Key Insights

- The ZRO token price increased by 37.2% QoQ to $4.57. Likely due to Sybil filtering during the token launch, which removed Sybil farmers who might have sold the token.

- Average value transferred was up 161% QoQ, securing $1,668 in assets per message. Indicating that durable users are leveraging the protocol for high-value transfers.

- CryptoEconomic DVN Framework launched in partnership with Eigen Labs to strengthen omnichain security.

- The lzCatalyst program aims to support omnichain application development by investing up to $300 million, in partnership with a16z Crypto, Animoca Brands, Franklin Templeton, and PayPal Ventures.

- BitGo selected LayerZero as the interoperability provider for Wrapped Bitcoin (WBTC), expanding support to BNB Chain and Avalanche, enhancing secure and low-cost transfers across chains.

Primer

Though blockchains are designed to be secure, facilitating safe communication between networks is challenging. LayerZero is an interoperability protocol that allows secure communication between over 80 networks for omnichain applications, such as tokens.

The protocol sends and receives messages via an immutable set of Endpoints, with verification and execution facilitated by a permissionless set of decentralized verifier networks (DVNs) and Executors. Executors carry out a message’s instructions in the destination chain, while DVNs ensure end-to-end validity of messages. The security stack, including executors and DVNs – along with block confirmations – can be configured by each independent application built on LayerZero depending on the level of security required for sending and receiving messages.

LayerZero is a standardized communication protocol, allowing omnichain applications to communicate on distinct networks. Its primary use case is transferring arbitrary data between these networks, with asset transfer being the most popular type of data moved. Other use cases include any application that might need to send messages between multiple chains, including gaming, cross-chain governance, identity solutions, restaking, and Enterprise products.

LayerZero Labs is the initial developer and core contributor to the LayerZero protocol. In April 2023, it raised a $120 million Series B. LayerZero V2 went live in January 2024, featuring a common messaging system and common security properties to simplify cross-network communication and improve the developer experience. LayerZero launched its native token, ZRO, in June 2024. For a full primer on LayerZero refer to our Initiation of Coverage.

Website / X (Twitter) / Discord

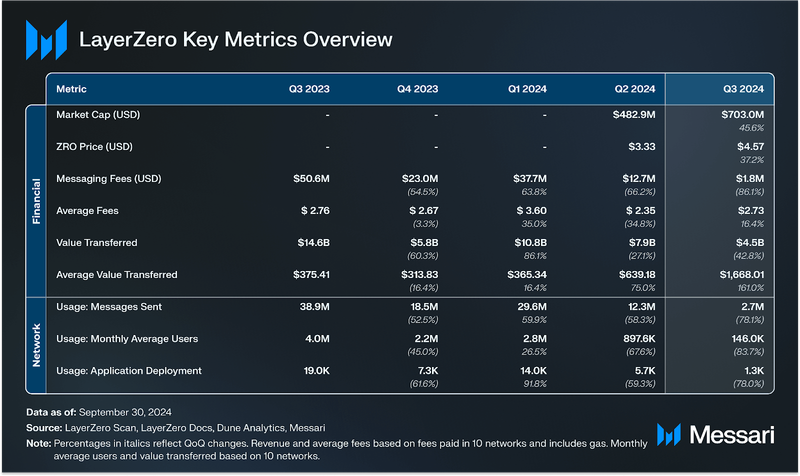

Key Metrics

Performance Analysis

Financial Overview

Market Capitalization and Token Price

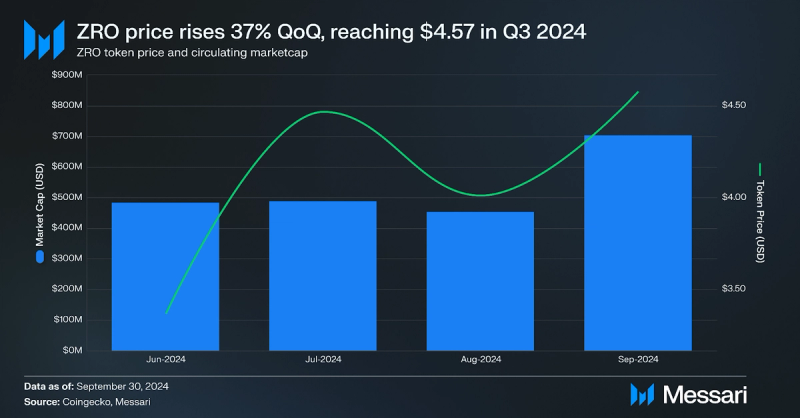

On June 20, 2024, LayerZero Foundation launched ZRO, the native token of the LayerZero protocol. As an Omnichain Fungible Token (OFT), ZRO grants holders governance control over a protocol fee switch, a permissionless mechanism that can collect fees on each message sent through LayerZero and burn ZRO fee tokens.

ZRO closed Q3 with a market cap exceeding $700 million and a token price of $4.57, reflecting a 45.6% increase in market cap and a 37.2% rise in price QoQ. The strong price growth in the months following launch may be attributed to Sybil filtering, which excluded Sybil addresses from the airdrop. It’s assumed that durable users selected for the airdrop are more likely to be long-term holders rather than selling for profit.

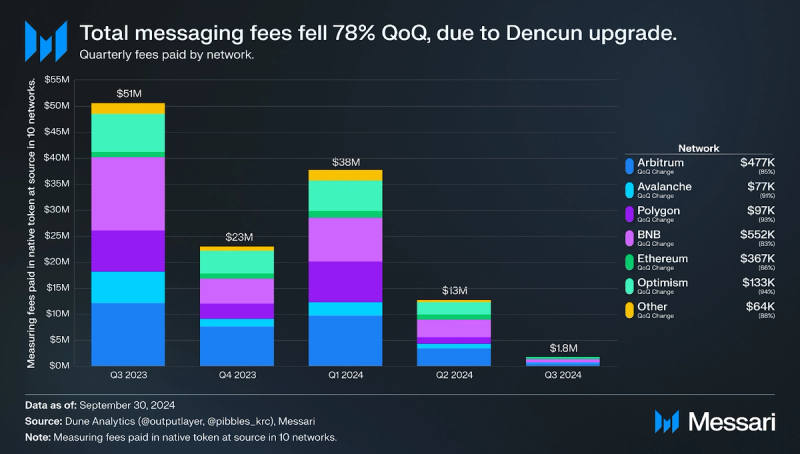

Messaging Fees

Messaging fees are collected in the native token of the source chain. These fees serve three purposes:

- To distribute to DVNs and Executors for verification and execution, respectively.

- To pay for gas on the destination chain for the end user (gas abstraction)

- To burn on the source chain if the protocol fee accrual is activated, a decision controlled by tokenholder governance that is currently turned off

Revenue generated from these fees by DVNs pays for security and Executors pays for gas abstraction. Each application chooses its own configurations of DVNs for verification. Simultaneously, Executors are also selected to deliver messages accurately. If the fee switch is activated, protocol fee accrual reduces the circulating supply of ZRO through a burn mechanism. This control over supply and market capitalization incentivizes ZRO holders to engage in governance.

Total messaging fees paid by users dropped 78% QoQ to $1.8 million in Q3’24. The top source chains for messaging fees were BNB Chain ($553,000), Arbitrum ($478,000), Ethereum ($368,000), and Optimism ($134,000). This decline followed the Dencun upgrade, which reduced Ethereum gas fees through EIP-4844, lowering overall fees since gas costs make up the majority of total messaging fees. This data does not include a number of EVM chains such as Base, Linea or Scroll and does not account for 1.16 million messages sent from EVM chains.

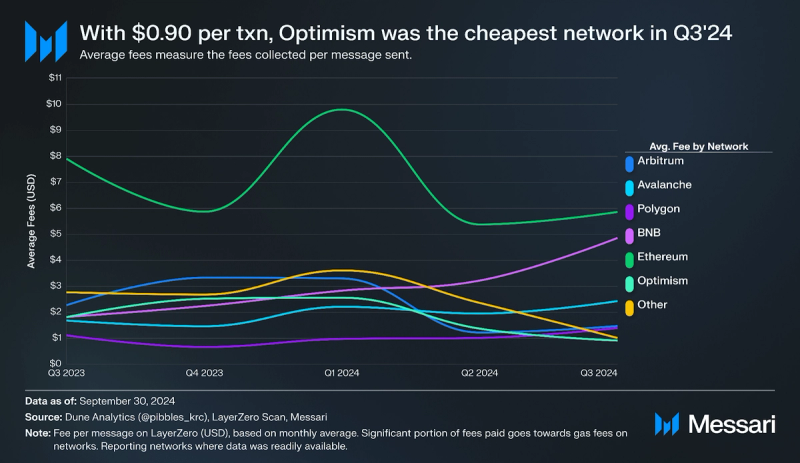

The average fees metric represents the fees collected per message sent on the network, with a significant portion going towards gas costs on various chains. High-fee networks like Ethereum can drive up the average fees due to their higher transaction costs. In Q3 2024, Optimism had the lowest average transaction cost at $0.90 per message, a 34% reduction QoQ. This aligns with Optimism having some of the lowest total fees collected amongst EVM chains during the quarter.

Value Transferred

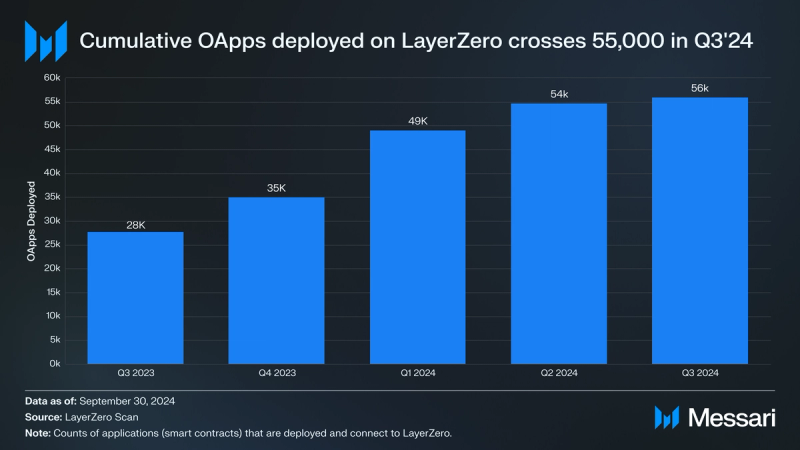

As of Q3’24, LayerZero has over 56,000 contracts using its omnichain communication protocol and is live on over 95 different networks, including Ethereum, Optimism, Arbitrum, Polygon, Solana, BNB Chain, TRON, and Base. These contracts use LayerZero messaging for various use cases, supporting almost 350 user-facing applications.

Transferring assets between distinct networks (bridging) is one of the most common use cases for LayerZero. Other use cases include gaming, cross-chain governance, and identity solutions.

Using bridges built on LayerZero, assets can be transferred by swapping native assets on source chains for native assets on destination chains (e.g., Stargate) or via LayerZero’s token standards — called Omnichain Fungible Tokens (OFTs) and Omnichain Non-Fungible Tokens (ONFTs). The standard OFT is burned on the source chain and minted on the destination chain. Examples of native bridges using standard OFTs are: Aptos Bridge, Core DAO, and Harmony Bridge. For existing native tokens, applications can adopt the OFT standard by locking the tokens on the native chain and minting equivalent tokens on the destination chain. Tokens are received by the destination chain issuing new tokens, 1:1 for each token locked or burned.

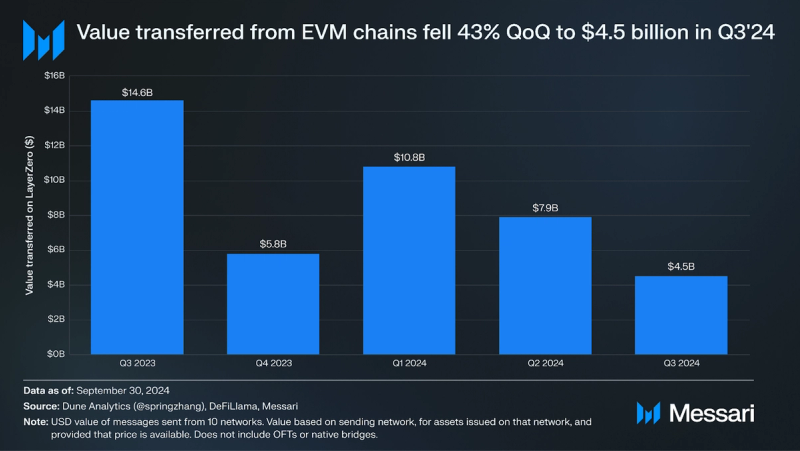

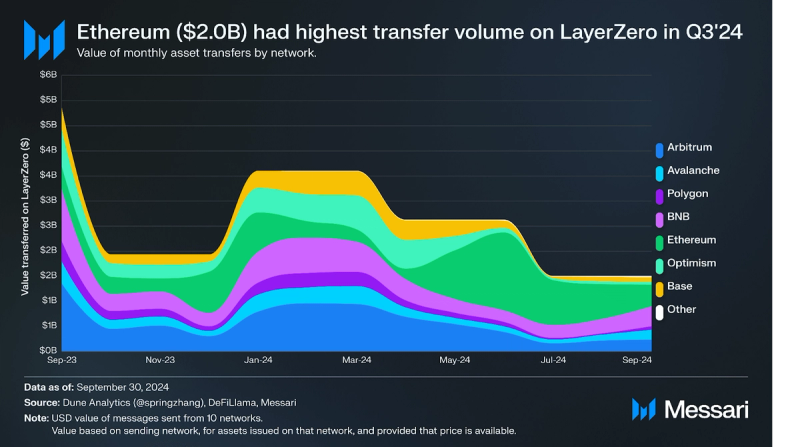

In Q3 2024, the value of assets transferred via LayerZero bridge applications across 10 EVM networks totaled $4.5 billion, a 43% decrease QoQ. This decline was mainly due to efforts to deter Sybil farming ahead of the token generation event (TGE), resulting in a figure that likely represents more legitimate network usage. Additionally, this data does not include Solana,Aptos, or OFTs which is supported by LayerZero and had the largest net inflows at $1.5 billion and $14 million during Q3, respectively.

By deterring Sybil farming, on-chain data now reflects durable users rather than inflated numbers from entities using multiple wallets (defined as clusters of 20 addresses linked to the same individual by the LayerZero Foundation ahead of the TGE). The average value per message increased by 161% QoQ to over $1,600 in Q3 and is 450% higher than in Q1 2024, before the Sybil deterrence announcement. This suggests that genuine users are leveraging the LayerZero protocol for higher-value transactions compared to industrial Sybil farmers.

In Q3 2024, Ethereum ($2.02 billion), BNB chain ($936 million), and Arbitrum ($607 million) were the top three source networks in transfer volume for bridges built on top of LayerZero. Ethereum’s market share among EVM chains dropped to 29% from 37% in Q2 2024. A number of key factors incentivized users to use the Ethereum ecosystem including: lower gas fees on Ethereum due to the introduction of EIP-4844 and the introduction of omnichain native restaking, incentivizing users to use LayerZero.

Protocol Overview

Usage

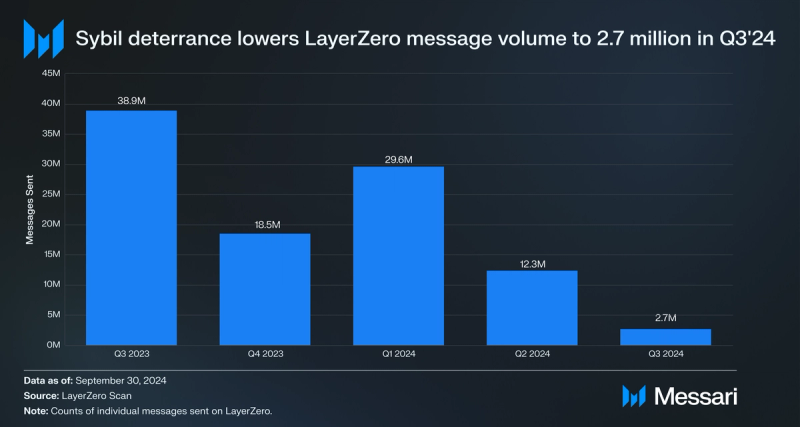

Messages (packets of data) sent are a key indicator of LayerZero’s total usage since they are user-initiated and used in all use cases, such as bridging (e.g., Stargate ), token issuance (e.g., PancakeSwap and ether.fi), cross-chain liquidity (e.g Orderly Network) governance (e.g., Angle), gaming (e.g., Nine Chronicles), cross-chain identity (e.g., Clusters), and fee/rewards distribution (e.g., Pendle). By excluding Sybil farmers from the token launch, LayerZero adjusted onchain usage metrics to reflect durable users instead of inflated numbers from entities using multiple wallets. Data from Q3’24 accurately represents real protocol usage.

The number of messages sent on LayerZero was over 2.7 million in Q3 2024, down 78% QoQ. On September 25, 2024, LayerZero’s daily messages surged to 98,000, marking a 433% increase following the announcement of a reallocation to token claimers. This surge reflects LayerZero’s effort to incentivize ongoing user engagement by rewarding active participants while excluding previous airdrop claimants who showed no activity afterward. The airdrop’s 30-day claim window could help sustain heightened activity levels.

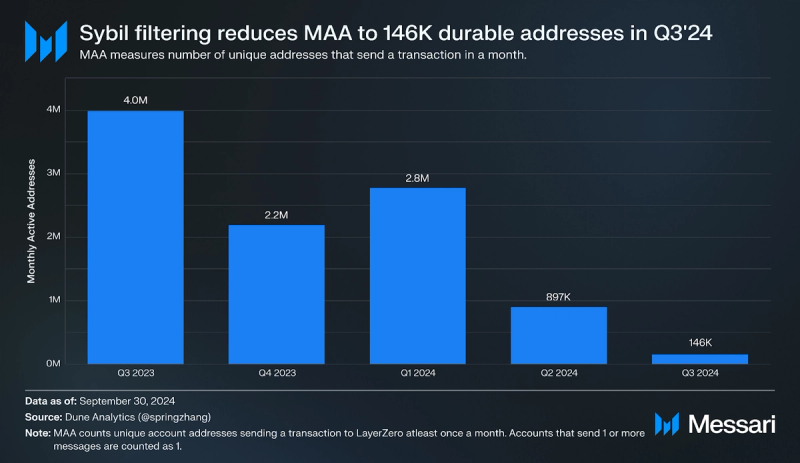

Since the launch of the protocol in 2022, over 6 million unique wallets have interacted with LayerZero. Monthly active addresses (MAA) was reduced 43.7% QoQ to 146,000 users across EVM chains. This correlates with the reduction in messages sent and represents durable usage of the protocol. This reduction was observed across all EVM chains, since Solana had the largest user base in Q3. For comparison Arbitrum One’s MAA was down 28% QoQ in Q3.

Application Deployment

Applications that send and receive messages over LayerZero are called Omnichain Applications (OApps). These applications consist of deployed smart contracts on either source or destination networks. OApps connect to LayerZero via endpoint contracts on their respective networks. These applications can have a host of functions, including asset/token transfers, voting in governance, distribution of fees/rewards, and items for gaming.

In Q3 2024, the LayerZero protocol surpassed the 55,000 milestone, ending with 56,000 OApps deployed. As part of the ZRO TGE, teams were invited to submit proposals and deploy OApps for the token. Over 200 developer teams submitted applications for ZRO allocations and deployed their own OApp. The number of developers in the RFP alone was more than some major blockchains. Teams included: GMX, TraderJoe, DeFi Kingdoms, and Dexalot.

Qualitative Analysis

Key Developments

ZRO Claims and Reallocation

The LayerZero Foundation launched its native token, ZRO, on June 20, 2024, with a total supply of 1 billion tokens. Of these, 23.8% was allocated to the community and builders, with an initial 8.5% distributed on the first day, involving over 1.28 million ZRO eligible wallets. The initial distribution included 5% to core contributors, 3% through Requests for Proposals (RFPs), and 0.5% to a separate community pool for creators and researchers.

On Sept. 20, 2024, the ZRO claim period ended, and unclaimed tokens were reallocated. Eligible wallets were those that claimed ZRO and conducted transactions post-TGE. These wallets will receive a pro-rata share of unclaimed tokens based on their initial claim and gas fees paid since the TGE. Wallets that claimed ZRO but showed no activity post-TGE, as well as wallets identified as Sybil in either the first or second reviews, were deemed ineligible for further reallocation. Any tokens not claimed in the next 30 days will go to the LayerZero Foundation.

This reallocation strategy encourages genuine participation and deters opportunistic behavior. Eligible users receive an additional share of unclaimed tokens, distributed based on the gas each user spent since the TGE, providing an incentive for continued engagement with the LayerZero protocol.

ZRO Functionality

The ZRO token serves an essential role in LayerZero’s governance, allowing holders to influence the protocol’s fee structure through the “protocol fee switch,” voted on every six months via an immutable omnichain governance process. When activated, collected fees are used to burn ZRO, reducing supply.

With the recent introduction of the CryptoEconomic Decentralized Verifier Network (DVN) Framework, developed in partnership with Eigen Labs, ZRO also contributes to cryptoeconomic security by serving as a staking asset subject to slashing. CryptoEconomic DVNs require verifiers to stake assets, such as ETH, ZRO, and EIGEN, acting as collateral to deter malicious behavior. If verifiers act incorrectly or dishonestly, their staked assets are slashed, ensuring verifiers always have “skin in the game.” This approach shifts the trust model to a quantifiable, economically secured system.

The CryptoEconomic DVN Framework also includes Actively Validated Services (AVS), which define the assets that can be staked and the specific conditions under which slashing can occur. This flexibility allows DVNs to customize their economic security based on the use case, whether it’s using zk-proofs, middlechains, or other mechanisms. Furthermore, the framework promotes permissionless security by allowing anyone to contribute to the security of LayerZero’s omnichain messaging by staking assets into a DVN. The first DVN to utilize this framework is the LayerZero Labs DVN, providing a secure, economically backed verification network for omnichain messaging.

ZRO Claiming Mechanism

To foster the ecosystem, LayerZero introduced Proof of Donation, where participants could claim ZRO by donating to Protocol Guild, supporting Ethereum Layer-1 research and development. Additionally, the Foundation matched donations up to $10 million.

LayerZero also implemented a Sybil filtering mechanism to ensure fair token distribution, targeting behaviors such as using multiple addresses and industrial farming. Sybil users were offered a chance to self-report for a reduced allocation, while others were publicly listed for bounties. This collaborative effort, involving LayerZero, Nansen, and Chaos Labs, successfully filtered out inauthentic activity and ensured that durable users were prioritized.

Community Program Launch

On Sept. 2, 2024, the LayerZero Community Program went live, inviting builders, content creators, and onchain enthusiasts to become part of the LayerZero community. The program introduces three roles tailored to participants’ interests: Community, Builder, and Content. Community members can also progress through different tiers: zerolayer, intern, hero, OG, legend, and god, depending on their level of involvement and contributions. The program operates primarily on Discord, where role selection, announcements, and activities occur.

The program allocates 5 million ZRO tokens to reward participants, with an initial 25,000 ZRO distributed to pre-June 2024 community members.

lzCatalyst Program

On Sept. 17, 2024, the LayerZero Foundation launched lzCatalyst, a program connecting top builders with leading venture capital firms, such as a16z Crypto, Animoca Brands, Franklin Templeton, Delphi Ventures and PayPal Ventures. These partners can invest up to $300 million in projects developing omnichain applications on LayerZero. The initiative aims to provide developers with capital and resources, with additional strategic investments available from the Foundation for projects backed by multiple partner funds.

Ecosystem

Enterprise Integrations

LayerZero’s enterprise integrations gained significant traction in Q3’24 with new partnerships and initiatives:

- BitGo Chooses LayerZero for WBTC: On Sept. 10, 2024, BitGo, a digital asset trust and security company, chose LayerZero as its interoperability provider for Wrapped Bitcoin (WBTC). WBTC, the largest on-chain bitcoin derivative with over $9.5 billion issued, is now expanding to BNB Chain and Avalanche, enabling native minting on these networks without bridging risks. LayerZero’s Omnichain Fungible Token (OFT) standard facilitates secure, low-cost WBTC transfers across chains, leveraging a decentralized verifier network (DVN) involving BitGo, LayerZero Labs, and Polyhedra.

- Collaboration with Animoca Brands: On July 31, 2024, Animoca Brands announced a partnership with LayerZero Labs, establishing LayerZero as the default interoperability solution for Animoca’s entire ecosystem. Animoca Brands will also recommend LayerZero as the preferred interoperability solution to its over 540 investment portfolio companies. Projects like Mocaverse and Open Campus benefit from seamless omnichain interactions using LayerZero’s OFT standard and messaging capabilities, enhancing both user and developer experiences.

- Dinero: On Aug. 14, 2024, the Dinero team introduced ipxETH, an institutional-grade ETH yield product powered by LayerZero’s OFT standard. In collaboration with Laser Digital, ipxETH leverages liquid staking strategies, offering fully collateralized on-chain yield exposure.

In Q2’24, LayerZero Labs partnered with IntellectEU to facilitate the first Delivery vs. Payment (DvP) transaction using the LayerZero protocol. This involved sending Swift message transfer standard between Hyperledger Besu (private) and Polygon (public) blockchains, integrating traditional financial infrastructure with blockchain technology. The collaboration built on existing partnerships with institutions like J.P. Morgan Chase, Apollo’s Onyx Digital Assets, and Avalanche’s Evergreen Subnet, Spruce.

Network Integrations

In Q3’24, LayerZero added support for over 12 new networks, bringing the total to 95 networks, including Gravity Chain,ZKLinkNova, Ozean, Bitlayer, Glue, LightLink and Flare. Following the addition of Solana support in Q2, the memecoin season on Solana during Q3 took advantage of LayerZero’s OFT standard, with projects like DOGWIFHAT (WIF) expanding the reach of their community to Base.

Application Integration

Surpassing 55,000 OApp deployments in Q3, LayerZero saw growth in applications across gaming, SocialFi, DeFi, AI, token issuance, and other sectors utilizing its omnichain communications. Notable deployments included Dubbz, DOGWIFHAT, Sandbox. KelpDAO, DtravelDAO, Yay! Global, Usual, DeFi.Money and Beyond. Many existing applications also expanded to new chains supported by LayerZero, such as Radiant Capital expanded to Base and Ethena expanded to Solana. Ether.fi, a liquid Ethereum restaking platform, was the first to support omnichain restaking on a number of L2s in Q2, amassing over $600 million in restaked ETH on L2s. KelpDAO followed in Q3, introducing its own omnichain staking tokens on Ethereum L2s. As of writing, $40 billion in assets have adopted the OFT Standard.

Aragon has launched gasless on-chain voting for Ethereum Mainnet DAOs, utilizing LayerZero V2 to aggregate votes across chains. This new solution provides DAO participants with a secure, cross-chain voting experience without gas costs, enhancing engagement and accessibility for decentralized governance.

DVN Integration

Recently, LayerZero Labs, in collaboration with Eigen Labs, introduced the CryptoEconomic Decentralized Verifier Network (DVN) Framework. This framework integrates cryptoeconomic security into omnichain messaging by requiring DVNs to stake assets, ensuring verifiers are financially incentivized to act honestly. The LayerZero Labs DVN, the first to use this framework, accepts ETH, ZRO, and EIGEN as staking assets. The framework supports slashing for dishonest behavior, creating a secure environment for cross-chain messaging.

LayerZero continues to offer a diverse marketplace of over 35 DVNs, which includes zk-tech verifiers like Polyhedra and enterprise solutions like Google Cloud. The addition of DVN Adapters in V2 enables applications to integrate third-party validators, expanding security options further.

Upcoming Events

Expansion to Cosmos Ecosystem

Solana, Tron, and Aptos are amongst the first non-EVM Layer-1s supported on the LayerZero protocol. LayerZero Labs has partnered with Initia Labs to explore expanding omnichain support to Cosmos chains. These expansions demonstrate LayerZero’s commitment to standardize interoperability across every blockchain.

Ubisoft Game Launch

Ubisoft is set to launch its first blockchain-based game, Champion Tactics Grimoria, by the end of 2024. Built on the Oasys blockchain, the game will leverage LayerZero’s omnichain interoperability to enhance player ownership of in-game assets.

Closing Summary

In Q3 2024, LayerZero made strides in enhancing protocol security, community engagement, and developer adoption. Implementing Sybil resistance strategies corresponded to a 37% price increase QoQ despite a challenging market environment. The average value transferred per message increased by 161% to $1,668, demonstrating high-value transactions by durable users. The announcement of token reallocation further incentivized user participation by redistributing unclaimed tokens to active participants. Additionally, the launch of the LayerZero Community Program fostered deeper engagement among builders, creators, and enthusiasts. LayerZero is now supported on 95 networks, reinforcing itself as a leading omnichain interoperability protocol.