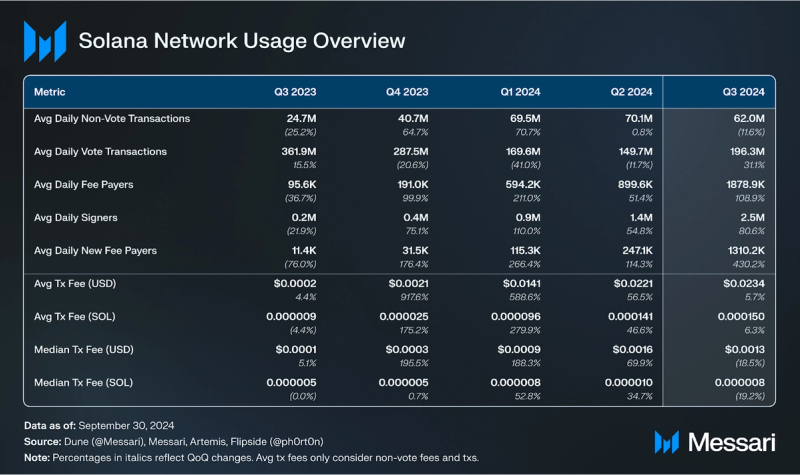

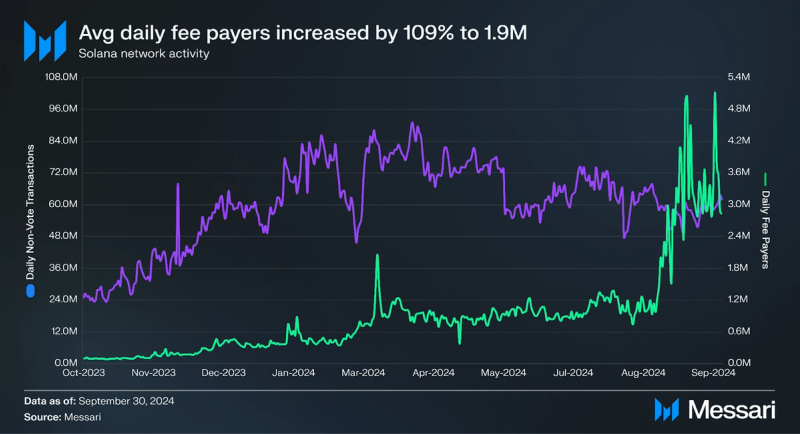

Network activity, measured by non-vote transactions and fee payers, maintained elevated levels throughout Q3’24 after its growth since Q1’23. Average daily fee payers increased by 109% QoQ to 1.9 million, and average daily new fee payers grew by 430% QoQ to 1.3 million. Average daily non-vote transactions decreased by 12% to 62.0 million.

Ore v2 relaunched on August 5, but this time, the mining did not lead to any network congestion issues due to the implementation of Stake-Weighted Quality of Service (SWQoS). At the time of launch, Ore mining transactions accounted for 10-15% of all transactions, at the end of the quarter, Ore mining transactions only accounted for 6% of all transactions. The above data only includes processed transactions (successful and failed).

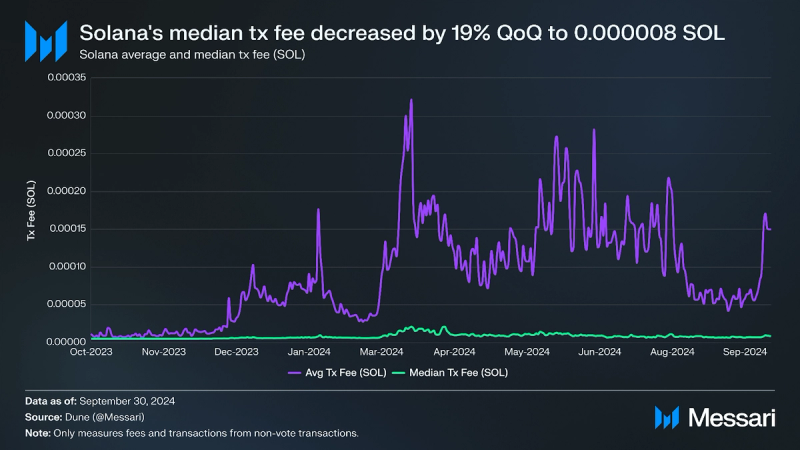

The average transaction fee increased by 6% QoQ to 0.00015 SOL ($0.023), and the median transaction fee decreased by 19% QoQ to 0.000008 SOL ($0.0013). The average transaction fee saw an uptick at the end of the quarter due to the resurgence of memecoins.

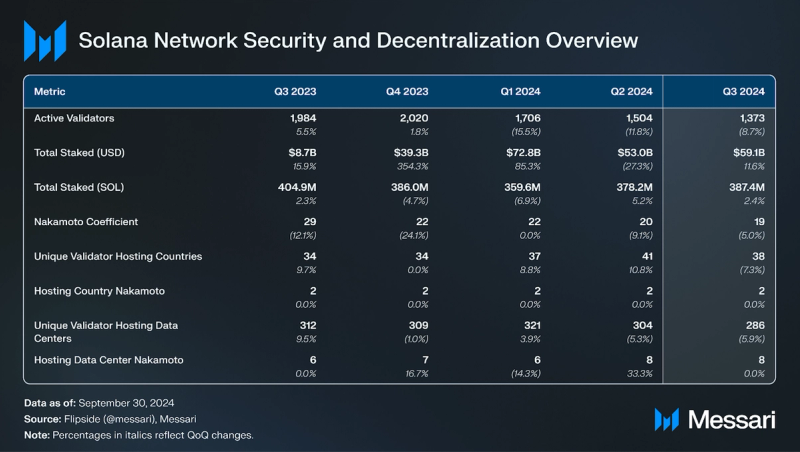

Security and Decentralization

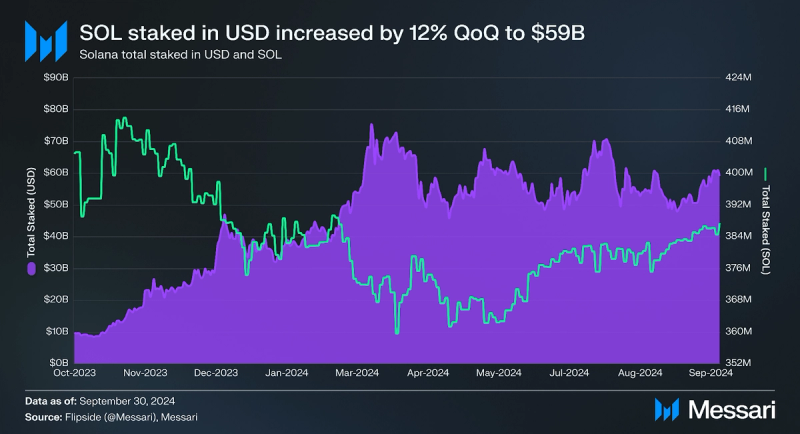

Staked SOL decreased by 5% in Q4’23 and then 7% in Q1’24, largely driven by the FTX Estate unstaking its tokens as they unlocked. However, the amount of SOL staked continued to rebound in Q3, increasing by 2% to 387 million, regaining Q4’23 levels. Staked SOL in USD terms increased by 12% QoQ to $59 billion.

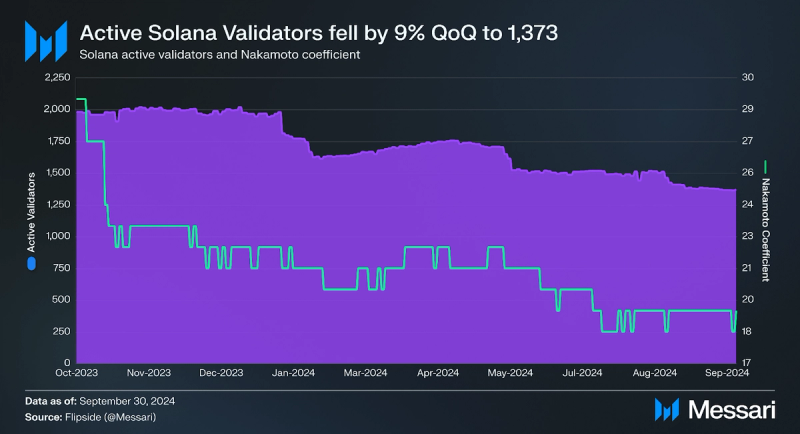

In July, Solana’s Nakamoto coefficient fell to 18, an all-time low since the protocol broke out in 2021. While ending the quarter at 19, Solana’s quarter-end Nakamoto coefficient remains above the median of other networks.

The Nakamoto coefficient is the minimum number of nodes needed to break liveness. The metric can also be measured across other dimensions important to the resilience of a validator network, including distribution of stake by location, hosting provider, and clients.

Solana network’s 1,373 active validators are hosted in 38 countries, down 7% QoQ and up 12% YoY. At the end of last year, Solana was nearing 33% of its stake in the United States but has since dropped to 20%. With the United Kingdom at 13%, Solana has a geographic Nakamoto coefficient of 2. Solana validators are hosted in 286 unique data centers, down 6% QoQ. However, its data center’s Nakamoto coefficient stayed flat at 8.

Performance, Upgrades, and Roadmap

Agave Updates

After a phased rollout, the V1.18 update reached a supermajority of validator stake in mid-June. The main new feature in V1.18 was the anticipated update to Solana’s transaction scheduler, which is responsible for building blocks. The previous implementation had limitations leading to non-deterministic transaction ordering and inclusion. In other words, transactions with higher priority fees were not guaranteed to be ordered accordingly or have a higher probability of block inclusion. Instead, ordering and inclusion partially relied on variance and FIFO, which incentivized spam. A central scheduler thread was introduced to address these issues, which receives incoming transactions and assigns them to one of four threads for processing. Several validators have reported higher block rewards than the cluster average since enabling the optional scheduler update.

At the end of the quarter, 60% of the network is using V1.18.25, which was released on September 30. The most significant changes for this release are to extend the Turbine fanout experiment to a broader fanout value and set the allocation size to 0 for transactions known to fail. The Anza team is also simultaneously developing Agave V2.0, which was announced at Breakpoint. At the end of the quarter, the client was live on Solana’s Testnet and Devnet. This new client version will complete the transition from the Solana Labs repository and archive the repository and no longer be used. Currently, most of the changes will involve removing and renaming RPC endpoints, SDK calls, crates, and validator arguments. This update will be worth keeping an update on as many apps are still using methods that will break once this is on mainnet. According to Anza, the update will occur sometime in October.

Independent Client Updates

Beyond improvements to the Agave client, the network is set to benefit from upcoming clients being written from scratch. Notably, Jump Crypto is developing Firedancer in C. At Breakpoint, the Jump team displayed an update on the client’s development. Frankendancer is now live on Solana mainnet and Firedancer is live on testnet. Firedancer is also live on mainnet in a non-voting mode, which means the client can listen to the network and replay blocks in real time. The team highlighted that the Firedancer client has been active on testnet for 12 weeks, voted on over 10 million blocks, and can build a block with 136,000 transactions.

Other teams are also upgrading the network. The Jito team announced another bug bounty program to discover bugs and vulnerabilities, where developers can earn up to $250,000. Syndica has now completed the repair stage, allowing the client to fetch blocks and rewrite the SVM. The Mithril client, a full node client aiming to lower hardware requirements needed to verify blocks, has completed the reimplementation of the SVG in Golang. The team is currently implementing block replay and a simple RPC interface. The Tinydancer team has also been working to develop light clients for Solana. In mid-May, it launched its simplified payment verification (SPV) client on Solana testnet.

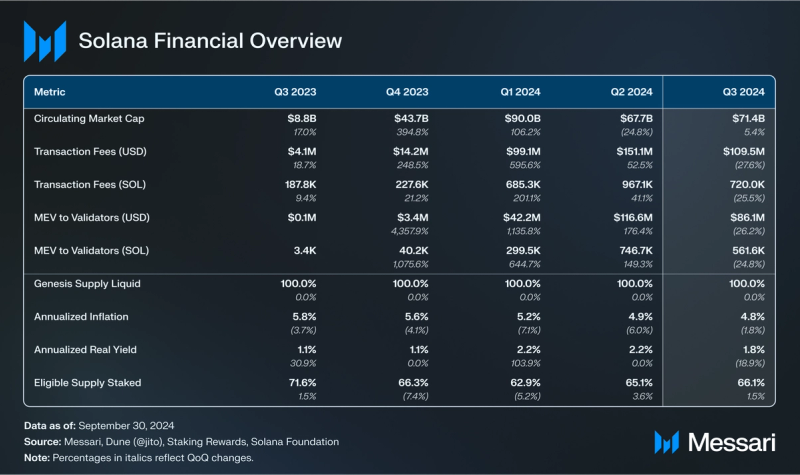

Financial Analysis

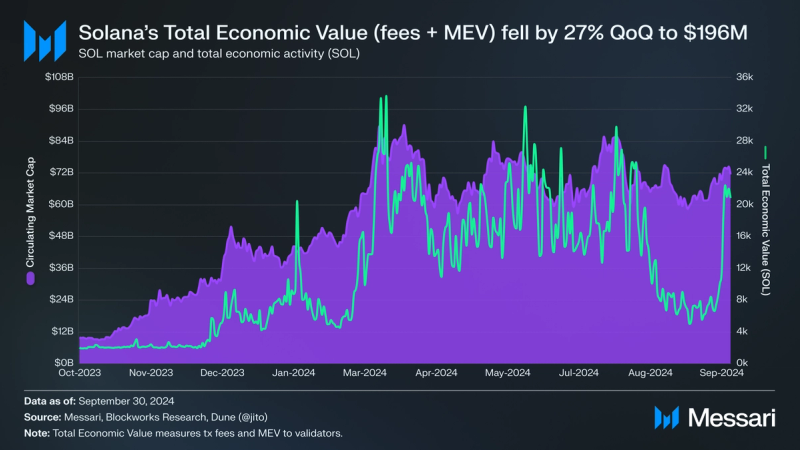

SOL’s market cap grew by 5% QoQ to $71 billion. It remained ranked 5th among all tokens in market cap, only behind BTC, ETH, USDT, and BNB. Solana’s Real Economic Value, which measures all transaction fees and MEV to validators, decreased by 25% QoQ in SOL terms to 1.3 million ($196 million). Of this, 56% came from transaction fees, with the rest coming from MEV tips.

Currently, 50% of Solana transaction fees are burned, while the other half are distributed to the block producer. Due to the implementation of SIMD-0096, 100% of the priority fee will be distributed to validators while continuing to burn 50% of the base fee. The Agave and Firedancer clients have implemented the proposal and are currently waiting for mainnet activation. During the quarter, the amount of SOL burned hovered around 30% of Real Economic Value, ending at 25%. The burned tokens reduced Solana’s annualized quarterly inflation rate from 4.9% to 4.8% in Q2.

As noted above, validators do not have native functionality to share transaction fees (base and priority) with delegators. By default, most validators only share inflationary rewards and MEV tips. SIMD-0123 was proposed in May to enable native transaction fee distribution.

In Q2, the FTX Estate auctioned off the remaining tokens acquired from the Solana Foundation and Solana Labs. In early April, it was reported that the Estate sold 30 million SOL at $64 per token. At the end of April, a smaller sale of 1.8 million SOL at prices between $95 and $110 was reported. By the end of May, it was reported that the Estate had sold the last of its tokens, with one purchaser reportedly paying around $102 per token. Reported buyers among the sales have included Pantera Capital, Figure Markets, Galaxy Trading, and Neptune Digital. The tokens sold are subject to the same unlock schedules as the original purchases by Alameda and FTX. The average unlock date of the tokens is in Q4’25, with March ‘25 featuring by far the most unlocks of any month (at least 7.5 million tokens). Upcoming unlocks can be viewed on Solana Compass and Gelato.

Within the US, the momentum to get a SOL ETF approved has stalled, with the odds of approval in 2024 at $0.06 on Polymarket. Because of this, investors are paying a 700% premium on the Grayscale Solana Trust to gain exposure to SOL in the form of a security. On August 20, Brazil approved their second ETF, allowing Brazil-based asset manager Hashdex to launch their product. This follows the approval of QR Asset’s product on August 8. On September 12, the Canadian traded company Cypherpunk Holdings rebranded to SOL Strategies, representing their bet on the Solana ecosystem. Their strategy is similar to Microstrategy’s; however, SOL Strategies is going a step further by staking their SOL tokens (over 86,000) and investing in projects in the ecosystem.

Closing Summary

Solana remained a prominent hub for crypto innovation and activity in Q3 2024, marked by significant developments across its DeFi, consumer, and infrastructure sectors. DeFi on Solana showed impressive growth, with TVL increasing by 26% to $5.7 billion. Kamino took the lead in DeFi TVL, while PYUSD adoption, combined with new product innovations, contributed to the DeFi sector’s expansion. Jupiter and Raydium maintained leading positions in decentralized exchange volumes, benefiting from the ongoing memecoin activity and product launches like Moonshot.

The ecosystem saw major strides in stablecoins and liquid staking, with PayPal’s PYUSD expanding on Solana and Sanctum gaining traction in liquid staking solutions. These innovations underline Solana’s ability to attract users seeking yield-bearing and privacy-focused assets. The network also enhanced its consumer-facing offerings, with Solana Mobile announcing new hardware and Dialect and the Solana Foundation introducing blinks, a new feature designed to enhance blockchain interactions across digital environments.

Infrastructure improvements, such as the rollout of V1.18 and Firedancer going live on mainnet in non-voting mode, have strengthened Solana’s transaction scheduling and block production capabilities, further positioning it for enhanced performance and scalability. The introduction of solutions like ZK Compression by Light Protocol and Helius aims to keep users on the L1 while scaling activity efficiently.

The quarter also saw substantial financial growth, including a combined $173 million in fundraising announcements across 29 projects, highlighting continued investor confidence. Institutional interest remained robust, with Visa expanding its USDC settlement pilot to Solana and Société Générale’s digital assets subsidiary adding support for Solana-based stablecoin issuance.

Despite market fluctuations, Solana’s market cap rose by 5% QoQ to $71 billion, and the ecosystem continued to be a top choice for both retail and institutional users. Overall, Q3 2024 demonstrated Solana’s resilience, scalability, and increasing adoption, solidifying its position as a leading blockchain network with strong fundamentals for future growth.