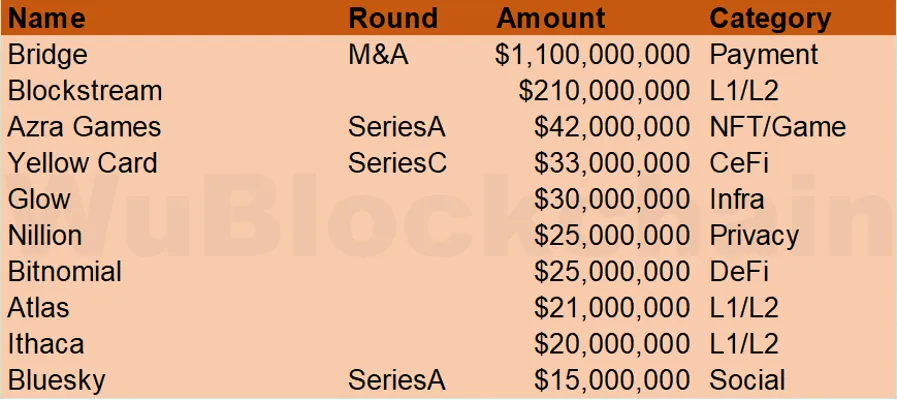

- Stripe’s $1.1 billion acquisition of Bridge boosts its crypto and stablecoin capabilities in payment solutions.

- Blockstream secures $210 million to expand Bitcoin mining and layer-2 tech, enhancing blockchain scalability and efficiency.

October saw a significant increase in venture capital (VC) for crypto and blockchain projects, with total funding reaching $780 million—a substantial 28% increase compared to September’s $610 million.

This increase occurred in spite of a minor decline in the number of publicly revealed cryptocurrency VC investment initiatives, which dropped by 3% to 95 projects in October.

Stripe and Blockstream Drive Major Moves in Crypto Innovation

Among the notable deals, Stripe made news when it paid an astounding $1.1 billion for Bridge. Stripe’s biggest venture into the crypto space thus far is this acquisition, which goes beyond conventional finance solutions into the space of stablecoin payments and blockchain technologies.

Stripe seeks to improve its current payment options by including Bridge’s stablecoin infrastructure, therefore enabling faster and more effective worldwide transactions. This phase fits the company’s plan to provide companies with a complete array of payment choices, including stablecoin features among the worldwide acceptance of digital money.

In a similarly noteworthy move, according to CNF, top Bitcoin infrastructure company Blockstream raised $210 million via convertible notes, attracting support from important industry players.

Among the several ambitious projects funded by the raised funds will be the growth of Blockstream’s layer-2 Bitcoin technology, an increase in its mining activities, and an enhancement of its Bitcoin reserves.

This calculated action aligns with Blockstream’s dedication to enhancing the ecosystem of Bitcoin, particularly given the rising market for scalable and effective blockchain technologies.

Blockstream aims to meet the urgent needs of the Bitcoin network with these investments, therefore maintaining its competitiveness and efficiency, especially in view of increasing competition from alternative blockchain networks with sophisticated scaling options.

October’s Major Investments Highlight Growth in Blockchain Innovation

These large October outlays show a larger trend in the crypto and blockchain sectors, where businesses are positioning themselves for future expansion among changing market dynamics and regulatory uncertainty.

Along with well-publicized acquisitions and strategic expansions, the funding surge shows how strong the crypto sector is and how much venture capital interest it still draws.

Leading the charge are industry titans like Stripe and Blockstream, who will probably inspire further ideas and partnerships meant to forward blockchain technology and its practical uses.

On the other hand, as we noted earlier, two Abu Dhabi companies started a special investment fund meant to buy US Treasury securities, which are then tokenized on the IOTA and Ethereum blockchains.